Tennessee Assignment of Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

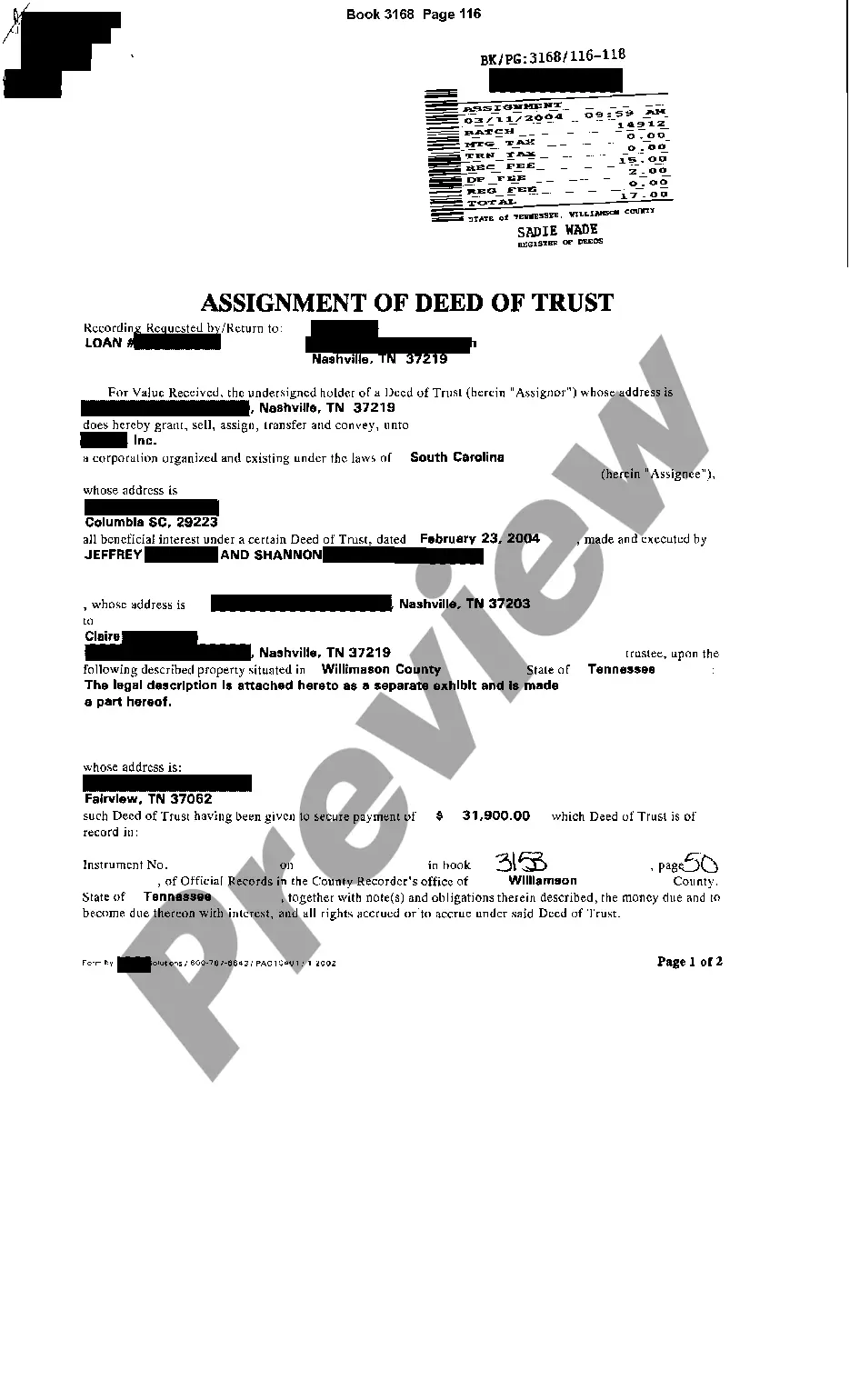

Assignment of Mortgage refers to the process whereby a mortgage holder transfers their rights and obligations under the mortgage to another party. This can occur when a mortgage is sold or when the original lender wants to offload the debt to another financial institution. This process is legally binding and requires careful documentation to ensure all parties' rights are maintained.

Step-by-Step Guide

- Review the Original Mortgage Agreement: Verify if the original mortgage contract allows assignment. Some mortgages include a clause that restricts assignment without prior approval.

- Find a Suitable Party: The current mortgage holder needs to find a person or entity willing to take over the mortgage.

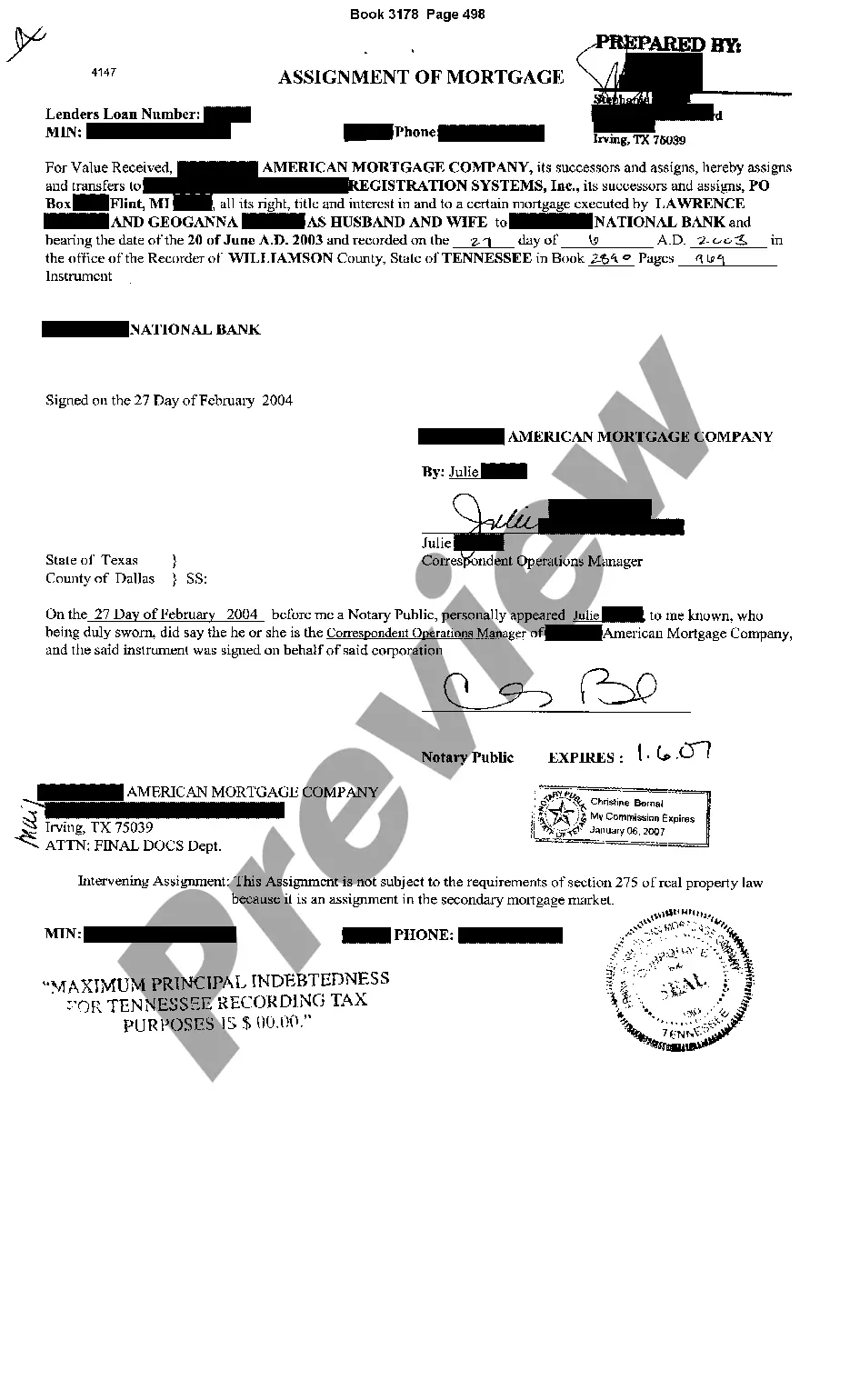

- Execute an Assignment Agreement: Both parties must agree on the terms and execute an assignment agreement, which should be in writing and include all pertinent details of the transfer.

- Record the Agreement: Register this agreement with the relevant government body or court to make it official and public.

- Notify the Mortgagor: Inform the person who took out the original mortgage about the transfer of rights.

Risk Analysis

- Legal Risks: If the assignment is not documented properly, it might lead to legal disputes between the original and new lender or between the new lender and the borrower.

- Financial Risks: The new holder of the mortgage inherits all the risks associated with the mortgage, including the risk of default by the borrower.

- Compliance Risks: There are strict laws governing the assignment of mortgages, and failure to comply can lead to penalties.

Pros & Cons

- Pros:

- Provides liquidity to lenders.

- Allows lenders to manage risk.

- Enables the consolidation of loans.

- Cons:

- Risks of legal complications if not properly executed.

- Can lead to borrower confusion or dissatisfaction if not clearly communicated.

- Potential financial risk to the new lender.

Best Practices

- Ensure Legal Compliance: Always verify that the assignment adheres to local and federal laws.

- Clear Documentation: Maintain clear, thorough documentation of the assignment process to avoid future legal troubles.

- Effective Communication: Clearly communicate the changes to all affected parties, especially the borrower.

Key Takeaways

The assignment of a mortgage can help lenders manage and redistribute risk but requires meticulous attention to legal and procedural details to ensure smooth transfer and avoid future disputes.

How to fill out Tennessee Assignment Of Mortgage?

Get access to high quality Tennessee Assignment of Mortgage templates online with US Legal Forms. Prevent hours of wasted time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific authorized and tax forms that you can save and complete in clicks in the Forms library.

To find the example, log in to your account and click Download. The document will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- See if the Tennessee Assignment of Mortgage you’re looking at is suitable for your state.

- Look at the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay out by card or PayPal to finish making an account.

- Select a preferred format to save the file (.pdf or .docx).

You can now open the Tennessee Assignment of Mortgage sample and fill it out online or print it out and get it done by hand. Take into account sending the file to your legal counsel to ensure all things are filled in properly. If you make a mistake, print and complete application again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get far more forms.

Form popularity

FAQ

Code Ann. § 28-2-101). A person can also establish this type of presumptive ownership under color of title after having paid the taxes on a piece of property for 20 years or more without the original owner, or the government, objecting. (See Tenn.

Paying Someone Else's Property Taxes The taxing authority might then simply sell the home at auction, satisfying the tax lien from the buyer's funds. In other states, the taxing authority will auction off a tax lien certificate instead, rather than the actual property.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

Information on NSW Land Tax available from: www.osr.nsw.gov.au/taxes/land. Land tax is a tax levied on the owners of land in NSW as at midnight on 31 December of each year. In general, your principal place of residence (your home) or land used for primary production (a farm) is exempt from land tax.

The Tennessee State Department of Revenue controls the Tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness of property value.

Tennessee is a redeemable tax deed state. In a redeemable tax deed state the actual property is sold after tax foreclosure and then the former owner has one last opportunity to redeem the property (pay the delinquent taxes).

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

It depends, under certain circumstances a party's payment of property taxes can create a rebuttable presumption that the party has title, or ownership, to the property in question. These requirements are addressed in Tennessee Code Annotated ? 28-2-109 & 110. T.C.A.