Texas Application to Determine Heirship - Descent

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

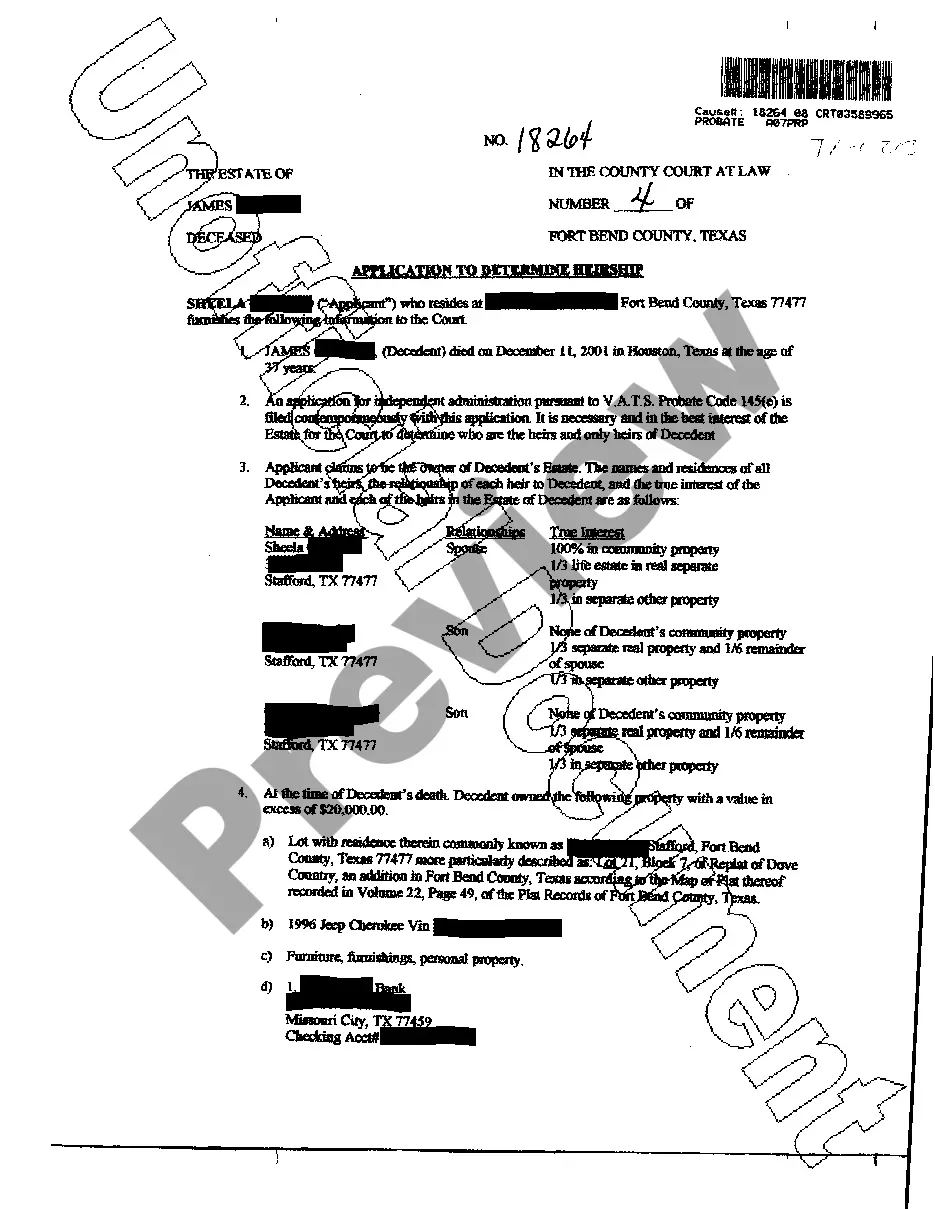

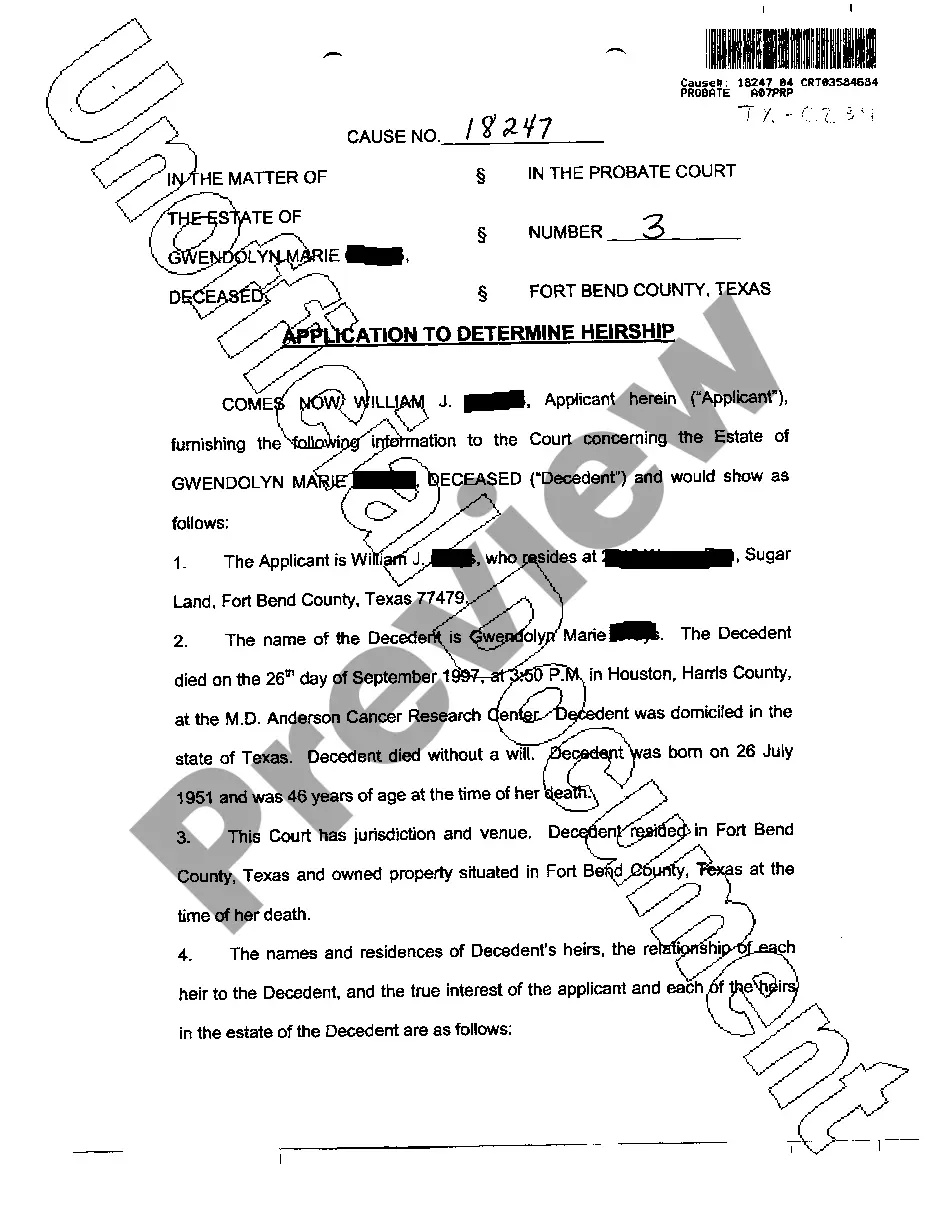

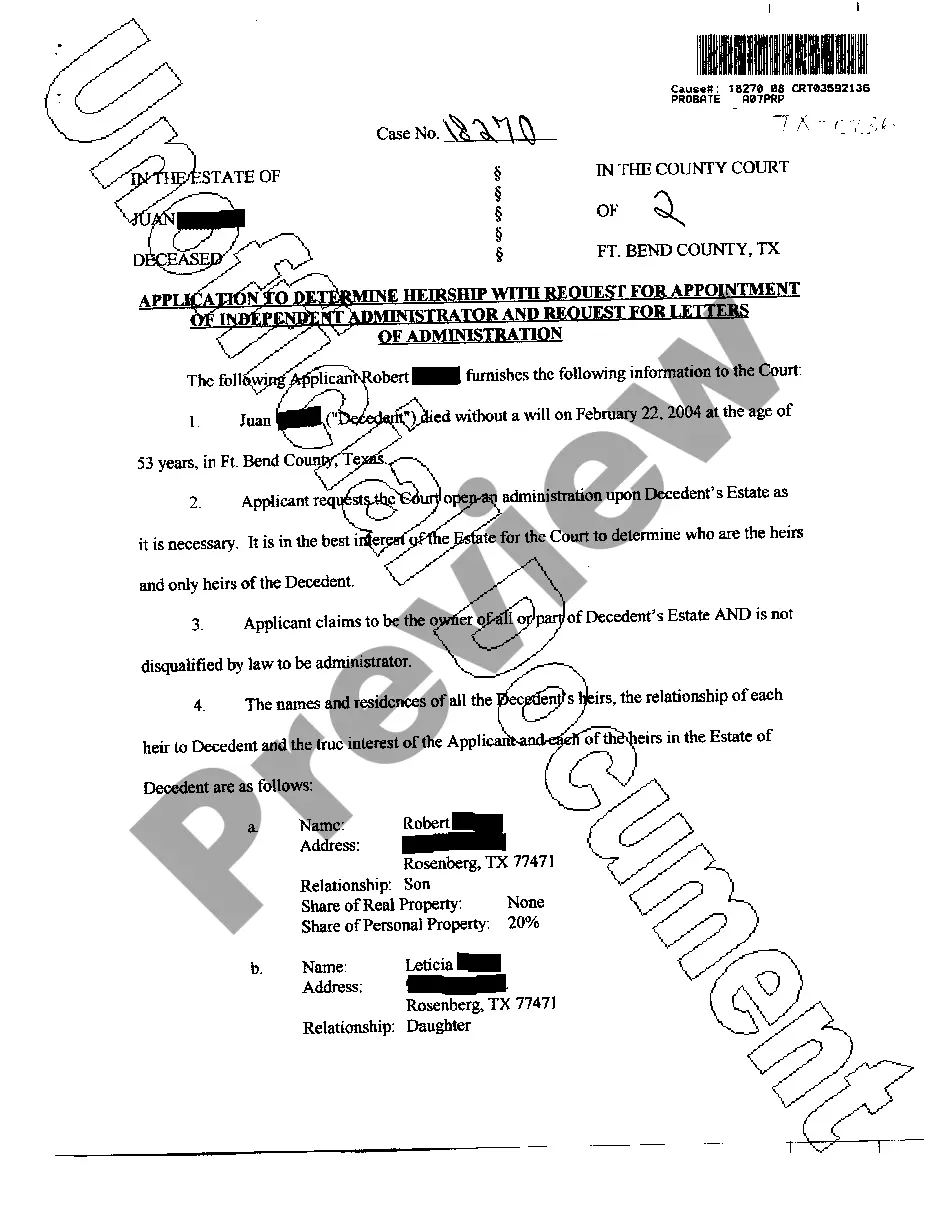

A01 Application to Determine Heirship Descent is a legal document used to establish the rightful heirs to an estate when a formal will is not present. This application is critical in probate law to ensure the assets of a deceased person are distributed according to state laws and that all potential heirs are considered.

Step-by-Step Guide

- Confirm the Need for Application: Verify that no valid will exists and assess whether an application for determining heirship is necessary.

- Gather Necessary Documents: Collect death certificate, proof of relationship, and any other documents that support the claim of heirship.

- File the Application: Complete the A01 application form and file it with the appropriate probate court in the county where the deceased resided.

- Notice to Potential Heirs: Notify all potential heirs about the application and the proceeding to determine descent.

- Court Hearing: Attend the court hearing, where evidence and testimonies will be reviewed to determine the legitimate heirs.

- Issuance of Order: Wait for the court to issue an order that outlines the heirship determination based on the findings.

Risk Analysis

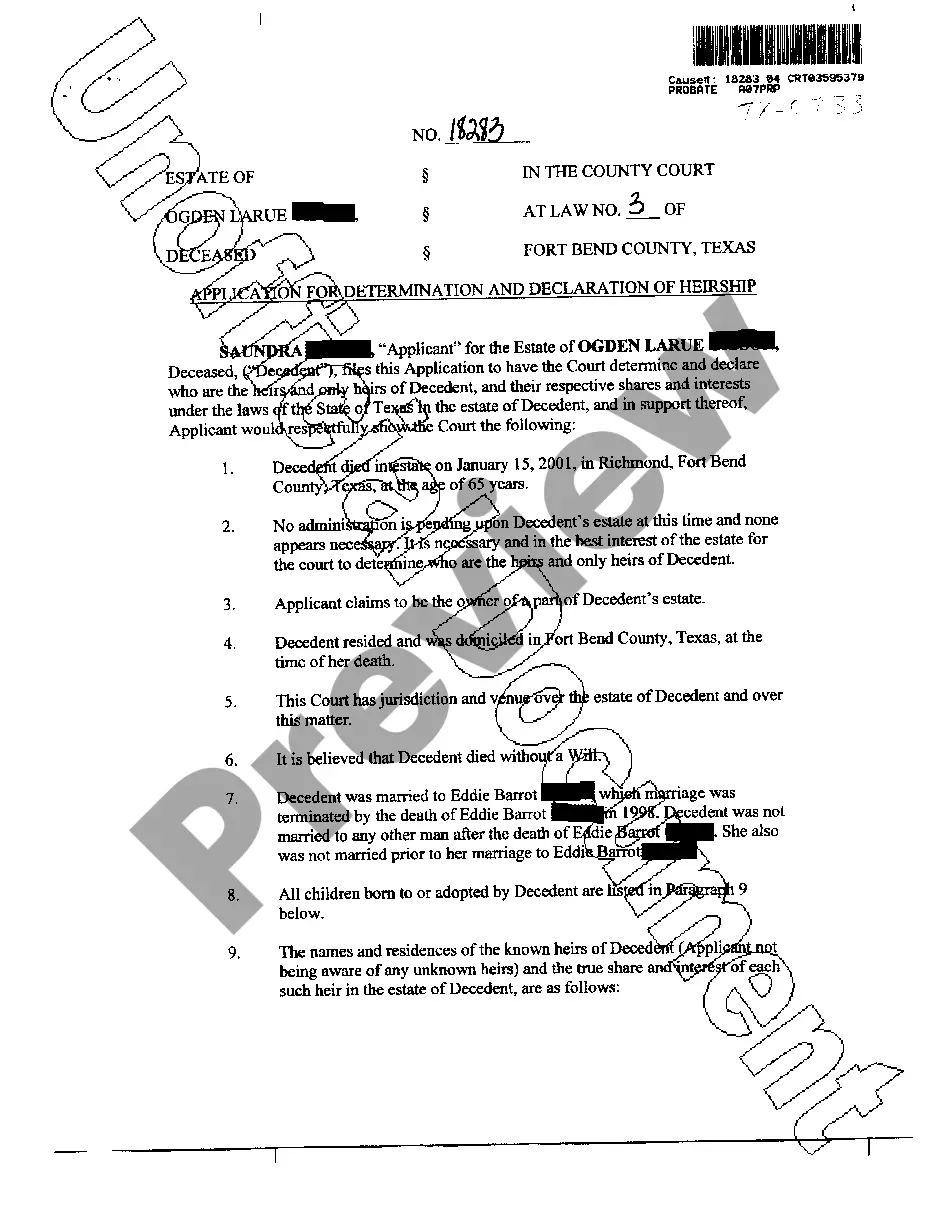

- Legal Disputes: Incorrect or incomplete submissions can lead to legal disputes among potential heirs.

- Delays: Missing documents or incorrect information can cause procedural delays, extending the period before assets are distributed.

- Financial Costs: Court and attorney fees involved in filing and defending an heirship application can be substantial.

Key Takeaways

Understanding the A01 Application to Determine Heirship Descent is essential for managing estates without a will. Adequate preparation, proper documentation, and understanding potential legal and financial risks can streamline the process, reduce conflicts, and ensure rightful heirs receive their inheritance.

How to fill out Texas Application To Determine Heirship - Descent?

Access to quality Texas Application to Determine Heirship - Descent samples online with US Legal Forms. Avoid hours of lost time searching the internet and dropped money on forms that aren’t updated. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific legal and tax samples that you could download and complete in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the Texas Application to Determine Heirship - Descent you’re considering is suitable for your state.

- See the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete creating an account.

- Pick a preferred file format to download the document (.pdf or .docx).

Now you can open the Texas Application to Determine Heirship - Descent sample and fill it out online or print it and get it done by hand. Consider giving the papers to your legal counsel to be certain everything is filled out correctly. If you make a error, print and complete application once again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

What is an application for determination of heirship? An application to determine heirship is a proceeding in which a court determines who the deceased's heirs are, and which heirs get which shares of the property.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

It is a judicial determination of heirship made. in connection with and as a part of the administration proceeding. itself, to which the land has been subject, and therefore constitutes the highest form of evidence as to the devolution of title.

(A judgment in this case is a court order, in writing, reciting that the deceased person is dead, the date of death and a list of who are the heirs.) Proof. Once the judgment is issued, copies of the judgment can be used to show proof as to who is entitled to estate assets.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).