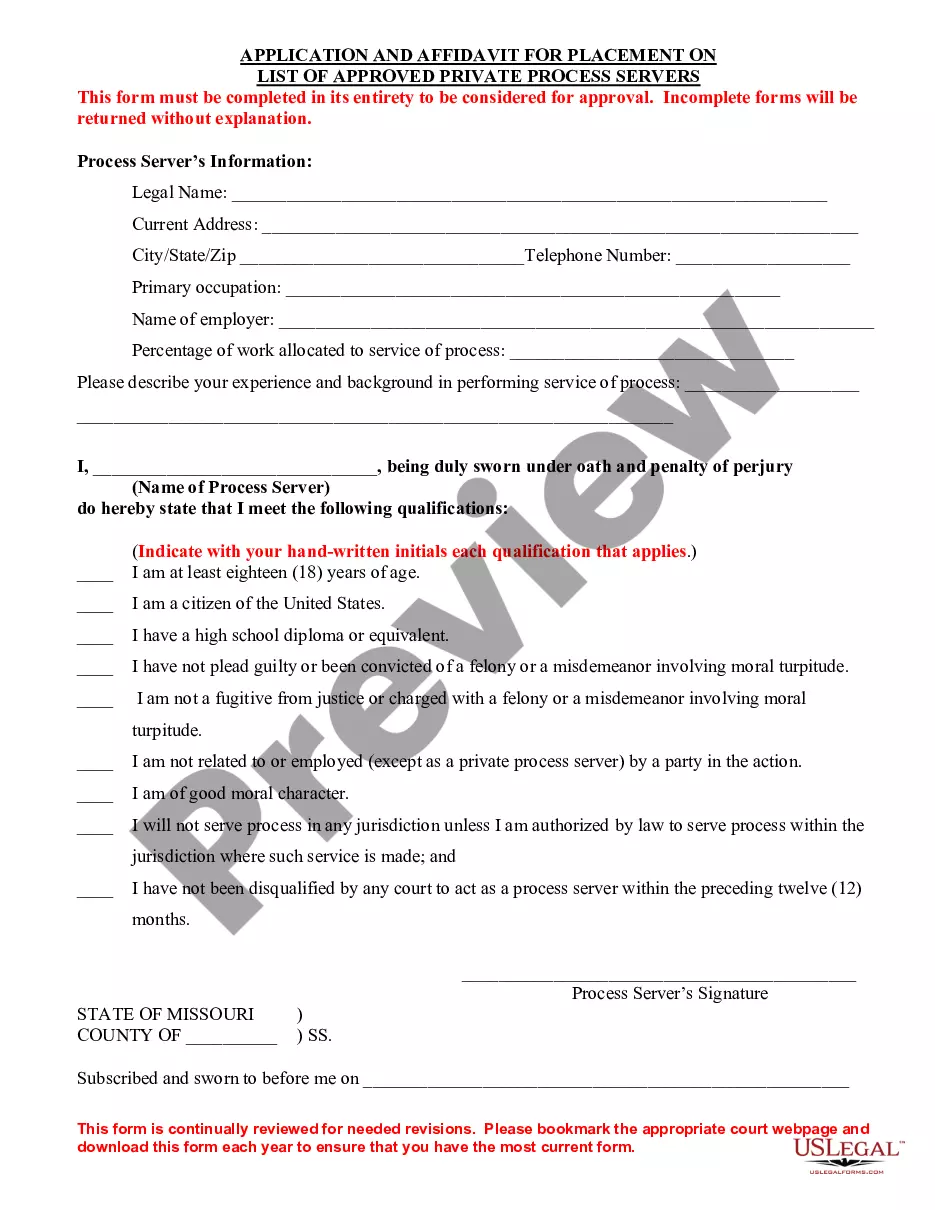

The Texas Statement for Permanent Age Exemption is a document that allows a minor (under 18) to purchase alcohol beverages without adult supervision. It is designed to prevent minors from attempting to purchase alcohol by providing proof of age and parental consent. The statement must be signed by the minor's parent or guardian, and must be presented to the seller of alcoholic beverages when purchasing alcohol. There are two types of Texas Statement for Permanent Age Exemption: a Standard Statement and an Enhanced Statement. The Standard Statement is intended for minors who are purchasing alcohol for personal consumption and is valid for up to two years. The Enhanced Statement is for minors who are purchasing alcohol for an event, such as a wedding or special occasion, and is valid for up to five years. Both forms must include the minor's full legal name, date of birth, parent or guardian's full legal name, and both the parent or guardian's signature and date of signature.

Texas Statement for Permanent Age Exemption

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Statement For Permanent Age Exemption?

How much time and resources do you often spend on drafting official paperwork? There’s a better way to get such forms than hiring legal specialists or wasting hours searching the web for a suitable template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, such as the Texas Statement for Permanent Age Exemption.

To acquire and prepare an appropriate Texas Statement for Permanent Age Exemption template, adhere to these simple instructions:

- Look through the form content to ensure it complies with your state requirements. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Texas Statement for Permanent Age Exemption. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Texas Statement for Permanent Age Exemption on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

To apply for exemption, complete AP-204. Include any additional documentation to show the corporation meets the requirements. Non-Texas corporations must also include a copy of the corporation's formation documents and a current Certificate of Existence issued by their state of incorporation.

At what age do you stop paying school taxes in Texas? Never! Unless they are totally exempt from property taxes, a homeowner continues to pay property tax even after age 65, so long as they live in that house. Homeowners aged 65 and above are eligible for a "tax-ceiling".

State law provides for a variety of exemptions from property tax for property and property owners that qualify for the exemption. Texas offers a variety of partial or total (absolute) exemp- tions from property appraised values used to determine local property taxes.

Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114. If you turn 65 or become disabled, you need to submit another application to obtain the extra exemption using the same Form 50-114.

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.