Texas General Warranty Deed

About this form

The General Warranty Deed is a legal document used to transfer property ownership from multiple grantors to a single grantee. This deed provides a guarantee that the property is free of any claims or encumbrances, ensuring that the grantee receives clear title. Unlike other deeds, a General Warranty Deed protects the grantee against any future claims related to the property's ownership, making it a reliable choice for real estate transactions.

Main sections of this form

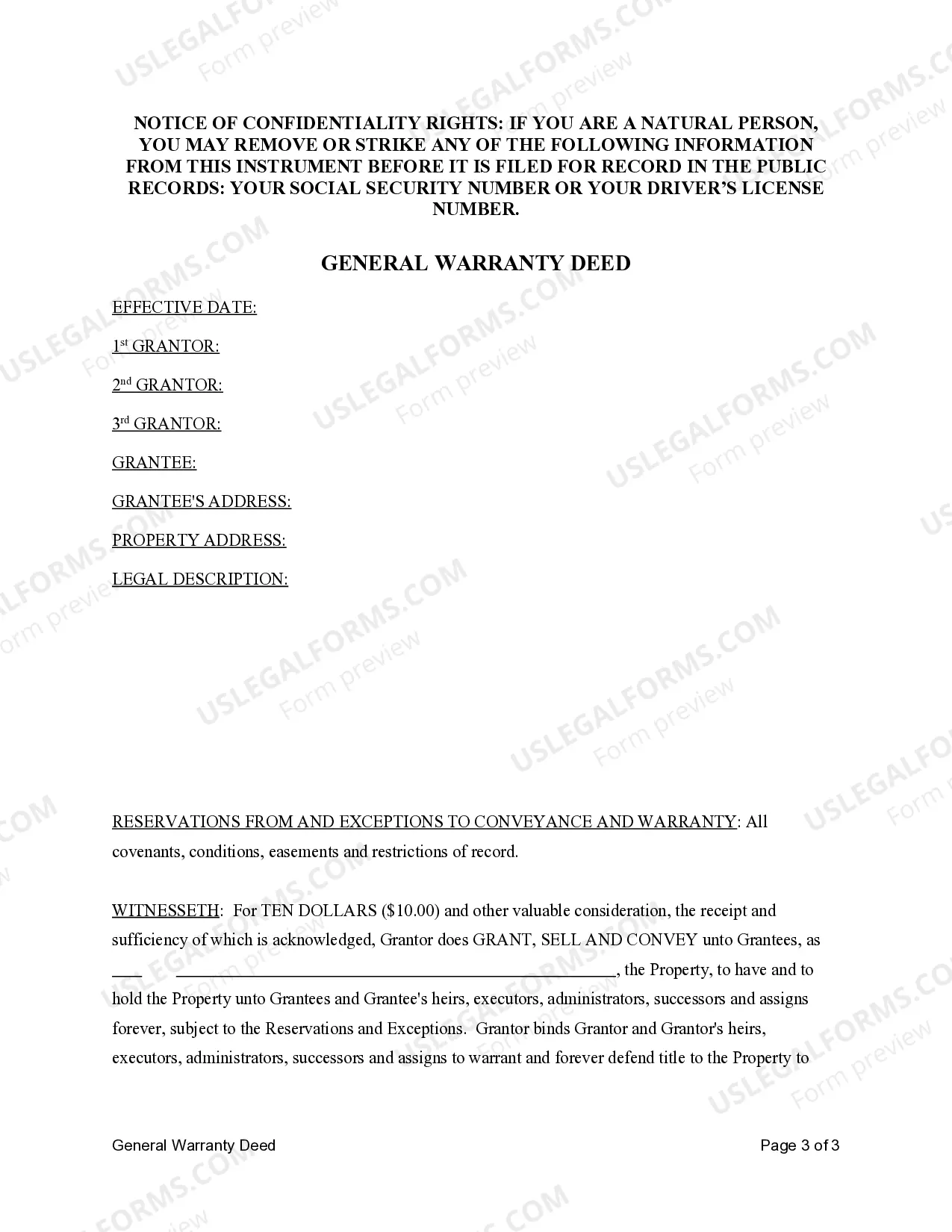

- Identification of grantors and grantee.

- Description of the property being transferred.

- Guarantee of title against future claims.

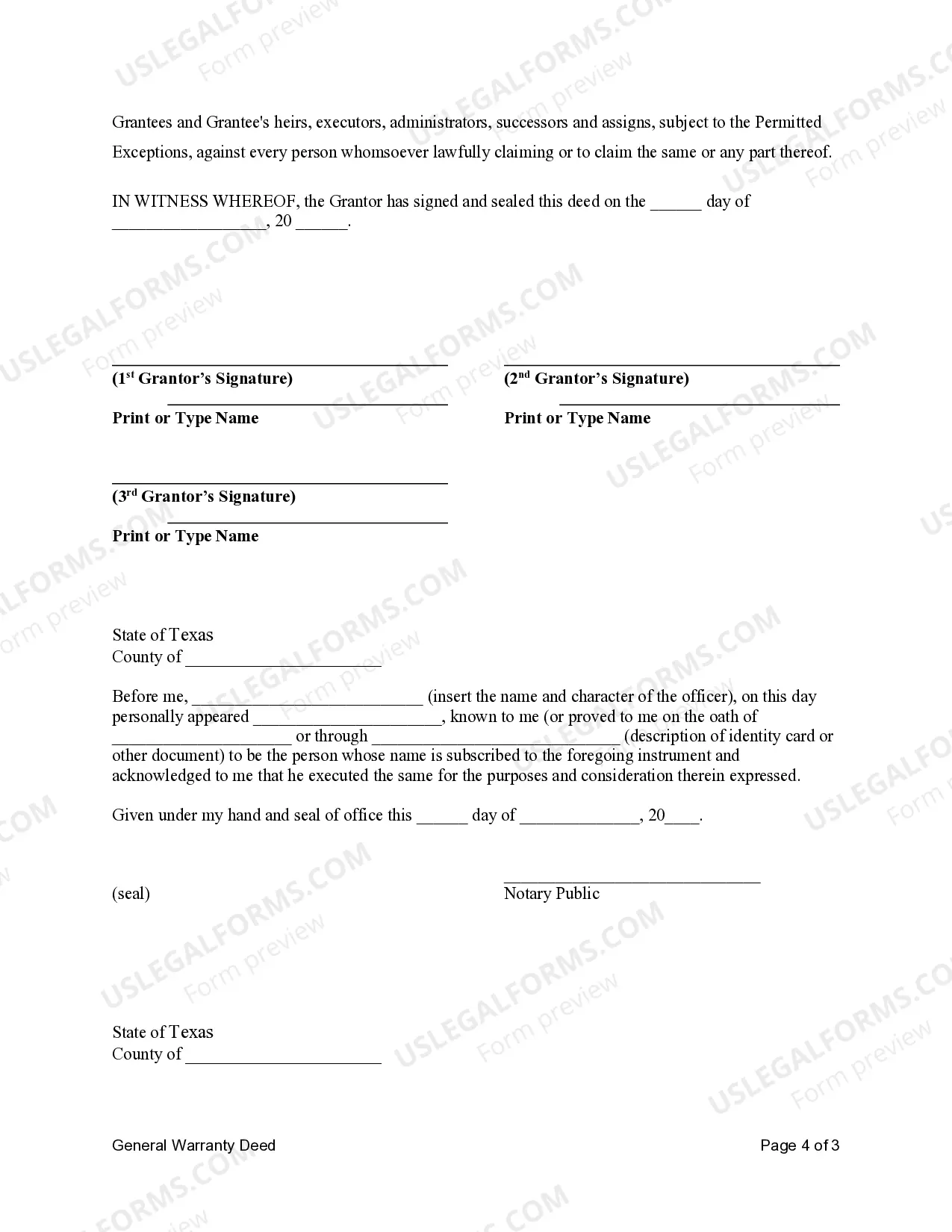

- Signatures of the grantors with date of acknowledgment.

- Notary section for legal verification.

Common use cases

This form is needed when individuals wish to sell or transfer ownership of real estate, ensuring that the buyer receives a clear title with full legal protection. It is commonly used in residential real estate transactions, especially when multiple sellers are involved in the transfer.

Who this form is for

This form is suitable for:

- Individuals or entities selling real estate.

- Property owners transferring ownership to another individual.

- Real estate agents or attorneys assisting clients in property transactions.

How to complete this form

- Identify all grantors by providing their full names and addresses.

- Identify the grantee by full name and address who will receive the property.

- Clearly describe the property being transferred, including legal descriptions.

- All grantors must sign the document in the presence of a notary.

- Enter the date of acknowledgment and complete any notary requirements.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide complete and accurate property descriptions.

- Not having all grantors sign the deed.

- Neglecting to include notarization, which may invalidate the deed.

- Forgetting to check for any outstanding liens or claims on the property.

Why use this form online

- Convenient access to legally drafted forms at any time.

- Editability allows for easy customization to meet specific needs.

- Secure and reliable download options ensure safe storage.

Quick recap

- The General Warranty Deed is essential for protecting the grantee's interests in a property transfer.

- Proper completion and notarization are critical for legal validity.

- This form is compliant with Texas laws regulating property transactions.

Looking for another form?

Form popularity

FAQ

The Texas warranty deed is a form of deed that provides an unlimited warranty of title.In Texas, warranty deeds are often used: When a buyer is purchasing residential property from a seller for full value; When the buyer does not intend to purchase title insurance; or.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating