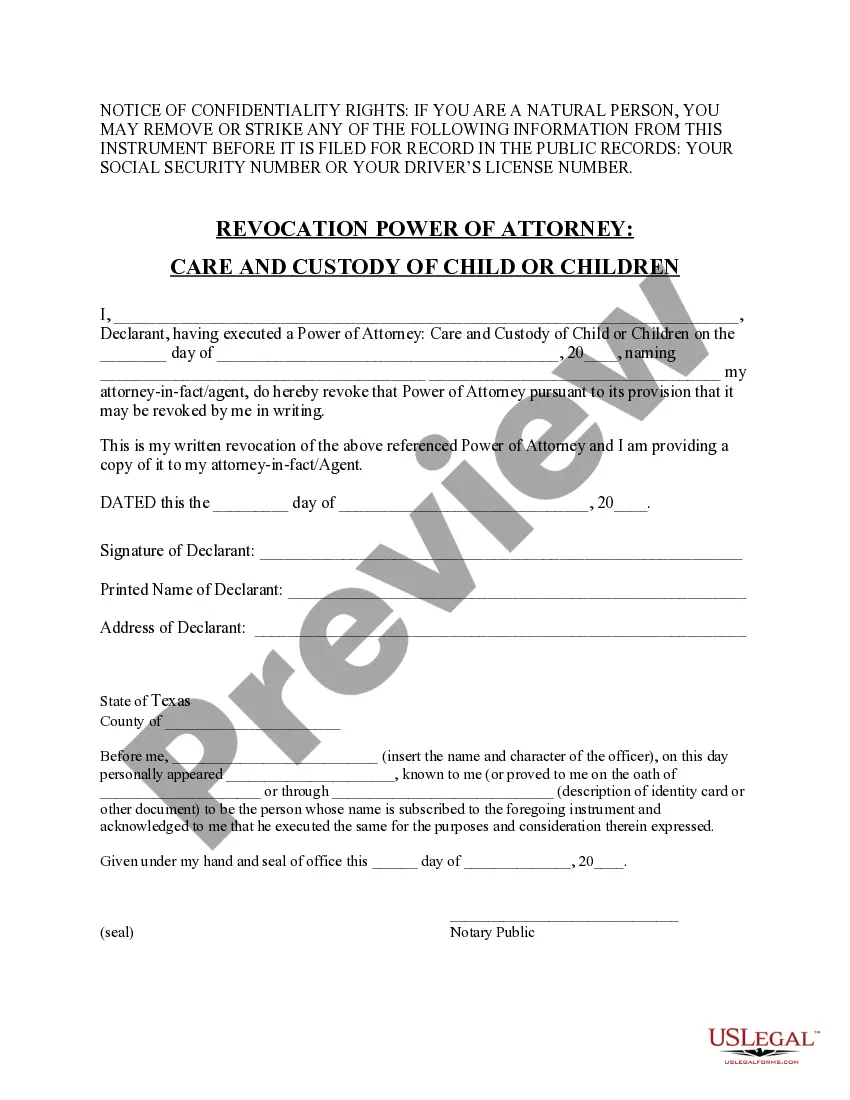

This is a revocation of the power of attorney for the care and custody of a child or children provided for in Form TX-P007. A Power of Attorney can be revoked by the principal at any time, as long as he or she is competent. This form complies with all state statutory laws.

Texas Revocation of Power of Attorney for Care of Child or Children

Description

How to fill out Texas Revocation Of Power Of Attorney For Care Of Child Or Children?

Access to top quality Texas Revocation of Power of Attorney for Care of Child or Children forms online with US Legal Forms. Prevent days of wasted time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find more than 85,000 state-specific authorized and tax samples that you could save and submit in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document will be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Check if the Texas Revocation of Power of Attorney for Care of Child or Children you’re looking at is suitable for your state.

- See the sample using the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred file format to save the file (.pdf or .docx).

You can now open up the Texas Revocation of Power of Attorney for Care of Child or Children template and fill it out online or print it out and get it done yourself. Think about giving the document to your legal counsel to ensure everything is completed correctly. If you make a error, print and complete sample once again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

Revoke Your Current Power of Attorney. To change or cancel your current power of attorney, you should complete a formal, written revocation. Notify Your Power of Attorney. Once you complete your revocation, notify your agent of the cancellation in writing. Notify Relevant Third Parties. Execute a New Power of Attorney.

In other words, a Revocation of Power of Attorney is written confirmation that a principal (the person who appointed power in a Power of Attorney) no longer wants or needs their attorney-in-fact (the person who was appointed power in a Power of Attorney, sometimes called an agent or donor) to act on their behalf.

While any new power of attorney should state that old powers of attorney are revoked, you should also put the revocation in writing. The revocation should include your name, a statement that you are of sound mind, and your wish to revoke the power of attorney.

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.

Unless the power of attorney states otherwise, and they usually don't, a revocation of a POA must be made in writing. A verbal revocation may not be enough.A revocation will reference the existing POA and the current attorney-in-fact and revoke the document and the powers granted.

This can be done by firstly issuing a notice in a local daily newspaper or even a national daily. The donor of the power of attorney will have to get a registered cancellation deed (registered from the office of the respective sub-registrar).

Until an attorney-in-fact's powers are properly revoked, they can continue to legally act for the principal. To cancel a Power of Attorney, the principal can create a document called a Revocation of Power of Attorney or create a new Power of Attorney that indicates the previous Power of Attorney is revoked.

You can always resign. Just put in writing that you resign, deliver it to anyone you have dealt with under the PoA in the past, and to the principal and the alternate agent (if any) and you're done...

You may use form LHT 96.1, instrument of revocation to cancel all types of power of attorneys. Texas law requires you to file a notice of revocation with establishments dealing with the designated agent in writing. You may choose to provide the reason for revocation in the Revocation Power of Attorney Form Texas.