Tennessee Sample Letter for Settlement Check

Description

How to fill out Sample Letter For Settlement Check?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates that you can download or print.

Using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Tennessee Sample Letter for Settlement Check in just seconds.

If you have a monthly subscription, Log In and download the Tennessee Sample Letter for Settlement Check from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously purchased forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device.

Edit. Fill out, modify, and print and sign the downloaded Tennessee Sample Letter for Settlement Check. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another version, just go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your area/state.

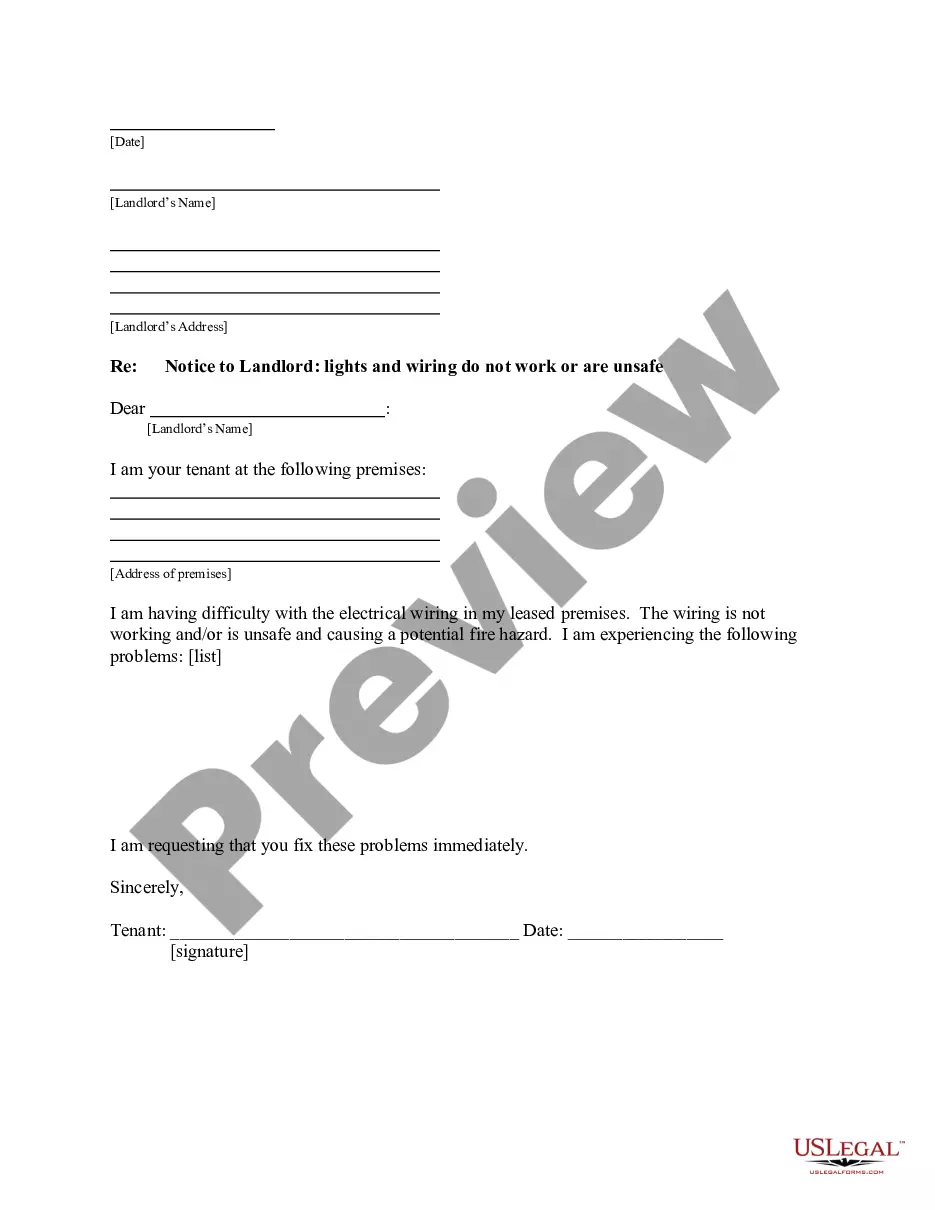

- Click the Preview button to review the form's content.

- Read the form summary to confirm you have selected the right form.

- If the form doesn't meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

To write a settlement check, include the payee's name, the correct amount in both numbers and words, and a clear description of the purpose of the check. Make sure to sign the check properly to validate it. Utilizing a Tennessee Sample Letter for Settlement Check can provide insights into how to accompany your check with a letter that explains the settlement and reinforces its purpose.

A settlement offer typically includes the amount proposed, a brief explanation of the reasons behind that amount, and any conditions attached to the offer. It is often formatted as a formal letter, ensuring clarity and professionalism. You can refer to a Tennessee Sample Letter for Settlement Check to visualize how to structure your offer properly and ensure all critical elements are included.

To write a strong settlement letter, clearly outline your position and provide supporting evidence for your claims. Be concise but thorough, and express your willingness to negotiate. A Tennessee Sample Letter for Settlement Check can guide you in structuring your letter effectively, helping you to present your case in a compelling manner that encourages a positive response.

An acceptable settlement offer typically reflects the value of the claim, taking into account damages and other factors. It should be a fair amount that both parties can agree upon, often influenced by previous cases and negotiations. Using a Tennessee Sample Letter for Settlement Check can help you articulate your offer effectively, ensuring that it meets legal standards while addressing the concerns of both parties.

To write a settlement offer letter, start by clearly stating your intention to settle. Include the details of the case, the amount you are proposing, and the reasons for this amount. Use a Tennessee Sample Letter for Settlement Check as a template to ensure you cover all necessary points and maintain a formal tone. This approach will enhance your credibility and improve your chances of a favorable response.

A settlement claim letter is a formal document used to present a claim for compensation to an insurance company or another party. It details the specifics of the claim, the amount requested, and any relevant evidence. For assistance in crafting your letter, consider using a Tennessee Sample Letter for Settlement Check to ensure clarity and effectiveness.

Common mistakes in settlement letters include vague language, insufficient documentation, and unrealistic settlement amounts. Additionally, failing to highlight key details about your case can weaken your position. Reviewing a Tennessee Sample Letter for Settlement Check can help you avoid these pitfalls and strengthen your letter.

You can obtain a claim settlement letter by either drafting one yourself or requesting one from your insurance company. If you choose to draft your own, using a Tennessee Sample Letter for Settlement Check can provide valuable guidance. Ensure all relevant details are included to support your claim effectively.

The purpose of a settlement letter is to initiate negotiations between parties to resolve a claim without going to court. It outlines the terms of the settlement and encourages dialogue about compensation. By using a Tennessee Sample Letter for Settlement Check, you can ensure your settlement letter is comprehensive and persuasive.

Writing a lawsuit settlement letter requires you to present your case clearly and concisely. Begin by stating the nature of the lawsuit, the parties involved, and the desired settlement amount. Incorporating a Tennessee Sample Letter for Settlement Check can provide a solid framework to help you craft an effective letter.