Tennessee Proxy Statement - Neuberger and Berman - with exhibits

Description

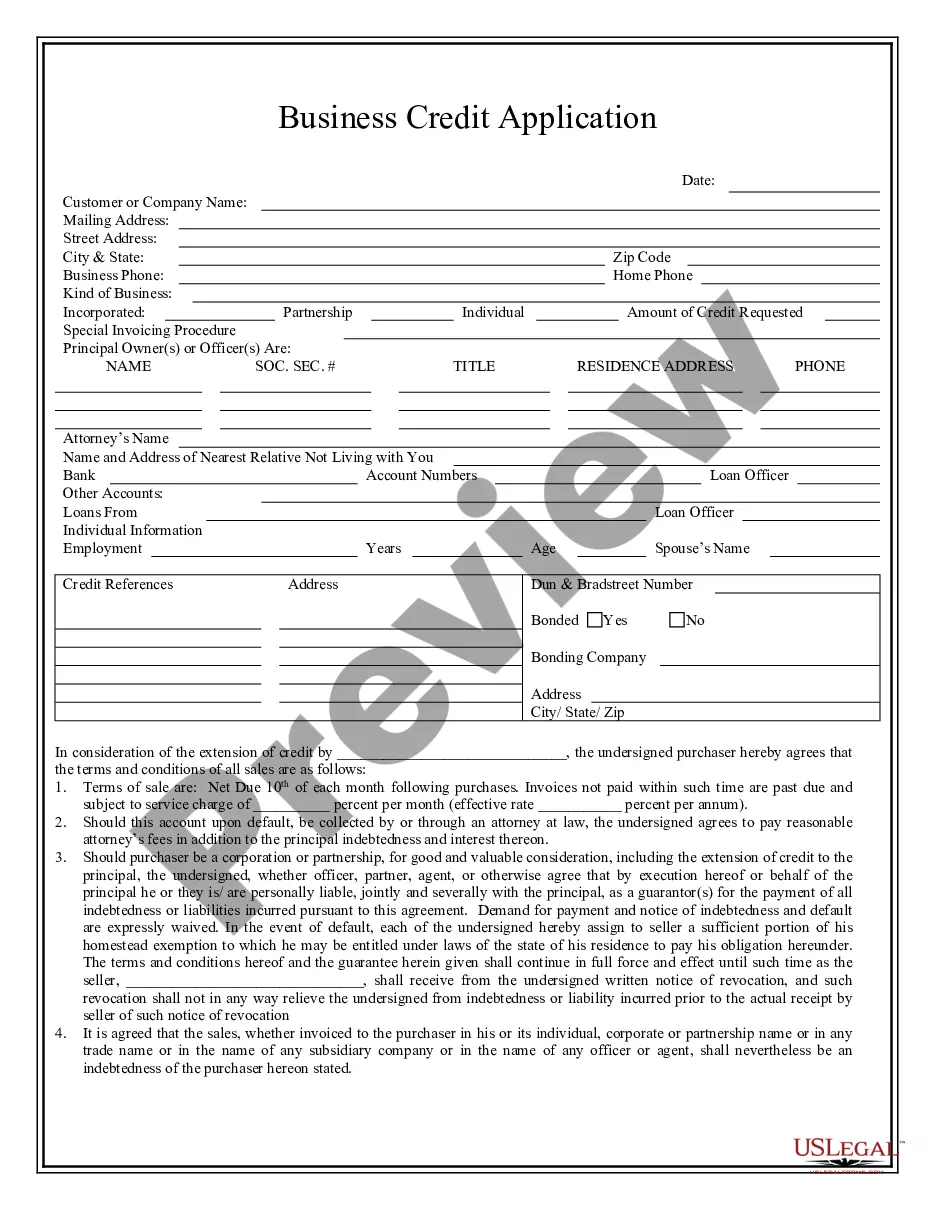

How to fill out Proxy Statement - Neuberger And Berman - With Exhibits?

If you wish to total, download, or print out legitimate file web templates, use US Legal Forms, the greatest selection of legitimate varieties, that can be found on the web. Make use of the site`s simple and hassle-free research to find the files you need. Various web templates for company and person uses are sorted by types and says, or keywords. Use US Legal Forms to find the Tennessee Proxy Statement - Neuberger and Berman - with exhibits in a number of clicks.

When you are presently a US Legal Forms client, log in to the bank account and click on the Download key to get the Tennessee Proxy Statement - Neuberger and Berman - with exhibits. You can also accessibility varieties you earlier delivered electronically in the My Forms tab of your own bank account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the right metropolis/nation.

- Step 2. Use the Preview method to look over the form`s content. Don`t forget about to read through the explanation.

- Step 3. When you are not happy with the type, take advantage of the Look for field towards the top of the display to get other types of the legitimate type format.

- Step 4. When you have identified the form you need, click the Acquire now key. Opt for the prices program you like and add your credentials to register on an bank account.

- Step 5. Approach the transaction. You may use your bank card or PayPal bank account to finish the transaction.

- Step 6. Choose the formatting of the legitimate type and download it on your gadget.

- Step 7. Full, revise and print out or signal the Tennessee Proxy Statement - Neuberger and Berman - with exhibits.

Every legitimate file format you buy is the one you have permanently. You have acces to every single type you delivered electronically within your acccount. Go through the My Forms area and decide on a type to print out or download once more.

Contend and download, and print out the Tennessee Proxy Statement - Neuberger and Berman - with exhibits with US Legal Forms. There are millions of expert and status-certain varieties you can use for your personal company or person requires.

Form popularity

FAQ

1 By law, publicly traded companies must host an annual shareholder meeting once a year. The Securities and Exchange Commission (SEC) requires that these companies also send proxy statements to shareholders ahead of their annual meetings.

Proxy statements must offer insights into board and company performance, including: The salaries of the company's five highest-paid executives (including bonuses and equity) and the appropriate benchmark in chart form. Executive performance and the performance of executives of similar companies. What is a proxy statement? Definition, rules, & examples diligent.com ? resources ? blog ? what-is-a-... diligent.com ? resources ? blog ? what-is-a-...

A company is required to file its proxy statements with the SEC no later than the date proxy materials are first sent or given to shareholders. You can see this filing by using the SEC's database, known as EDGAR. Enter the company's name here and select the appropriate company to view its SEC filings. Proxy Statements: How to Find - Investor.gov investor.gov ? investing-basics ? glossary investor.gov ? investing-basics ? glossary

SEC Form DEF 14A, also called a definitive proxy statement, is intended to furnish security holders with adequate information to be able to vote confidently at an upcoming shareholders' meeting. Form DEF 14A is most commonly used with an annual meeting proxy and filed in advance of a company's annual meeting.

Form PRE 14A is normally filed ten calendar days before a company files SEC Form DEF 14A, or a definitive proxy statement. However, not all shareholder votes require the company to file a preliminary proxy statement.