Texas IRS is the Internal Revenue Service (IRS) office that handles taxes for the state of Texas. It is responsible for administering federal tax laws and collecting taxes for the U.S. government. It also assists taxpayers in understanding the tax code and filing taxes accurately. There are several types of Texas IRS offices, including: • The IRS Taxpayer Assistance Center (TAC), which provides face-to-face assistance to taxpayers. • The IRS Taxpayer Advocate Service (TAS), which helps taxpayers with problems related to their taxes. • The IRS Office of Appeals, which handles taxpayer disputes. • The IRS Criminal Investigation Division, which investigates and prosecutes individuals who commit tax fraud. • The IRS Examination Division, which audits taxpayers’ returns. • The IRS Collection Division, which collects delinquent taxes. • The IRS Automated Collection System (ACS), which helps taxpayers pay taxes and resolve tax disputes. • The IRS Refund Inquiry Program, which helps taxpayers track the status of their refunds.

Texas IRS

Description

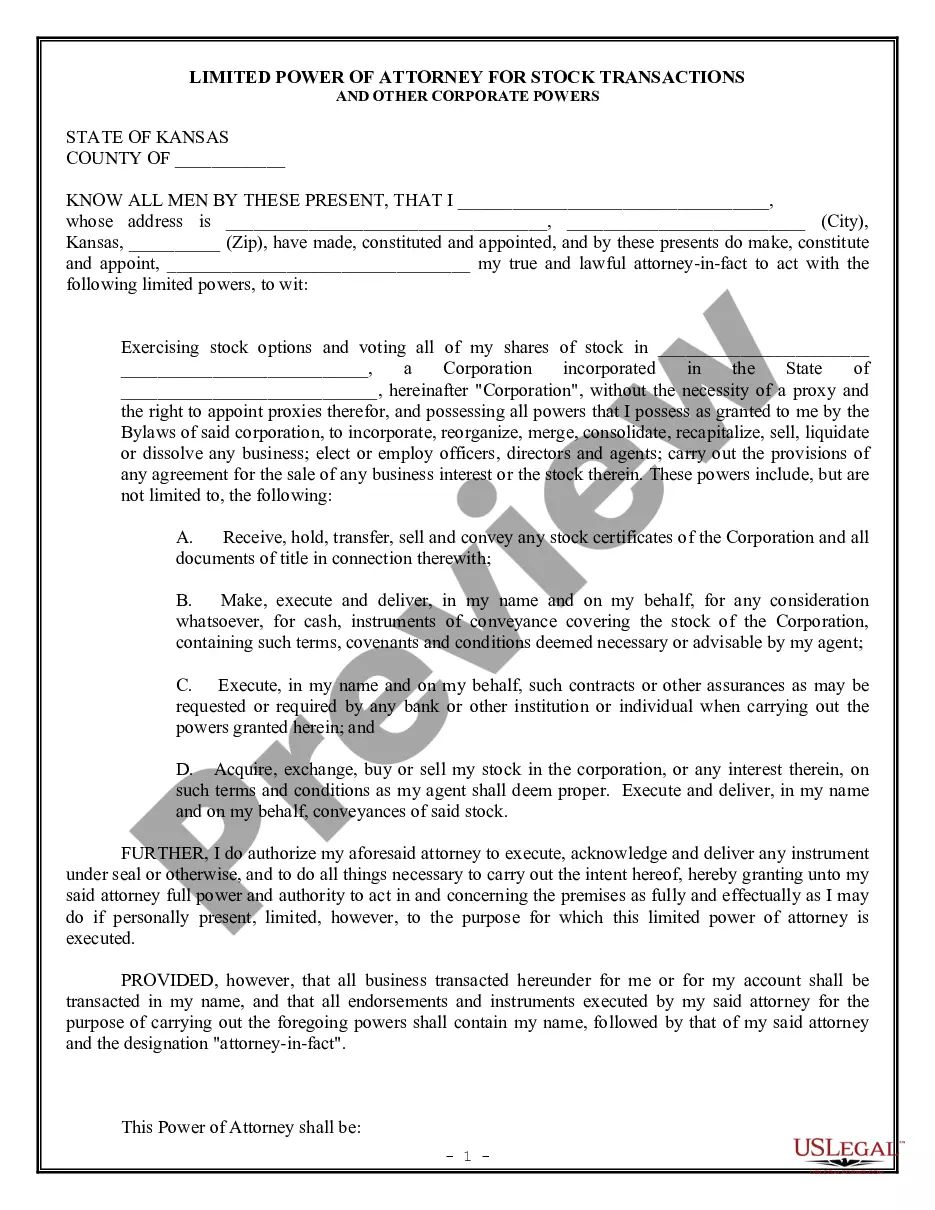

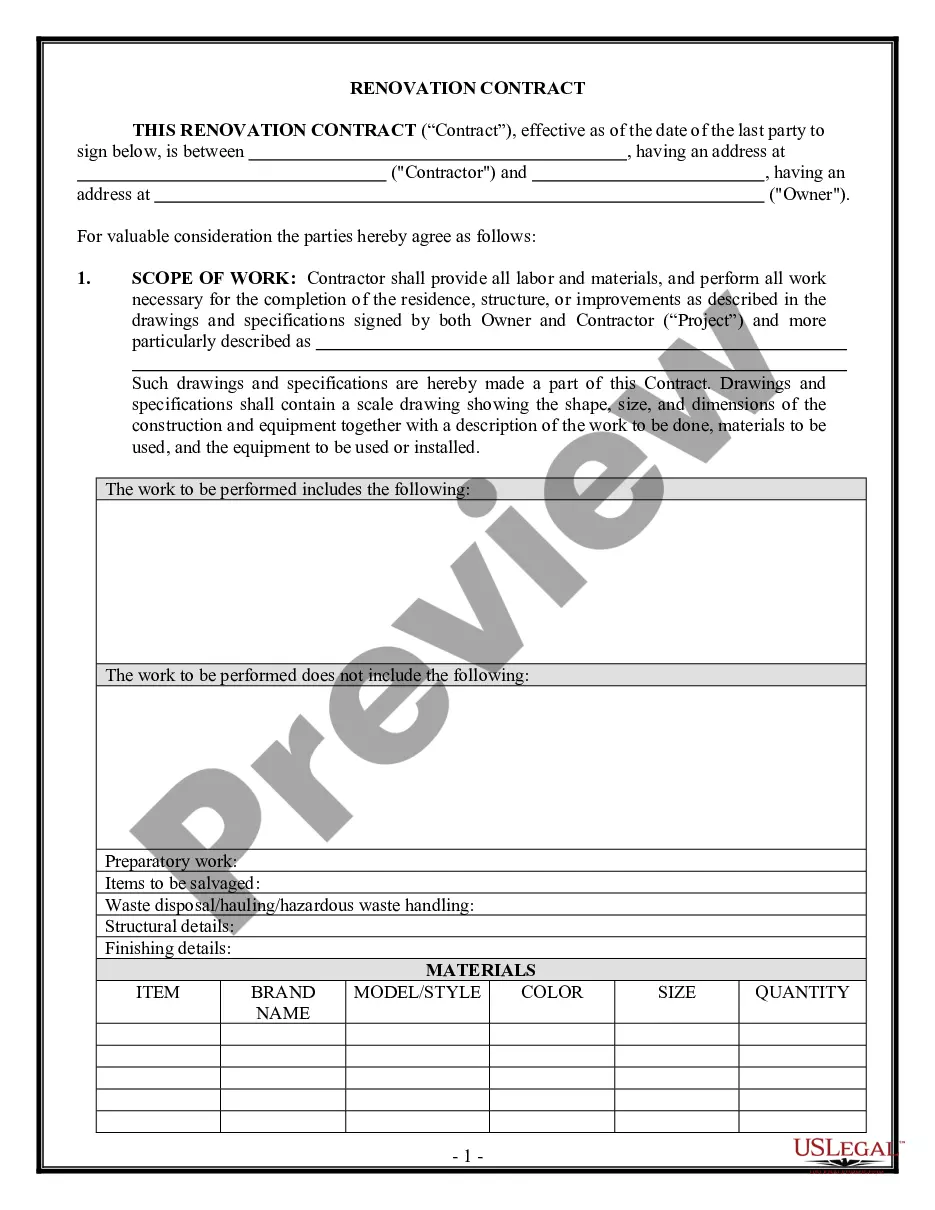

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas IRS?

How much time and resources do you often spend on drafting formal paperwork? There’s a better option to get such forms than hiring legal specialists or wasting hours searching the web for an appropriate blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Texas IRS.

To obtain and prepare an appropriate Texas IRS blank, follow these simple instructions:

- Look through the form content to ensure it meets your state requirements. To do so, check the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Texas IRS. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Texas IRS on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us today!

Form popularity

FAQ

You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day. Tax forms and instructions for current and prior years are available by calling 1-800-829-3676. You can also order free publications on a wide variety of tax topics.

Visit .irs.gov/paymentplan for more information on installment agreements and online payment agreements. You can also call us at 1- 800-829-0922 to discuss your options. For information on how to obtain your current account balance or payment history, go to .irs.gov/balancedue.

IRS Customer Service, Online Live Chat The IRS live chat feature can be found on many of their pages by clicking the "Start a conversation" button found at the bottom of a limited number of IRS webpages.

Here's how to get through to a representative: Call the IRS at 1-800-829-1040 during their support hours.Select your language, pressing 1 for English or 2 for Spanish. Press 2 for questions about your personal income taxes. Press 1 for questions about a form already filed or a payment. Press 3 for all other questions.

Taxpayers need to remember that the IRS will not contact them by text message or social media and ask for personal or financial information. The IRS will also not initiate contact by phone or email. If the IRS needs to contact you, it'll usually first send a letter in the mail through the U.S. Postal Service.

IRS Toll-Free Help You may call 800-829-1040 with any Federal tax questions.

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

Call the IRS immediately. If you are inside the U.S., contact the toll-free Identity Verification line at 800-830-5084.