Tennessee Authorization to purchase corporation's outstanding common stock

Description

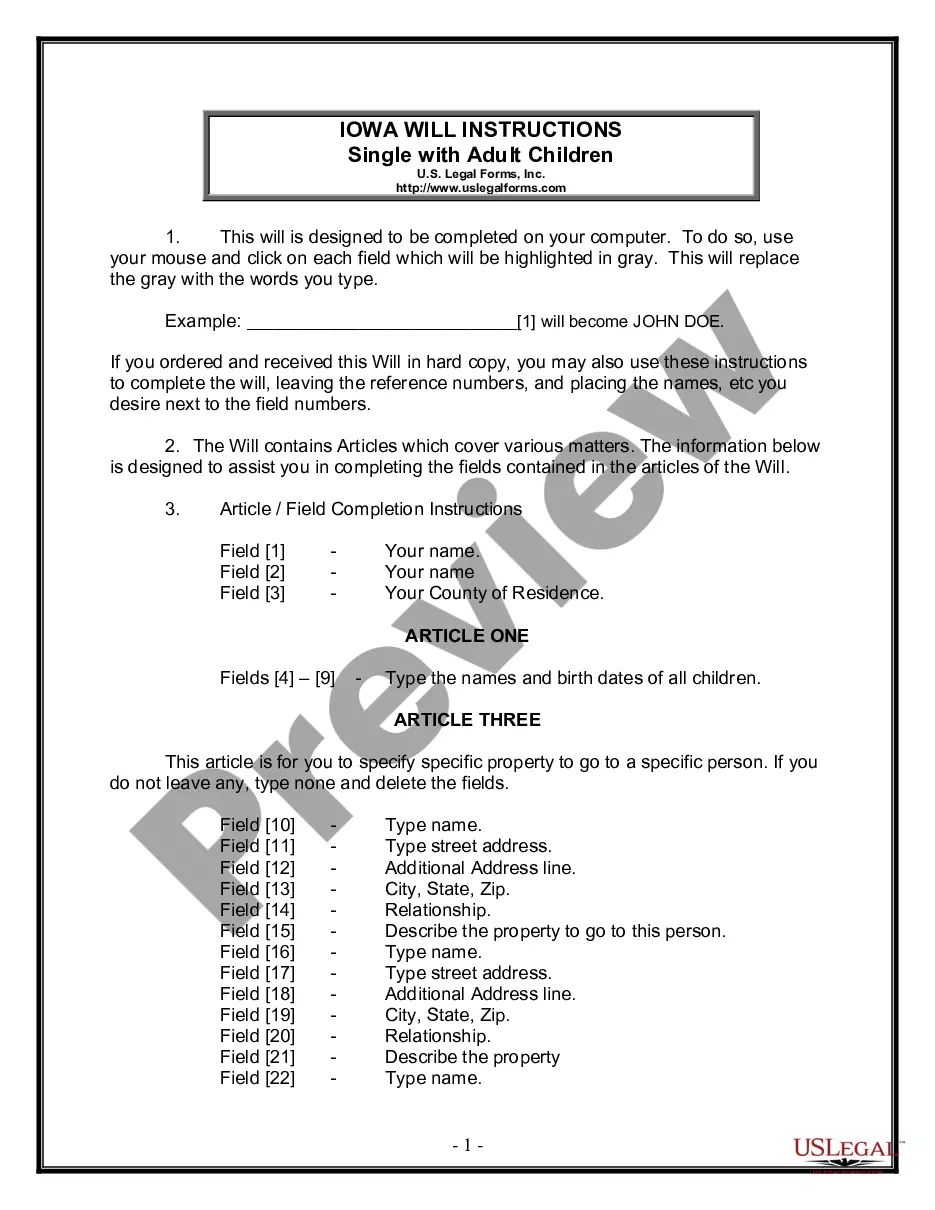

How to fill out Authorization To Purchase Corporation's Outstanding Common Stock?

You can commit time on-line looking for the lawful file template that meets the federal and state requirements you need. US Legal Forms offers thousands of lawful varieties that are examined by professionals. You can actually acquire or print the Tennessee Authorization to purchase corporation's outstanding common stock from your service.

If you currently have a US Legal Forms profile, it is possible to log in and click the Obtain option. Next, it is possible to full, change, print, or signal the Tennessee Authorization to purchase corporation's outstanding common stock. Each lawful file template you purchase is your own forever. To acquire an additional backup of the acquired type, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website for the first time, adhere to the basic directions listed below:

- First, ensure that you have chosen the best file template for the region/area of your choice. Look at the type description to make sure you have chosen the appropriate type. If offered, use the Preview option to check through the file template also.

- In order to find an additional variation of the type, use the Lookup discipline to obtain the template that suits you and requirements.

- After you have located the template you need, simply click Buy now to carry on.

- Pick the rates strategy you need, type in your references, and sign up for an account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal profile to cover the lawful type.

- Pick the structure of the file and acquire it for your gadget.

- Make alterations for your file if necessary. You can full, change and signal and print Tennessee Authorization to purchase corporation's outstanding common stock.

Obtain and print thousands of file layouts utilizing the US Legal Forms website, that offers the largest selection of lawful varieties. Use specialist and express-certain layouts to deal with your business or specific demands.

Form popularity

FAQ

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

Some jurisdictions?the District of Columbia, Louisiana, New Hampshire, New York City, Tennessee, and Texas?do not recognize the federal S corporation election and, for the most part, tax S corporations like other business corporations.

Difference Between LLC and S Corp While LLCs are often treated as pass-through entities, meaning the income of the LLC flows through to its members, S Corps are accounting entities, meaning the S Corp itself calculates income and deductions at the corporate level before income is allocated to individual shareholders.

For federal tax purposes, a corporation must file Form 2553, Election by a Small Business Corporation, to gain S corporation status. Most states follow the federal government in recognizing the S election. However, Arkansas, New Jersey and New York require a separate state S election.

In other words, in most states, S corporations are pass-through entities. Tennessee, however, is different: it does not recognize the federal S election, and instead treats S corporations like traditional corporations, including requiring them to pay the same taxes as traditional corporations.

Businesses that are incorporated in another state will typically apply for a Tennessee certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

Does Tennessee support tax extension for business income tax returns? Yes. Tennessee requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax extension Form can be filed only if the federal tax extension Form 7004 was not granted or the payment was not made.

Authorized shares are those that a company is legally able to issue?the capital stock, while outstanding shares are those that have actually been issued and remain outstanding to shareholders.