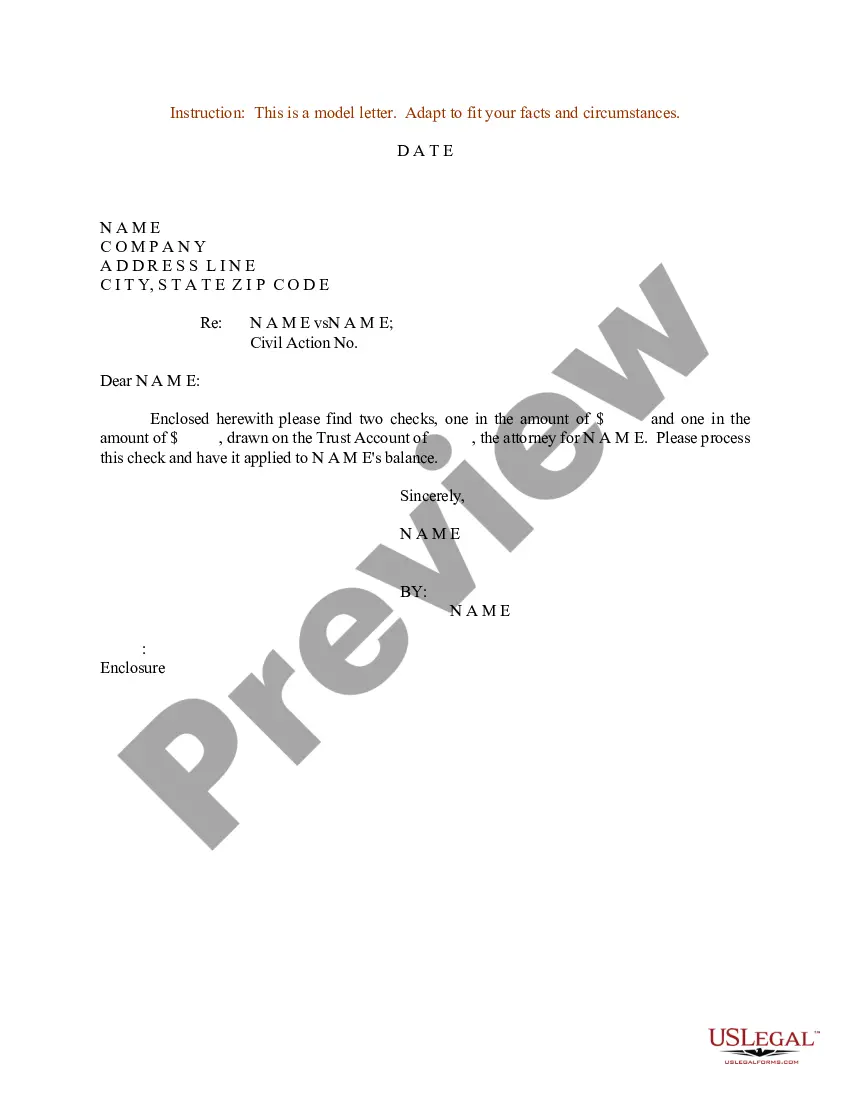

Tennessee Sample Letter for Applying Check to Accounts

Description

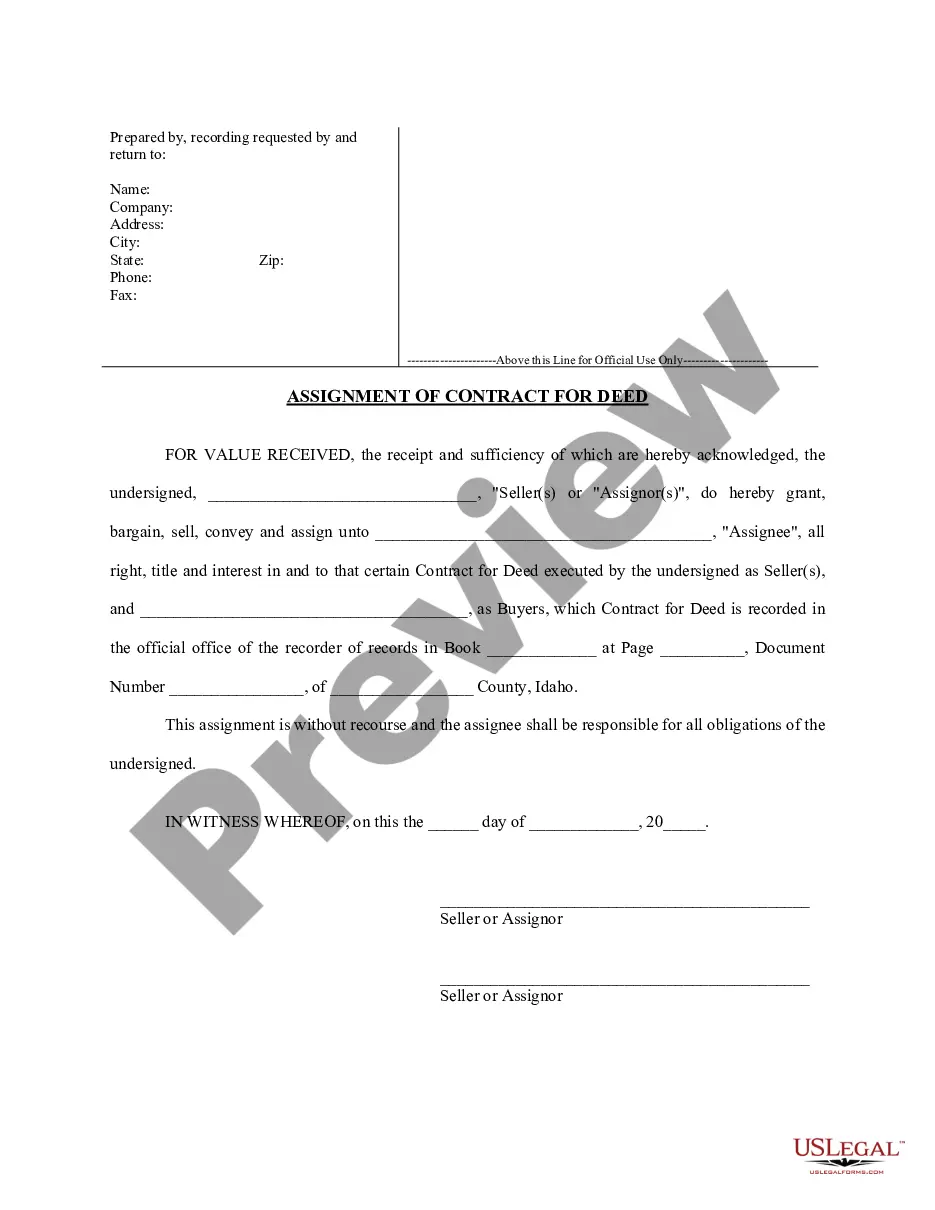

How to fill out Sample Letter For Applying Check To Accounts?

Choosing the right lawful papers format can be quite a struggle. Needless to say, there are a variety of layouts available on the net, but how can you get the lawful develop you need? Use the US Legal Forms site. The assistance gives a huge number of layouts, like the Tennessee Sample Letter for Applying Check to Accounts, that you can use for business and personal requires. All of the kinds are inspected by specialists and satisfy state and federal specifications.

When you are already signed up, log in to your bank account and then click the Down load button to have the Tennessee Sample Letter for Applying Check to Accounts. Make use of bank account to look with the lawful kinds you have ordered previously. Visit the My Forms tab of your bank account and acquire an additional copy of the papers you need.

When you are a brand new end user of US Legal Forms, listed here are simple guidelines for you to comply with:

- First, make certain you have chosen the correct develop for your metropolis/area. You are able to look through the form using the Review button and browse the form outline to guarantee this is the best for you.

- If the develop does not satisfy your needs, make use of the Seach area to obtain the correct develop.

- When you are sure that the form is proper, go through the Get now button to have the develop.

- Pick the pricing program you want and enter in the necessary information. Create your bank account and purchase an order utilizing your PayPal bank account or bank card.

- Choose the file formatting and download the lawful papers format to your gadget.

- Full, modify and print out and indicator the attained Tennessee Sample Letter for Applying Check to Accounts.

US Legal Forms will be the greatest local library of lawful kinds where you can discover numerous papers layouts. Use the service to download skillfully-manufactured paperwork that comply with condition specifications.

Form popularity

FAQ

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.

How to Dissolve an LLC in Tennessee in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

The Department of Revenue issues this letter upon taxpayer request. A Certificate of Tax Clearance declares that all tax returns administered by the Department of Revenue have been filed and all liabilities have been paid. Certificates of Tax Clearance are issued to both terminating and ongoing businesses.

Sir/Ma'am, I am Priyanka Dhoot, a bank account holder in your bank for 4 years with account number 123XX89. I am writing this letter to request you for a new bank cheque book with 100 leaves as I have exhausted my previous one. I have attached my Aadhar card, PAN card and address proof for your verification.

Cheque Book Request Letter to Bank I have to make the payments latest by the 7th of January, 2022. I request you to kindly understand my situation and issue me a cheque book of 50 leaves at the earliest. I have enclosed herewith a self-attested copy of my PAN card and my Aadhaar card as proof for your reference.

Businesses that are incorporated in another state will typically apply for a Tennessee certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

The Department of Revenue offers a toll free tax information line for Tennessee taxpayers. The number is 1-800-342-1003. If calling from Nashville or out-of-state, you may call (615) 253-0600.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.