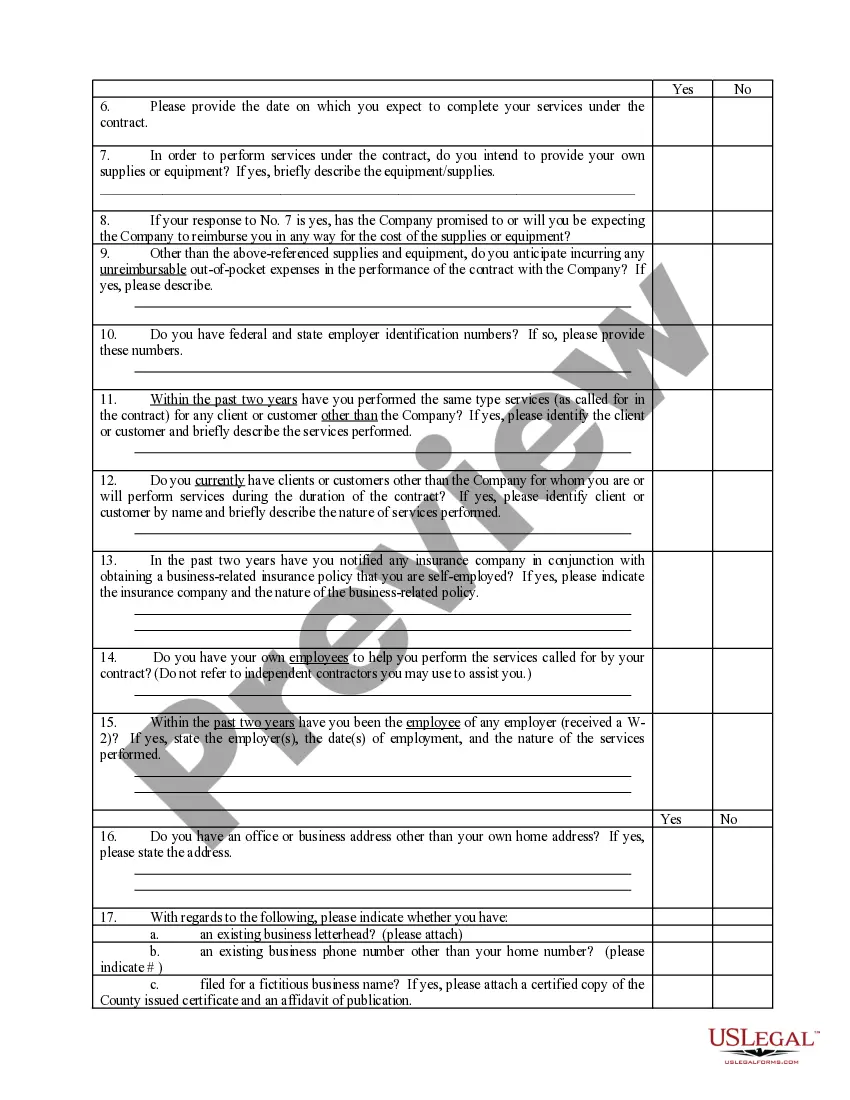

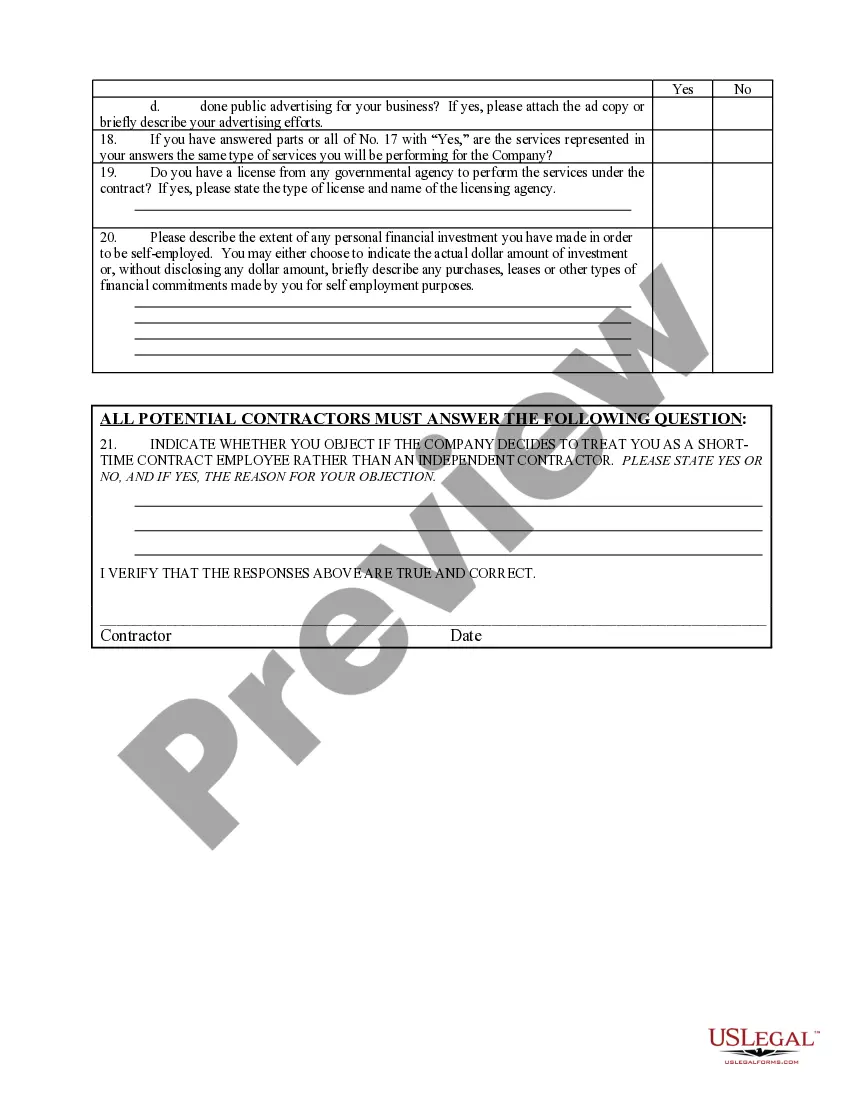

Texas Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

Locating the appropriate valid document template can be challenging.

Indeed, numerous designs exist online, but how can you locate the authentic form you require.

Make use of the US Legal Forms website. This service offers thousands of designs, such as the Texas Self-Employed Independent Contractor Questionnaire, suitable for both business and personal purposes.

You can review the form using the Review button and check the form description to confirm it is indeed the right one for you.

- All forms are reviewed by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Texas Self-Employed Independent Contractor Questionnaire.

- Utilize your account to browse through the legal forms you have purchased previously.

- Visit the My documents tab in your account to retrieve another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

A third way of approaching this problem is called the "ABC" test, which is used by almost two thirds of the states (not including Texas) in determining whether workers are employees or independent contractors for state unemployment tax purposes.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

An independent contractor is self-employed, bears responsibility for his or her own taxes and expenses, and is not subject to an employer's direction and control. The distinction depends upon much more than what the parties call themselves.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

Whether you're an employee or an independent contractor depends on the conditions of your employment, not your job title or work schedule. The law says you're an employee unless your employer can show otherwise. Your employer might have misclassified you as an independent contractor when you're actually an employee.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The ABC test is a legal test used by many states in employment-related laws, such as for workers' compensation or unemployment compensation, to determine whether a worker is an employee or independent contractor.