Texas Grant Deed - Trust to Individual

What this document covers

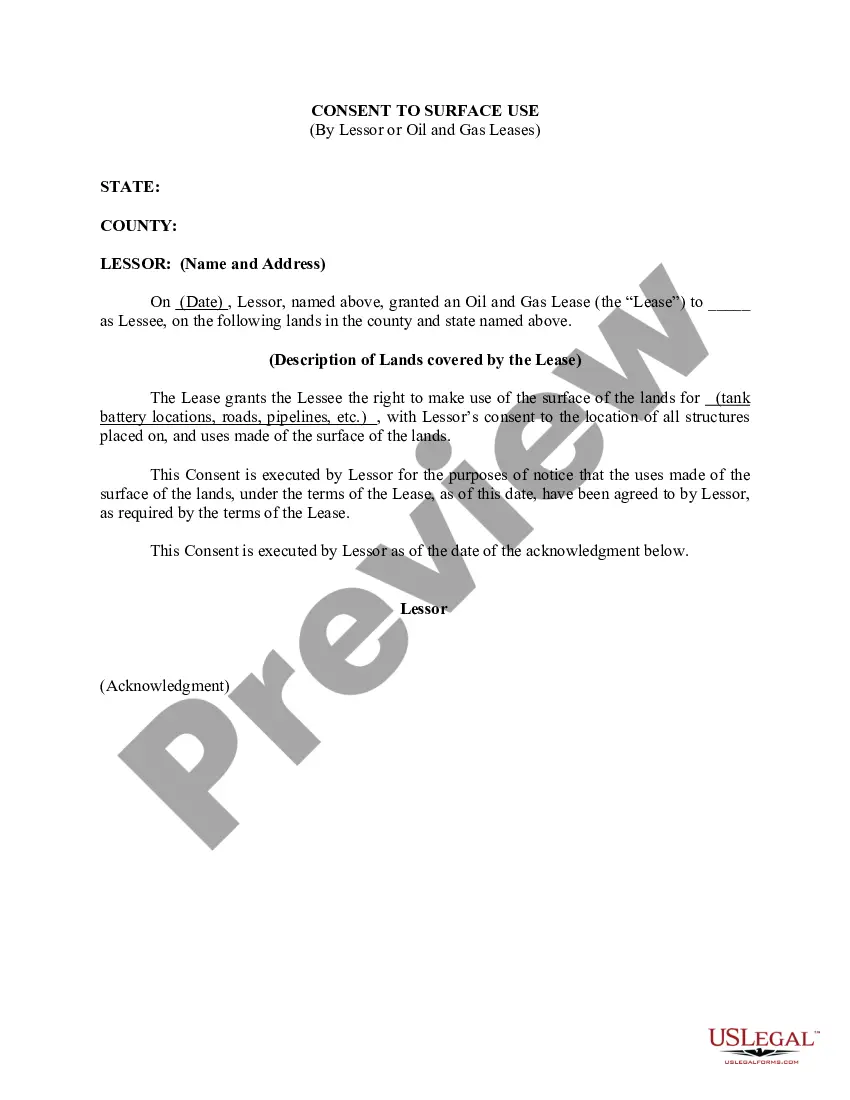

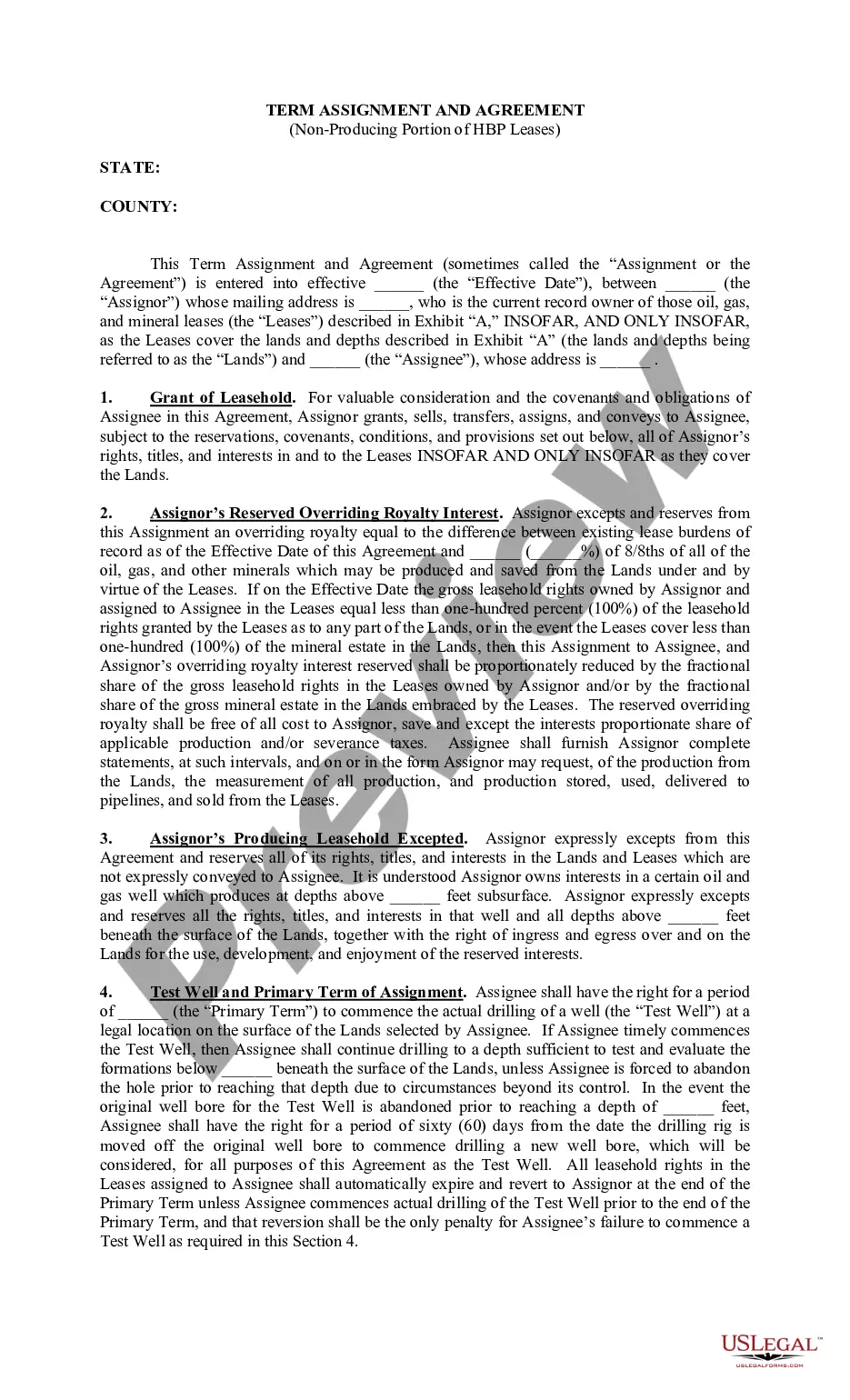

The Grant Deed - Trust to Individual is a legal document that formalizes the transfer of property from a trust (the Grantor) to an individual (the Grantee). This type of deed is specific in its purpose and structure, differing from general deeds by specifically involving a trust as the entity conveying property. This form ensures compliance with all applicable state laws, providing a clear pathway for property ownership transfer.

Key components of this form

- Identification of the Grantor (Trust) and Grantee (Individual)

- Description of the property being transferred

- Effective date of the transfer

- Signature lines for the Grantor

- Notary acknowledgment section (if applicable)

When to use this form

This form is used when a trust wishes to transfer ownership of property to an individual. Common scenarios include estate planning where a trustee transfers property to a beneficiary or when a property needs to be transferred for financial or legal reasons involving the trust's assets. It is essential to ensure that the trust has the authority to make this transfer.

Who should use this form

This form is suitable for:

- Trustees of a trust who need to transfer property to an individual

- Individuals acting on behalf of a trust in property transactions

- Beneficiaries of a trust receiving property

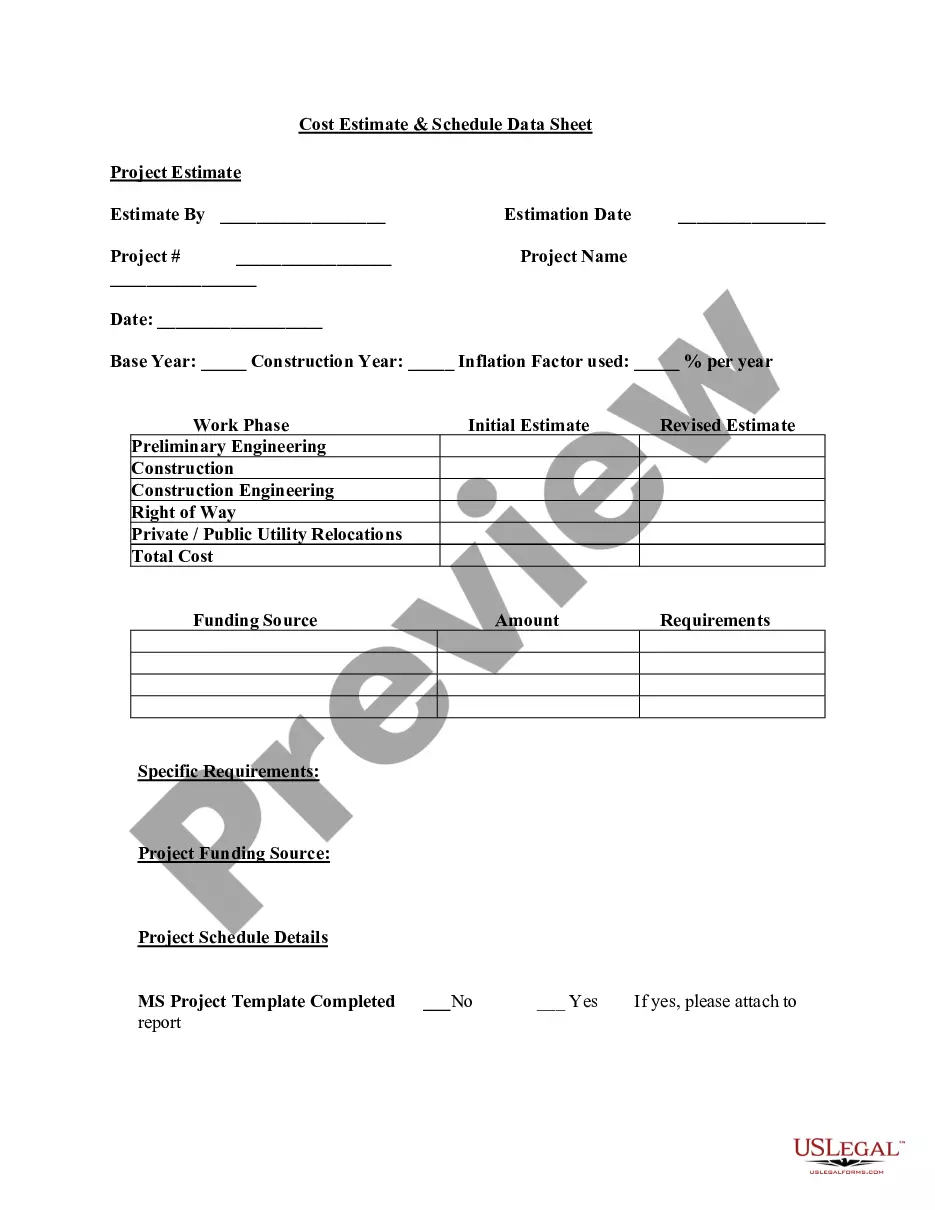

Completing this form step by step

- Identify the parties involved: the trust as the Grantor and the individual as the Grantee.

- Clearly describe the property being transferred, including its legal description.

- Enter the effective date of the transfer.

- Have the authorized representative of the trust sign and date the document.

- Complete the notary acknowledgment if required.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a full legal description of the property.

- Not obtaining the necessary signatures from the trustee.

- Neglecting to have the deed notarized when required.

- Incorrectly identifying the Grantor and Grantee.

Why use this form online

- Convenient access to complete the form from anywhere with an internet connection.

- Editability allows users to make changes easily before finalizing the document.

- Reliable templates drafted by licensed attorneys ensure legal compliance and accuracy.

Summary of main points

- The Grant Deed - Trust to Individual is essential for transferring property from a trust to an individual.

- Ensure all information is accurate and complete to avoid legal complications.

- Consider state-specific requirements when completing the form.

Looking for another form?

Form popularity

FAQ

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Grantor's name. Grantee's name and address. Description of grantee (ex: unmarried man, husband and wife, joint tenants) Person who requested grant deed. Address of real estate that is being transferred. Legal description of property (lot number) Original title order number for property.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Print a grant deed from an online source. Sign the document in the presence of a notary public. Take the deed to the recorder's office in the county where the property is located.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.