Texas Sample Letter for Apology for Accounting Errors and Past Due Notices

Description

How to fill out Sample Letter For Apology For Accounting Errors And Past Due Notices?

If you require extensive, acquire, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or search terms.

Step 4. Once you have identified the form you want, click the Get now button. Select your preferred payment method and provide your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to quickly find the Texas Sample Letter for Apology for Accounting Errors and Past Due Notices.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Texas Sample Letter for Apology for Accounting Errors and Past Due Notices.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct region.

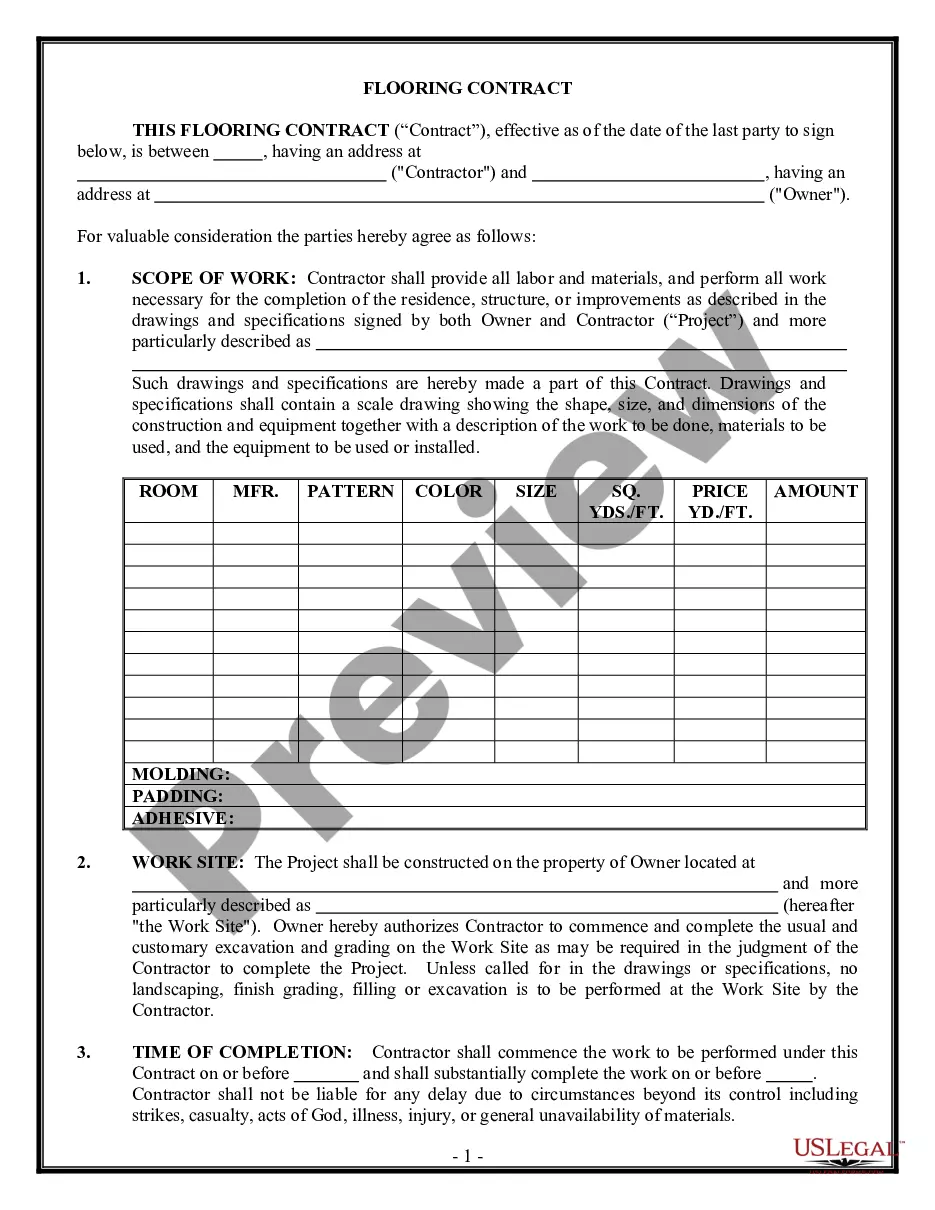

- Step 2. Use the Review option to examine the content of the form. Remember to read the details.

- Step 3. If you are not satisfied with the form, take advantage of the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

An example of a sincere apology letter includes a clear acknowledgment of the mistake, an expression of regret, and an outline of corrective actions. Consider using a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices to craft your letter thoughtfully. Keep your tone respectful and honest, showing empathy towards those affected. This will enhance the effectiveness of your apology.

Writing a strong apology letter involves clarity, sincerity, and commitment to amend the situation. Utilize a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices to structure your letter effectively. Acknowledge the mistake, express understanding of its impact, and outline the steps you will take to correct the issue. This comprehensive approach makes your apology more impactful.

Begin your apology letter by clearly stating the purpose of your letter. Use a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices for guidance. You might start with a simple acknowledgment of the issue, followed by an expression of genuine regret. This sets a sincere tone for the rest of your message.

When apologizing to someone you hurt deeply, start by acknowledging the pain caused by your actions. A sample letter from Texas for Apology for Accounting Errors and Past Due Notices can help format your thoughts. Speak honestly and from the heart, showing understanding of the hurt you caused. Strive to communicate genuine remorse and a desire to amend the situation.

The most sincere apologies come from genuine remorse about the impact of your actions. In a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices, express how the mistake affected the other party. Use a heartfelt tone, acknowledge any inconvenience caused, and offer reassurance about making it right. This builds trust and fosters goodwill.

A professional apology letter should include a clear statement of the mistake, such as an accounting error. You can refer to a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices for inspiration on format. Make sure to convey empathy and include any corrective actions you plan to take. This shows your commitment to accountability.

To apologize for a mistake professionally, start by acknowledging the error clearly. Use a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices as your guide for structure. Express sincere regret and take responsibility. Finally, offer a solution or steps you are taking to prevent future mistakes.

To start an explanation letter for a mistake, begin with a clear statement of the error, followed by an expression of regret. It's essential to set the tone of accountability while maintaining a professional demeanor. Using a framework like the Texas Sample Letter for Apology for Accounting Errors and Past Due Notices can help guide your introduction and overall narrative.

An example of an explanation letter for a mistake at work includes a straightforward acknowledgment of the error, a brief description of its impact, and your proposed solutions. You might mention relevant documentation, such as a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices, to illustrate how to structure your letter for maximum clarity.

Writing a letter to correct an error requires clarity and sincerity. Start by stating the error and providing context for its occurrence. Then, clearly detail the steps you will take to amend the mistake, and consider using a Texas Sample Letter for Apology for Accounting Errors and Past Due Notices as a template for your communication.