Oregon Commercial Rental Lease Application Questionnaire

Overview of this form

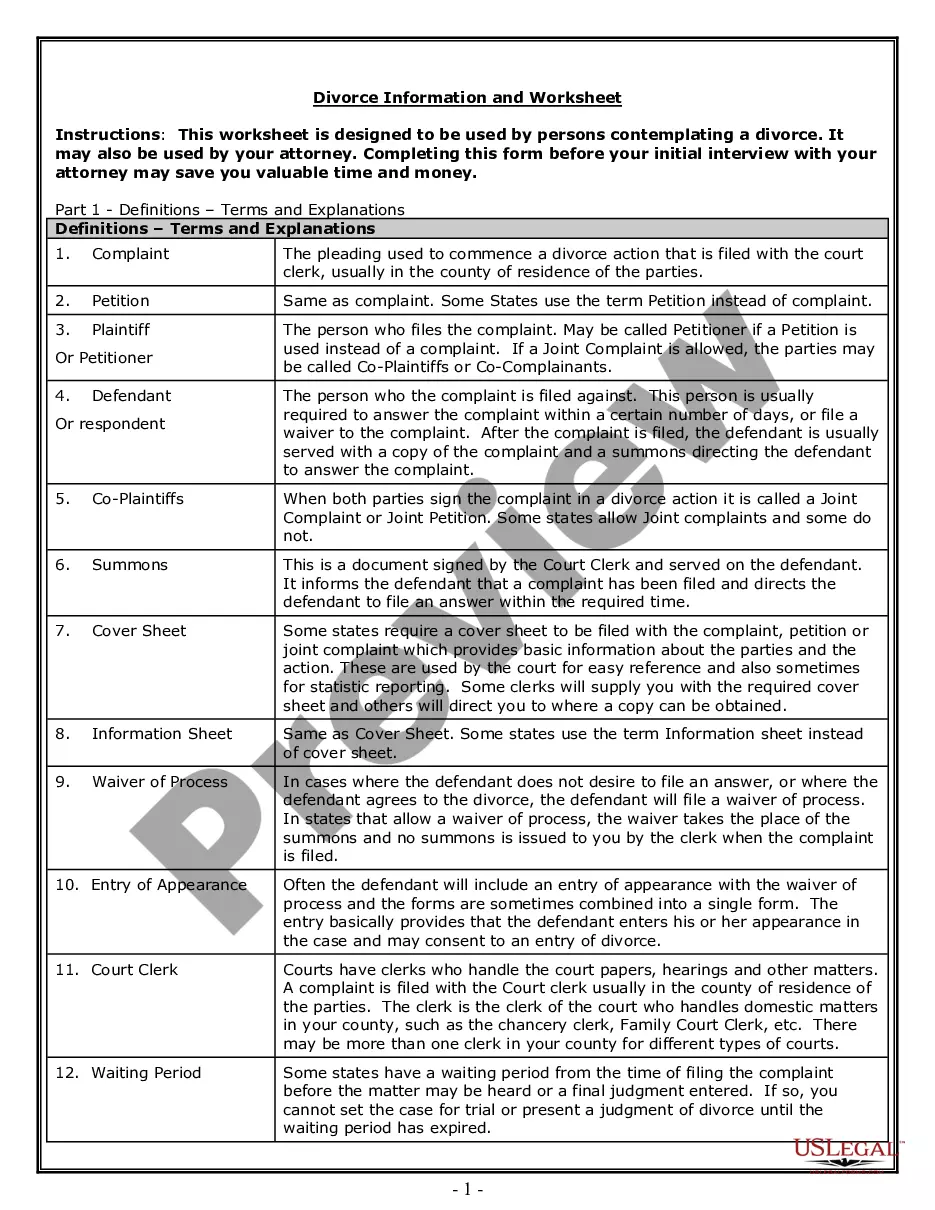

The Commercial Rental Lease Application Questionnaire is a legal document used by landlords to obtain pertinent information from prospective tenants (lessees) before entering into a commercial lease agreement. This form differs from residential lease applications as it focuses on businesses renting commercial properties. It includes necessary disclosures and authorization for a credit check, ensuring that landlords can make informed decisions regarding potential tenants' suitability for leasing their commercial spaces.

Key components of this form

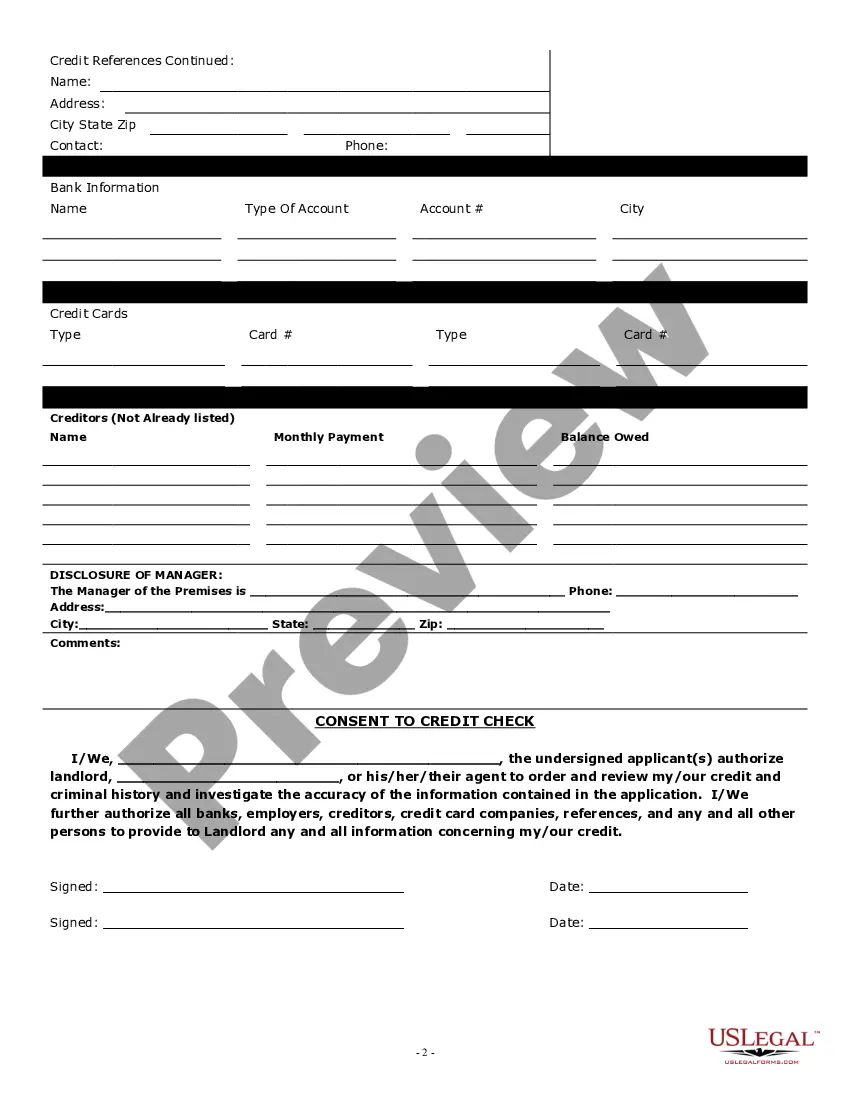

- Applicant Information: Personal details of the proposed tenant.

- Disclosure of Manager: Contact information for the property manager.

- Credit Check Consent: Authorization for the landlord to review the applicant's credit and background information.

- References: Sections for providing business and personal references related to credit history.

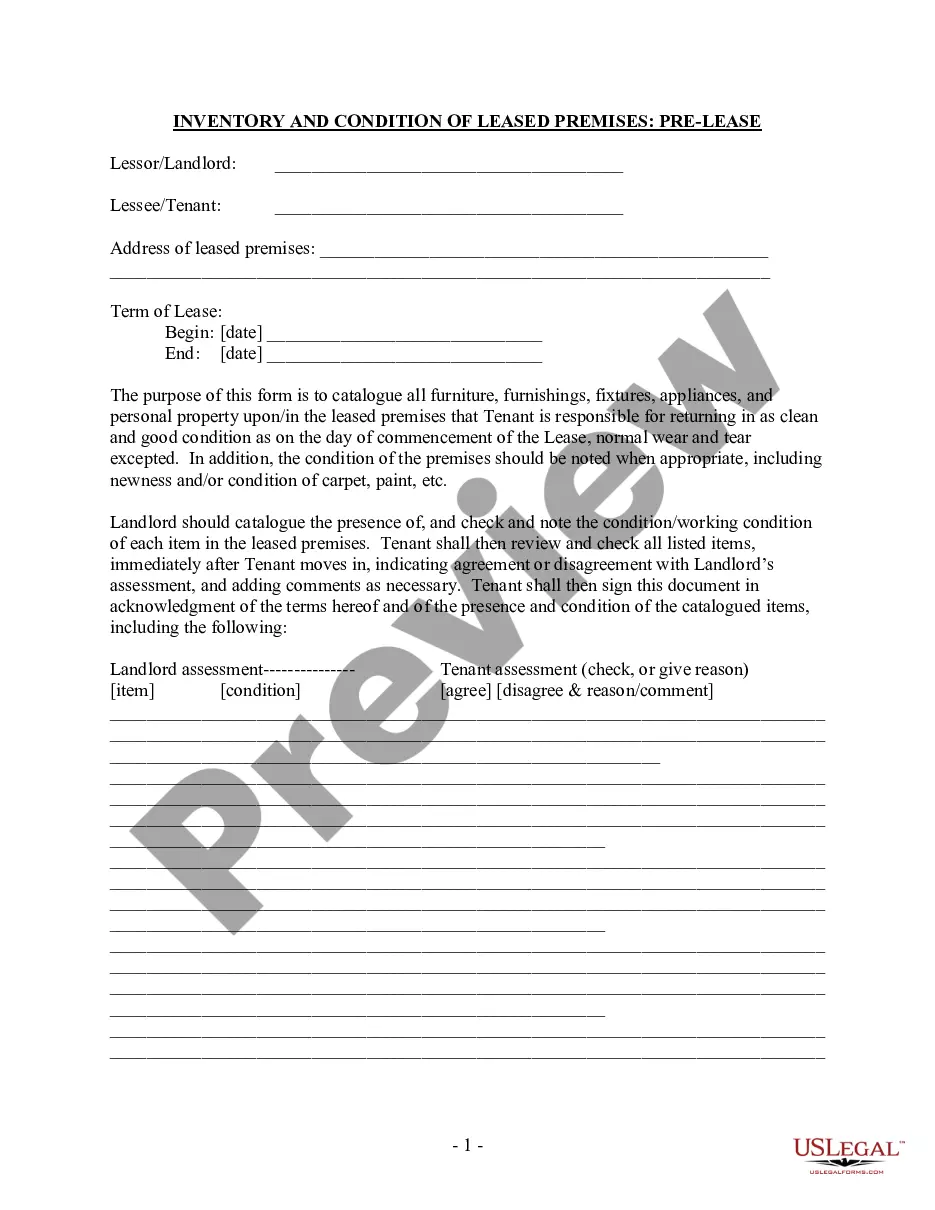

- Security Deposit and Lease Terms: Information regarding deposit amounts and lease duration.

Common use cases

This form should be used when a landlord is seeking to rent out commercial property and needs to evaluate potential tenants. It is typically used early in the rental process to gather essential information about the prospective tenant's financial reliability and business history, thereby assisting the landlord in screening applicants effectively.

Who can use this document

- Landlords or property managers of commercial real estate seeking to lease their properties.

- Businesses looking to rent commercial space and needing to provide necessary information.

- Real estate professionals involved in facilitating commercial lease agreements.

Instructions for completing this form

- Identify the parties: Fill in the names and contact information of all proposed tenants.

- Specify the property: Provide details about the commercial property being leased.

- Enter financial information: Complete the sections concerning credit references and financial history.

- Consent to credit check: Sign and date the authorization for a credit review.

- Submit the application: Ensure all pages are signed and submit to the landlord for review.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Leaving sections incomplete or skipping required signatures.

- Not providing updated or accurate credit references.

- Failing to sign the consent for a credit check.

Benefits of using this form online

- Convenience: Access and complete the form from anywhere at any time.

- Editability: Make changes easily as needed without redrafting the entire document.

- Reliability: Use professionally drafted templates to ensure all legal requirements are met.

Legal use & context

- Commercial leases are legally binding agreements that require full disclosure of financial and relevant personal information by the tenant.

- This form serves as a tool for landlords to assess potential tenants and helps ensure compliance with leasing regulations.

Main things to remember

- The Commercial Rental Lease Application Questionnaire is essential for evaluating prospective commercial tenants.

- Completing this form accurately is critical to prevent delays in the leasing process.

- Landlords should request this application before finalizing any lease agreements to ensure they choose qualified tenants.

Looking for another form?

Form popularity

FAQ

The process for retailers qualifying for a commercial lease can vary from landlord to landlord. Landlords consider several factors including tenant mix, personal credit history of the owner, company balance sheet, profit and loss statements, open credit lines, and growth projections.

Bank references. Current credit reports/scores from all three reporting bureaus. Previous/current landlord references (for an existing business moving to a new location) Personal and corporate financial statement(s) A copy of your business plan. Business bank statement(s) Prior tax returns.

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

A security deposit is typically an amount equivalent to one or two month's rent, which is deposited by the tenant to secure, as far as money can, the tenant's performance of the tenant's obligations under the Lease.

Every commercial tenant doesn't necessarily need a sterling credit history to lease space from you. But it's good to know what you're getting into ahead of time. Assessing credit helps you know when to add appropriate protections into a tenant's lease agreement.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.

Can the landlord refuse consent to an Assignment? Most leases will say that the Landlord cannot unreasonably withhold consent. According to section 19 (1A) of the Landlord and Tenant Act 1927 the landlord can insert conditions in the lease, which need to be met in the case of an assignment.

Commercial leases generally fall into one of three major categories based on how the building's operating expenses are passed on to tenants: Gross or full-service lease. You pay a flat monthly rate from which the landlord pays all operating expenses, including utilities, property taxes and maintenance.