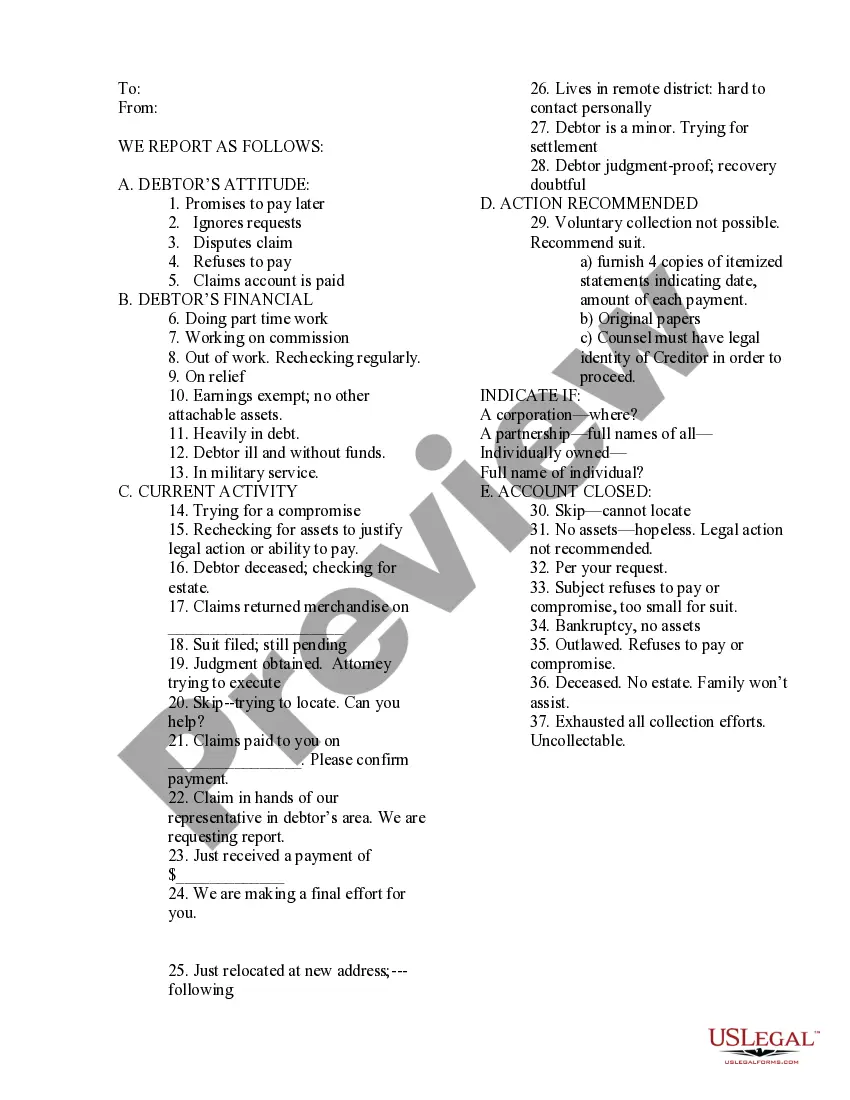

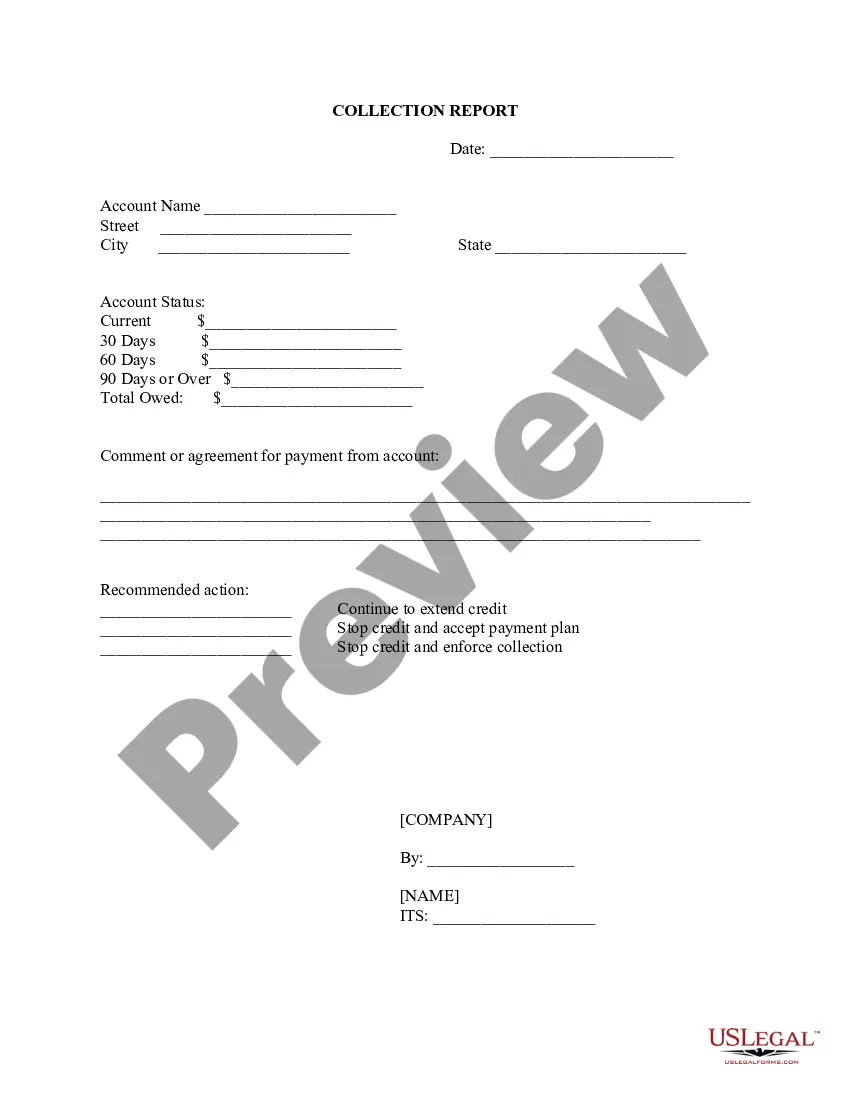

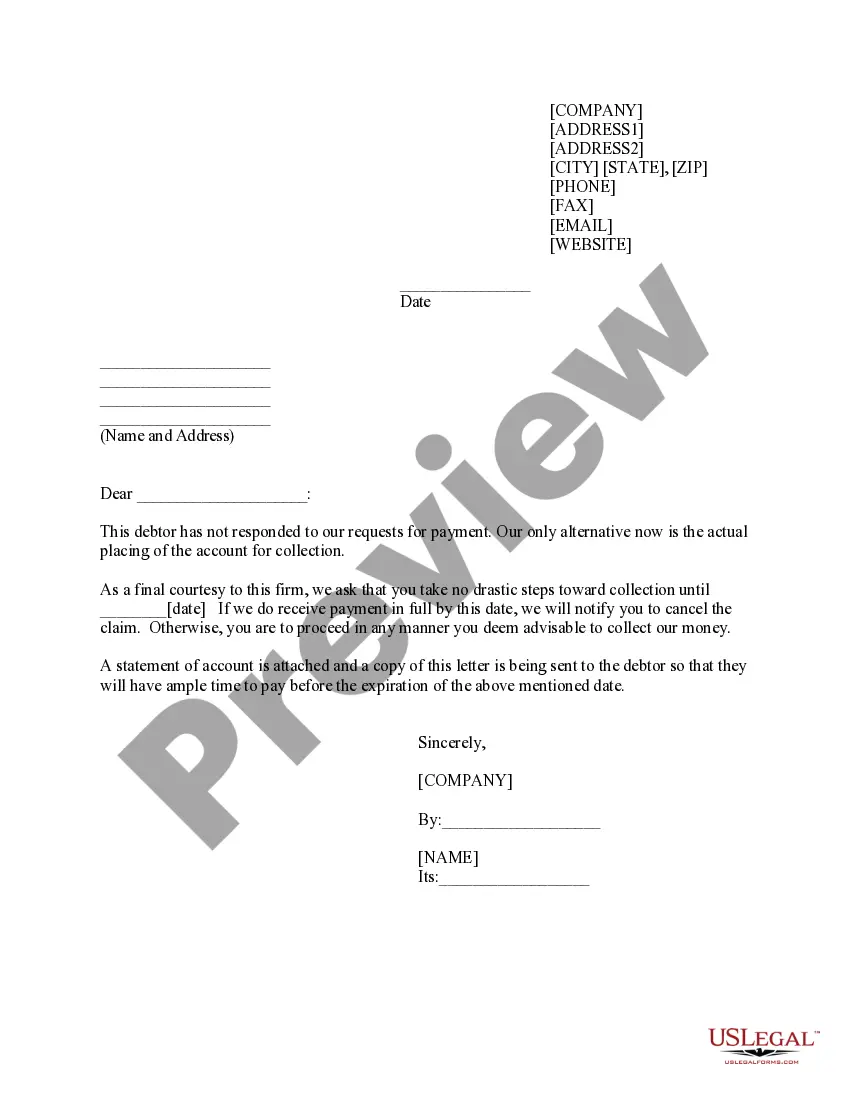

This is a form to track progress on a delinquent customer account and to record collection efforts.

Tennessee Delinquent Account Collection History

Description

How to fill out Delinquent Account Collection History?

If you require to complete, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the website's simple and user-friendly search feature to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you saved in your account. Go to the My documents section and choose a form to print or download again.

Complete and download, and print the Tennessee Delinquent Account Collection History with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Tennessee Delinquent Account Collection History within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Tennessee Delinquent Account Collection History.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your correct region/country.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal document template.

- Step 4. Once you have found the form you need, click the Buy Now option. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Download the format of your legal form to your device.

- Step 7. Complete, edit, and print or sign the Tennessee Delinquent Account Collection History.

Form popularity

FAQ

To find delinquent tax property in Tennessee, you should start by checking with your local county tax assessor's office. They maintain detailed records of properties with delinquent accounts. Additionally, you can visit official state websites that provide information about Tennessee delinquent account collection history. Utilizing online resources and property databases can also help you easily identify these properties.

In Kansas, property taxes can go unpaid for up to three years before the government initiates a tax foreclosure. It's critical to be aware of the varied rules across states, as Tennessee has different regulations concerning delinquent property taxes. Keeping track of the Tennessee delinquent account collection history can help you avoid these pitfalls in your financial dealings.

Yes, you can look up IRS tax liens by using the official IRS website or local tax authority resources. These sources provide publicly available information on tax liens, helping you understand the financial obligations of property owners. Understanding these liens can contribute to a clearer picture of the Tennessee delinquent account collection history associated with specific properties.

In Tennessee, a debt collector can legally pursue old debt for six years. This timeframe is specified by the state’s statutes of limitations on written contracts. It's important to understand that once this period expires, the collector cannot file a lawsuit to recover the debt, making it vital to know the Tennessee delinquent account collection history regarding your debts.

To pull a tax delinquent list in Tennessee, you typically start by visiting your county's tax assessor or treasurer's website. Many counties publish these lists online, containing details about properties with unpaid taxes. Additionally, you might consider using platforms like US Legal Forms to access comprehensive legal resources on Tennessee delinquent account collection history.

In TN, paying property tax does not, by itself, grant ownership of the property. Ownership is established through the title, while property tax payments assert your rights to that ownership. However, staying current with your taxes can help you avoid issues related to Tennessee's delinquent account collection history and maintain your rightful claims to the property.

Property taxes in Tennessee may go unpaid for up to three years before the county typically initiates a tax sale. This timeline allows property owners to regroup and settle their accounts, but it’s essential to act quickly to avoid losing your property. Familiarizing yourself with the Tennessee delinquent account collection history can provide valuable insights into this process.

In Tennessee, property owners can be delinquent on property taxes for several years before facing a tax sale. Typically, counties allow at least three years of delinquency before initiating the sale process. Nonetheless, it is crucial to address delinquent accounts promptly to avoid complications with your property ownership and to understand the implications of Tennessee delinquent account collection history.

Paying property tax does not automatically grant ownership of the property. In Tennessee, ownership is determined by the title, which is separate from tax payments. However, consistently paying property taxes can protect your ownership rights and prevent tax liens from leading to serious collections. Understanding Tennessee delinquent account collection history can help clarify these dynamics.

To discover if you are delinquent on taxes, review your property tax statements and contact your local tax office. They provide information regarding any outstanding balances and help clarify your Tennessee Delinquent Account Collection History. Regularly checking your account helps you maintain responsible property ownership.