Texas Self-Employed Independent Contractor Consideration For Hire Form

Description

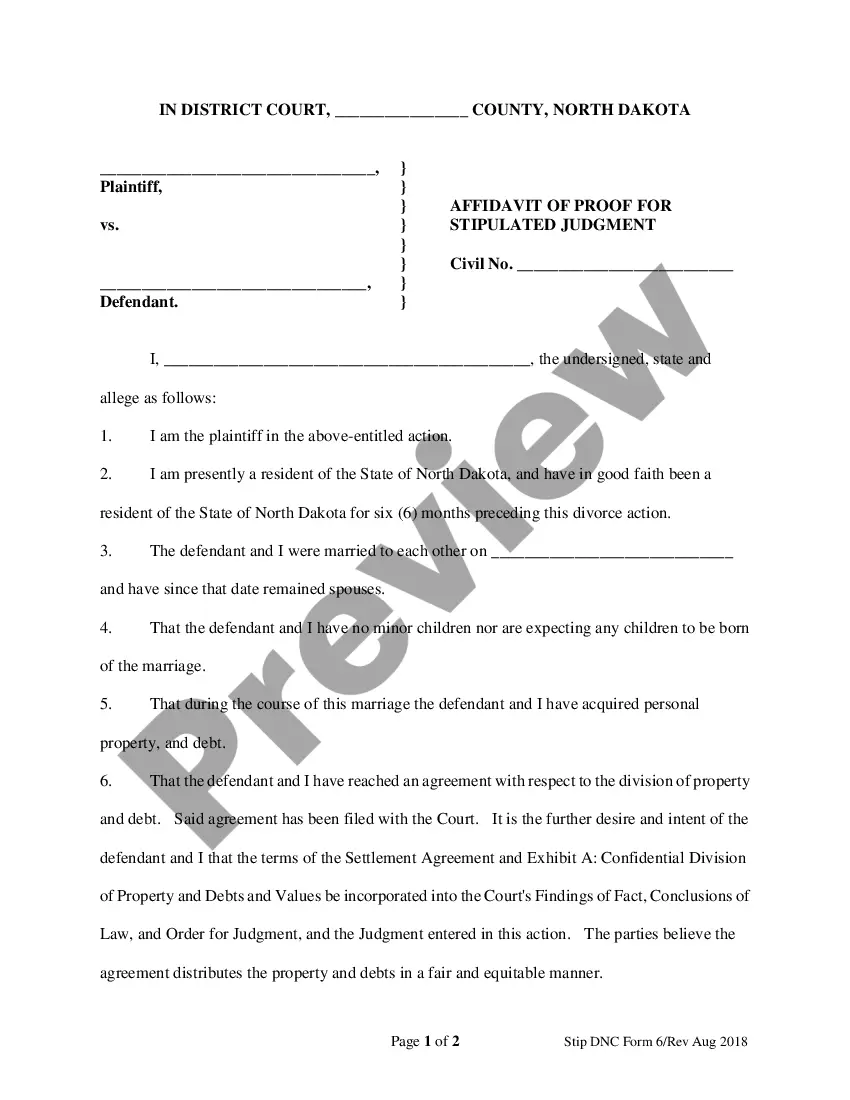

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal template formats that you can download or print. By using the website, you will access thousands of forms for commercial and personal use, organized by type, state, or keywords.

You can find the latest versions of forms such as the Texas Self-Employed Independent Contractor Consideration For Hire Form in just a few minutes. If you have an active subscription, Log In and download the Texas Self-Employed Independent Contractor Consideration For Hire Form from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously acquired forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have chosen the correct form for your city/state. Click the Review button to check the form's details. Read the form summary to confirm you have selected the right form. If the form does not meet your needs, use the Search box at the top of the page to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred payment plan and provide your credentials to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Texas Self-Employed Independent Contractor Consideration For Hire Form. Every template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Texas Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Navigate through the website easily to find documents tailored to your specifications.

- Enjoy the convenience of having all your forms organized and readily available for future reference.

- Experience a hassle-free transaction process with secure payment options.

- Benefit from continuous access to your forms without worrying about expiration.

Form popularity

FAQ

An independent contractor should complete several forms to operate legitimately. The most important is the Texas Self-Employed Independent Contractor Consideration For Hire Form to establish their working status. Additionally, they should fill out a W9 form to provide you with their tax identification information, ensuring smooth financial transactions.

Hiring independent contractors as a sole proprietor is straightforward. Begin by drafting a contract that details the work to be completed and include the Texas Self-Employed Independent Contractor Consideration For Hire Form for clarity on roles and payment terms. This process helps ensure both parties understand their responsibilities regarding the arrangement.

Proof of employment as an independent contractor can be demonstrated through several methods. Hold onto contracts that specify the job details, along with the Texas Self-Employed Independent Contractor Consideration For Hire Form that confirms your status. Additionally, invoices and payment records can also serve as effective proof.

To hire an independent contractor in Texas, you need several key documents. Firstly, the Texas Self-Employed Independent Contractor Consideration For Hire Form is essential to formalize the arrangement. Additionally, be sure to collect a W9 form to obtain tax details, and any relevant contracts that outline the scope of work.

Choosing between a 1099 and a W9 depends on your business needs. Typically, a 1099 form is issued to report payments made to independent contractors, while a W9 form gathers their taxpayer information. Using both appropriately ensures compliance and supports your operation of the Texas Self-Employed Independent Contractor Consideration For Hire Form.

In Texas, independent contractors must adhere to specific legal requirements. They must possess a valid business license and maintain proper tax identification. Additionally, they should complete the Texas Self-Employed Independent Contractor Consideration For Hire Form to clearly establish their status and obligations.

The primary consideration in determining whether a hired person is an independent contractor focuses on the level of control you have over how they perform their work. Independent contractors typically have the freedom to dictate their methods and schedules, distinguishing them from employees. It is essential to properly classify workers to meet legal and tax obligations. The Texas Self-Employed Independent Contractor Consideration For Hire Form helps clarify these distinctions effectively.

Hiring an independent contractor requires several key documents to ensure compliance and clarity. You will need the Texas Self-Employed Independent Contractor Consideration For Hire Form, along with a formal agreement detailing the scope of work and payment terms. Additionally, if applicable, prepare a 1099 for tax reporting. Utilizing resources from US Legal Forms can streamline the hiring process and ensure you have all necessary paperwork.

To fill out an independent contractor agreement, start by clearly stating the roles and responsibilities of both parties. Include payment terms, project deadlines, and any confidentiality or non-compete clauses. It is important to use terminology that accurately reflects your working relationship. For an effective agreement, consider using US Legal Forms, which provides templates tailored to Texas independent contractors.

Filling out an independent contractor form involves including key details such as the contractor's name, contact information, and the nature of the services they will provide. Additionally, specify the payment terms, deadlines, and any relevant legal terms. The Texas Self-Employed Independent Contractor Consideration For Hire Form streamlines this process, ensuring all necessary information is collected clearly. Tools from US Legal Forms can further assist you with correct form completion.