Texas Notification of Employer Full Salary Payment (124.2(e)(7))

Description

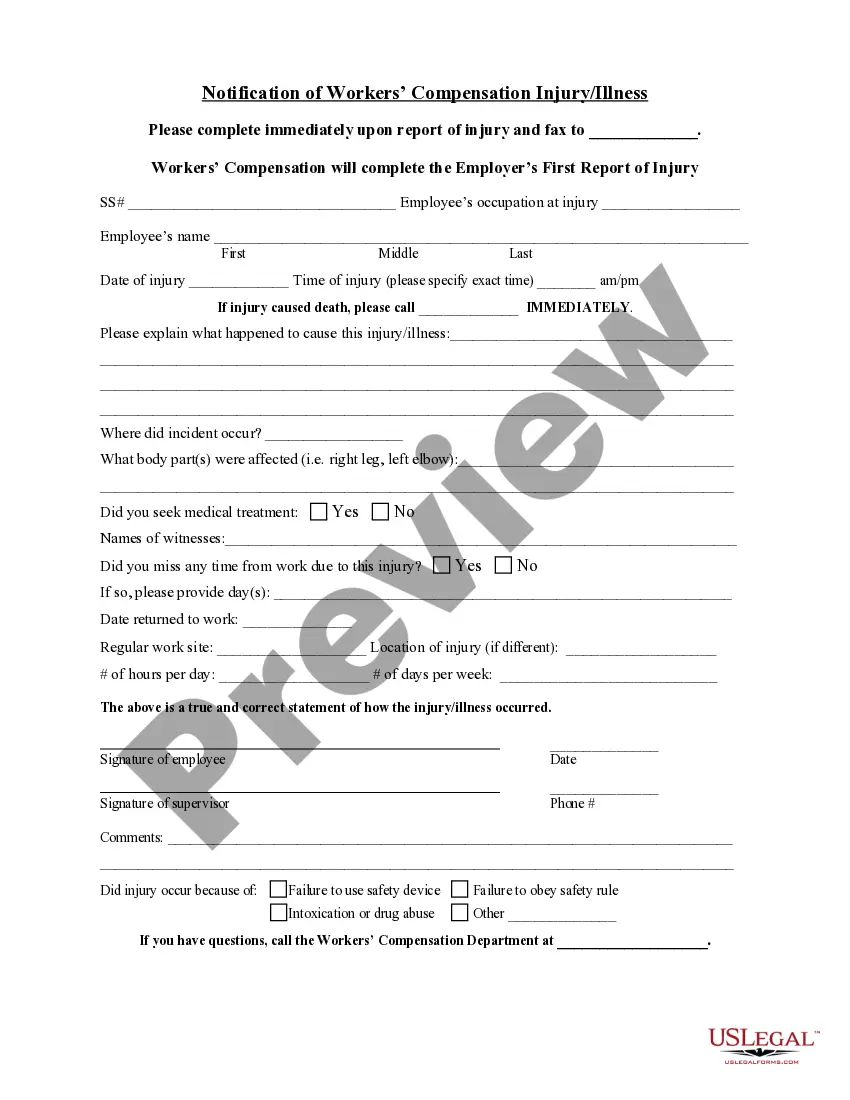

How to fill out Texas Notification Of Employer Full Salary Payment (124.2(e)(7))?

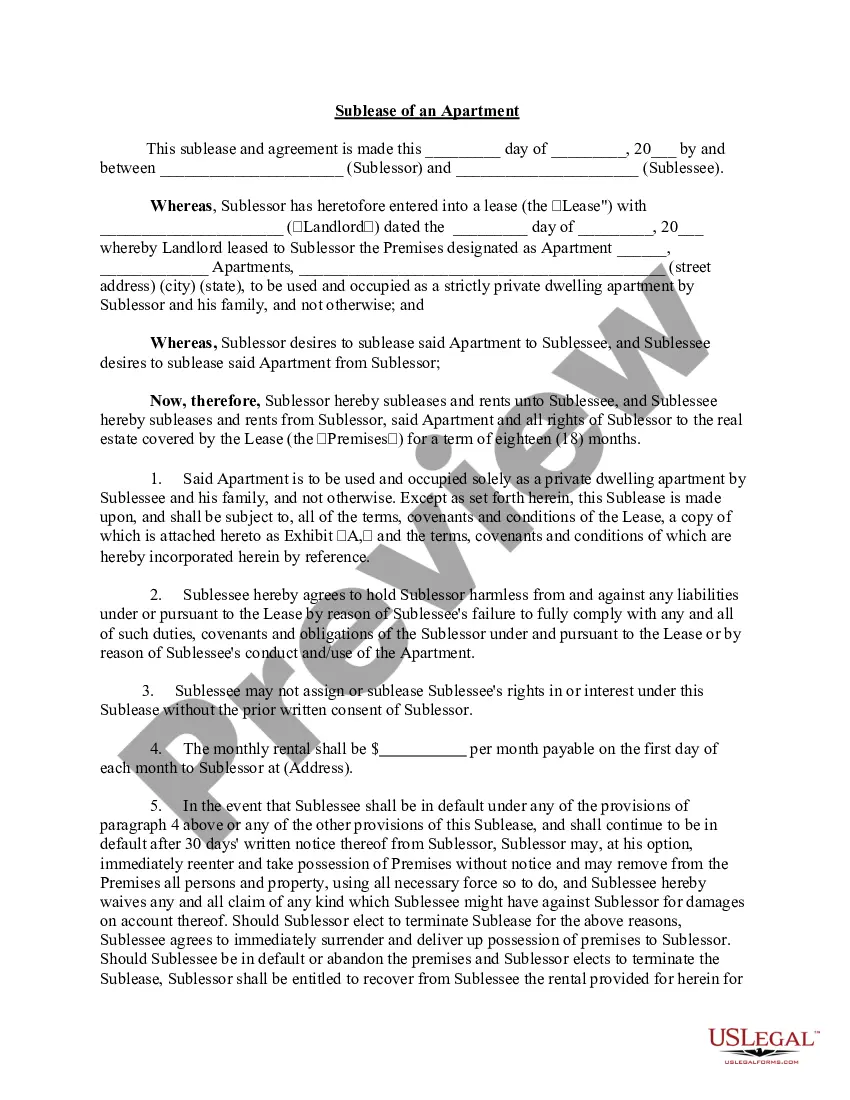

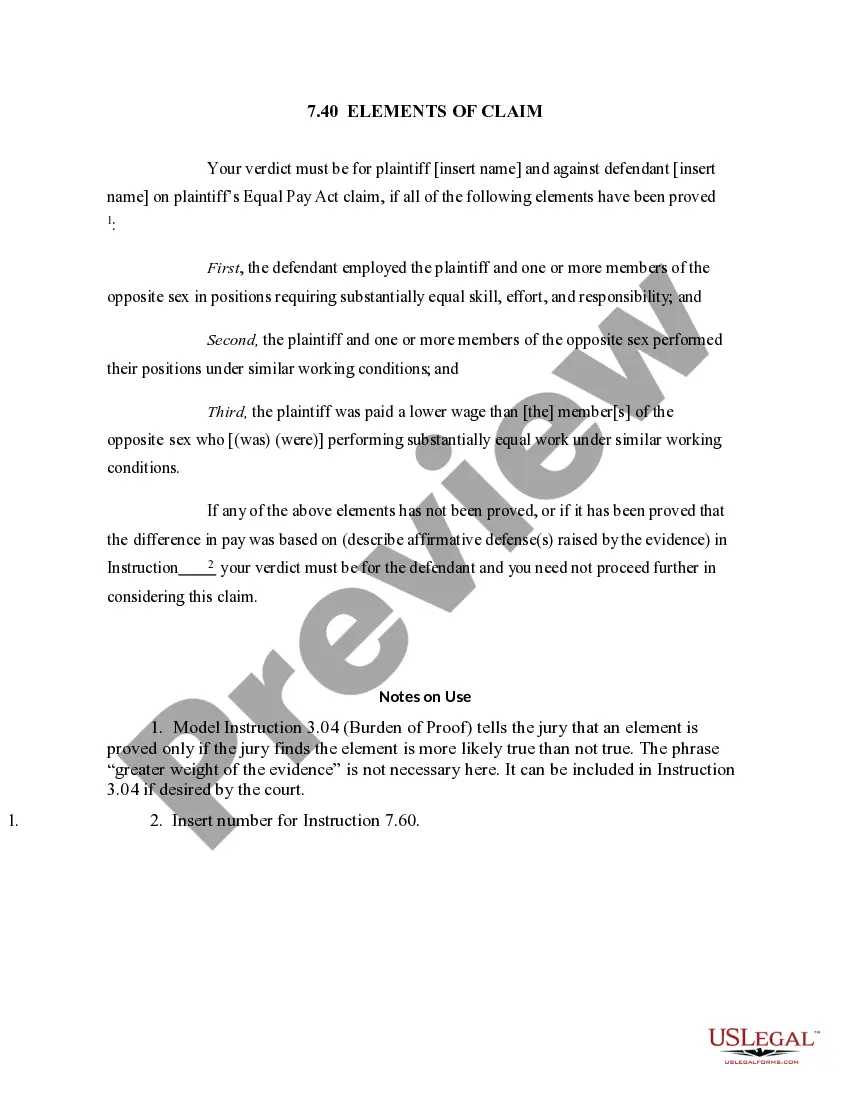

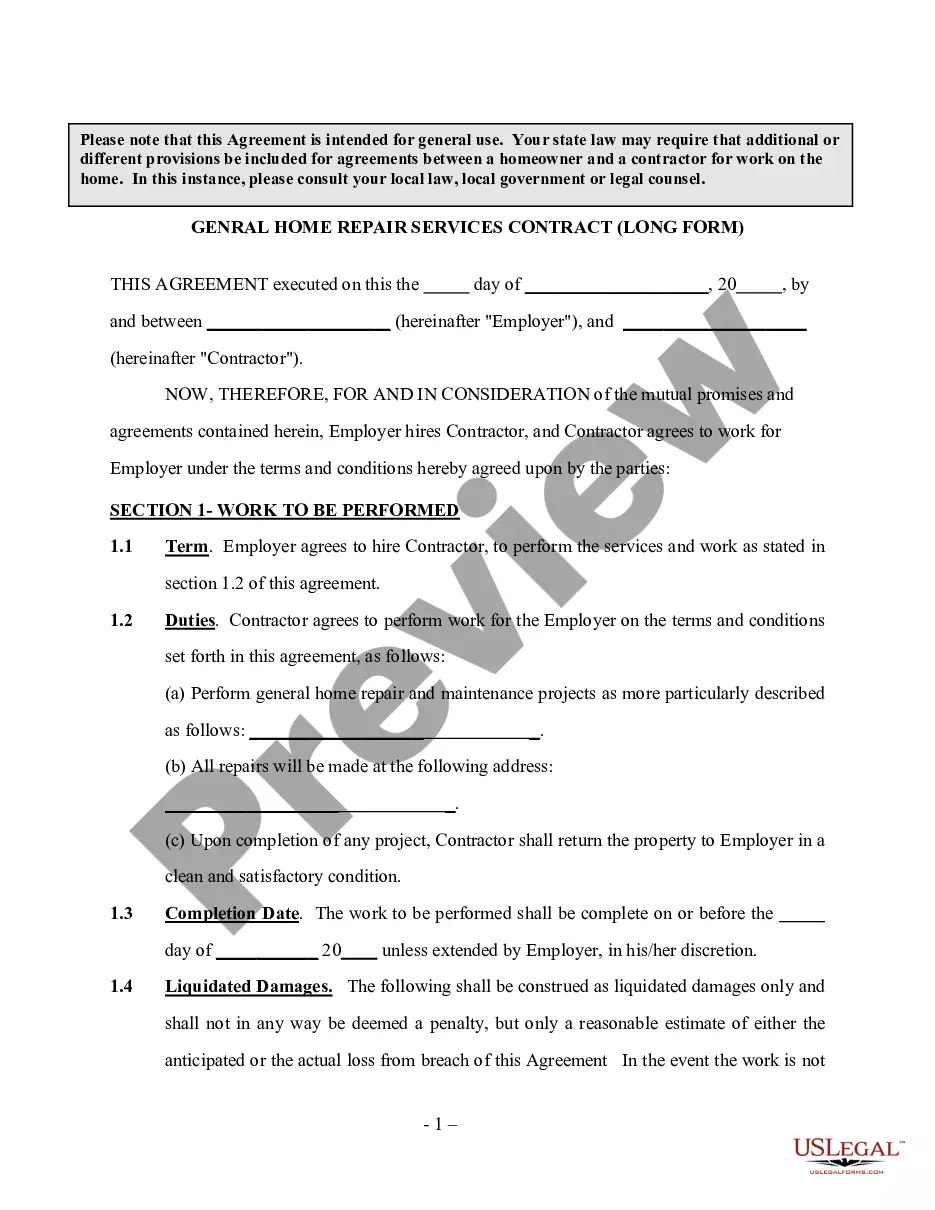

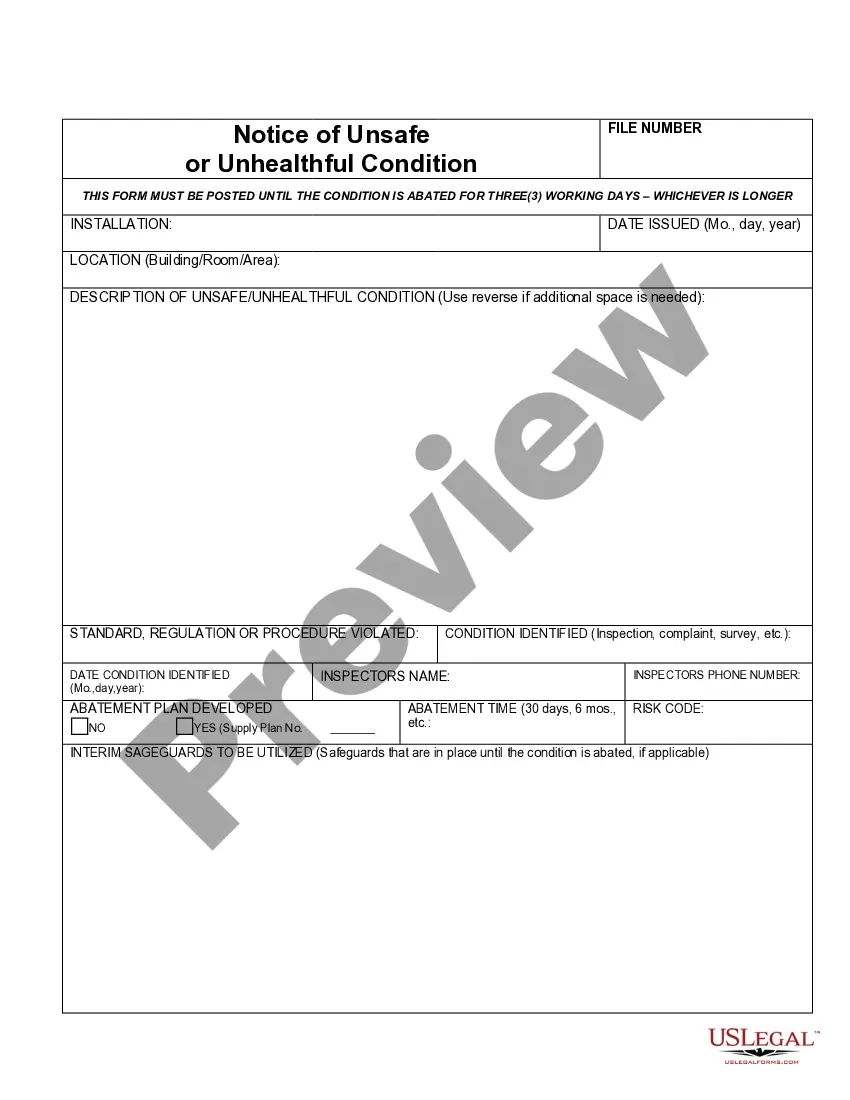

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are checked by our specialists. So if you need to complete Texas Notification of Employer Full Salary Payment (124.2(e)(7)), our service is the perfect place to download it.

Getting your Texas Notification of Employer Full Salary Payment (124.2(e)(7)) from our library is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the correct template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Texas Notification of Employer Full Salary Payment (124.2(e)(7)) and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

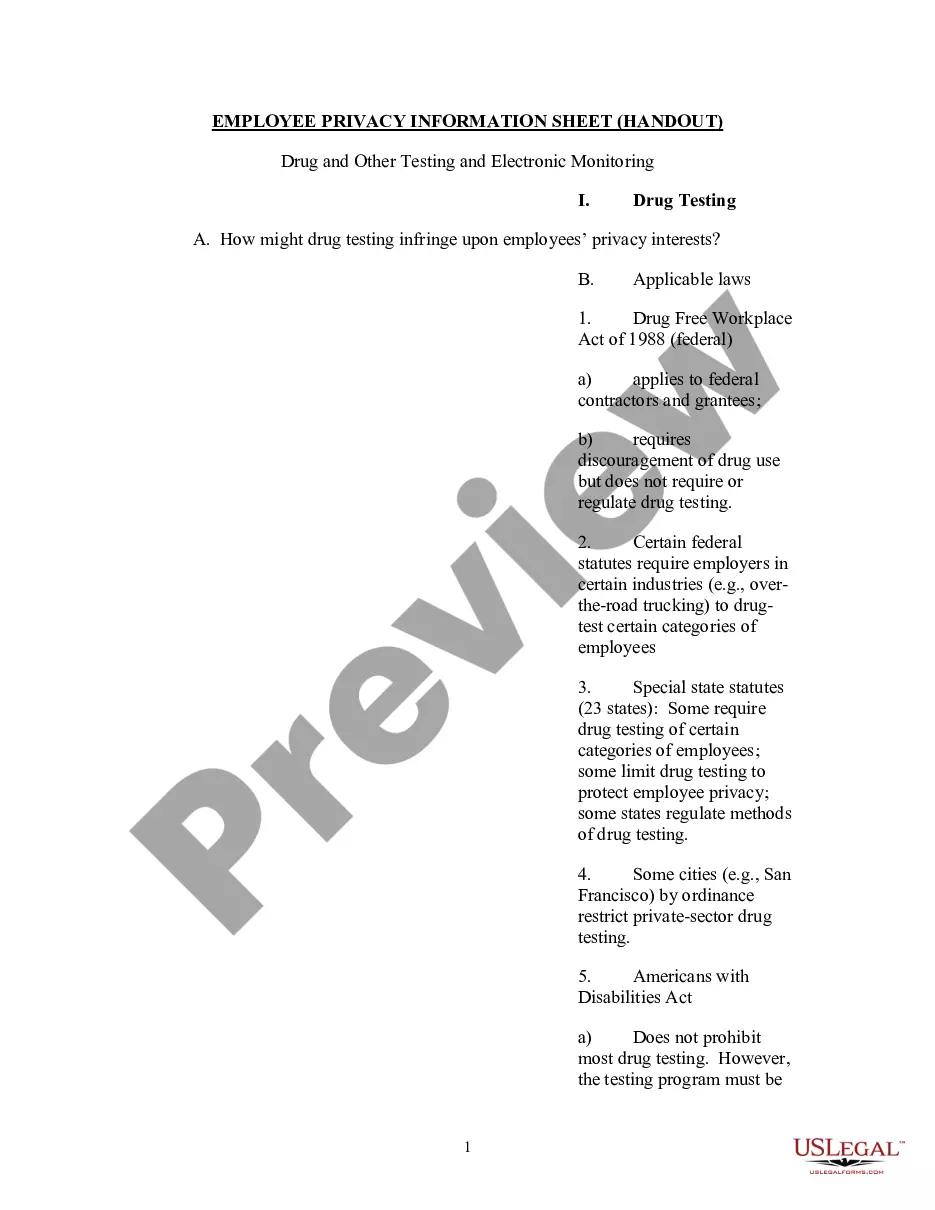

Corporation: Includes coverage for Executive officers of the corporation. Officer payrolls are capped at $62,400 for premium rating. Officers owning 25% or more of the business can choose to be excluded from coverage.

The main downside to such a claim is that you typically get paid less than you would if you were able to take the case to trial. However, under Texas law, an employee has the right to opt out of workers' compensation coverage.

In most cases, as a single-member limited liability corporation (LLC), you may not be required by your state to have workers' compensation coverage. However, you might choose to obtain coverage once you see what workers' compensation insurance can do to protect your assets.

Do I have to have workers' compensation insurance? Texas doesn't require most private employers to have workers' compensation. But private employers who contract with government entities must provide workers' compensation coverage for the employees working on the project.

Texas is the only state which does not require coverage. However, there are exclusions to this rule for some employers listed below: Any public employer including cities, counties, state agencies and state universities. Building and construction contractors for public employers.

Texas doesn't require most private employers to have workers' compensation. But private employers who contract with government entities must provide workers' compensation coverage for the employees working on the project.

Texas' State Workers' Compensation Benefits State minimum limits for workers' compensation are pretty universal. Workers' compensation state minimum limits: $100,000 per occurrence for bodily injury: This coverage is for any one employee. $100,000 per employee for bodily disease: This coverage is for any one employee.

Do sole proprietors need workers' compensation? Though it's not required by law, sole proprietors, independent contractors, and other self-employed individuals may elect to buy workers' comp insurance for themselves. Their clients might also require them to carry this coverage.