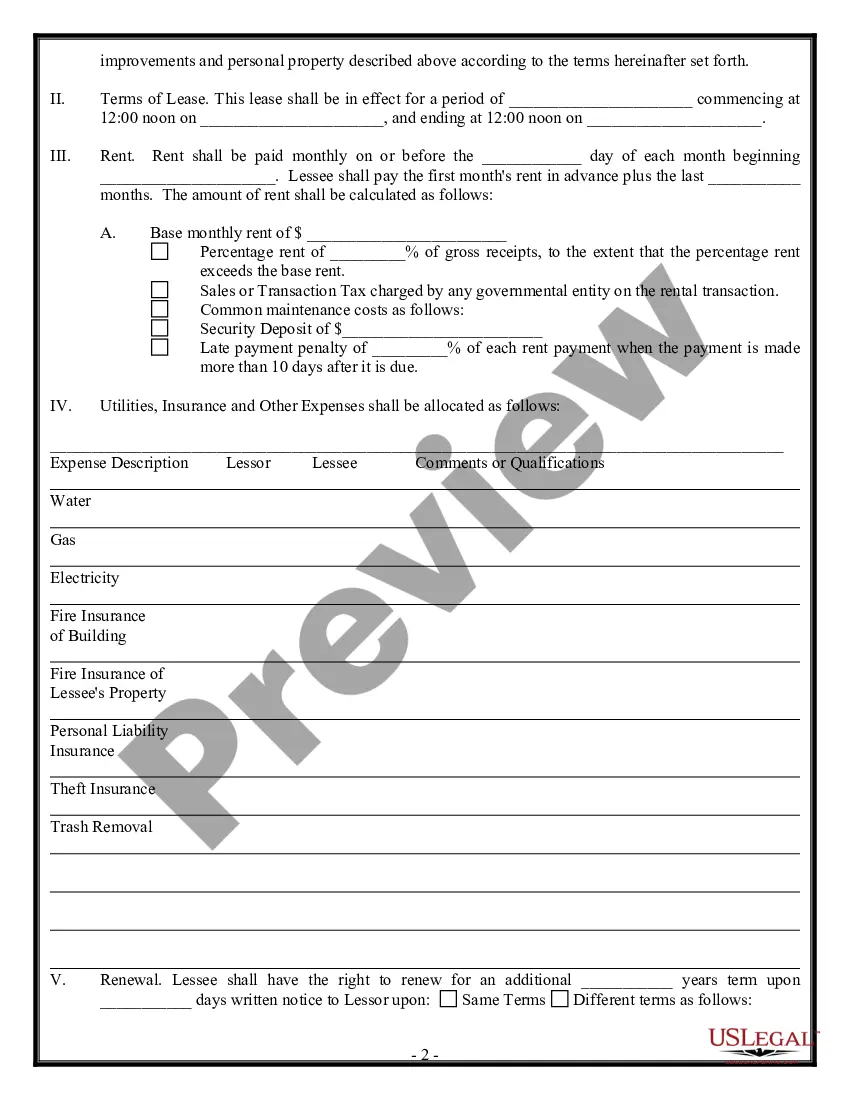

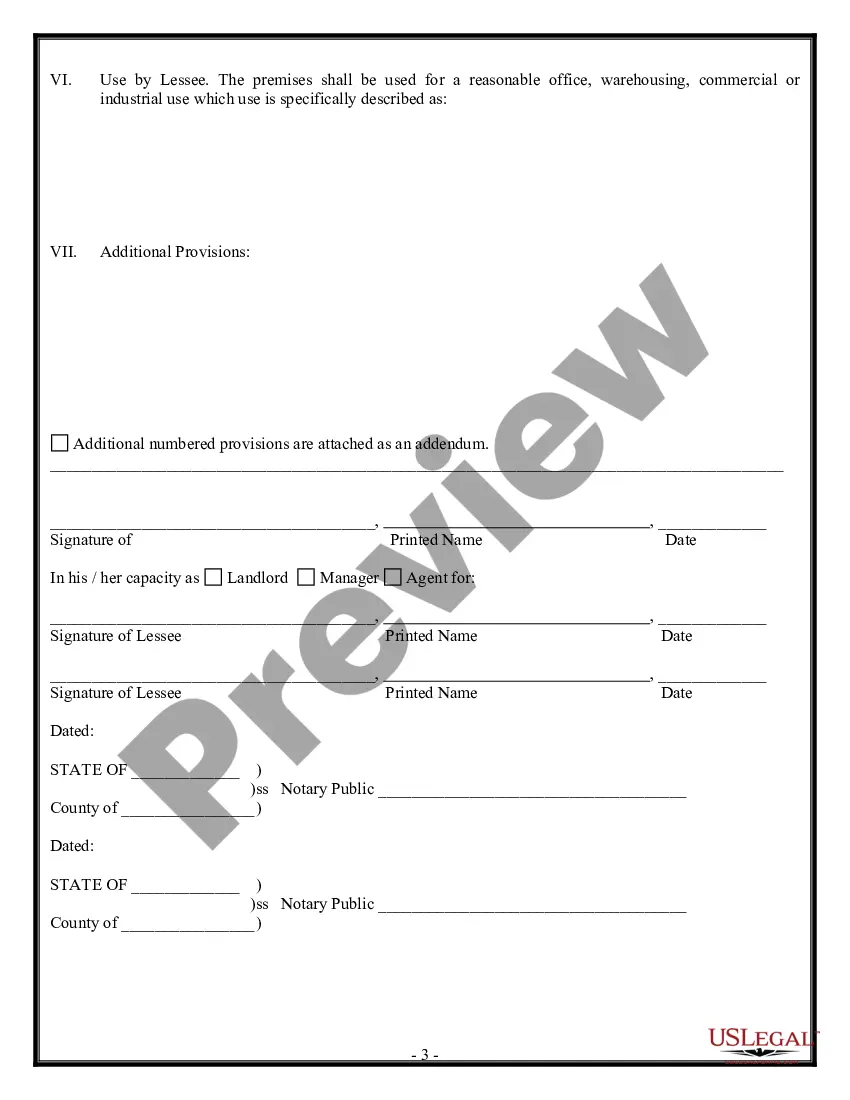

Tennessee Commercial Space Simple Lease

Description

How to fill out Commercial Space Simple Lease?

US Legal Forms - one of the most important collections of legally recognized documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You will find the most recent document types like the Tennessee Commercial Space Simple Lease within minutes.

If you already have an account, Log In and download the Tennessee Commercial Space Simple Lease from your US Legal Forms library. The Download button will be present on every form you view. You can access all previously saved forms within the My documents section of your account.

Make edits. Fill out, modify, print, and sign the saved Tennessee Commercial Space Simple Lease.

Each document you added to your account does not have an expiration date and belongs to you permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you wish to access. Obtain the Tennessee Commercial Space Simple Lease with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of specialized and state-specific templates that suit your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/region. Click the Review button to view the form's details.

- Read the description of the form to confirm that you have chosen the proper document.

- If the form does not meet your requirements, use the Search area at the top of the page to find the one that does.

- If you are happy with the form, finalize your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

In the world of Tennessee Commercial Space Simple Lease, you will encounter three primary types of leases: gross leases, net leases, and modified gross leases. A gross lease includes all expenses, while a net lease requires tenants to cover additional costs such as property taxes, insurance, and maintenance. Modified gross leases blend elements of both, creating a flexible option for renters. Understanding these leases helps you make informed decisions when securing your commercial space.

The best commercial lease for a tenant aligns with their business strategy and long-term goals. A Tennessee Commercial Space Simple Lease typically provides clarity and straightforward terms, allowing tenants to understand their responsibilities. Look for leases that offer favorable terms like minimal rent increases and maintenance responsibilities. Protect your interests by negotiating terms that fit your business needs.

A lease term that is too short may leave your business vulnerable to relocation and instability. While month-to-month leases offer flexibility, they can also lead to sudden rent increases or eviction notices. With a Tennessee Commercial Space Simple Lease, balance is key—choose a duration that provides stability for your operations. Evaluate your business plan thoroughly before deciding on a lease length.

You can secure a lease as short as one month, depending on the landlord's policies. Many entrepreneurs favor a Tennessee Commercial Space Simple Lease for flexibility and reduced risk. Short leases allow businesses to adapt quickly if market conditions change. Consider how frequently your needs may shift when looking for a lease term.

Leasing a commercial space involves several steps, starting from identifying your needs to negotiating the lease terms. You should request a Tennessee Commercial Space Simple Lease template to streamline the process. After finding a suitable location, review the terms, understand your obligations, and finalize the lease. Involve legal professionals if you have concerns before signing.

The shortest term of a commercial lease often starts at one month, with some landlords willing to offer flexible arrangements. For businesses exploring a Tennessee Commercial Space Simple Lease, this flexibility can be crucial in managing overhead costs. These short-term leases are beneficial for startups testing new markets. Always read the lease terms carefully to ensure they align with your business goals.

The shortest commercial lease can be as brief as month-to-month agreements, allowing parties flexibility. Many business owners look for Tennessee Commercial Space Simple Lease options that fit their short-term needs. These leases grant tenants the ability to assess their space without long-term commitments. Be sure to explore your choices based on your business requirements.

A normal commercial lease typically outlines the terms between a landlord and a business tenant. It includes details like rent amount, duration, and maintenance responsibilities. When considering a Tennessee Commercial Space Simple Lease, understanding these elements is essential. Clarity in these areas helps avoid disputes in the future.

Yes, landlords in Tennessee have the right to create their own lease agreements. However, it is important that the leases comply with state laws and accurately reflect the terms discussed with the tenant. To create a legally sound Tennessee Commercial Space Simple Lease, consider utilizing a template that incorporates standard provisions and legal requirements.

Absolutely, you can draft your own lease agreement in Tennessee. It is essential to ensure that your lease includes comprehensive terms that protect both parties. Using a well-designed Tennessee Commercial Space Simple Lease template can guide you in covering all necessary aspects while allowing you to create a customized agreement.