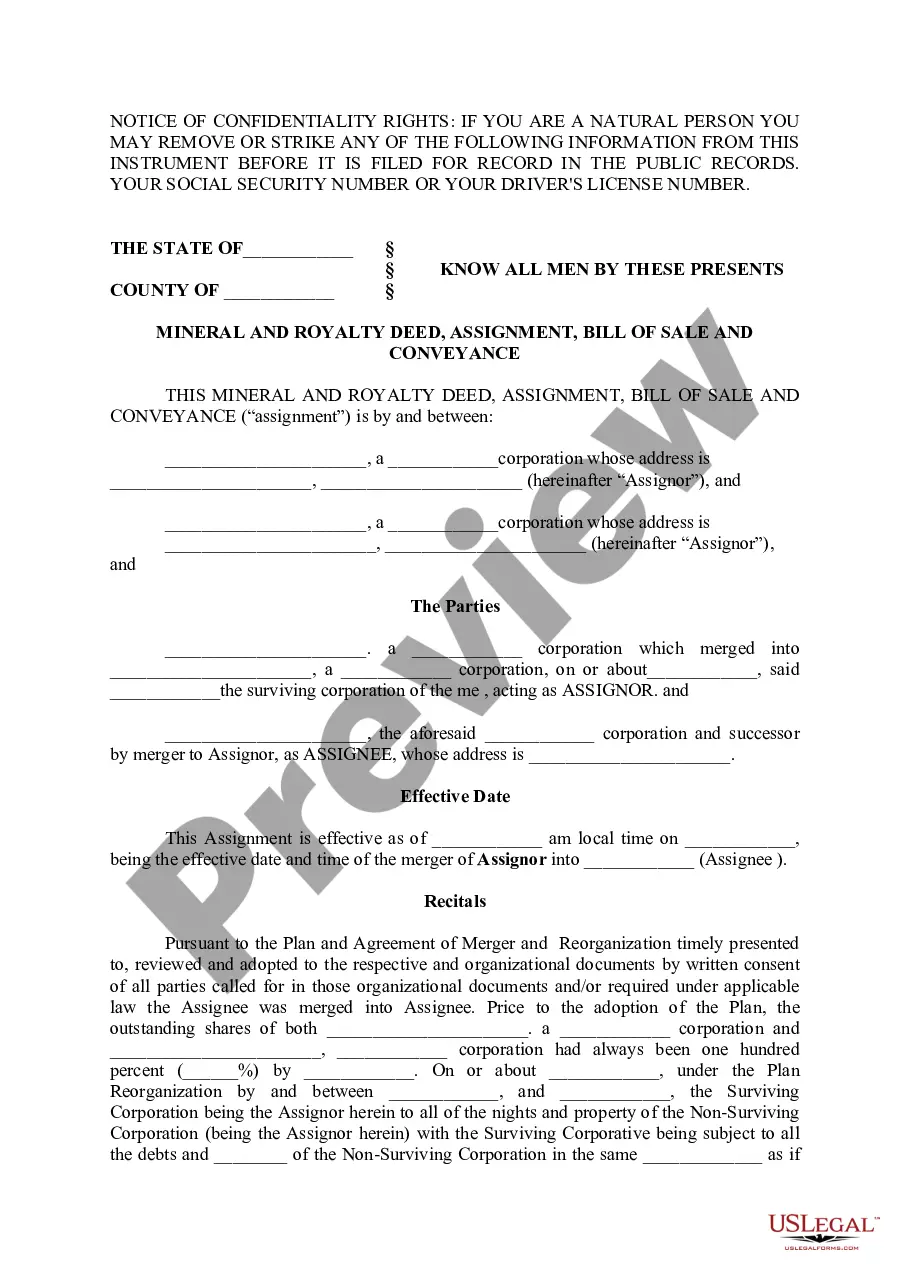

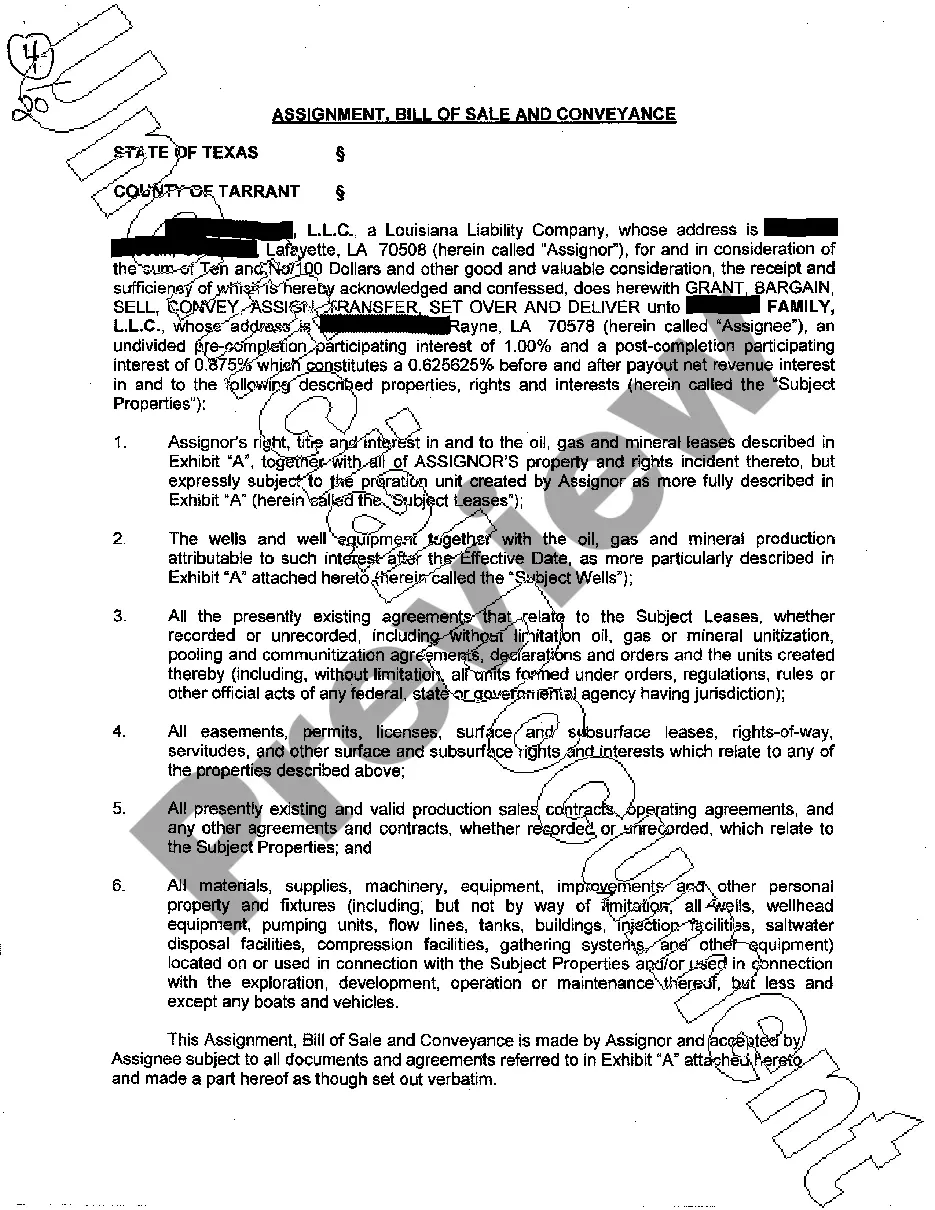

Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance

Description

How to fill out Texas Mineral And Royalty Deed, Assignment, Bill Of Sale And Conveyance?

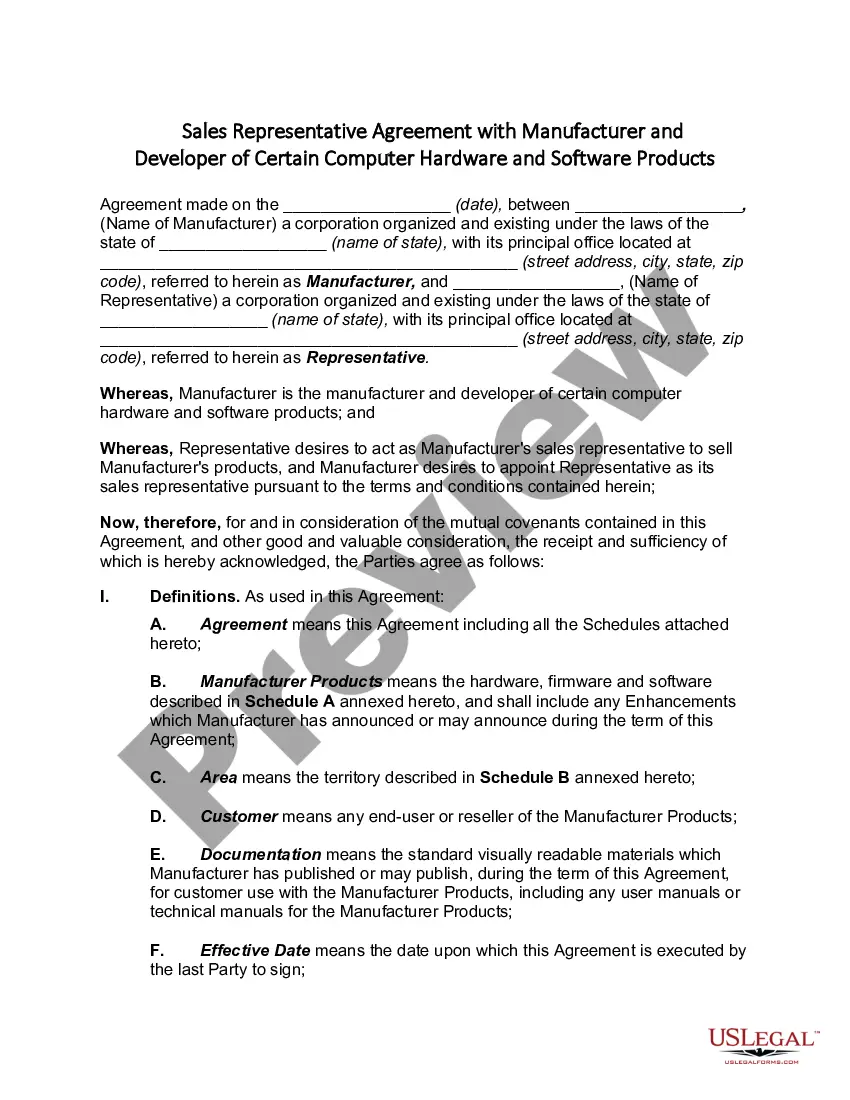

Get access to quality Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance samples online with US Legal Forms. Avoid hours of lost time seeking the internet and lost money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific legal and tax forms you can download and submit in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

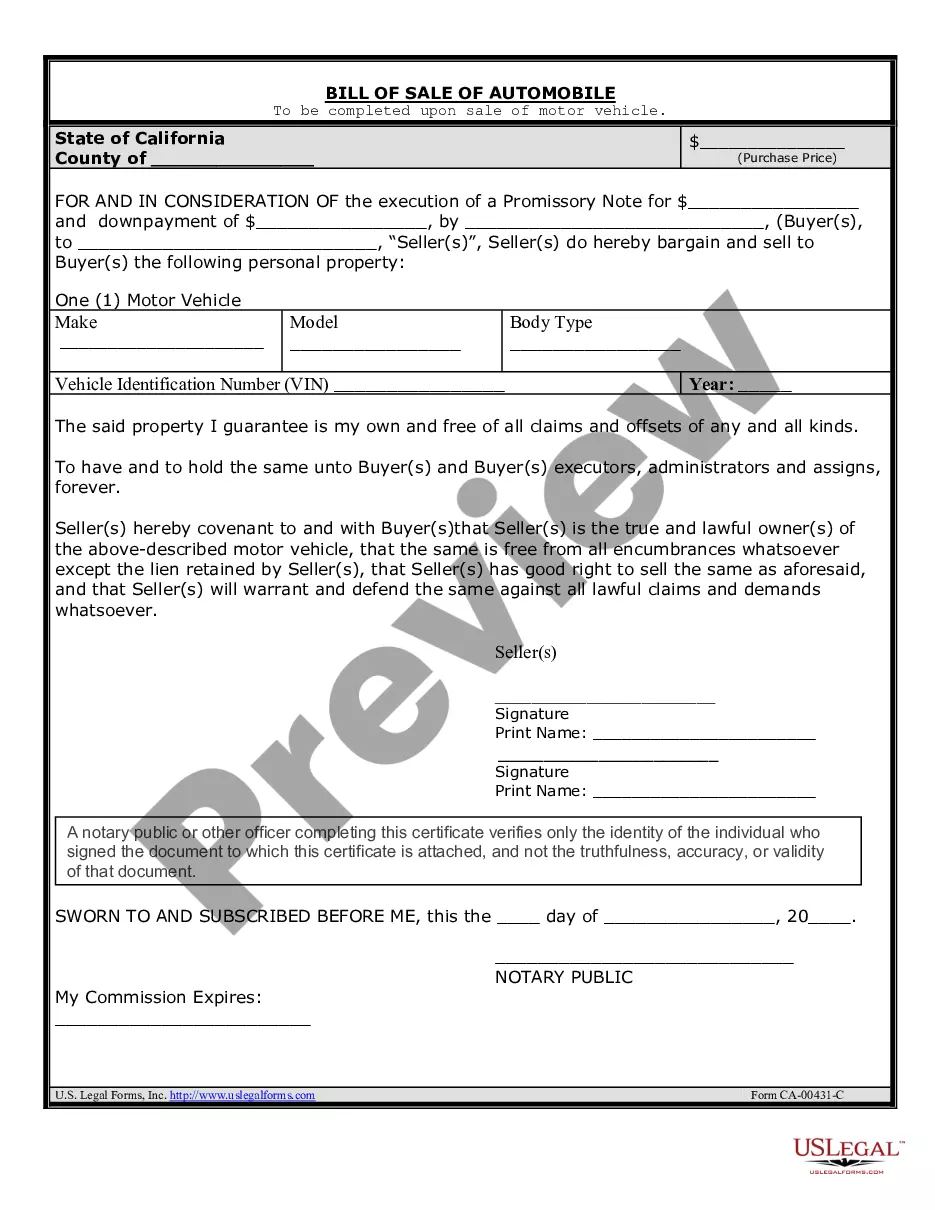

- Check if the Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance you’re considering is suitable for your state.

- View the form utilizing the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Pick a favored format to download the document (.pdf or .docx).

You can now open the Texas Mineral and Royalty Deed, Assignment, Bill of Sale and Conveyance template and fill it out online or print it and do it by hand. Consider sending the file to your legal counsel to be certain things are completed appropriately. If you make a mistake, print and fill sample again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

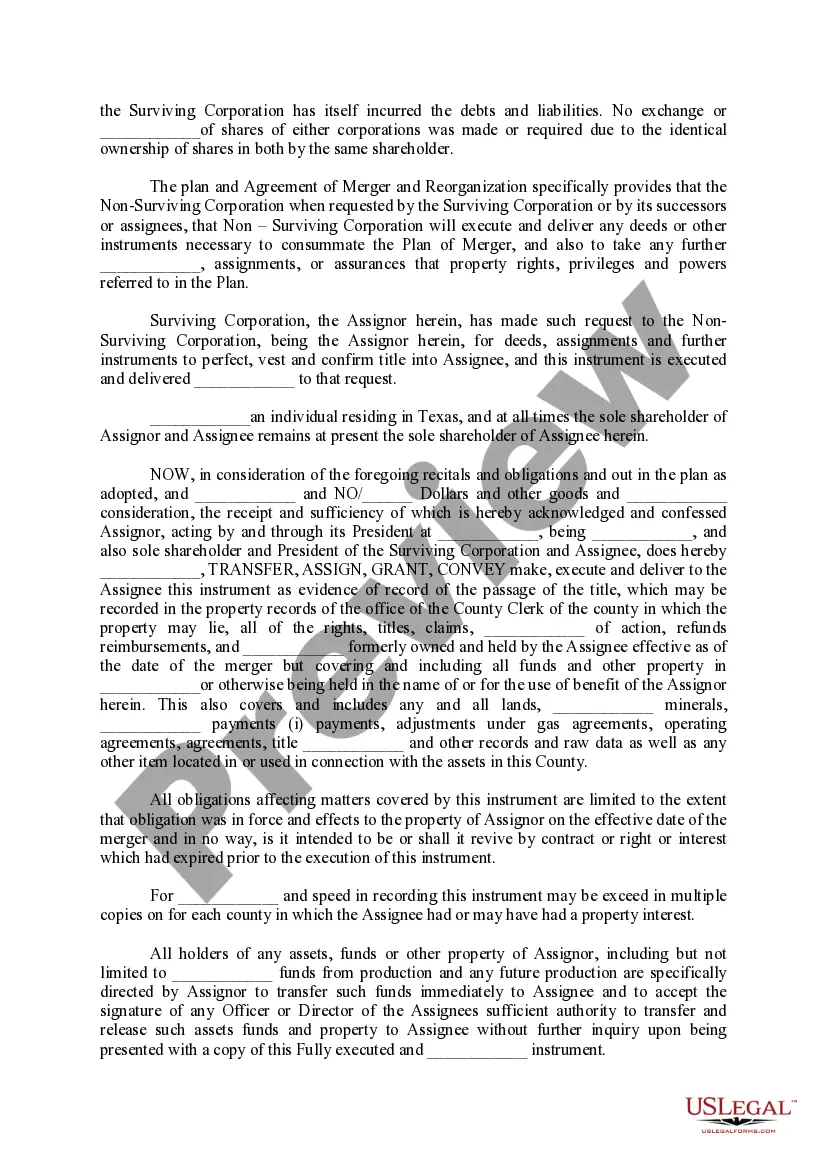

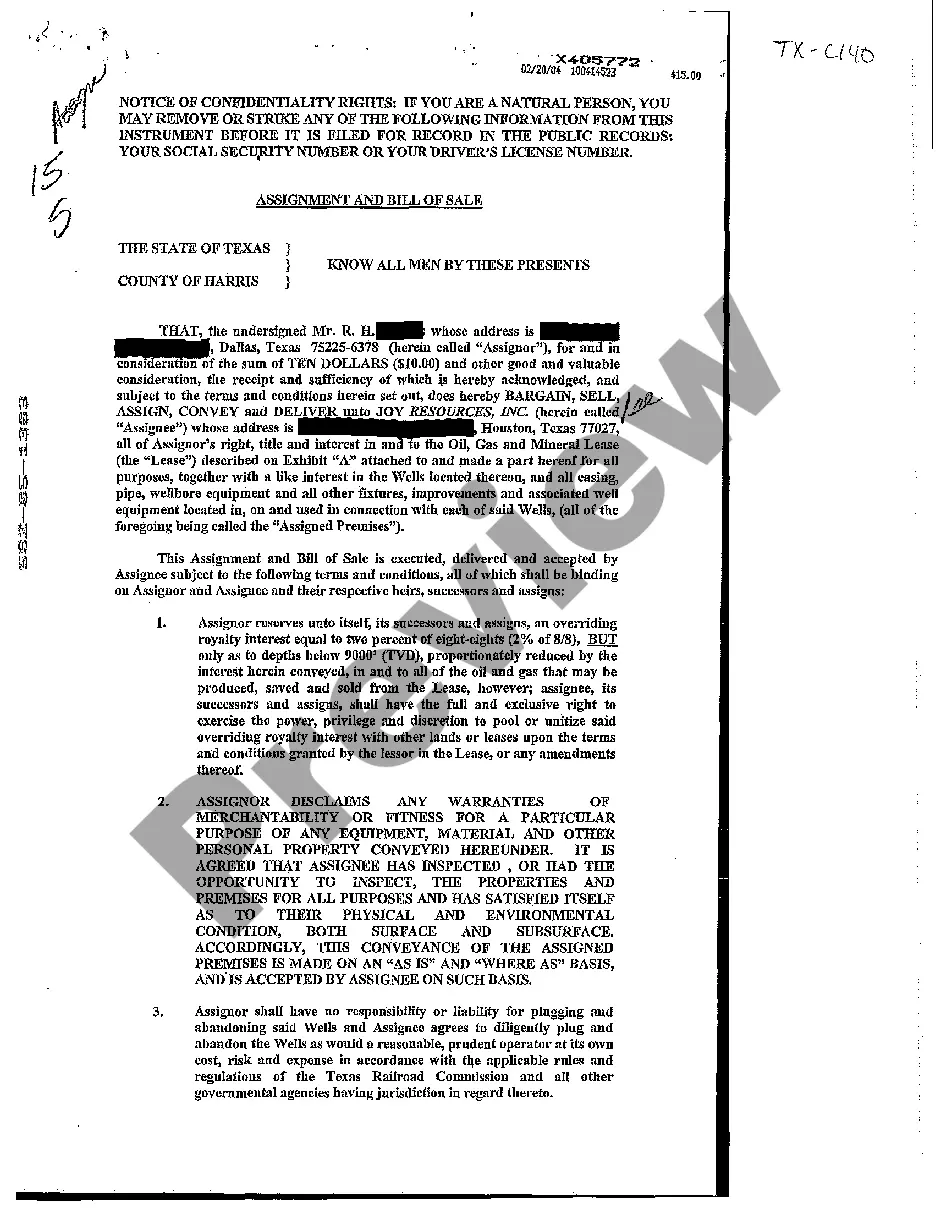

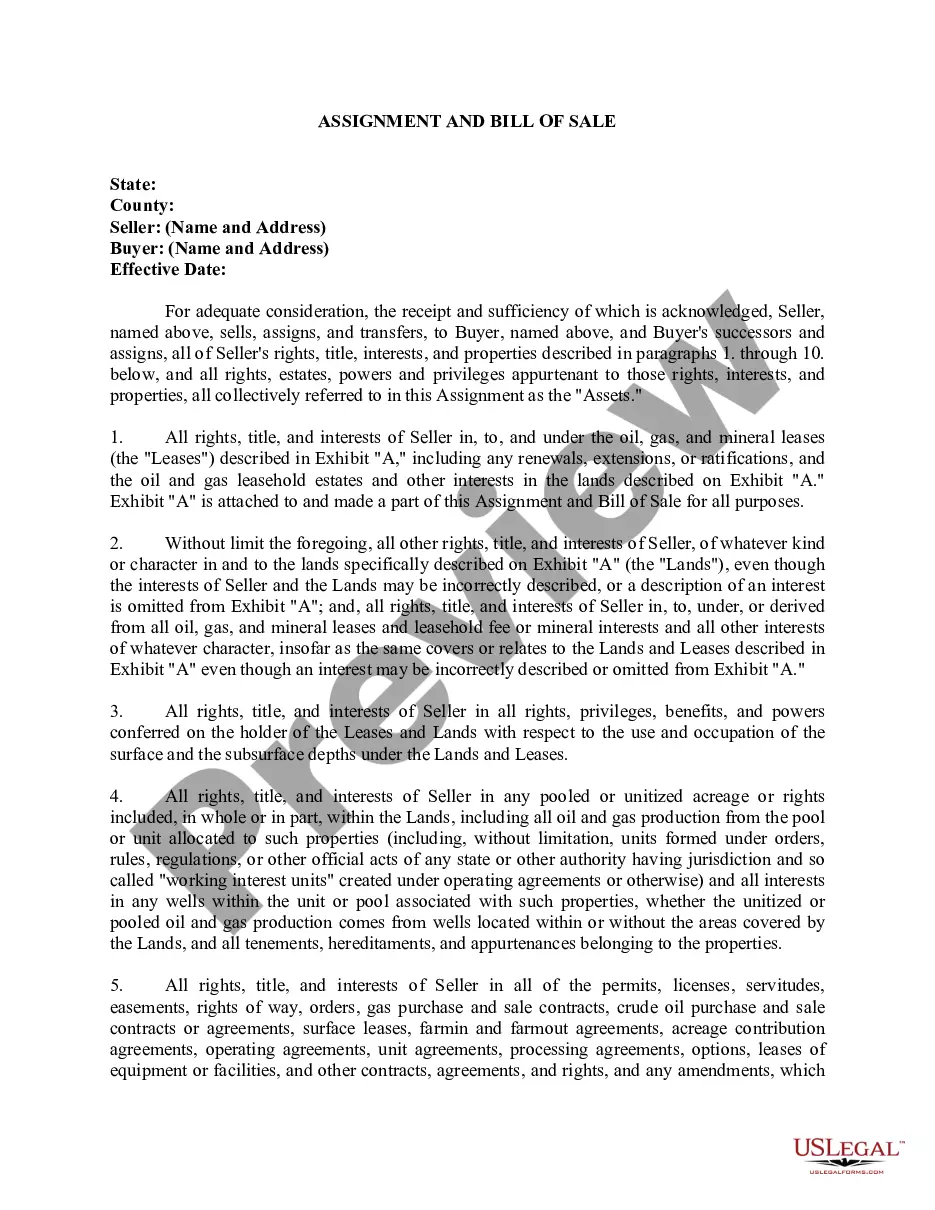

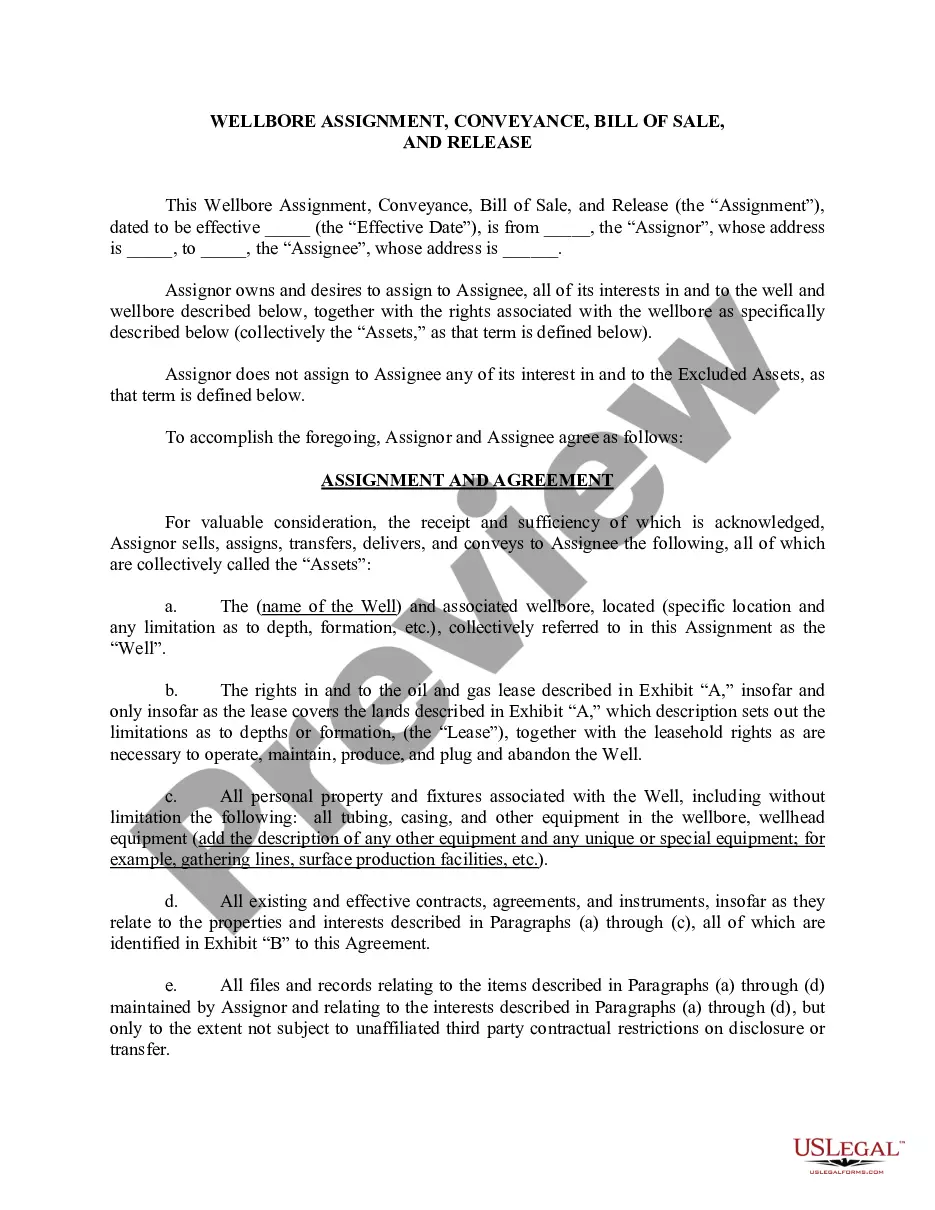

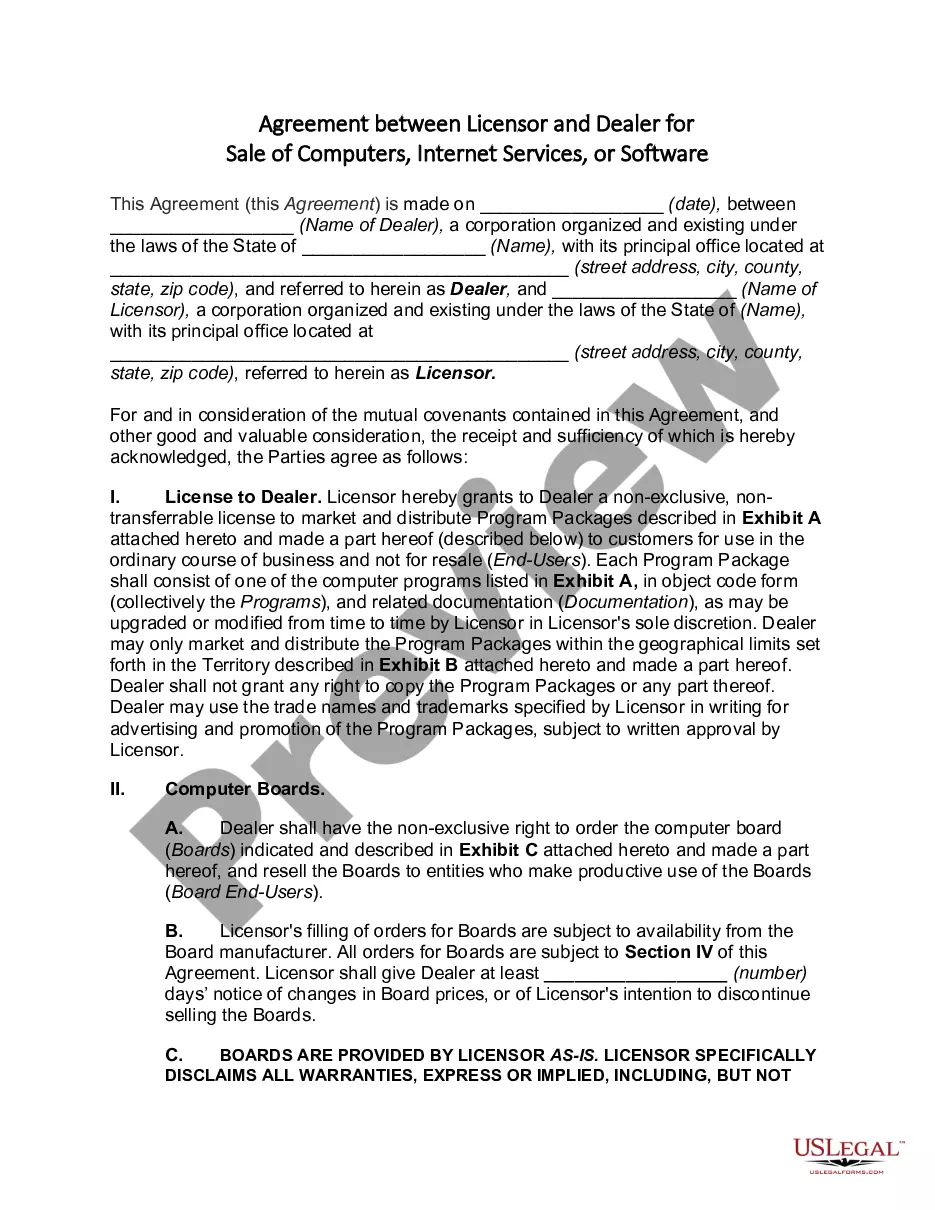

Wellbore. An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment.

A mineral deed form is a legal document, regarding the ownership of the minerals below the surface of the earth.A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

An owner can separate the mineral rights from his or her land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights. (This is accomplished by including a statement in the deed conveying the land that reserves all rights to the minerals to the seller.)

The General Mineral Deed in Texas transfers ALL oil, gas, and mineral rights from the grantor to the grantee.It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals.

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

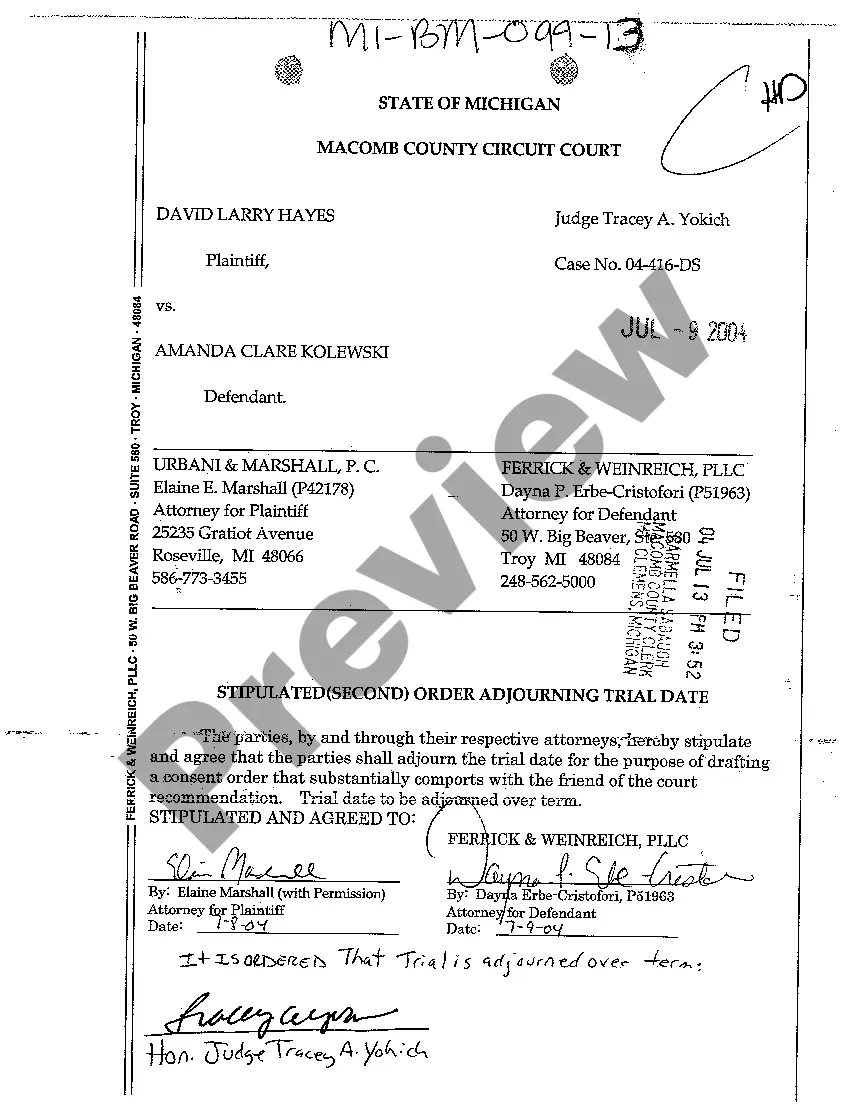

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.