Oregon Commercial Rental Lease Application Questionnaire

Description

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

When it comes to completing Oregon Commercial Rental Lease Application Questionnaire, you probably think about an extensive procedure that requires choosing a suitable form among a huge selection of very similar ones and after that being forced to pay legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific form in just clicks.

For those who have a subscription, just log in and click Download to have the Oregon Commercial Rental Lease Application Questionnaire template.

If you don’t have an account yet but want one, keep to the step-by-step manual below:

- Make sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do it by reading through the form’s description and also by visiting the Preview function (if readily available) to view the form’s content.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Get the record on your device or in your My Forms folder.

Professional lawyers work on drawing up our samples to ensure after saving, you don't have to bother about editing and enhancing content material outside of your personal info or your business’s information. Be a part of US Legal Forms and get your Oregon Commercial Rental Lease Application Questionnaire document now.

Form popularity

FAQ

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

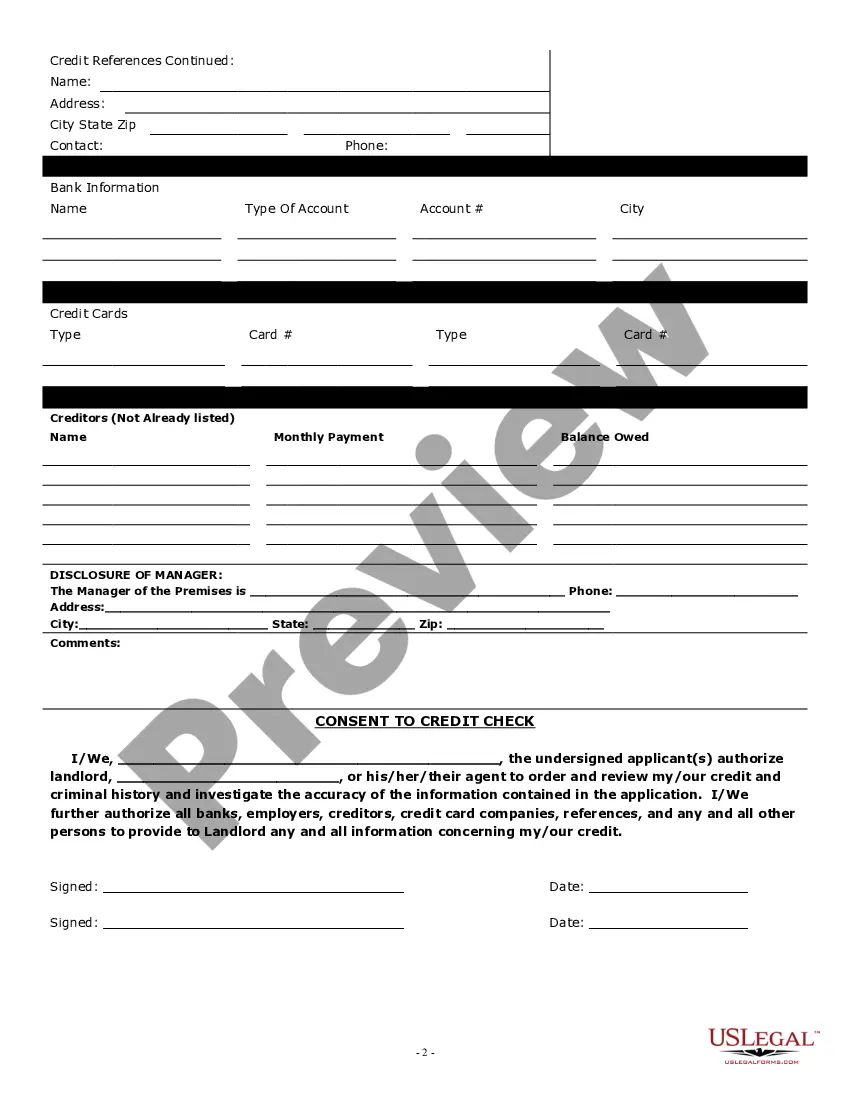

Bank references. Current credit reports/scores from all three reporting bureaus. Previous/current landlord references (for an existing business moving to a new location) Personal and corporate financial statement(s) A copy of your business plan. Business bank statement(s) Prior tax returns.

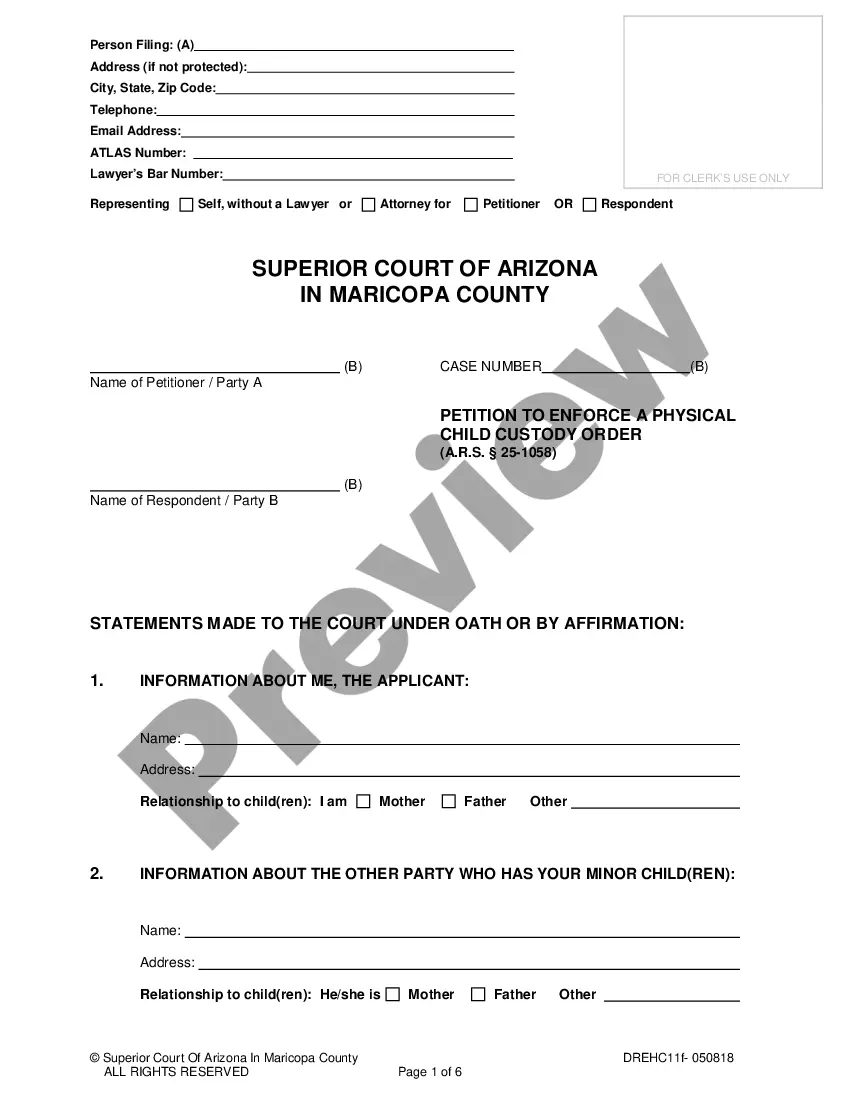

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

A security deposit is typically an amount equivalent to one or two month's rent, which is deposited by the tenant to secure, as far as money can, the tenant's performance of the tenant's obligations under the Lease.

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

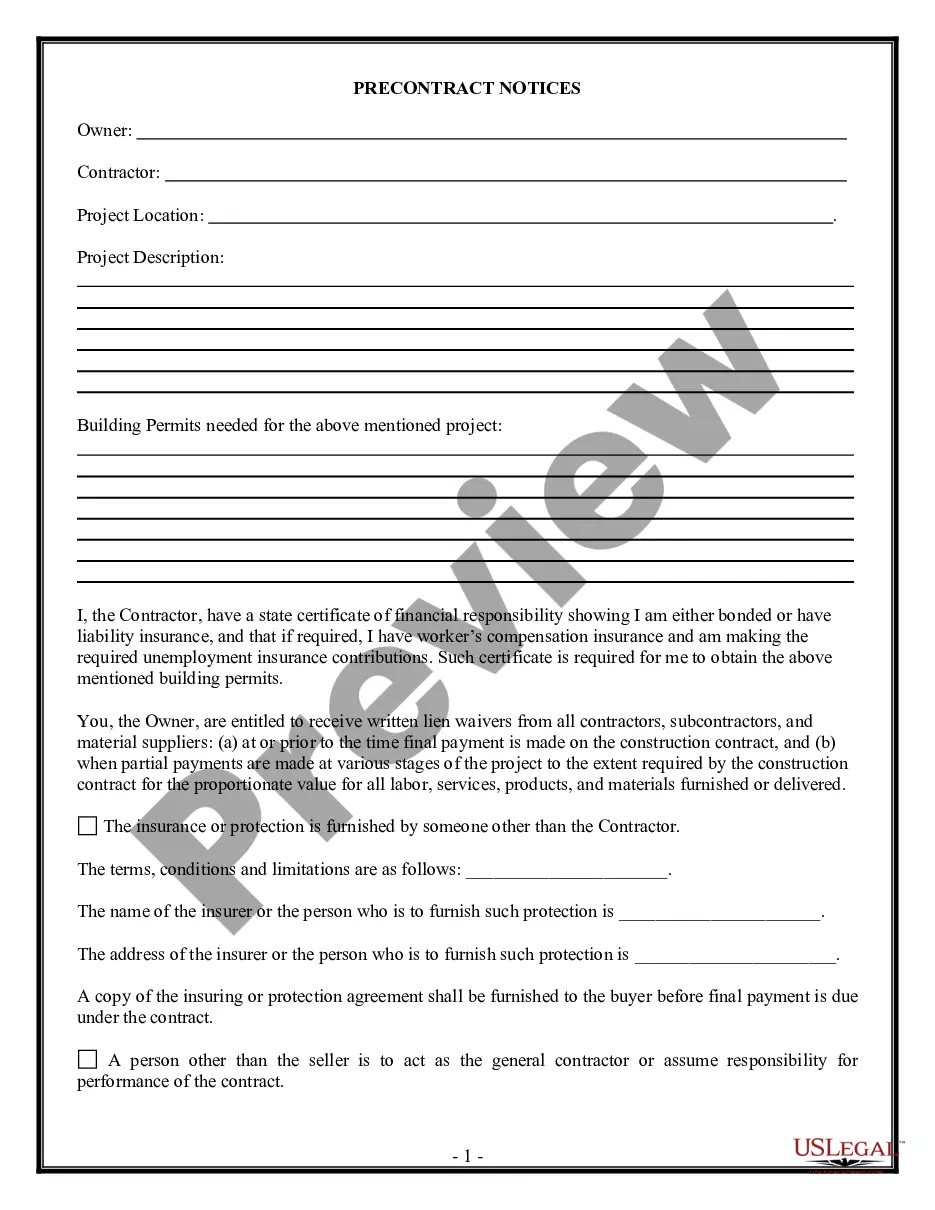

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.

Can the landlord refuse consent to an Assignment? Most leases will say that the Landlord cannot unreasonably withhold consent. According to section 19 (1A) of the Landlord and Tenant Act 1927 the landlord can insert conditions in the lease, which need to be met in the case of an assignment.

Commercial leases generally fall into one of three major categories based on how the building's operating expenses are passed on to tenants: Gross or full-service lease. You pay a flat monthly rate from which the landlord pays all operating expenses, including utilities, property taxes and maintenance.