A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

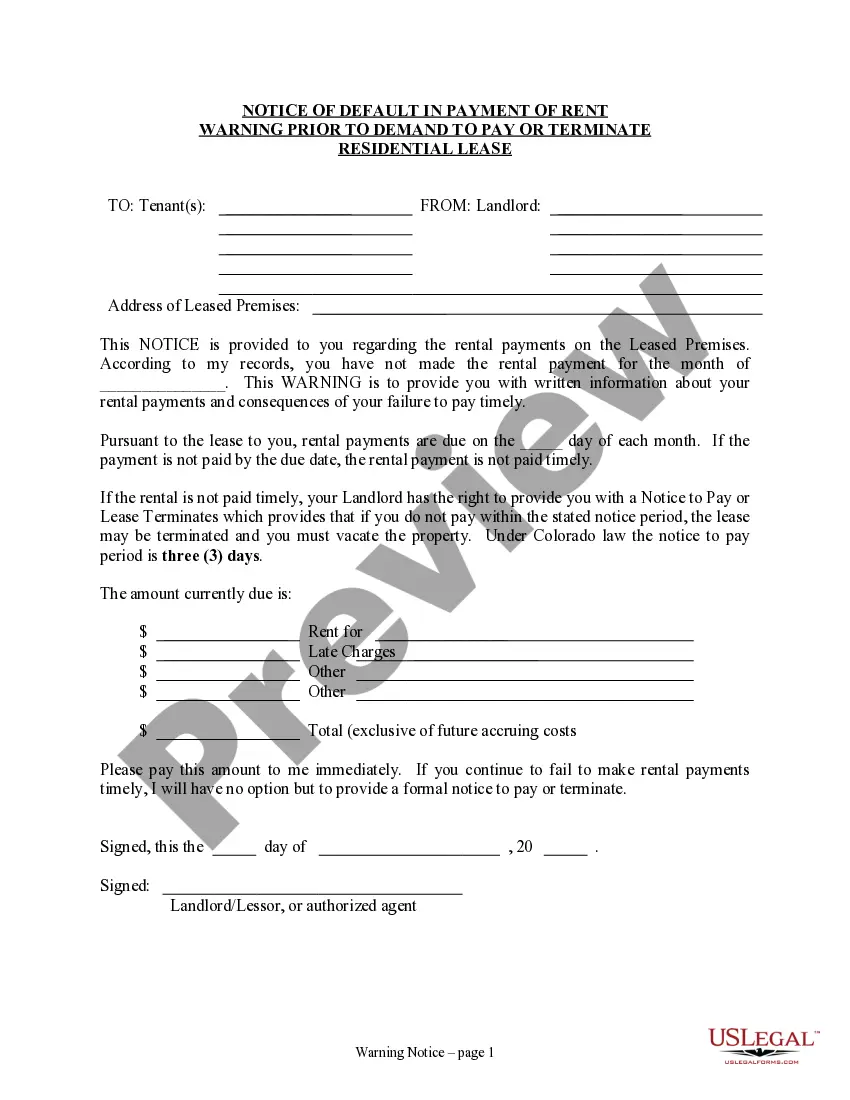

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

It is feasible to spend hours online searching for the authentic document template that complies with the state and federal standards you will require.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can download or print the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee from the services.

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can fill out, modify, print, or sign the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

- Every valid document template you obtain is yours permanently.

- To retrieve another copy of any acquired form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form details to verify you have chosen the correct form.

Form popularity

FAQ

Disclaimer trusts, while offering distinct advantages, can present challenges. For instance, beneficiaries may face difficulties in understanding the complex legal requirements associated with disclaiming an inheritance. Additionally, improper disclaiming could lead to unintended tax consequences or disputes among beneficiaries. Using a reliable platform like uslegalforms can simplify these complexities and guide you through the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee process.

Yes, a beneficiary can disclaim their interests in a trust, and doing so can provide various benefits, such as avoiding potential tax implications. To accomplish this, the beneficiary must file a formal disclaimer with the trustee, adhering to the guidelines specified in the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This process empowers beneficiaries to make informed decisions regarding their inheritance.

The disclaimer clause in a trust outlines the conditions under which a beneficiary can refuse their interest in the trust. This clause is critical as it clarifies the legal framework for disclaiming benefits while ensuring proper distribution in accordance with the trust's intentions. When executed correctly, the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee allows beneficiaries to navigate their options confidently.

Yes, you can decline to be a beneficiary of a trust through a legal process known as a disclaimer. This action allows you to reject your right to the inheritance, thus preventing any tax liabilities or responsibilities associated with the assets. It is essential to follow the proper legal procedures, such as the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, to ensure that your wishes are formally recognized.

A beneficiary disclaimer is a legal statement by a beneficiary who chooses to decline an inheritance. This decision allows the property to pass to alternate beneficiaries without triggering estate taxes for the disclaiming beneficiary. Understanding the process of a Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is crucial, and uslegalforms provides valuable resources to help you navigate this important decision.

Writing a disclaimer of inheritance involves drafting a formal document that clearly states your intention to refuse your share of an estate. This document must be signed and delivered to the executor of the estate in compliance with state laws. By using a well-structured platform like uslegalforms, you can ensure that your Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee reflects your wishes accurately and legally.

A disclaimer trust is a legally defined arrangement that allows a beneficiary to refuse an inheritance, redirecting it into a trust for other beneficiaries. For instance, if a parent leaves an estate to a child, the child can choose to disclaim the inheritance. This action effectively creates a Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, allowing the assets to pass to other designated heirs, often with beneficial tax implications.

To disclaim an inherited property, you must prepare a formal disclaimer that specifies your desire to refuse the property. This document should be signed and filed according to Texas regulations. It's essential to follow the guidelines to ensure the disclaimer is effective under the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. For assistance, platforms like UsLegalForms can guide you through the necessary steps and provide the required forms.

Yes, a trust beneficiary can disclaim their interest in the trust. Doing so often involves submitting a formal disclaimer document that meets Texas legal standards. This action allows the interest to pass to an alternate beneficiary, ensuring the property aligns with the intent of the trust. The Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a structured way for beneficiaries to disavow their rights efficiently.

To avoid capital gains tax on inherited property in Texas, you can take advantage of the stepped-up basis rule. This allows your basis in the property to adjust to its fair market value at the time of the decedent's death. If you choose to disclaim the property using the Texas Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, the property will pass to the next beneficiary, potentially avoiding tax implications for you.