This detailed sample Heirship Affidavit complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Texas Heirship Affidavit - Descent

Description

Key Concepts & Definitions

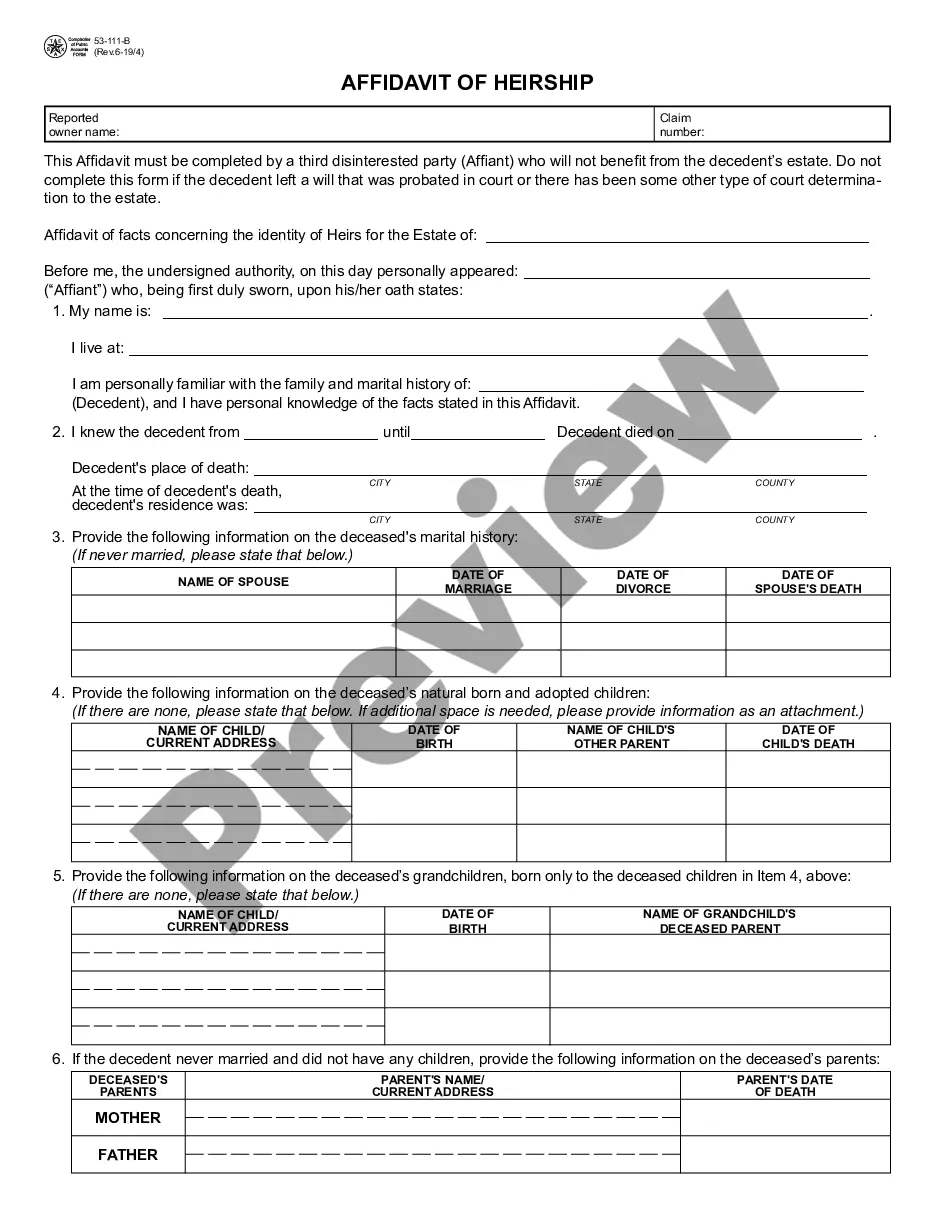

Heirship Affidavit Descent: An heirship affidavit descent is a legal document used in the United States to establish the ownership of property by heirs after the death of an individual who died intestate (without a will). This document declares who the rightful heirs are and is often required to transfer property without undergoing a full probate process.

Step-by-Step Guide

- Gather Necessary Information: Collect all relevant information about the decedent, including death certificate, list of known heirs, and details of the property.

- Contact a Legal Expert: Consult with an attorney who specializes in estate planning and inheritance law to ensure compliance with state laws and regulations.

- Prepare the Affidavit: The attorney will draft the heirship affidavit descent, detailing the heirs and their relationship to the deceased.

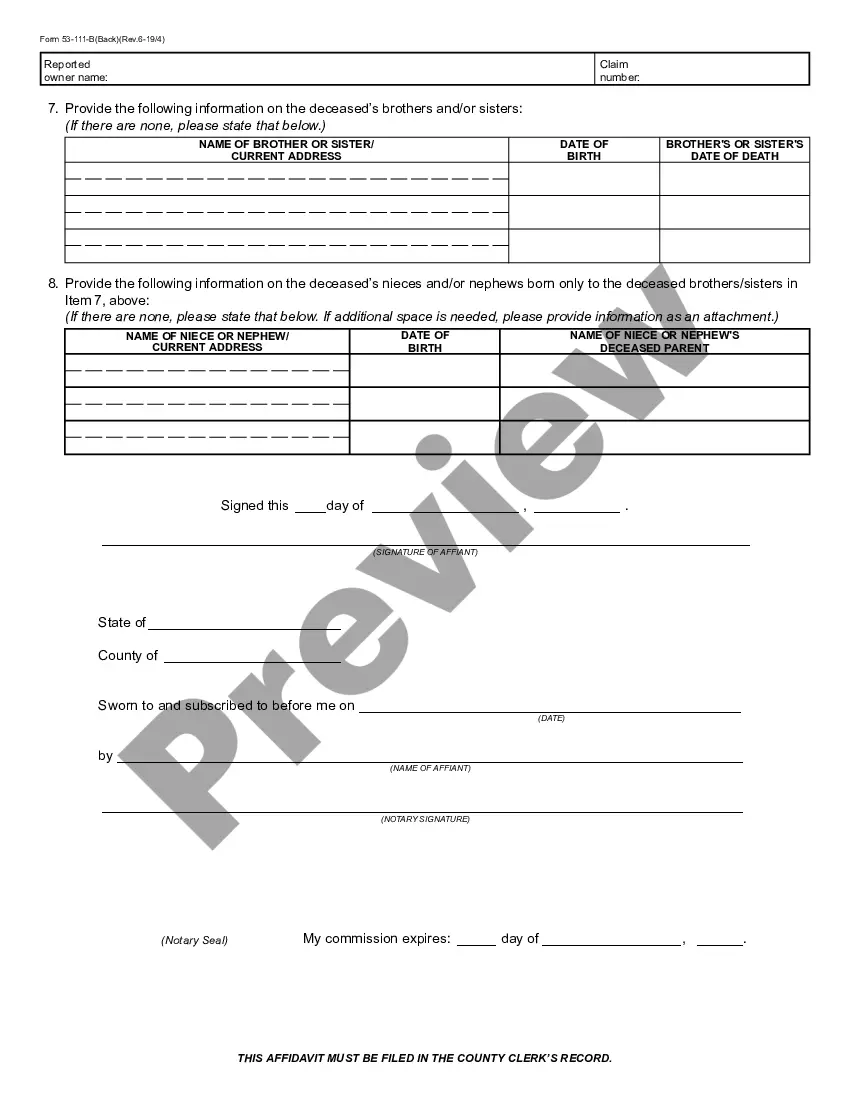

- Sign before a Notary: All heirs and the affiant must sign the affidavit in the presence of a notary public to verify the authenticity of the document.

- File with Relevant Authorities: Submit the notarized affidavit to the county recorders office or appropriate local jurisdiction where the property is located.

- Complete Property Transfer: Follow any additional steps as advised by your attorney or local laws to finalize the transfer of property to the named heirs.

Risk Analysis

- Legal Disputes: Incorrect or incomplete information can lead to disputes among potential heirs or challenges to the affidavit in court.

- Regulatory Risk: Failure to comply with specific state laws can invalidate the affidavit, leading to a lengthy probate process.

- Financial Implications: Errors in the heirship affidavit can cause significant delays and possibly financial losses due to unresolved property matters.

Best Practices

- Verify All Information: Double-check all the information provided in the affidavit to ensure accuracy and completeness.

- Seek Expert Advice: Engage with a legal professional who is well-versed in your state's inheritance laws.

- Maintain Transparency: Keeping clear communication among all heirs can prevent misunderstandings and disputes.

Common Mistakes & How to Avoid Them

- Overlooking Heirs: Ensure all potential heirs, including those not immediately direct like distant relatives, are considered to avoid future claims.

- Neglecting State Laws: Heirship affidavits are subject to state-specific laws, making it essential to understand and adhere to these regulations specific to the propertys location.

- Inadequate Documentation: Gather robust documentation to support the claims made in the heirship affidavit to prevent legal challenges.

FAQ

- What is an heirship affidavit used for? It is used to establish property ownership when the decedent has not left a will.

- Who can file an heirship affidavit? Typically, a close relative or legally appointed representative of the estate files the affidavit.

- Do I need a lawyer to create an heirship affidavit descent? Consulting a lawyer is advisable to ensure the affidavit adheres to legal standards and accurately reflects the descent of property.

How to fill out Texas Heirship Affidavit - Descent?

Access to top quality Texas Heirship Affidavit - Descent samples online with US Legal Forms. Steer clear of hours of lost time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific legal and tax samples you can download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Find out if the Texas Heirship Affidavit - Descent you’re considering is suitable for your state.

- See the sample using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Select a favored format to save the document (.pdf or .docx).

Now you can open the Texas Heirship Affidavit - Descent example and fill it out online or print it out and get it done by hand. Take into account sending the papers to your legal counsel to ensure all things are completed appropriately. If you make a mistake, print out and fill application once again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.

The personal representative of the estate, a creditor of the estate, a person claiming to be the owner of all or part of the decedent's estate, a party seeking the appointment of an independent administrator.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.