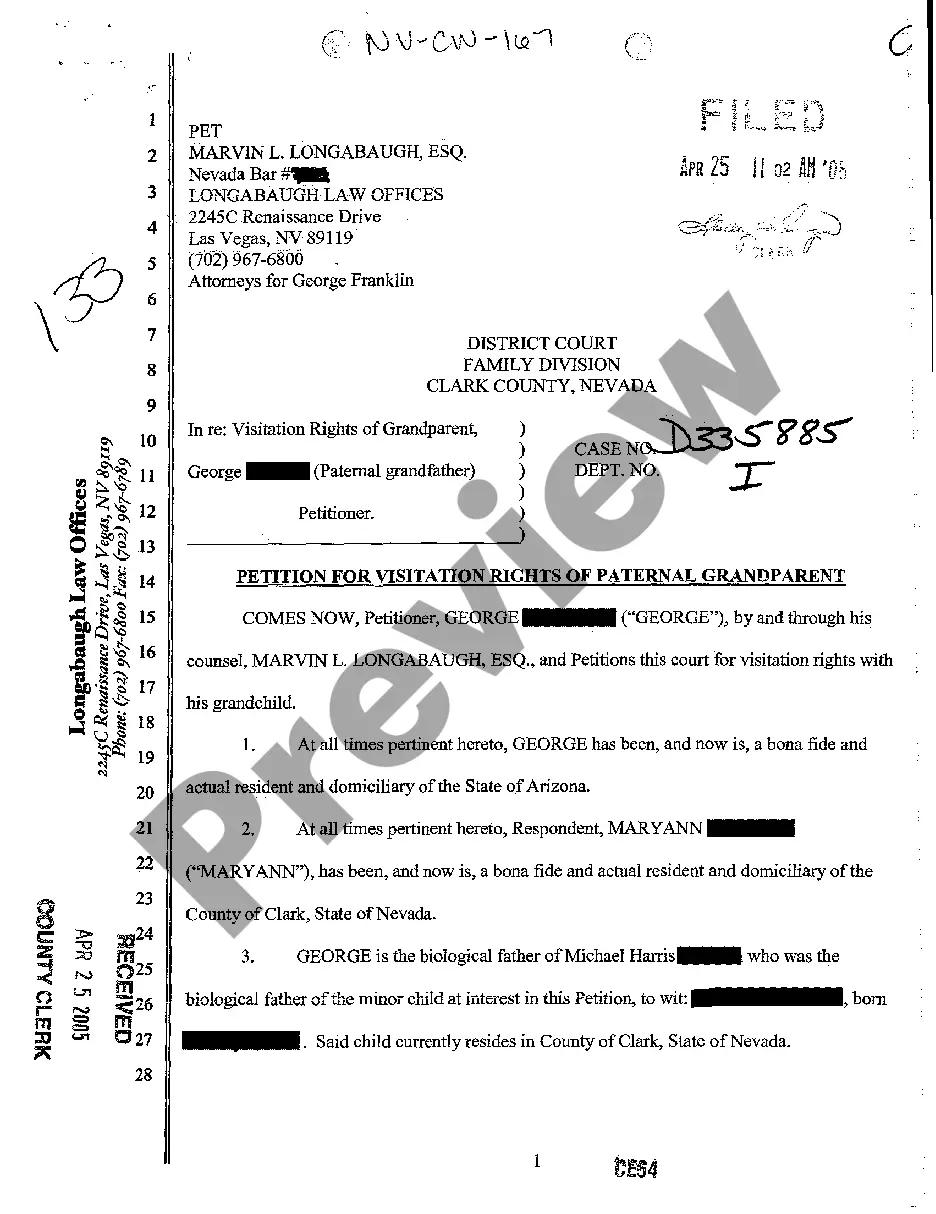

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are Husband and Wife. Grantor conveys and quitclaims the described property to Grantees. Grantees take the property as community property, community property with the right of survivorship, joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

California Quitclaim Deed from a Limited Liability Company to a Husband and Wife

Description

How to fill out California Quitclaim Deed From A Limited Liability Company To A Husband And Wife?

If you're looking for a suitable California Quitclaim Deed from a Limited Liability Company to a Husband and Wife examples, US Legal Forms is what you require; obtain documents provided and validated by state-certified attorneys.

Using US Legal Forms not only spares you from headaches associated with legal documentation; in addition, you conserve effort and time, as well as money! Downloading, printing, and completing a professional template is far less expensive than hiring an attorney to do it for you.

And that's it. In just a few straightforward steps, you have an editable California Quitclaim Deed from a Limited Liability Company to a Husband and Wife. Once you create your account, all future orders will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form's page. When you need to use this template again, you can always find it in the My documents section. Don't squander your time comparing numerous forms on different websites. Purchase professional templates from one secure service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the steps outlined below to create your account and locate the California Quitclaim Deed from a Limited Liability Company to a Husband and Wife template to address your situation.

- Utilize the Preview tool or review the document information (if available) to verify that the form is suitable for your needs.

- Confirm its relevance in your state.

- Click on Buy Now to place an order.

- Choose a preferred pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Select a convenient format and download the form.

Form popularity

FAQ

Transferring property to an LLC in California can trigger tax implications such as reassessment of the property value for tax purposes. This reassessment often results in increased property taxes, which could affect your financial planning. Additionally, the transfer could have potential capital gains tax consequences if the property appreciates in value. When utilizing a California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, it's crucial to consult a tax professional to understand the full impact of the transfer.

A quitclaim deed cannot be used to transfer property that has a mortgage unless all parties agree. Additionally, it is not suitable for transferring property when the title is disputed or when debt obligations are associated with the property. In cases involving divorce or when creating a trust, more formal methods may be necessary. When considering a California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, be aware of situations where using a quitclaim deed might not be appropriate.

A quitclaim deed between husband and wife allows one spouse to transfer their interest in a property to the other. This type of deed can simplify the transfer process and is often used when couples want to clarify ownership. In the context of a California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, the deed can serve to consolidate property ownership within the marriage. It's important to ensure that the deed is properly executed to avoid any future disputes.

Yes, a title company can handle a quitclaim deed transaction. When you seek a California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, a title company can assist with creating and filing the necessary documents. They also provide title insurance to protect your ownership rights. Engaging a title company helps ensure a seamless process and may save you time and effort.

To quitclaim a California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, you first need to prepare the deed document. Ensure it includes the names of the LLC and the couple, along with the property description. After signing the deed in front of a notary, record it with the county clerk where the property is located. Consider using a reliable service like US Legal Forms to simplify the process and ensure compliance with California regulations.

Adding someone to a deed in California can lead to tax implications, particularly regarding property tax reassessment. A California Quitclaim Deed from a Limited Liability Company to a Husband and Wife may trigger reassessment, which might increase property taxes. It is advisable to consult a tax professional to understand the potential financial impact before proceeding.

A quitclaim deed primarily benefits individuals looking to simplify property transfers, especially among family or close relations. This includes situations such as the California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, which orients toward easing the process of joint ownership. Its simplicity makes it a favorable choice in such cases.

You can add a spouse to a deed without refinancing, especially when using a California Quitclaim Deed. This method allows you to transfer ownership without altering your mortgage agreement. Just be cautious about the implications, as adding a spouse may affect future ownership and estate planning.

To transfer property from an LLC to an individual, you will typically need to execute a California Quitclaim Deed. This legal document effectively transfers ownership from the LLC to the person, enabling the transaction to be recorded with the county. Utilizing a platform like uslegalforms can make this process simpler, providing you with all the necessary forms and instructions.

Adding a spouse to a deed is not extremely difficult, but it does require a proper understanding of the legal process. With the California Quitclaim Deed from a Limited Liability Company to a Husband and Wife, you can facilitate this transfer efficiently. Just ensure that you have the correct documentation and follow the necessary filing procedures to avoid complications.