Texas General Power of Attorney - Form 11A - Pre and Post 2005 Act

Description

How to fill out General Power Of Attorney - Form 11A - Pre And Post 2005 Act?

Discovering the right authorized record format can be a have a problem. Needless to say, there are a lot of web templates available online, but how will you discover the authorized develop you want? Use the US Legal Forms internet site. The support gives a huge number of web templates, like the Texas General Power of Attorney - Form 11A - Pre and Post 2005 Act, that you can use for company and personal requirements. Each of the types are checked out by pros and meet federal and state needs.

In case you are previously signed up, log in to your account and then click the Obtain button to get the Texas General Power of Attorney - Form 11A - Pre and Post 2005 Act. Make use of your account to check throughout the authorized types you may have bought earlier. Visit the My Forms tab of your account and obtain yet another duplicate from the record you want.

In case you are a brand new consumer of US Legal Forms, listed here are easy directions so that you can adhere to:

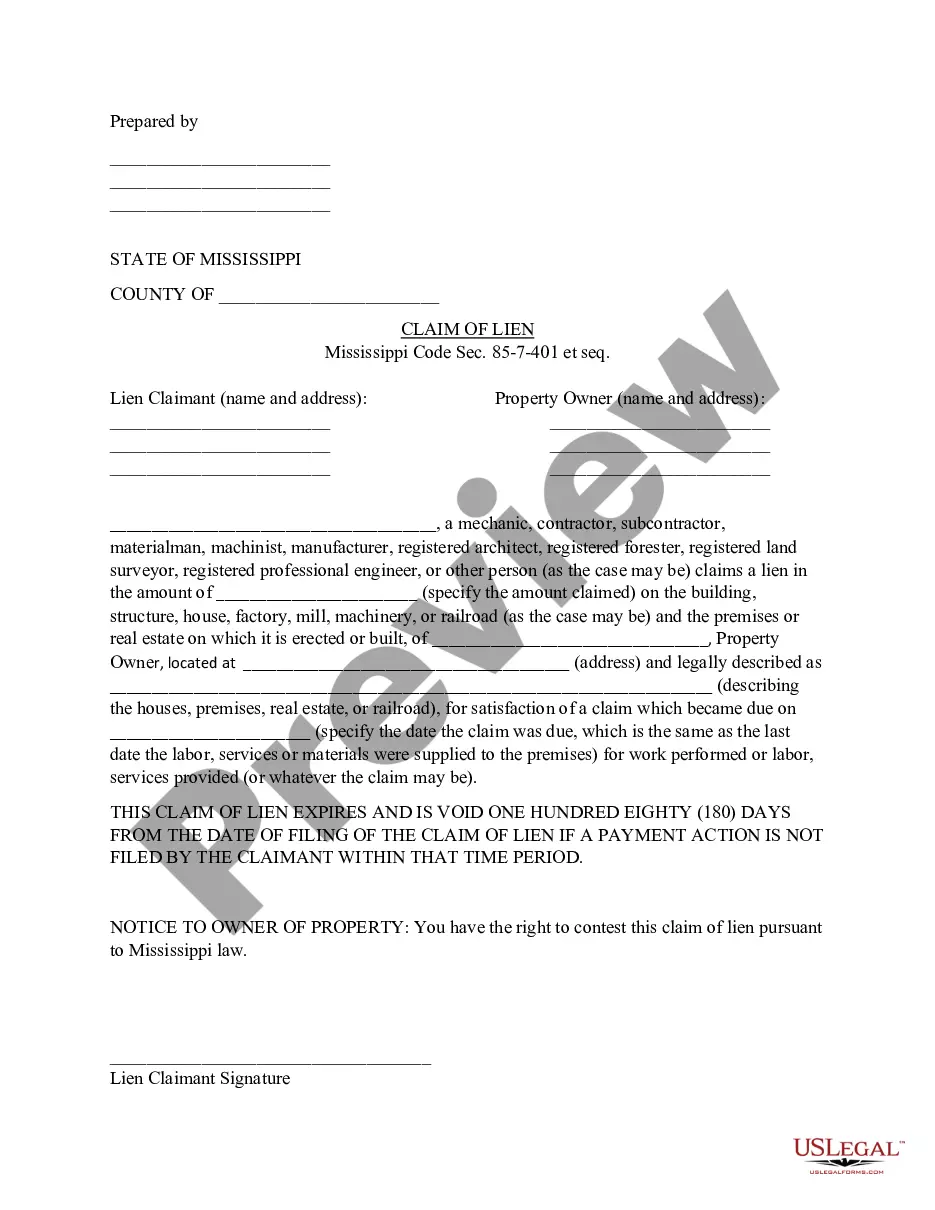

- Initial, make certain you have selected the right develop for your area/region. You may check out the form while using Preview button and study the form description to guarantee it will be the best for you.

- When the develop fails to meet your preferences, make use of the Seach area to get the right develop.

- When you are positive that the form is suitable, select the Purchase now button to get the develop.

- Select the prices plan you would like and type in the needed information. Make your account and purchase the transaction using your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and obtain the authorized record format to your product.

- Complete, revise and produce and indicator the obtained Texas General Power of Attorney - Form 11A - Pre and Post 2005 Act.

US Legal Forms will be the largest collection of authorized types where you will find a variety of record web templates. Use the service to obtain expertly-made files that adhere to status needs.

Form popularity

FAQ

We often hear the question, ?does the power of attorney need to be notarized in Texas?? The answer is yes; the document and any changes to it should be formally notarized. Once these steps are completed, power of attorney is validly granted.

In order for this power of attorney to be valid it must be notarized, but it doesn't need to be signed by any witnesses like a will does. You do not need to file a power of attorney at the courthouse unless you want your agent to be able to act on your behalf in regards to a real estate transaction.

Create your official document You can work with an attorney, use estate planning software or download Texas' Statutory Durable Power of Attorney or Medical Power of Attorney Designation of Health Care Agent forms to print and fill out yourself. Choose your agent and detail the authority you'd like them to have.

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.

A Power Of Attorney Doesn't Address What Happens to Assets After Your Death. A power of attorney ends at your death, so it does not do anything to protect your wealth after you are gone or to facilitate the timely transfer of assets to loved ones.