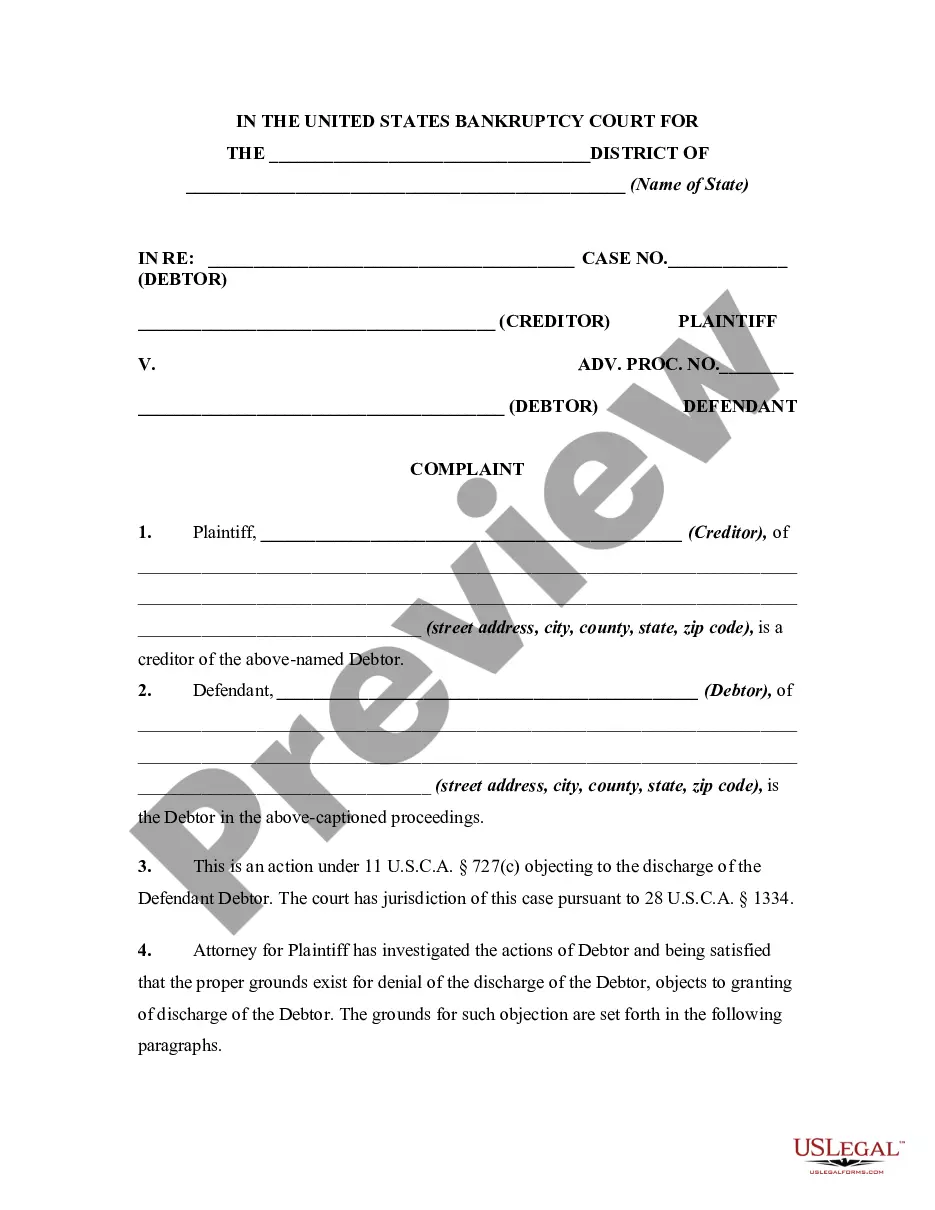

The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

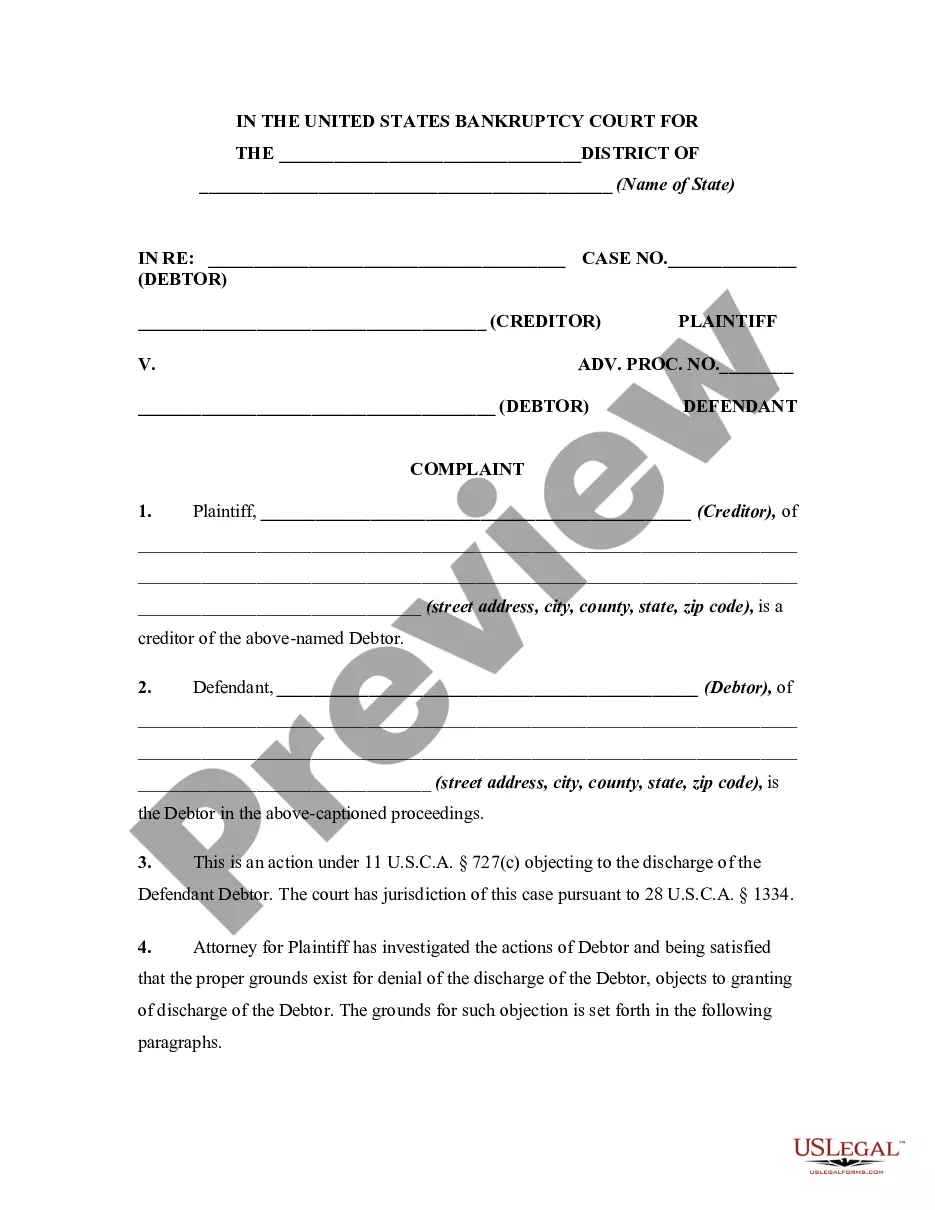

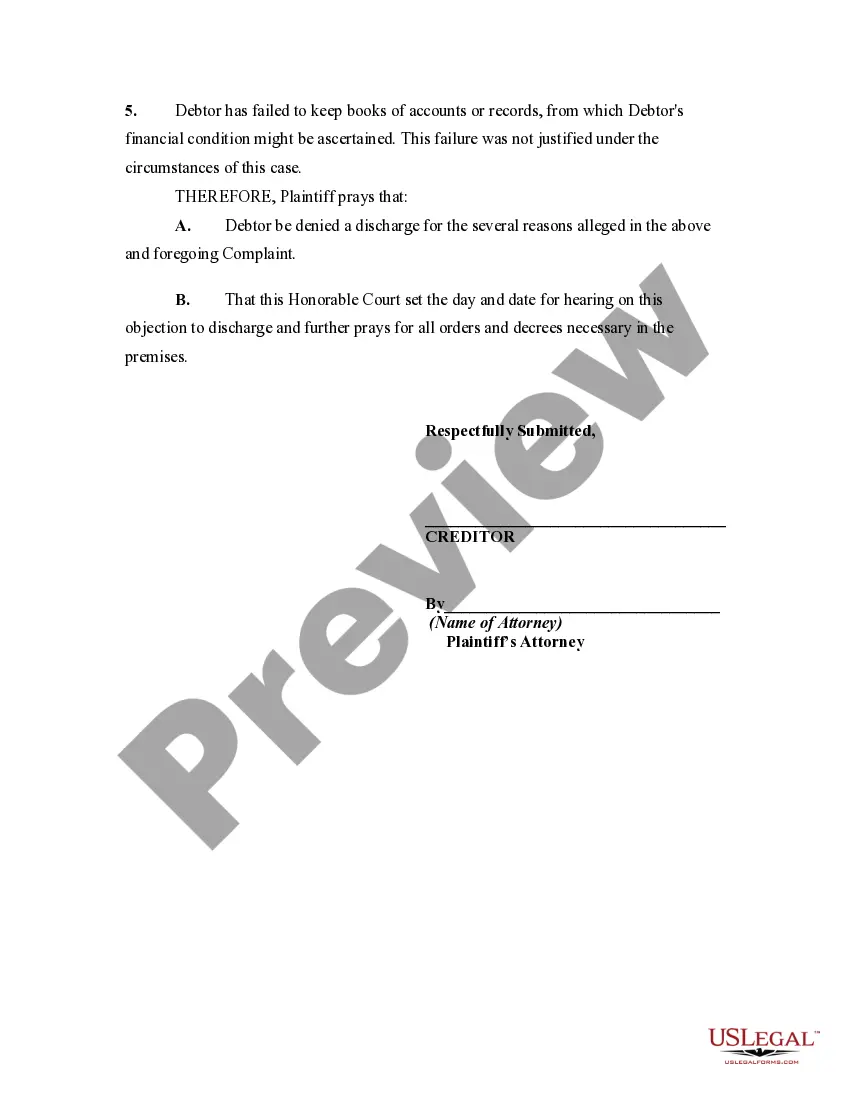

Texas Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records

Description

How to fill out Complaint Objecting To Discharge Or Debtor In Bankruptcy Proceeding For Failure To Keep Books And Records?

Choosing the right legitimate record format could be a battle. Obviously, there are a lot of web templates accessible on the Internet, but how would you discover the legitimate form you need? Use the US Legal Forms internet site. The assistance gives 1000s of web templates, for example the Texas Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records, that you can use for enterprise and private requirements. Each of the types are examined by pros and fulfill state and federal specifications.

If you are previously registered, log in to your profile and then click the Obtain option to find the Texas Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records. Make use of profile to check from the legitimate types you might have bought earlier. Go to the My Forms tab of the profile and get an additional duplicate of the record you need.

If you are a fresh user of US Legal Forms, listed below are easy instructions for you to follow:

- First, be sure you have selected the appropriate form to your metropolis/region. You may examine the shape making use of the Preview option and read the shape explanation to make sure it is the right one for you.

- When the form does not fulfill your needs, make use of the Seach discipline to find the correct form.

- When you are positive that the shape is acceptable, click the Get now option to find the form.

- Opt for the costs prepare you need and enter the required details. Make your profile and pay money for an order with your PayPal profile or credit card.

- Opt for the document file format and acquire the legitimate record format to your device.

- Total, revise and printing and signal the received Texas Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records.

US Legal Forms is definitely the largest library of legitimate types where you will find different record web templates. Use the service to acquire skillfully-made papers that follow status specifications.

Form popularity

FAQ

These include partnerships and corporations, railroads, and any person that may be a debtor under Chapter 7. Ineligible debtors under Chapter 11 include shareholders, commodities and stock brokers, insurers, banks, credit unions, and savings and loan associations.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

A debtor in possession (DIP) is a business or individual that has filed for Chapter 11 bankruptcy protection but still holds property to which creditors have a legal claim under a lien or other security interest. A DIP may continue to do business using those assets.

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

Chapter 11 bankruptcy is commonly called reorganization bankruptcy. It allows a business to continue operations while the business makes a plan to repay or discharge its debts. The plans are designed to keep the business operational during and following the bankruptcy process.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Restructuring of Secured Debt: Under chapter 11, secured debt may be restructured by lowering the interest rate on the obligation, extending its maturity, or both. In certain circumstances, the amount of secured debt can be written down to the value of the creditor's collateral.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.