Tennessee Sample Letter for Check Stipulations

Description

How to fill out Sample Letter For Check Stipulations?

Choosing the best lawful record template can be quite a have difficulties. Obviously, there are tons of web templates accessible on the Internet, but how would you get the lawful type you will need? Take advantage of the US Legal Forms site. The support provides a huge number of web templates, such as the Tennessee Sample Letter for Check Stipulations, which can be used for organization and personal requirements. All of the varieties are checked out by professionals and meet federal and state demands.

In case you are currently authorized, log in to your accounts and click the Download key to get the Tennessee Sample Letter for Check Stipulations. Use your accounts to check from the lawful varieties you possess purchased earlier. Proceed to the My Forms tab of your own accounts and obtain another duplicate in the record you will need.

In case you are a brand new end user of US Legal Forms, here are basic recommendations so that you can adhere to:

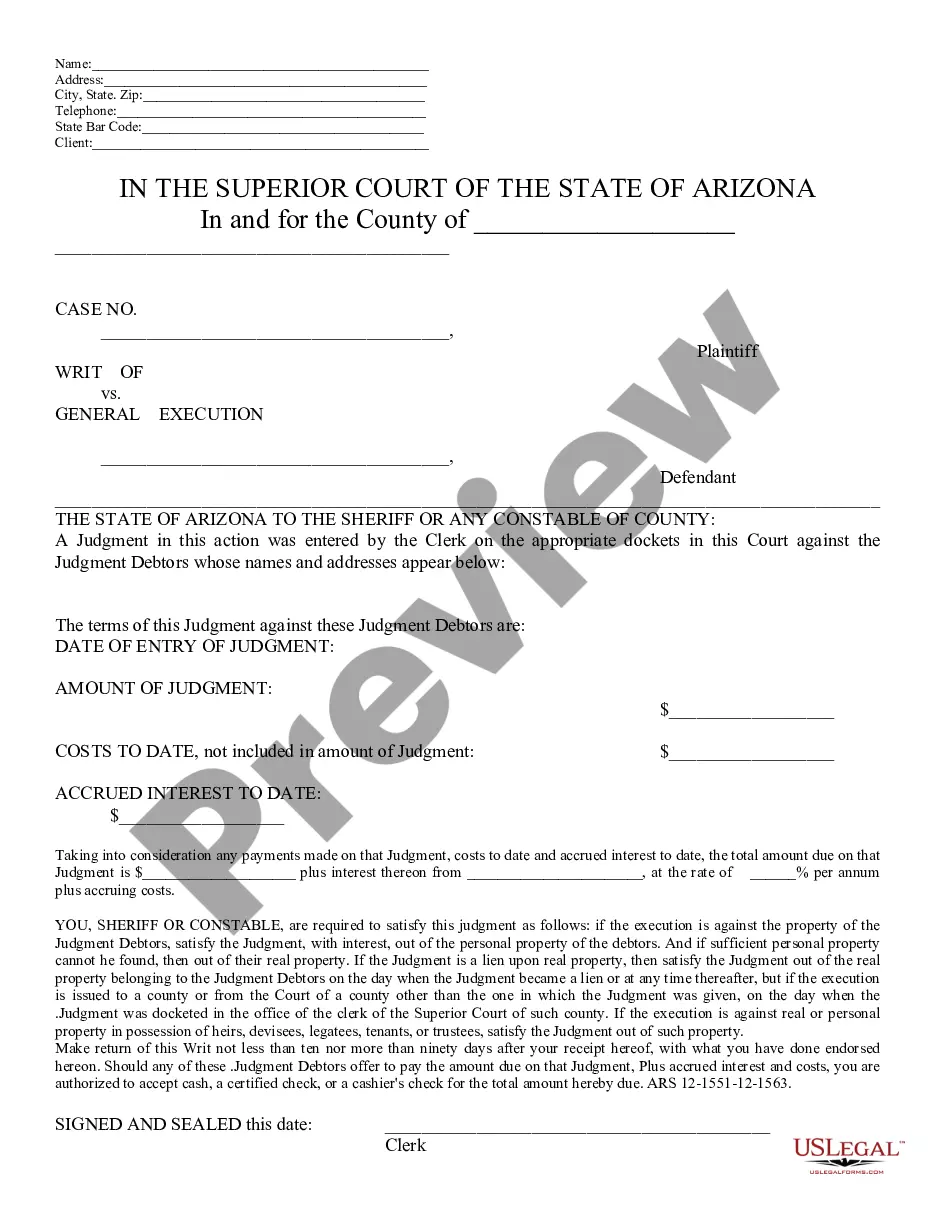

- Very first, be sure you have selected the proper type for the metropolis/state. You may look through the form making use of the Preview key and study the form explanation to make certain it will be the right one for you.

- In the event the type will not meet your preferences, make use of the Seach area to discover the appropriate type.

- When you are sure that the form is acceptable, select the Get now key to get the type.

- Select the rates program you want and enter the essential information and facts. Make your accounts and pay for an order with your PayPal accounts or bank card.

- Select the data file structure and obtain the lawful record template to your device.

- Total, revise and print out and signal the acquired Tennessee Sample Letter for Check Stipulations.

US Legal Forms will be the most significant library of lawful varieties that you can see numerous record web templates. Take advantage of the company to obtain skillfully-produced papers that adhere to condition demands.

Form popularity

FAQ

A background check is a comprehensive examination of an individual's history, encompassing various aspects such as criminal records, credit history, employment and education history.

Criminal background checks search a candidate's criminal record to reveal arrests, convictions, incarcerations, and both current and past arrest warrants. This search can be conducted directly through the Tennessee Bureau of Investigation (TBI) or by partnering with a qualified background check provider, like Checkr.

The Department of Revenue issues this letter upon taxpayer request. A Certificate of Tax Clearance declares that all tax returns administered by the Department of Revenue have been filed and all liabilities have been paid. Certificates of Tax Clearance are issued to both terminating and ongoing businesses.

How Far Back Does an Employment Background Check Go in Tennessee. The state of Tennessee is governed by the Federal Credit Reporting Act when it comes to the time limit for looking into pre-hire histories. This standard lookback period is seven years. There are some exceptions to this time limit, however.

Lifetime disqualification for any violent offense, most sex offenses, any felony or misdemeanor drug offenses, as well as other offenses that present a ?threat to the health, safety or welfare? of children. Disqualifying offenses include pending charges and certain juvenile offenses.

Due diligence consists of mailing a first class letter to the owner. The purpose of the letter is to give the owner the opportunity to collect the funds from you and relieve you of the liability to have to report and remit the funds to the Unclaimed Property Division.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

The most common background checks search for criminal activity and verify employment and education?including identity verification and driving records. Some employers also review the candidate's credit and social media history, and conduct drug tests.