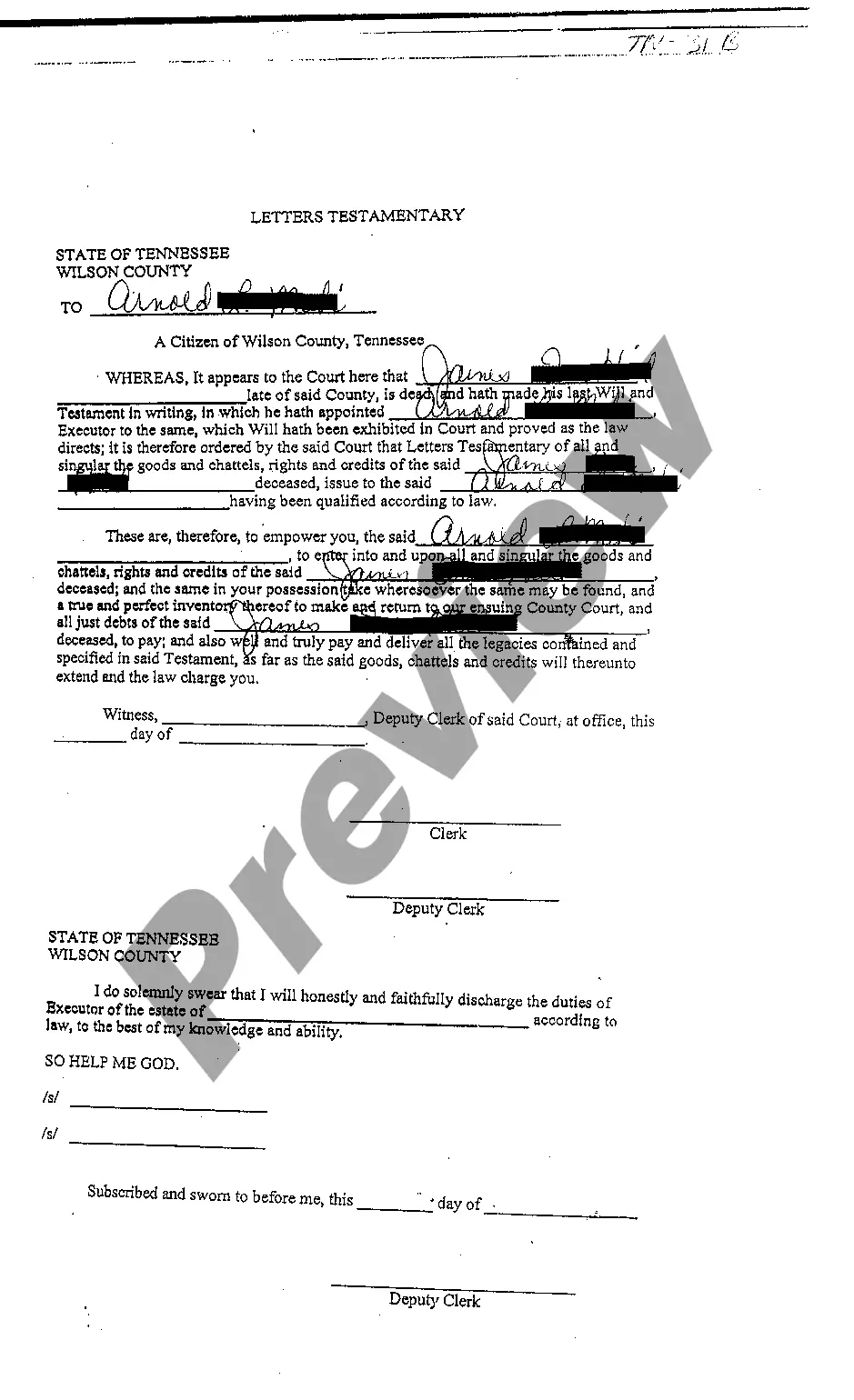

Tennessee Letters To Testamentary

Description

Key Concepts & Definitions

Letters Testamentary: A legal document issued by a probate court authorizing an executor to administer the estate of a deceased person. Estate Planning: The process of arranging who will receive your assets and handle your responsibilities after your death. Probate Court Process: A legal procedure through which the assets of a deceased person are distributed.

Step-by-Step Guide on Obtaining Letters Testamentary

- Determine Jurisdiction: Identify the probate court in the county where the deceased lived.

- File a Petition: Submit a petition for probate along with the original will and the death certificate.

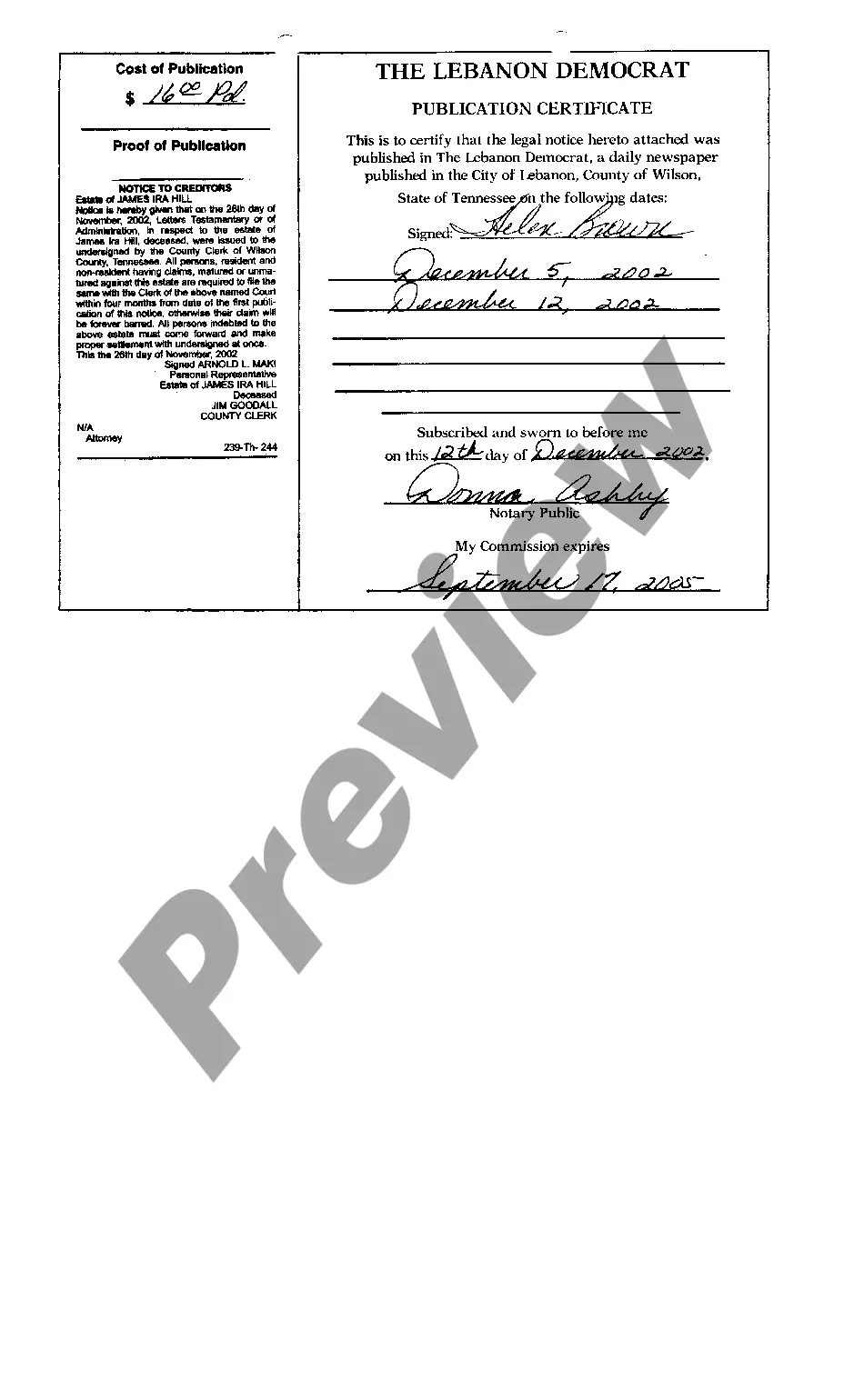

- Notice of Hearing: Notify interested parties of the time and place of hearing.

- Attend the Hearing: Answer any questions posed by the probate judge.

- Issuance of Letters: Obtain the letters testamentary from the court post approval.

Risk Analysis

- Delay in Probate: Delays can occur due to incomplete documentation or legal challenges.

- Financial Risk: Improper handling can lead to financial loss or debt obligations.

- Legal Liabilities: Executors can face legal liabilities if found negligent in their duties.

Common Mistakes & How to Avoid Them

- Not Updating the Will: Regular updates to reflect current wishes and legal standards prevent disputes.

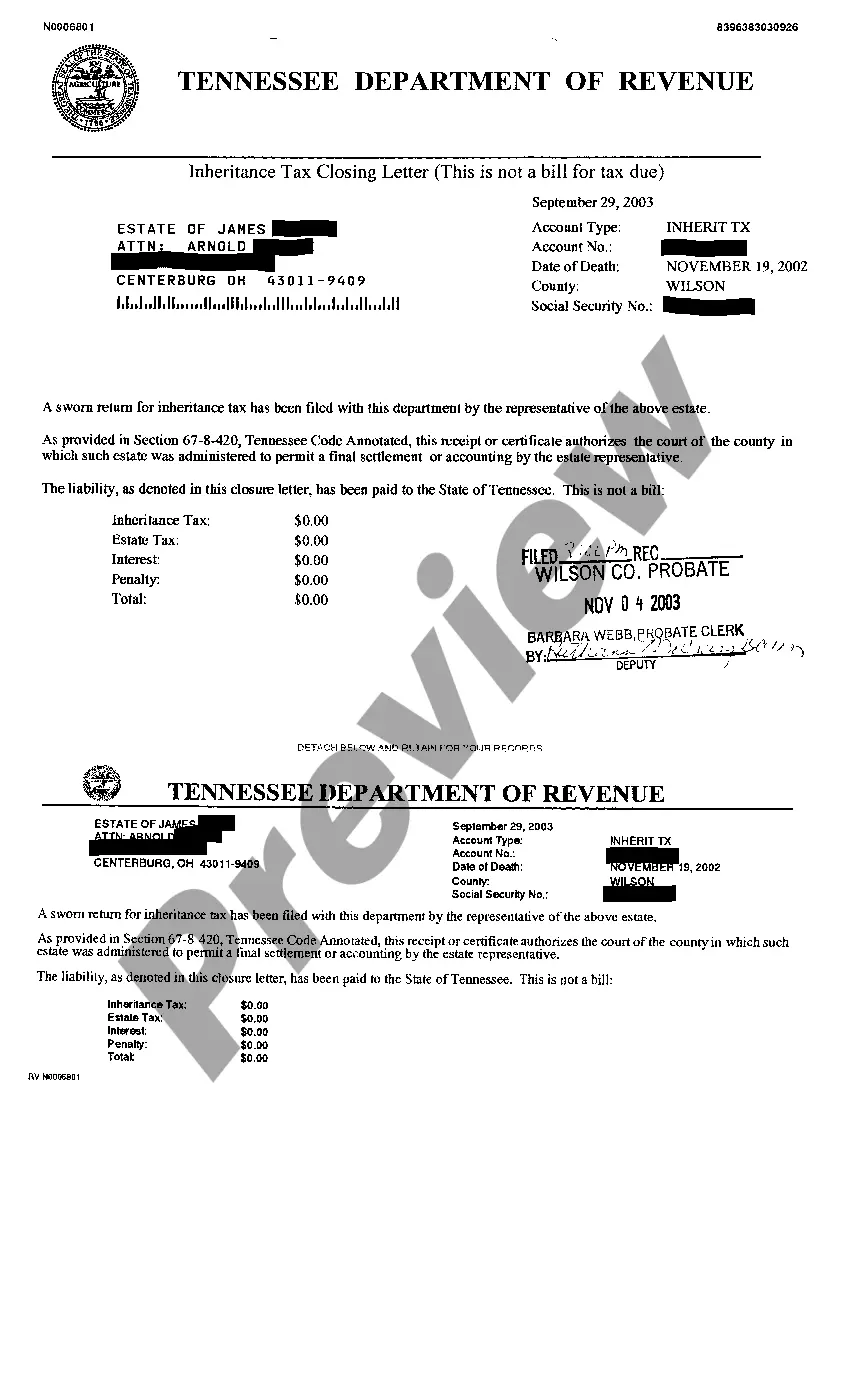

- Ignoring Tax Implications: Consult with a personal attorney for inheritance tax planning to ensure compliance and optimization.

- Omitting a Probate Lawyer: Hiring expertise helps navigate complexities, particularly with large estates or in specialized areas like New York probate.

FAQ

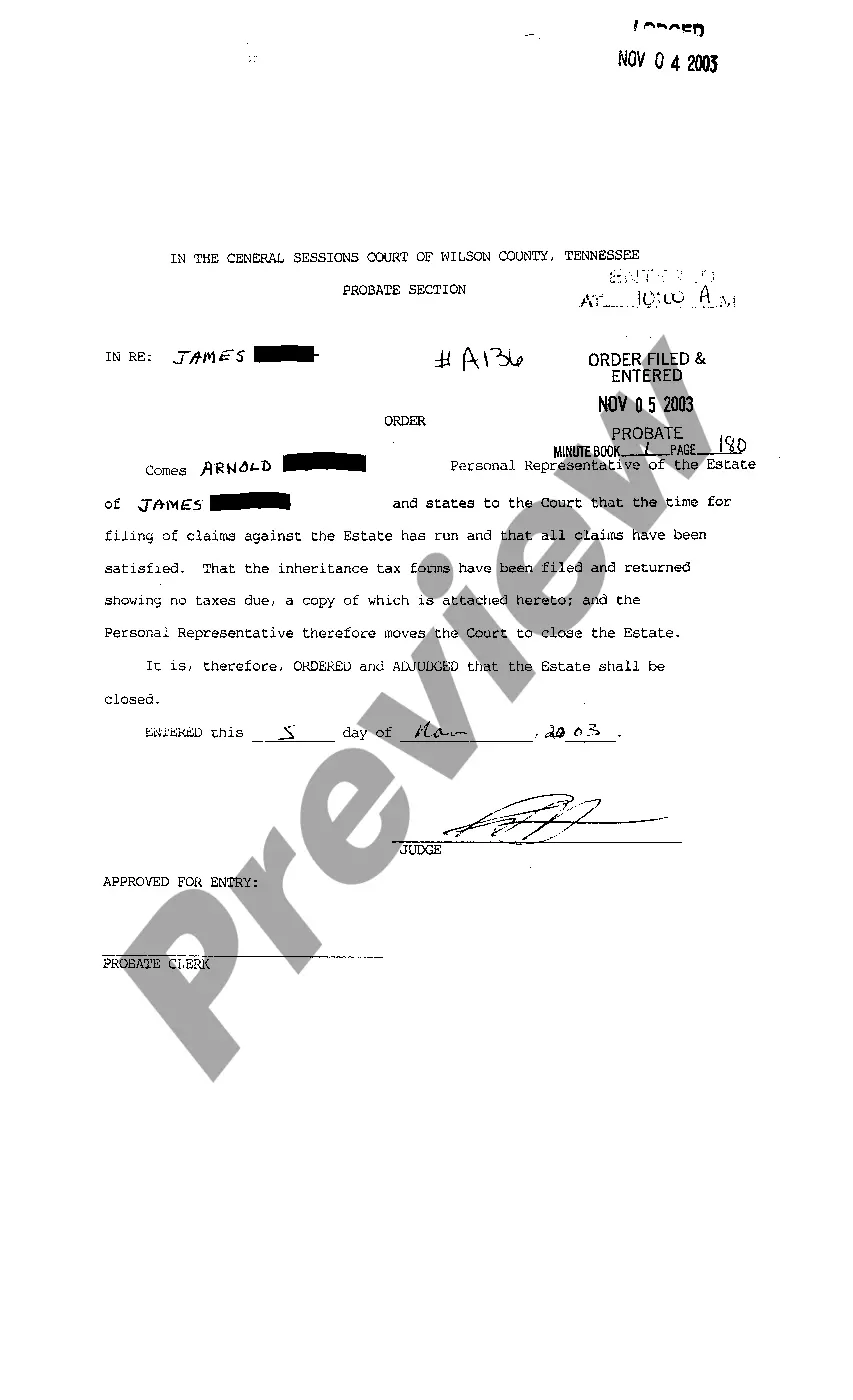

- What are executor responsibilities? Executors manage the deceased's estate, ensure debts and taxes are paid, and distribute remaining assets accordingly.

- How does real estate management fit into probate? Real estate often forms a significant part of the estate and may require management or sale during the probate process.

- Is there a benefit to small business insurance in probate? Yes, insurance can help cover outstanding business debts and protect the estate's value.

Summary

Understanding and correctly managing the A02 letters testamentary process is crucial for efficient estate administration. By following legal protocols, consulting with professionals, and being aware of potential risks, executors can effectively fulfill their duties and honor the final wishes of the deceased.

How to fill out Tennessee Letters To Testamentary?

Access to high quality Tennessee Letters To Testamentary samples online with US Legal Forms. Prevent hours of wasted time looking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific authorized and tax templates that you can download and fill out in clicks in the Forms library.

To find the sample, log in to your account and click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Verify that the Tennessee Letters To Testamentary you’re looking at is appropriate for your state.

- Look at the form utilizing the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Choose a favored format to save the document (.pdf or .docx).

You can now open the Tennessee Letters To Testamentary template and fill it out online or print it and do it yourself. Consider sending the papers to your legal counsel to make certain everything is completed properly. If you make a error, print out and complete sample again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

There are two components of letter of testamentary cost: the court fee and the attorney's fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney's fees start at about $2,500 and can go up depending on the complexity of the case.

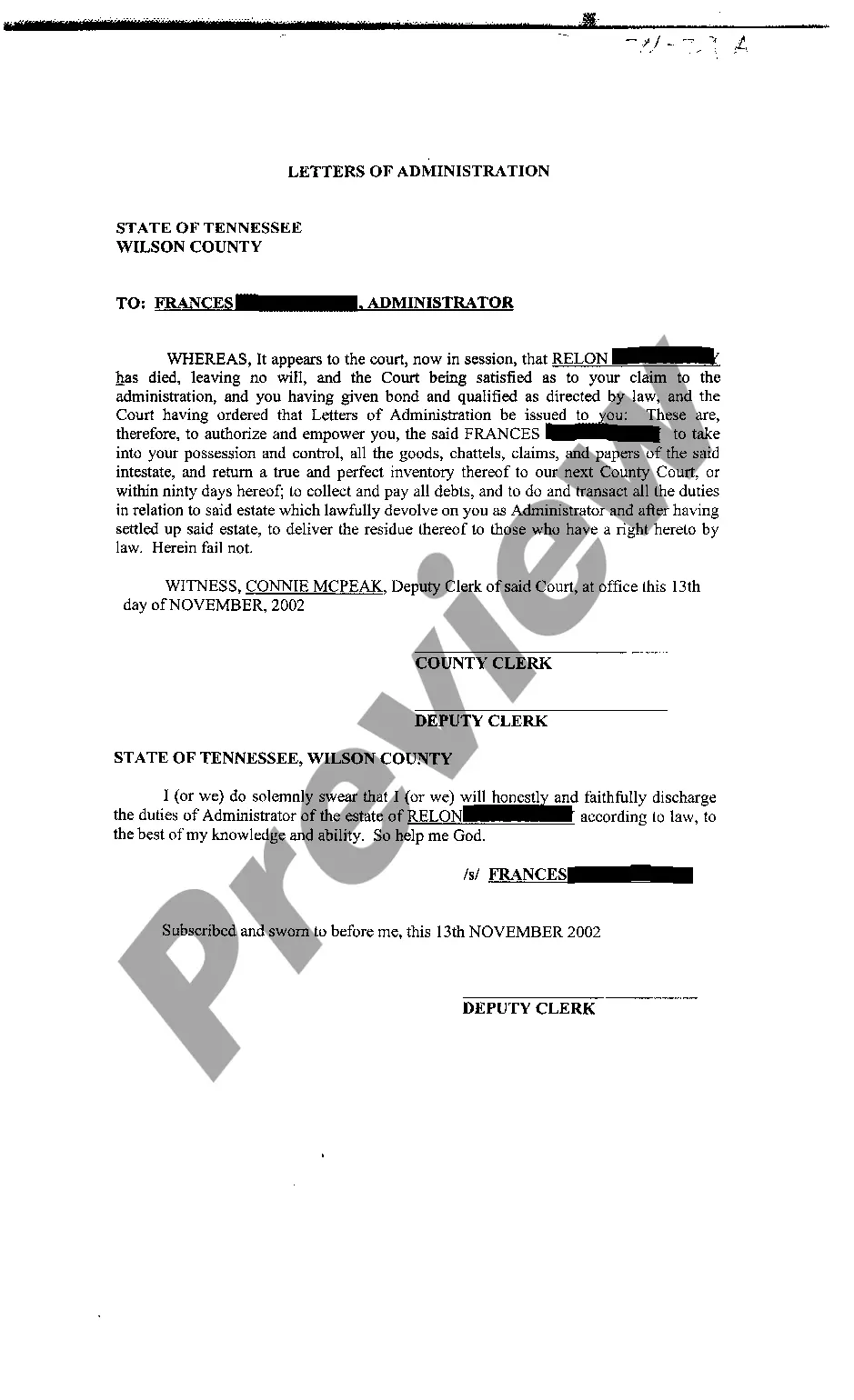

2) Letters of Administration is basically identical to letters testamentary but means either there is no will or the person named executor is not serving (i.e. petition for letters with will annexed).

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

Application fees for probate are £155 if you apply through a solicitor and A£215 if you're taking the DIY option. Estates worth less than A£5,000 pay no fee. Additional copies of the probate form can be ordered for A£1.50 each.

Most likely you will need an attorney to obtain letters testamentary. Many attorneys offer a free consultation. At least meet with an attorney to make sure letters testamentary is what you need.

Basic Court Fees For the most straight forward probate, there largest filing fees are incurred at the beginning and end of the process. The 2018 fee charged to file a probate petition is $435. There will be a $435 filing fee to file the petition for final distribution of the estate assets.

Tennessee provides an alternative to regular probate if the estate is small. The simplified procedure is available if the total probate estate is worth no more than $50,000, not counting real estate.