Texas Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

If you require extensive, download, or print approved document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are categorized by type and state or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Texas Revocable Living Trust for a Single Person in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the Texas Revocable Living Trust for a Single Person.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

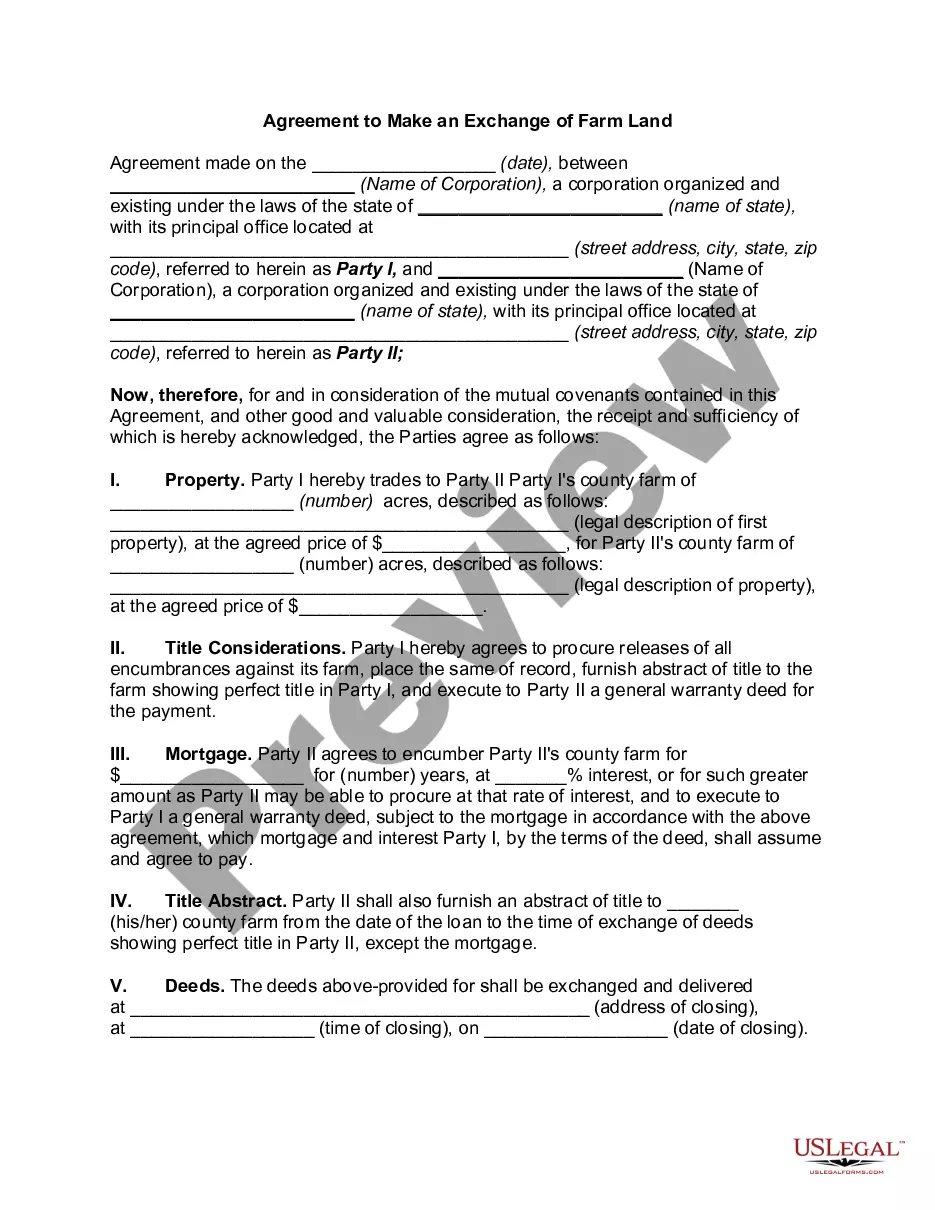

- Step 2. Use the Preview option to review the form's content. Always remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

In a Texas Revocable Living Trust for Single Person, you retain ownership of the property as the trustee. As long as the trust is active, you can manage, sell, or reclaim your assets without restriction. Only upon your passing does the property transfer to your beneficiaries as specified in the trust document, thereby avoiding the probate process.

In essence, a living trust and a revocable trust serve the same purpose and function similarly in Texas. The best choice for you often depends on your specific estate planning needs. A Texas Revocable Living Trust for Single Person is a flexible option that allows adjustments as your circumstances change. Therefore, evaluate both options in the context of your personal goals.

The primary downside of a living trust in Texas is the absence of asset protection. A Texas Revocable Living Trust for Single Person does not shield your assets from lawsuits or creditors. Furthermore, if you do not transfer your assets into the trust properly, those assets may not be protected or managed as intended.

While a Texas Revocable Living Trust for Single Person offers many benefits, it also has some downsides. One major disadvantage is that it does not protect your assets from creditors during your lifetime. Additionally, setting up a revocable trust can be more complex than simply writing a will, which may involve more effort and legal fees.

In Texas, a revocable trust does not need to be recorded; rather, it operates privately. You can create a Texas Revocable Living Trust for Single Person without filing it with the state. This keeps your financial details confidential and out of public records, which can provide peace of mind to you and your beneficiaries.

In Texas, a living trust and a revocable trust are essentially the same. Both terms describe a trust that you create during your lifetime, allowing you to maintain control over your assets. The key feature of a Texas Revocable Living Trust for Single Person is that you can alter or cancel it at any time. This flexibility makes it an appealing option for managing your estate.

Yes, you can create your own living trust in Texas, including a Texas Revocable Living Trust for Single Person. However, ensuring that the trust is legally binding and meets all state requirements can be challenging. If you're unfamiliar with the legal requirements, it's wise to seek assistance from a platform like US Legal Forms. They provide easy-to-follow templates and legal resources to help you accurately establish your trust.

Deciding whether to place assets in a trust can depend on many factors. For many families, a Texas Revocable Living Trust for Single Person provides a streamlined way to manage and distribute assets while avoiding probate. However, your parents should consider their specific financial situation, family dynamics, and estate planning goals before making a decision. Consulting with an experienced advisor can help clarify whether a trust aligns with their long-term objectives.

Trust funds offer significant benefits, but there are some dangers to consider. Mismanagement or lack of proper oversight can lead to disputes among beneficiaries or depletion of the trust assets over time. Additionally, without a clear understanding of how a Texas Revocable Living Trust for Single Person operates, individuals may inadvertently create complications that affect their estate plans. It's essential to consult with a knowledgeable professional to ensure your trust is set up correctly.

Filling out a revocable living trust involves several steps, starting with identifying your assets and beneficiaries. For a Texas Revocable Living Trust for Single Person, you must list all property you wish to include, designate successors, and outline how you want the assets distributed. Using a user-friendly platform like uslegalforms can guide you through the process, ensuring you complete each section accurately. Properly completing this trust ensures your wishes are honored in the future.