Tennessee Authorization to purchase 6 percent convertible debentures

Description

How to fill out Authorization To Purchase 6 Percent Convertible Debentures?

US Legal Forms - one of several most significant libraries of legitimate types in the States - delivers a wide range of legitimate papers layouts it is possible to down load or printing. Utilizing the internet site, you may get 1000s of types for organization and personal reasons, sorted by classes, suggests, or keywords.You will find the latest versions of types just like the Tennessee Authorization to purchase 6 percent convertible debentures within minutes.

If you have a subscription, log in and down load Tennessee Authorization to purchase 6 percent convertible debentures through the US Legal Forms library. The Download switch will appear on each kind you see. You gain access to all earlier delivered electronically types in the My Forms tab of the profile.

In order to use US Legal Forms for the first time, here are simple recommendations to obtain began:

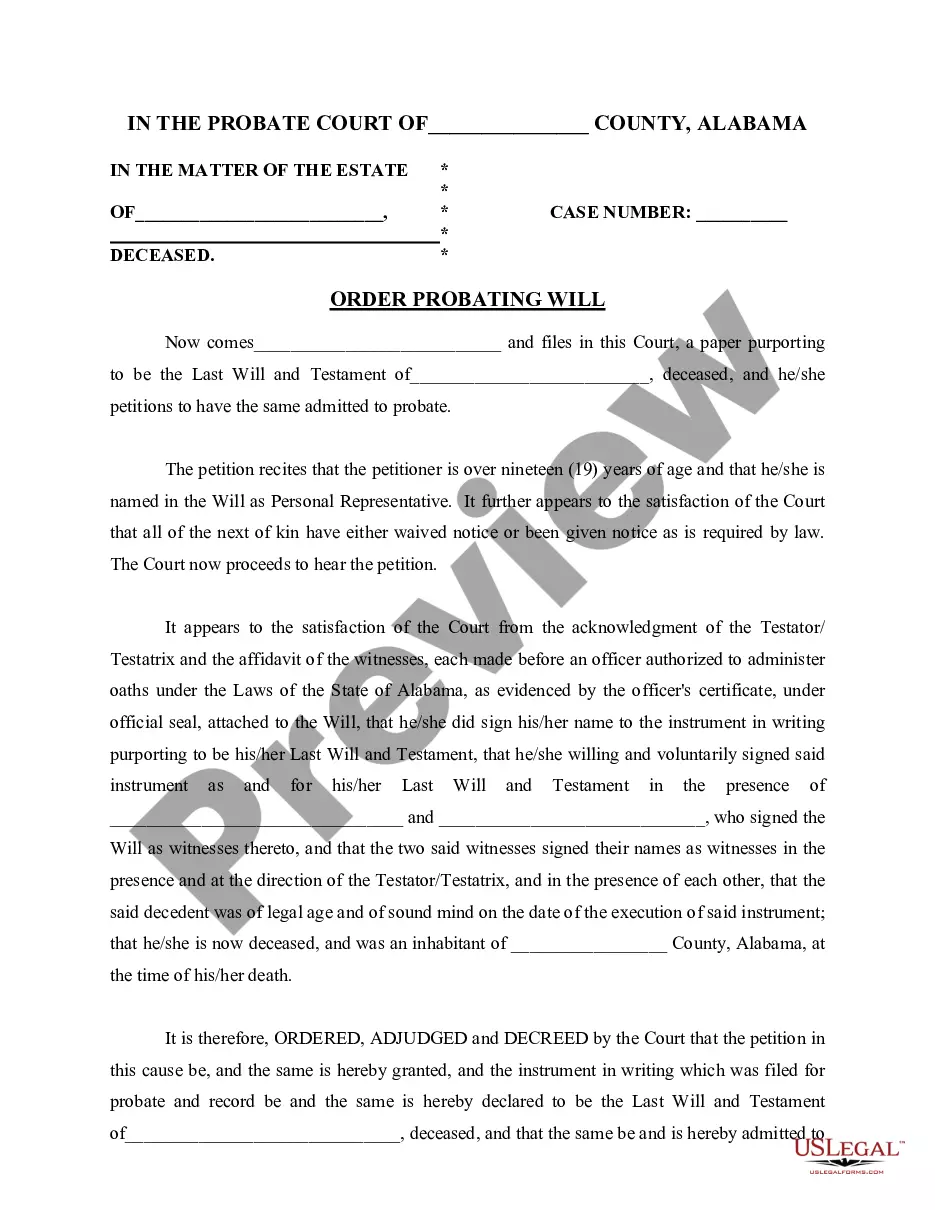

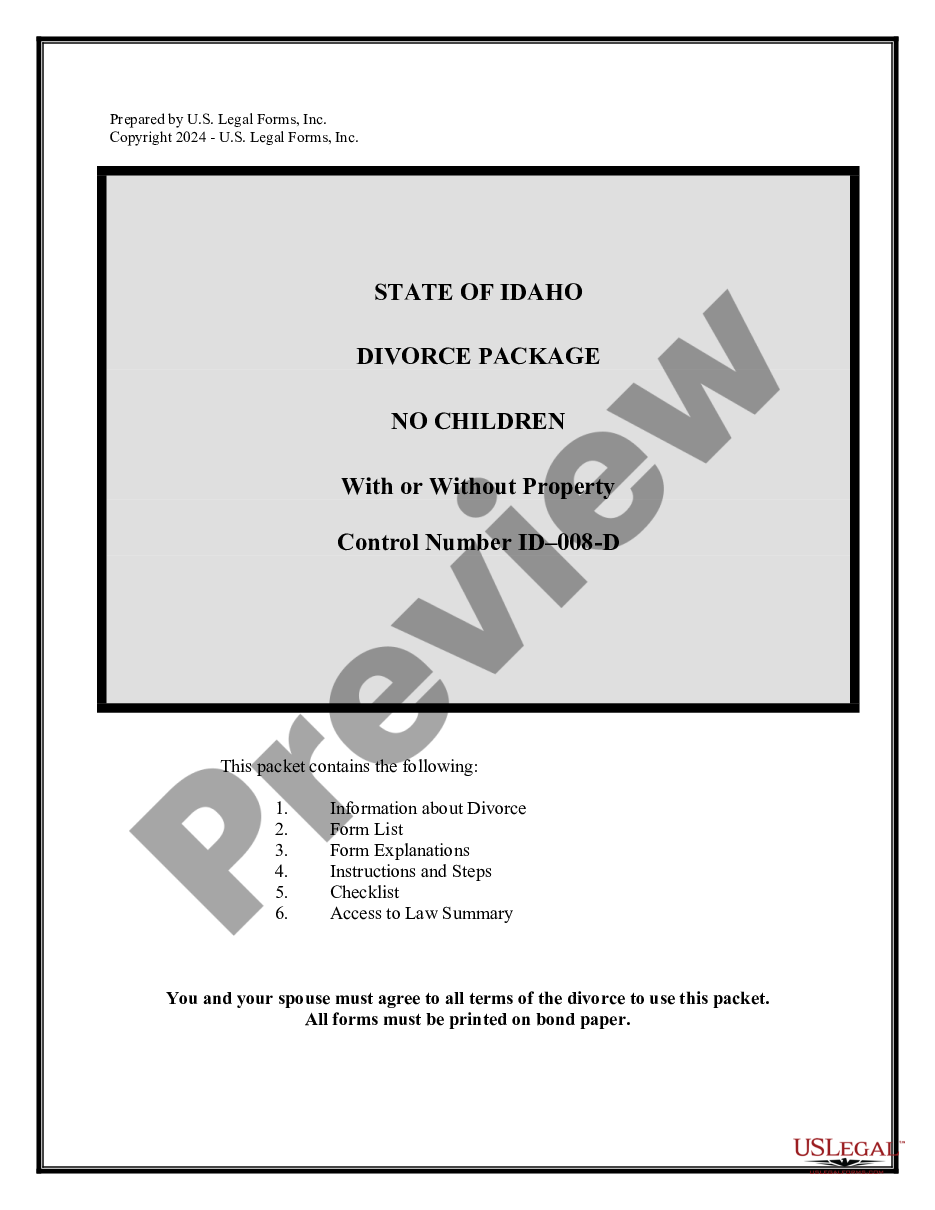

- Be sure you have picked the correct kind for the town/state. Select the Preview switch to check the form`s content. Read the kind description to actually have chosen the proper kind.

- In the event the kind does not match your requirements, make use of the Search industry towards the top of the screen to find the one which does.

- Should you be happy with the shape, verify your decision by clicking the Acquire now switch. Then, pick the costs prepare you like and offer your qualifications to sign up on an profile.

- Process the transaction. Use your charge card or PayPal profile to perform the transaction.

- Find the file format and down load the shape on the product.

- Make alterations. Load, modify and printing and indicator the delivered electronically Tennessee Authorization to purchase 6 percent convertible debentures.

Every design you added to your bank account lacks an expiry particular date which is the one you have eternally. So, if you want to down load or printing an additional backup, just visit the My Forms segment and click on the kind you will need.

Get access to the Tennessee Authorization to purchase 6 percent convertible debentures with US Legal Forms, by far the most considerable library of legitimate papers layouts. Use 1000s of specialist and state-certain layouts that fulfill your company or personal needs and requirements.

Form popularity

FAQ

A compulsory convertible debenture is a bond that must be converted into stock at its maturity date. For companies, it allows for repayment of debt without spending cash. For investors, it offers a return in interest and, later, ownership of shares in the company.

Later, the company issues the NCDs through a public issue that remains open for a specific period, similar to IPOs. The process of how to buy non-convertible debentures requires the investors to login into their online stock broking account and place a buy order to buy NCD online.

NCD issue process is similar to the IPO process Investors apply for NCD shares through a broker. Based on the subscription, they receive the number of NCD shares. The NCD's are credited to the demat account and the money gets deducted from the trading/bank account.

Advantages of investing in NCDs. NCDs offer higher interest rates as compared to traditional investment options like bank FDs, government bonds or securities, etc. Generally, the NBFC NCD rate of interest is higher by up to 150-175 basis points than bank FDs. NCDs are tradable in the share market, hence highly liquid.

Buying an NCD Directly from the Issuer: You may directly visit the issuer's website and can apply from there by making an online payment. Buying NCD through a Broker: If you already have a Demat account with any brokerage firm, you can buy the NCD when it starts trading in the secondary market.

The capital investment requirement differs with every NCD issue and is set by the company. However, the minimum required amount is Rs 10,000.

Investors can hold on to their convertible debentures and continue to receive fixed interest payments at the rate of 2% per year until the debt matures and the company returns their principal.

Fully Convertible Debenture: These are debentures in which the whole value of debentures can be converted into equity shares of the company. Partly Convertible Debenture: In this kind of debentures, only a part of the debentures will be eligible for conversion into equity shares.