This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Tennessee Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

US Legal Forms - one of several most significant libraries of lawful varieties in the States - provides a wide range of lawful file layouts you are able to acquire or print out. Making use of the site, you may get a large number of varieties for organization and personal uses, categorized by categories, says, or key phrases.You will find the most recent models of varieties just like the Tennessee Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries in seconds.

If you already possess a membership, log in and acquire Tennessee Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries through the US Legal Forms catalogue. The Download option will appear on each kind you look at. You have accessibility to all in the past downloaded varieties within the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, here are straightforward instructions to help you get started:

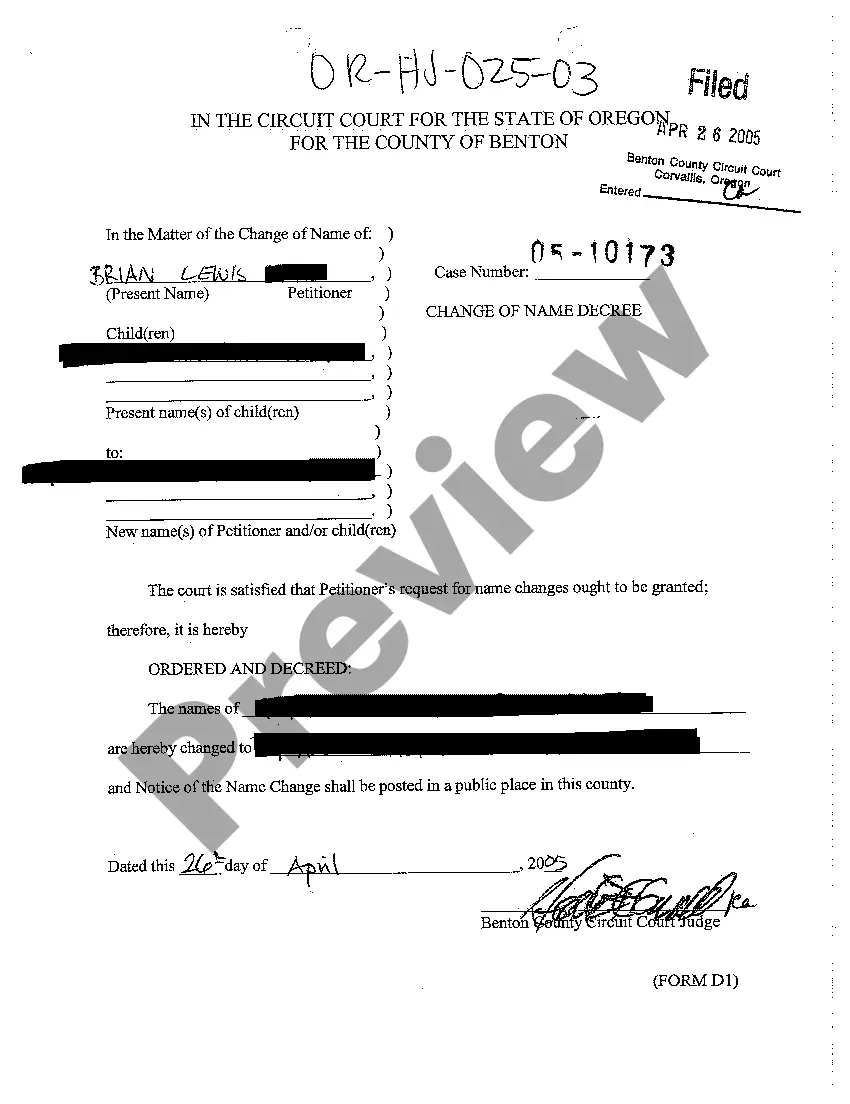

- Make sure you have selected the correct kind to your town/region. Click the Review option to check the form`s content material. See the kind information to ensure that you have chosen the right kind.

- When the kind does not fit your demands, make use of the Lookup industry near the top of the monitor to obtain the one that does.

- In case you are happy with the shape, verify your decision by visiting the Acquire now option. Then, select the prices strategy you prefer and supply your credentials to sign up to have an bank account.

- Process the purchase. Use your credit card or PayPal bank account to finish the purchase.

- Find the format and acquire the shape in your device.

- Make modifications. Complete, revise and print out and indication the downloaded Tennessee Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Every web template you included with your account does not have an expiration date and it is the one you have for a long time. So, in order to acquire or print out an additional version, just check out the My Forms area and click on on the kind you want.

Get access to the Tennessee Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with US Legal Forms, by far the most extensive catalogue of lawful file layouts. Use a large number of specialist and condition-particular layouts that meet your business or personal requirements and demands.

Form popularity

FAQ

Any individual who has control over the trust. Who is the Ultimate Beneficial Owner? The term Ultimate Beneficial Owner (UBO) is applied to individuals or entities who meet the beneficial owner definition and their ownership or voting rights are greater than 25%.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Tennessee law does not recognize transfer-on-death (TOD) deeds. In states that authorize them, TOD deeds allow real estate to automatically transfer to a named beneficiary upon the current owner's death. The advantage of TOD deeds is that they do not limit the owner's property rights during life.

Stocks and bonds can be transferred from the trust into the beneficiary's brokerage accounts. Beneficiaries typically have to pay taxes on trust income, except for distributions from the trust's principle.

There's a significant difference between being a beneficiary or trustee of a trust. If you're named as a beneficiary then you stand to benefit from the assets in the trust. On the other hand, if you're the trustee it's your job to manage those assets ing to the wishes of the trust creator.

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets.

So, now you know that the Trust Maker holds the most power before the Trust is established, but the Trustee holds the most power after the Trust is established.

Experience and Knowledge. Another key consideration is whether the individual or entity is qualified to act as trustee. If the trust has substantial assets, an individual with experience managing significant assets or with a background in finance or investments may be better suited to the role of trustee.