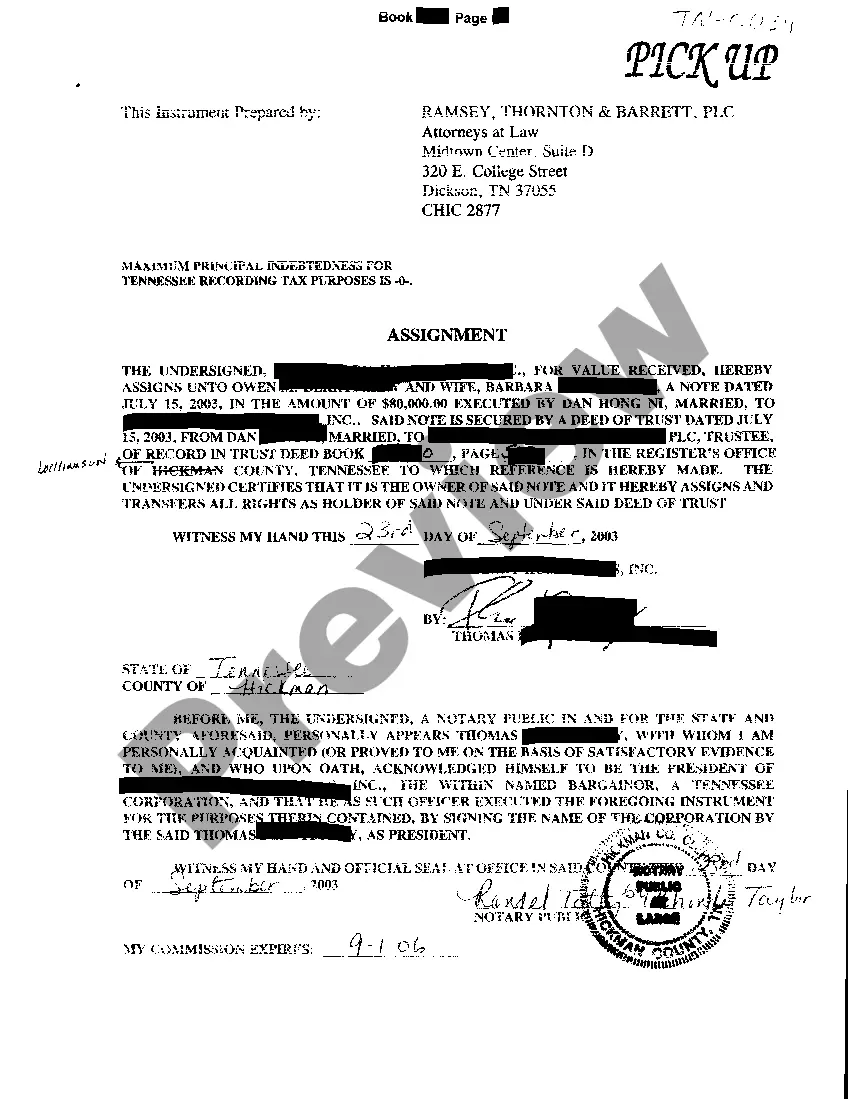

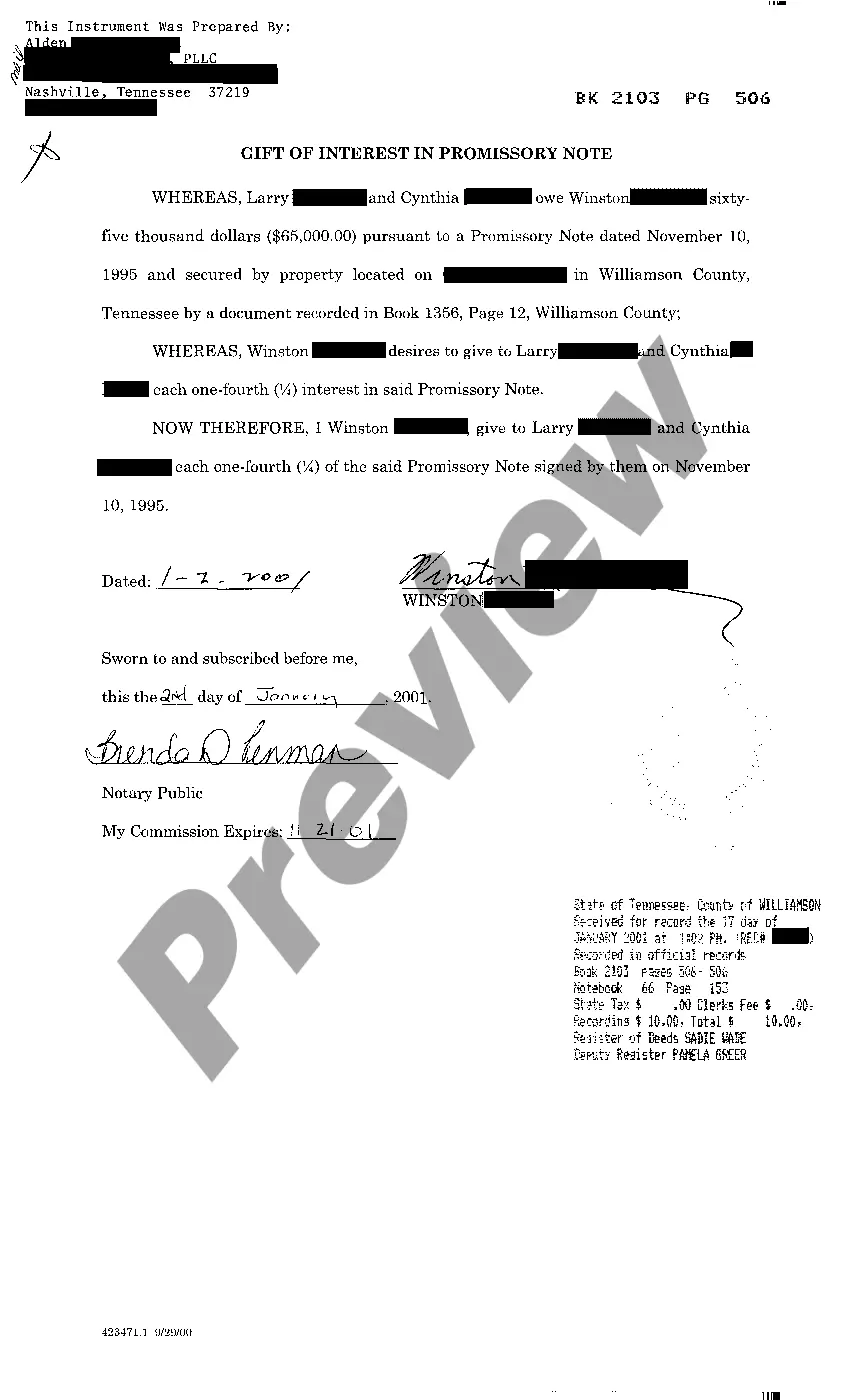

Tennessee Gift of Interest in Promissory Note

Description

How to fill out Tennessee Gift Of Interest In Promissory Note?

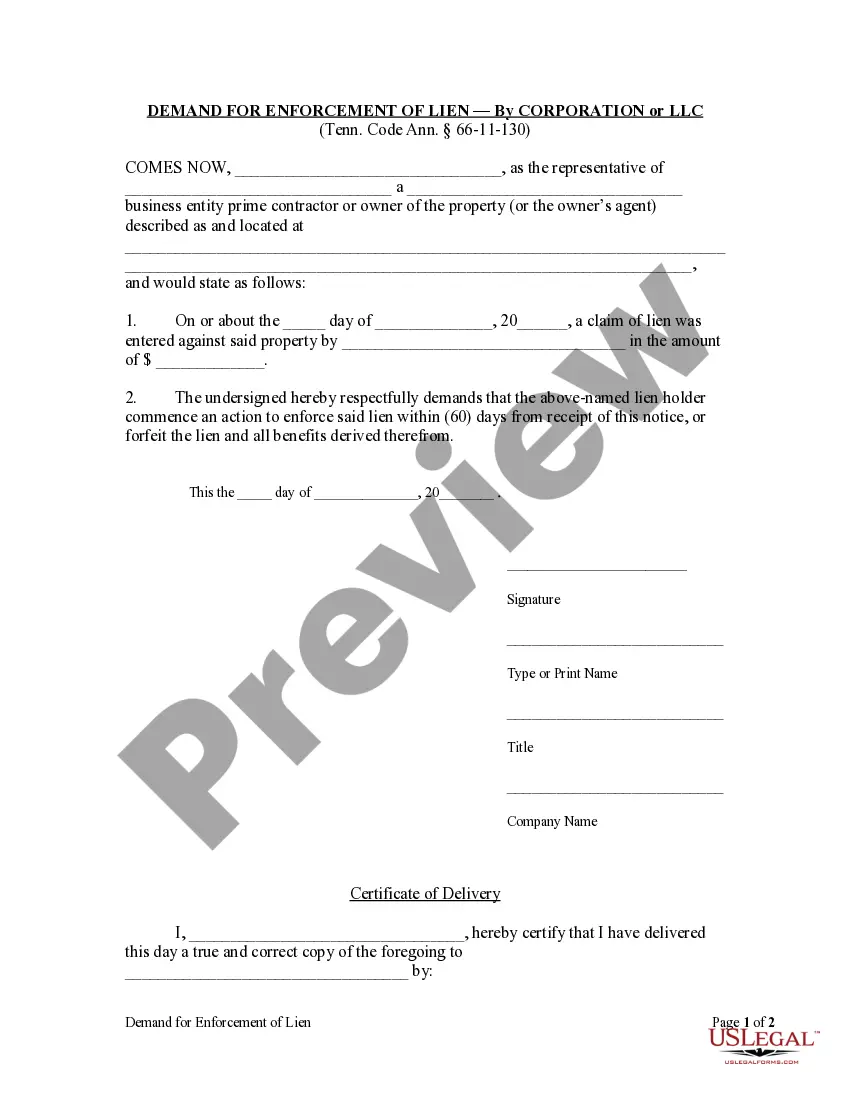

Access to high quality Tennessee Gift of Interest in Promissory Note forms online with US Legal Forms. Avoid days of lost time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax forms that you could download and fill out in clicks in the Forms library.

To find the sample, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Verify that the Tennessee Gift of Interest in Promissory Note you’re looking at is suitable for your state.

- View the sample making use of the Preview function and read its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by card or PayPal to finish creating an account.

- Pick a preferred format to save the file (.pdf or .docx).

Now you can open up the Tennessee Gift of Interest in Promissory Note example and fill it out online or print it and get it done yourself. Take into account mailing the papers to your legal counsel to be certain all things are filled in correctly. If you make a mistake, print and fill application again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get more templates.

Form popularity

FAQ

Gather the information. First collect the information you'll need, which should all be readily available on the note itself. Calculate interest for one year. Next, calculate the interest charge for one year by multiplying the principal by the interest rate. Calculate interest for the entire period.

Amount or principal : State the face amount of the money borrowed. Interest rate : If the loan involves interest, the promissory note should include the interest rate charged.For a promissory note to be legally enforceable, the document needs the signature of each party.

If you are paying the promissory interest and this is a personal loan, you can't deduct the interest. According to the IRS, only a few categories of interest payments are tax-deductible:Interest on money borrowed to purchase investment property. Interest as a business expense.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Calculating Simple Interest If your loan is for a period of years, multiply the product of principal times interest by the number of years.For example, for a nine-month promissory note, divide 9 by 12 (the number of months in a year) to equal 0.75. Multiply 750 by 0.75 to equal 562.50.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest. If the Lender decides to charge interest, they can pick how much interest to charge.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.