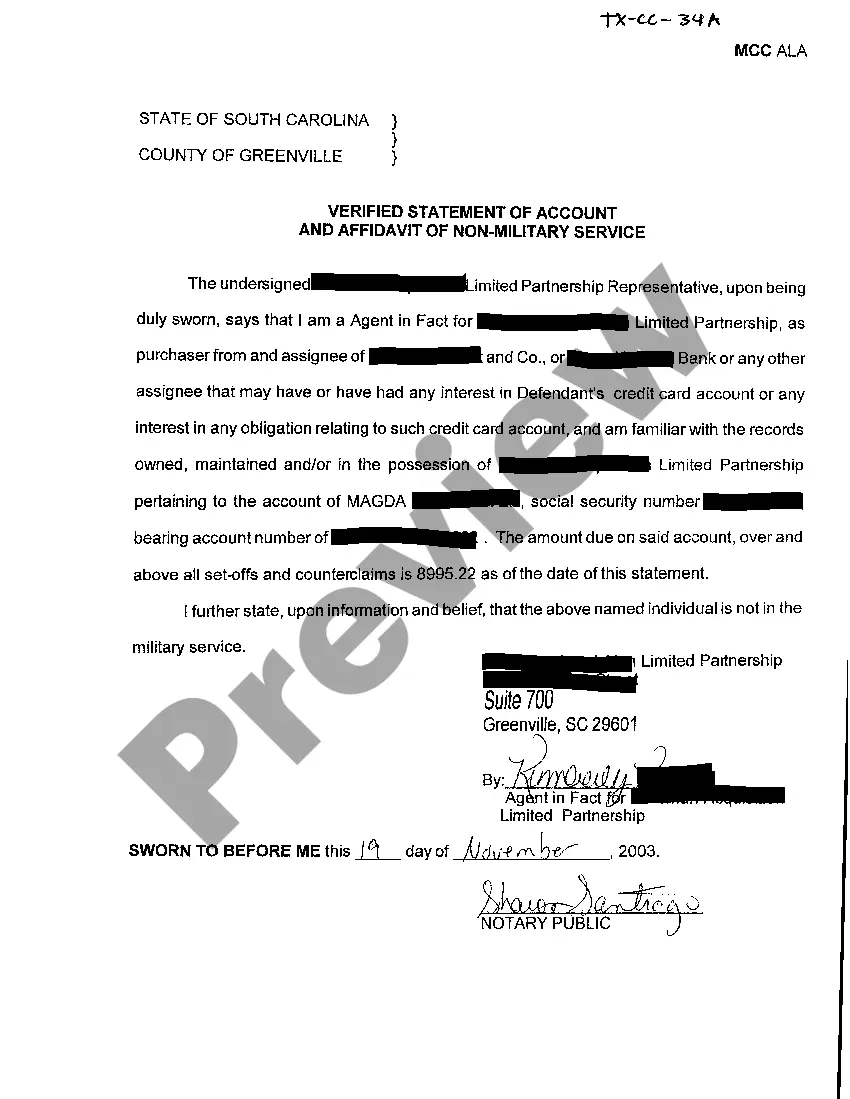

Texas Verified Statement of Account and Affidavit

Description

How to fill out Texas Verified Statement Of Account And Affidavit?

Get access to quality Texas Verified Statement of Account and Affidavit forms online with US Legal Forms. Avoid days of wasted time browsing the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific authorized and tax samples that you could save and fill out in clicks within the Forms library.

To find the example, log in to your account and click on Download button. The file is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

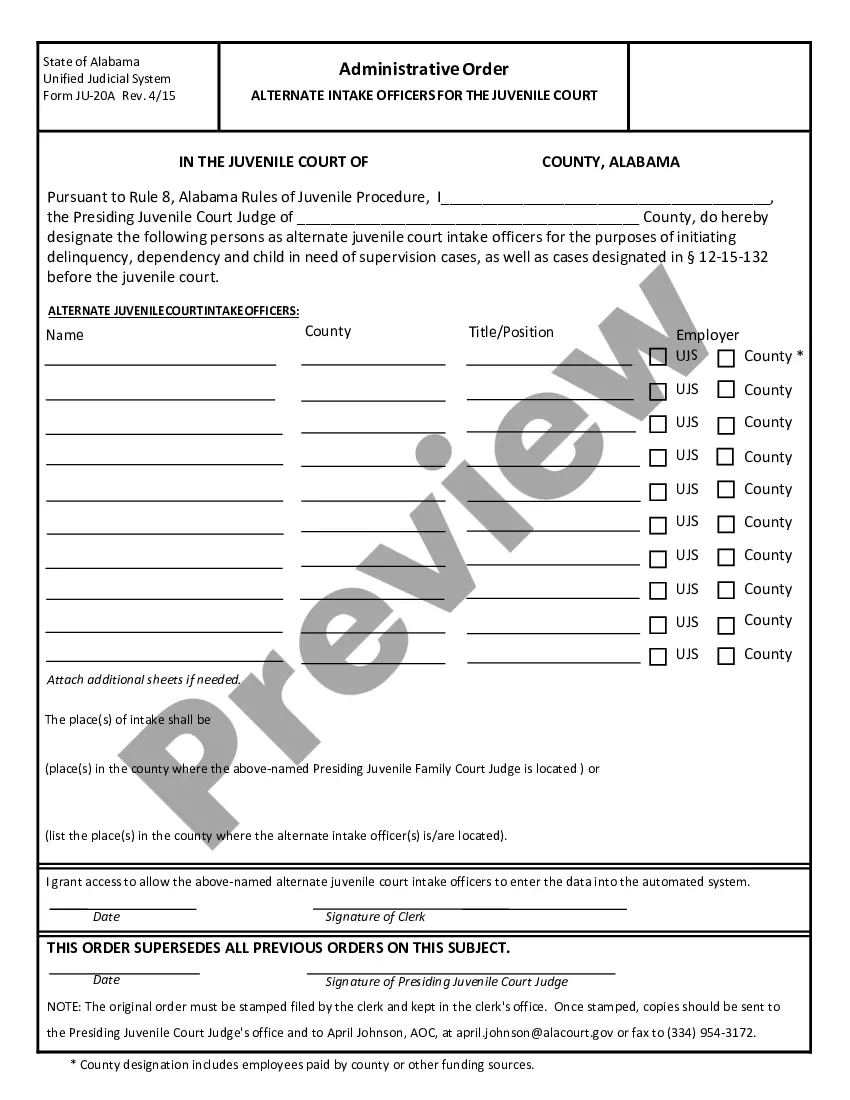

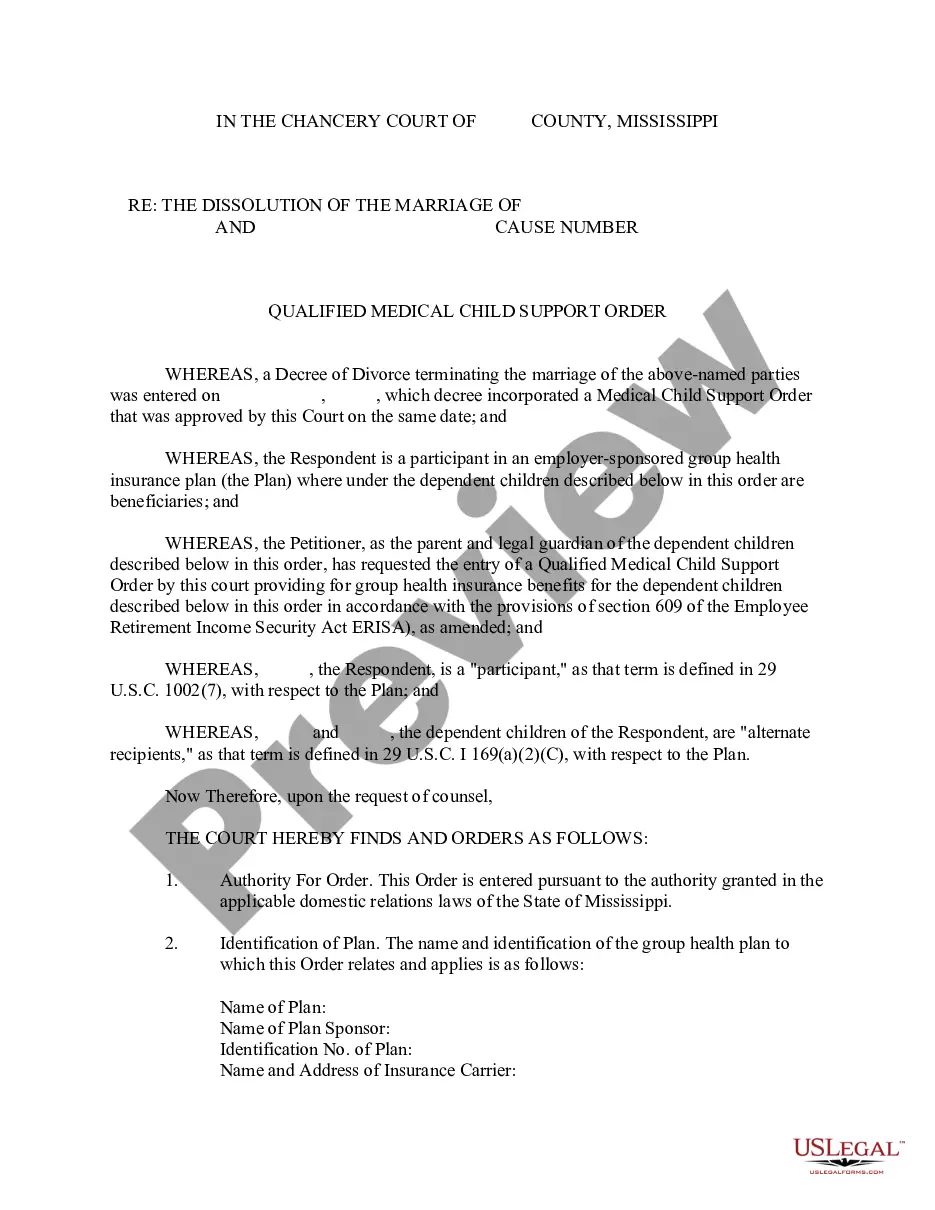

- Find out if the Texas Verified Statement of Account and Affidavit you’re considering is suitable for your state.

- See the form making use of the Preview function and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to complete making an account.

- Choose a favored file format to save the file (.pdf or .docx).

You can now open the Texas Verified Statement of Account and Affidavit template and fill it out online or print it and do it yourself. Take into account sending the document to your legal counsel to ensure things are filled out correctly. If you make a error, print out and complete sample again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

The California small estate affidavit, called a Petition to Determine Succession to Real Property, is used by successors in interest to a person who died to collect real and personal property totaling $166,250 or less in California. It cannot be filed until 40 days have elapsed since the person died.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.