Illinois Heirship Affidavit - Descent

Overview of this form

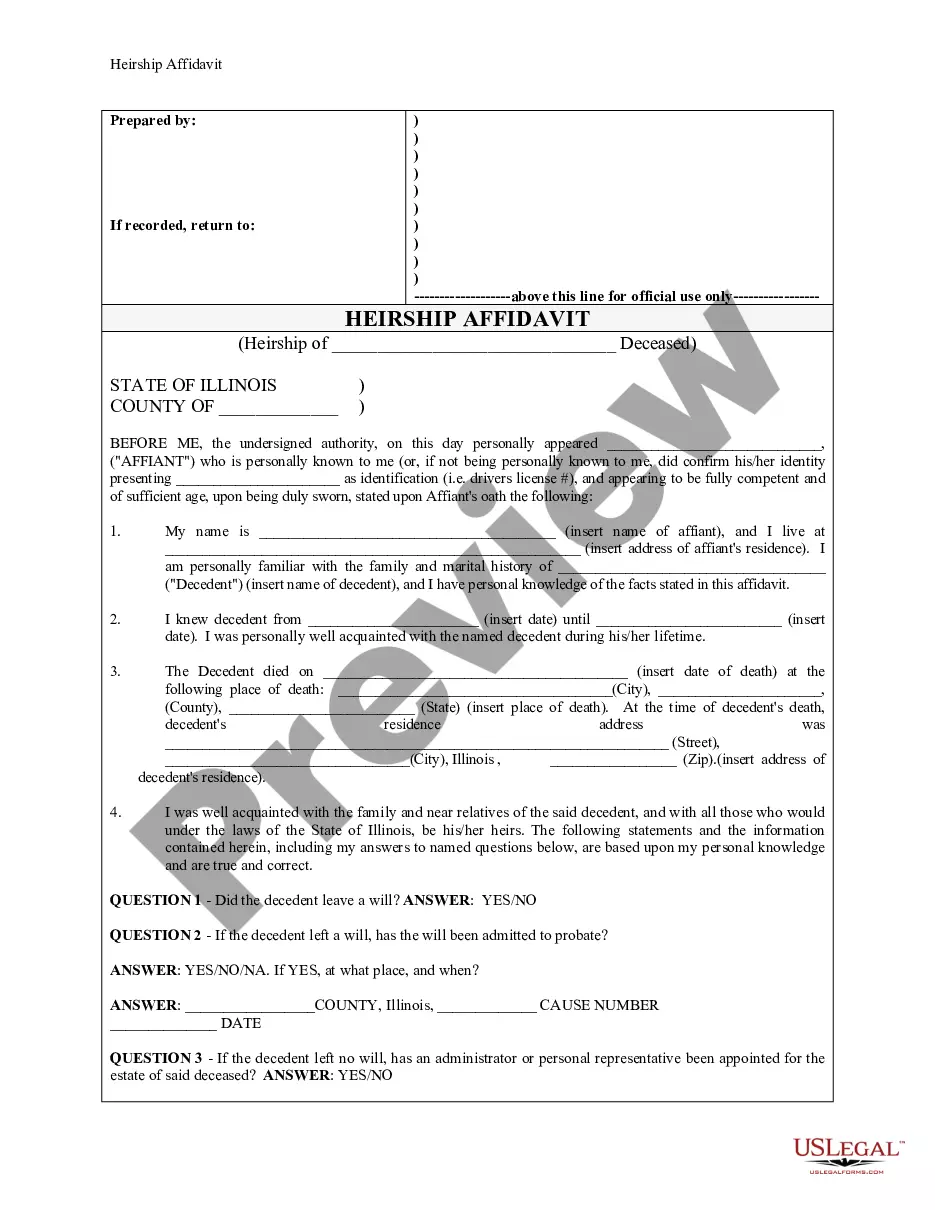

The Heirship Affidavit - Descent is a legal form used to declare the heirs of a deceased person. This affidavit is especially crucial when an individual dies without a will, as it helps establish rightful ownership of both personal and real property. Unlike other estate planning documents, an heirship affidavit is primarily focused on identifying the deceased's heirs and may be recorded in official land records if necessary, such as when selling property.

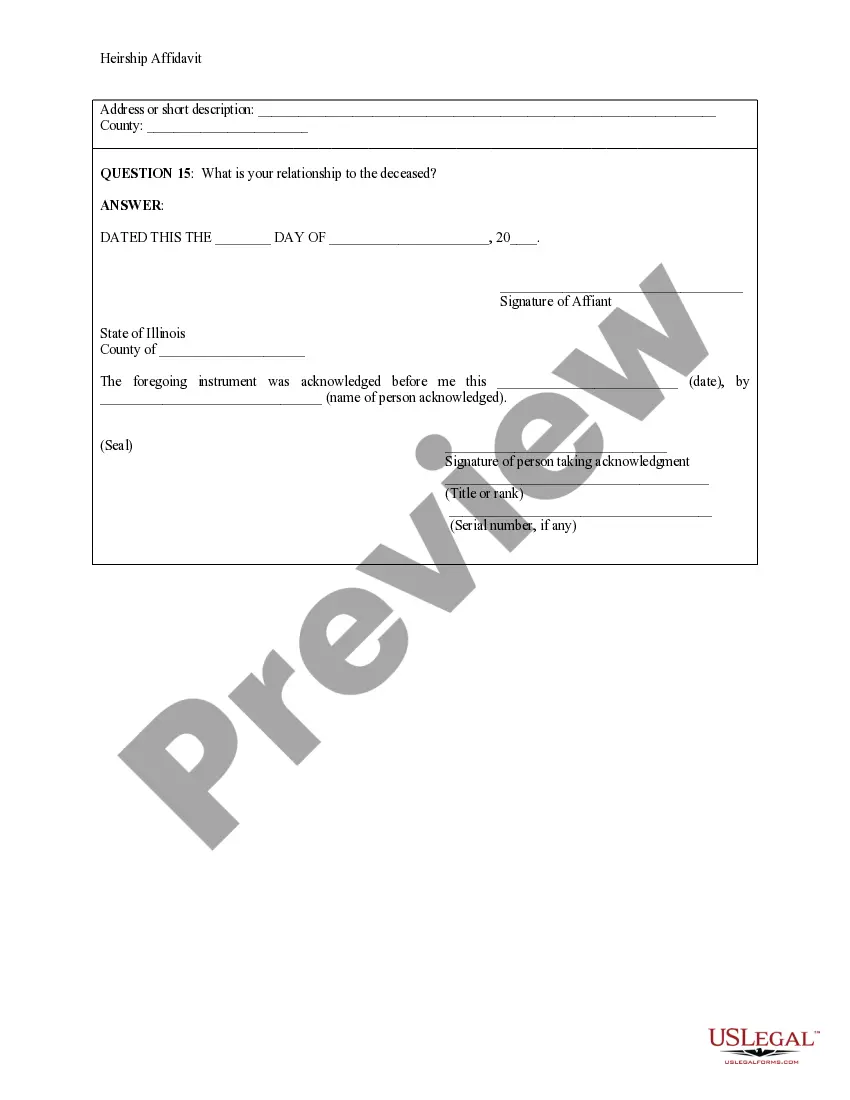

Main sections of this form

- Affiant details: Name, address, and relationship to the deceased.

- Information about the decedent: Name, date of death, and last known address.

- Questions about the existence of a will and probate status.

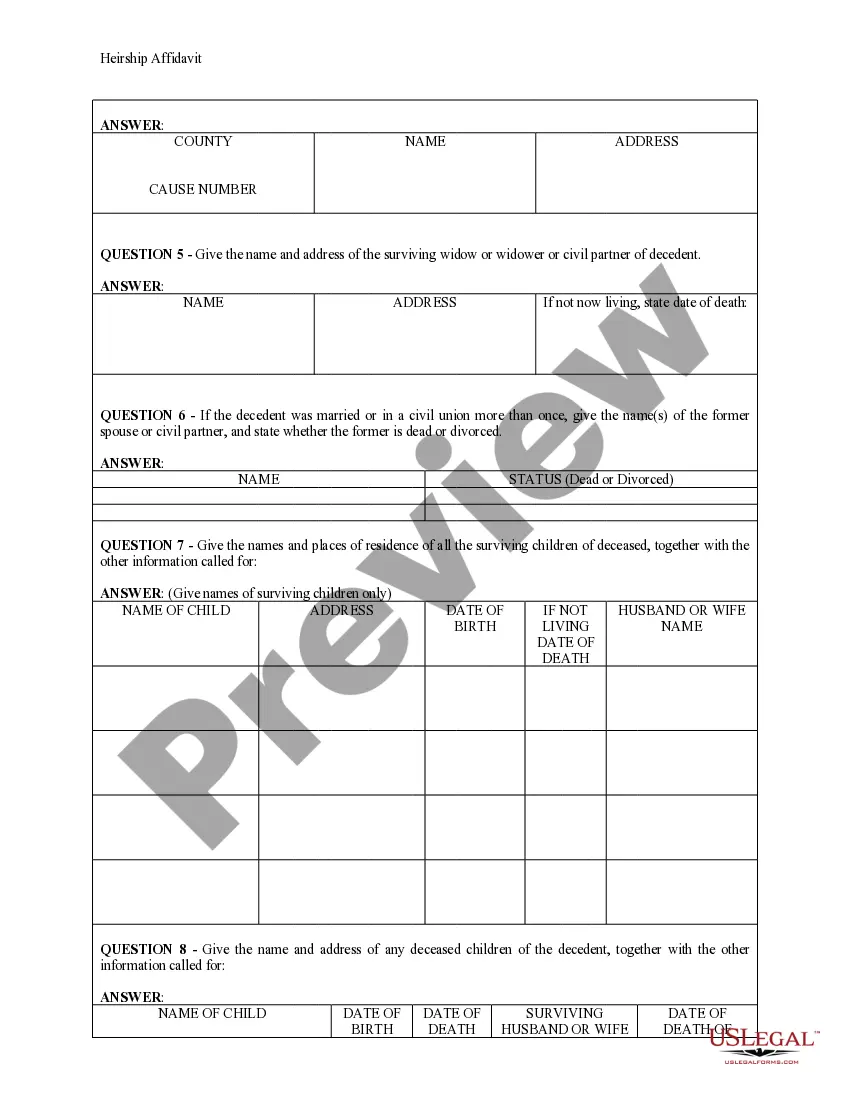

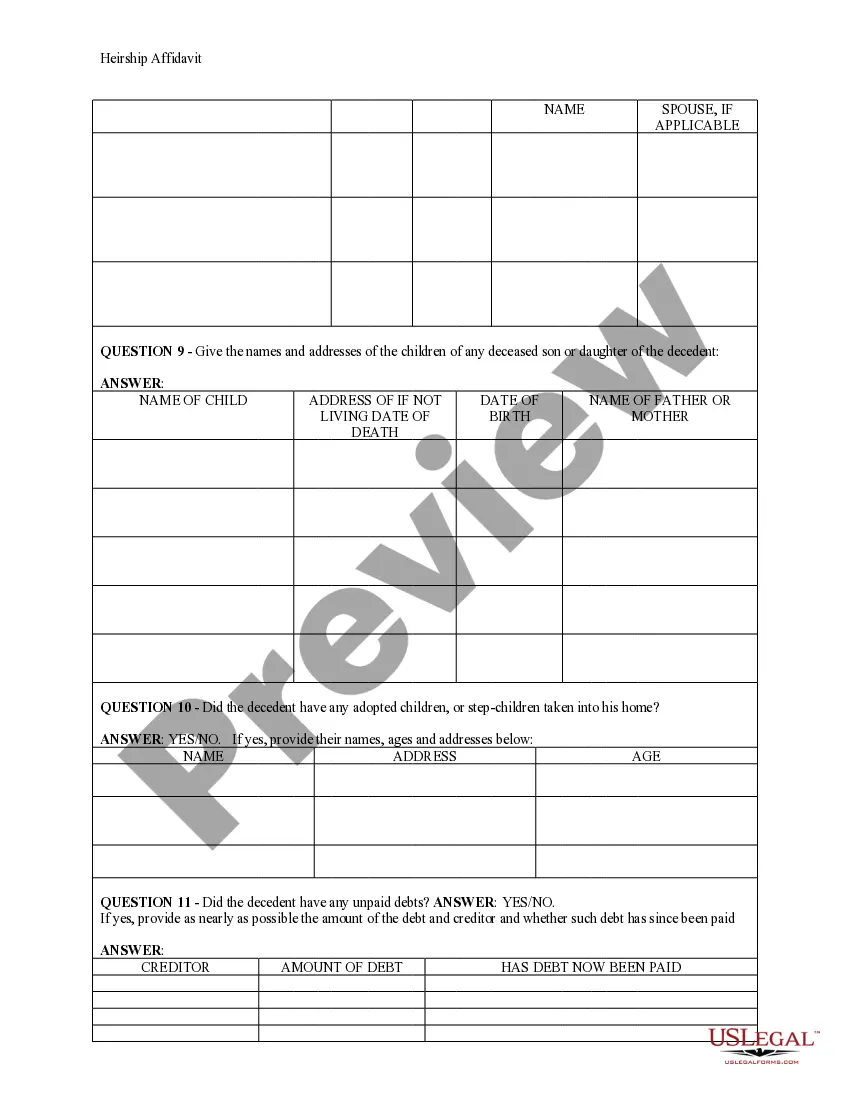

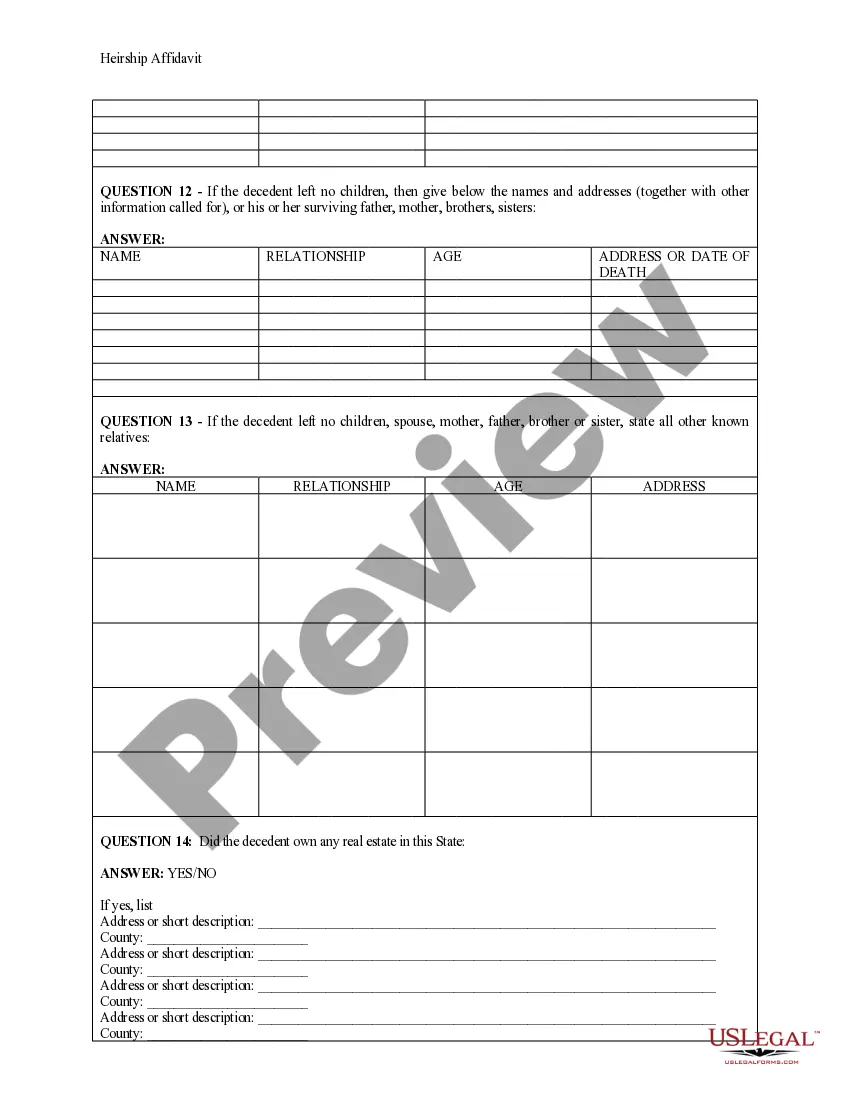

- Details regarding surviving heirs, including spouse, children, and any other known relatives.

- Identification of any real estate owned by the decedent.

- Notary section for official acknowledgment of the affidavit.

Situations where this form applies

This form is typically used in situations where a person passes away without a will, leaving behind heirs who need to establish their rights to inherit property. For example, if a deceased individual has a son but no estate has been opened, the son can use this affidavit to identify himself as an heir when selling or transferring property previously owned by the decedent.

Who can use this document

- Individuals who need to declare heirs following the death of a loved one.

- Persons involved in the transfer of property from a deceased individual to their heirs.

- Those handling estates without a will that require proof of heirship.

- Relatives or acquaintances of the deceased who are knowledgeable about the family history.

How to complete this form

- Identify yourself as the affiant: Provide your name and address.

- Fill in the decedent's information: Include the name, date of death, and last address.

- Answer questions carefully: Indicate whether a will exists and if it has been admitted to probate.

- Detail surviving heirs: List names and addresses of the spouse, children, and other relatives as applicable.

- Include any real estate ownership: Specify addresses of properties owned by the deceased.

- Sign in the presence of a notary: Ensure that you and the notary complete the signature section for legal validity.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete information about the decedent or the heirs.

- Not answering all the questions in the affidavit, which may lead to legal challenges.

- Overlooking the notary requirement, resulting in an invalid affidavit.

- Using outdated legal language that does not meet current standards or requirements.

Why use this form online

- Convenience: Access and download the form at any time without the need to visit a legal office.

- Editability: Fill out the form digitally or print it for manual completion.

- Reliability: Receive professionally drafted forms that meet state-specific legal requirements.

Looking for another form?

Form popularity

FAQ

Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

In Illinois, Per Stirpes is the default method of dividing up a deceased person's estate if the deceased dies without having a will.The other two surviving children of the father will again each get an equal amount of money, this time just a third of the estate.

Meaning differences. Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

(A judgment in this case is a court order, in writing, reciting that the deceased person is dead, the date of death and a list of who are the heirs.) Proof. Once the judgment is issued, copies of the judgment can be used to show proof as to who is entitled to estate assets.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

An heir is the person who legally stands to inherit assets in the absence of direction from the decedent. Whereas a legatee is someone the decedent has directed shall receive assets. So if a decedent had a will leaving money to a nephew, the nephew is a legatee.

The heirship of a deceased person is determined through a document called an Affidavit of Heirship. This is a form that gives a detailed explanation of the heirs at law of the deceased person at the time of his/her death.The deceased, DOROTHY, died at Anytown, Illinois on January 1, 2015.