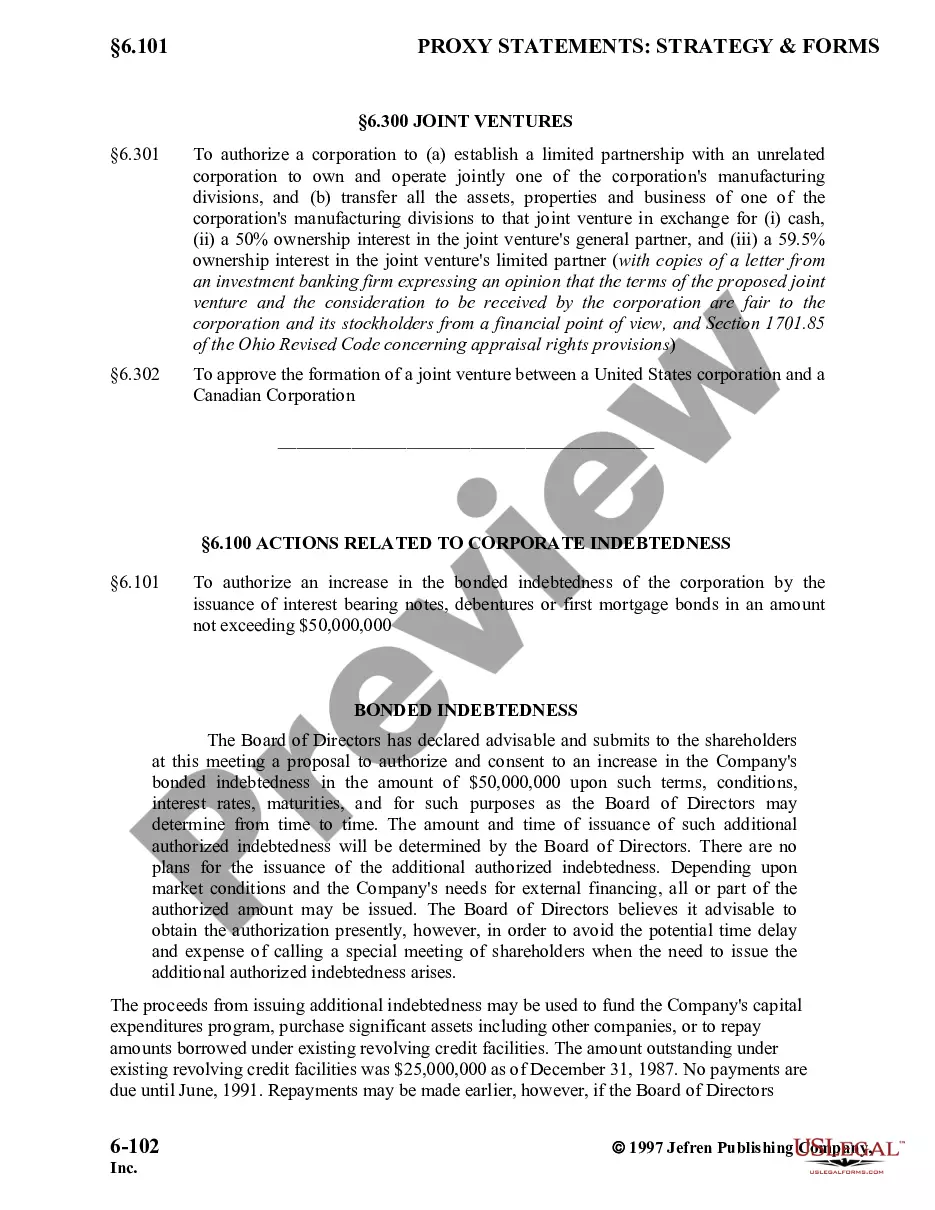

Texas Authorization to increase bonded indebtedness

Description

How to fill out Authorization To Increase Bonded Indebtedness?

US Legal Forms - one of many most significant libraries of legitimate forms in the States - offers a wide range of legitimate record layouts you are able to obtain or print out. Utilizing the web site, you can get a large number of forms for organization and individual functions, sorted by groups, suggests, or search phrases.You can get the most up-to-date variations of forms like the Texas Authorization to increase bonded indebtedness in seconds.

If you have a membership, log in and obtain Texas Authorization to increase bonded indebtedness through the US Legal Forms catalogue. The Down load switch will show up on every single kind you view. You gain access to all previously delivered electronically forms inside the My Forms tab of your profile.

If you want to use US Legal Forms for the first time, here are basic guidelines to obtain began:

- Make sure you have selected the proper kind for the city/region. Select the Review switch to examine the form`s information. Look at the kind description to ensure that you have chosen the right kind.

- In the event the kind does not suit your needs, utilize the Research industry on top of the display screen to get the the one that does.

- Should you be happy with the form, validate your choice by clicking on the Get now switch. Then, opt for the rates plan you want and offer your accreditations to sign up for an profile.

- Method the deal. Utilize your charge card or PayPal profile to complete the deal.

- Select the file format and obtain the form on your system.

- Make changes. Fill out, modify and print out and indication the delivered electronically Texas Authorization to increase bonded indebtedness.

Each format you included in your money lacks an expiration date and it is yours eternally. So, if you want to obtain or print out yet another version, just visit the My Forms segment and click about the kind you need.

Get access to the Texas Authorization to increase bonded indebtedness with US Legal Forms, probably the most considerable catalogue of legitimate record layouts. Use a large number of expert and express-specific layouts that meet your small business or individual requires and needs.

Form popularity

FAQ

Debt service: the city borrows money by issuing a bond and then the tax increment generated by the TIF district is used to pay back the bondholders. If a project has high up-front costs, the lump sum generated by a bond issuance enables a city to pay for them. In other words, the new, diverted taxes pay down the debt.

Is TIF an additional tax burden? No, TIF does not impose a new tax. Instead, it uses improvements to spur development and raise property values within a zone. Then it funnels some of the tax collected on that increase in value into a fund that pays for the improvements.

The allocation process for the state of Texas is set out in Chapter 1372 of the Texas Government Code. The Private Activity Bond Allocation Program regulates the volume ceiling and monitors the amount of demand and the use of private activity bonds each year.

The bonds are backed by the anticipated TIF revenue, and repaid with incremental tax receipts as private development activity increases.

Tax Increment Financing (TIF) is an economic development tool that allows cities and counties to capture tax revenue from Tax Increment Reinvestment Zones (TIRZs). When a TIRZ is formed, the amount of existing tax collections originating from inside the zone's boundary is set as the baseline.

TIFs: the potential positives and negatives Pro: TIFs can alleviate some of the burden on developers. ... Con: There may be backlash. ... Pro: TIF districts can grow the tax base. ... Con: Mediation can be a monster. ... Pro: TIF districts can revitalize parts of a city that are in decline. ... Con: The project could go either way.

Tax Increment Financing, or TIF, is simple in concept. TIF calls for local taxing bodies to make a joint investment in the development or redevelopment of an area, with the intent that any short-term gains be reinvested and leveraged so that all taxing bodies will receive larger financial gains in the future.

TIRZ stands for ?Tax Increment Reinvestment Zone.? TIRZs are governed by Chapter 311 of the Texas Tax Code. There are more than 180 TIRZs throughout Texas. TIRZs are used as forms of tax increment financing, which is an economic development tool to incentivize both development and redevelopment.