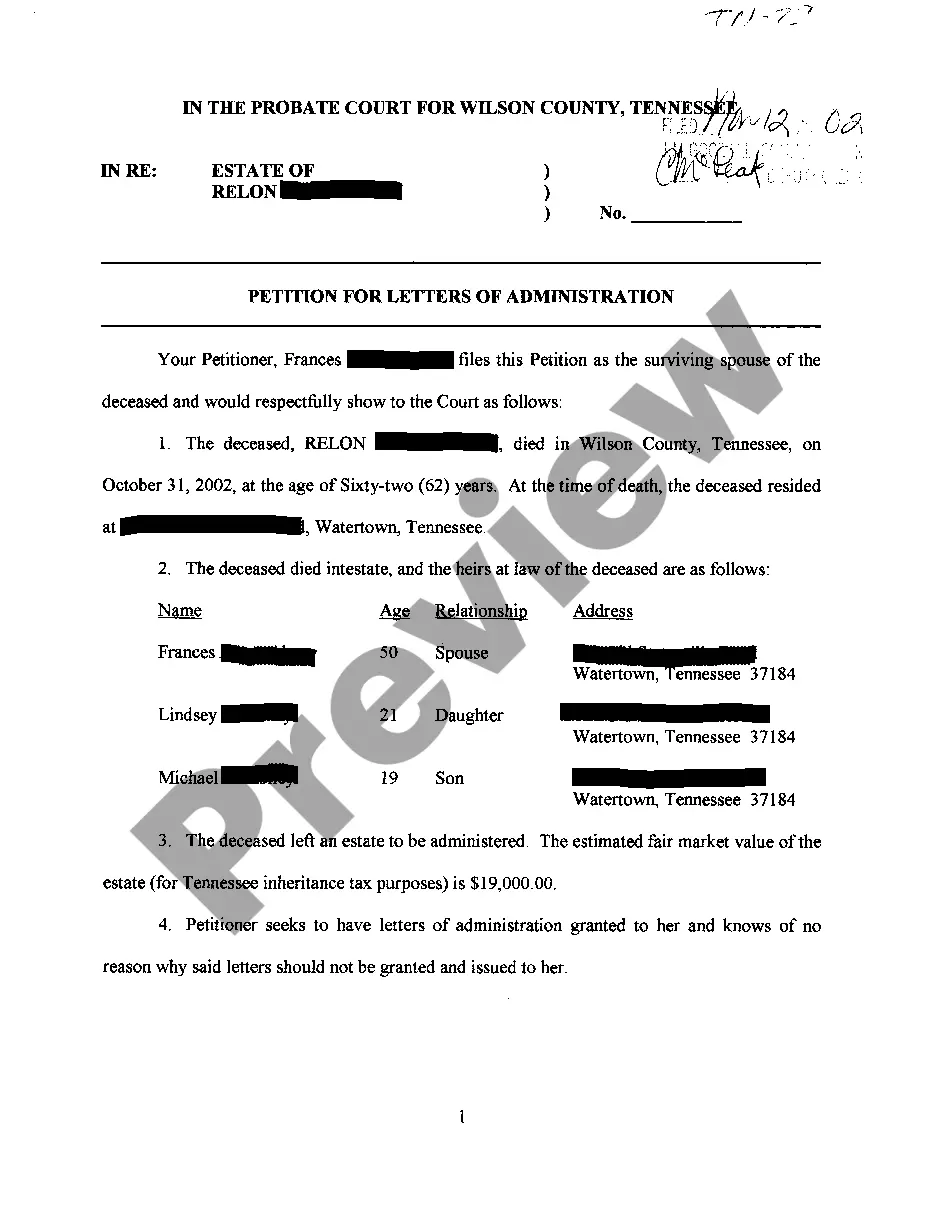

Tennessee Letters of Administration

Description

Key Concepts & Definitions

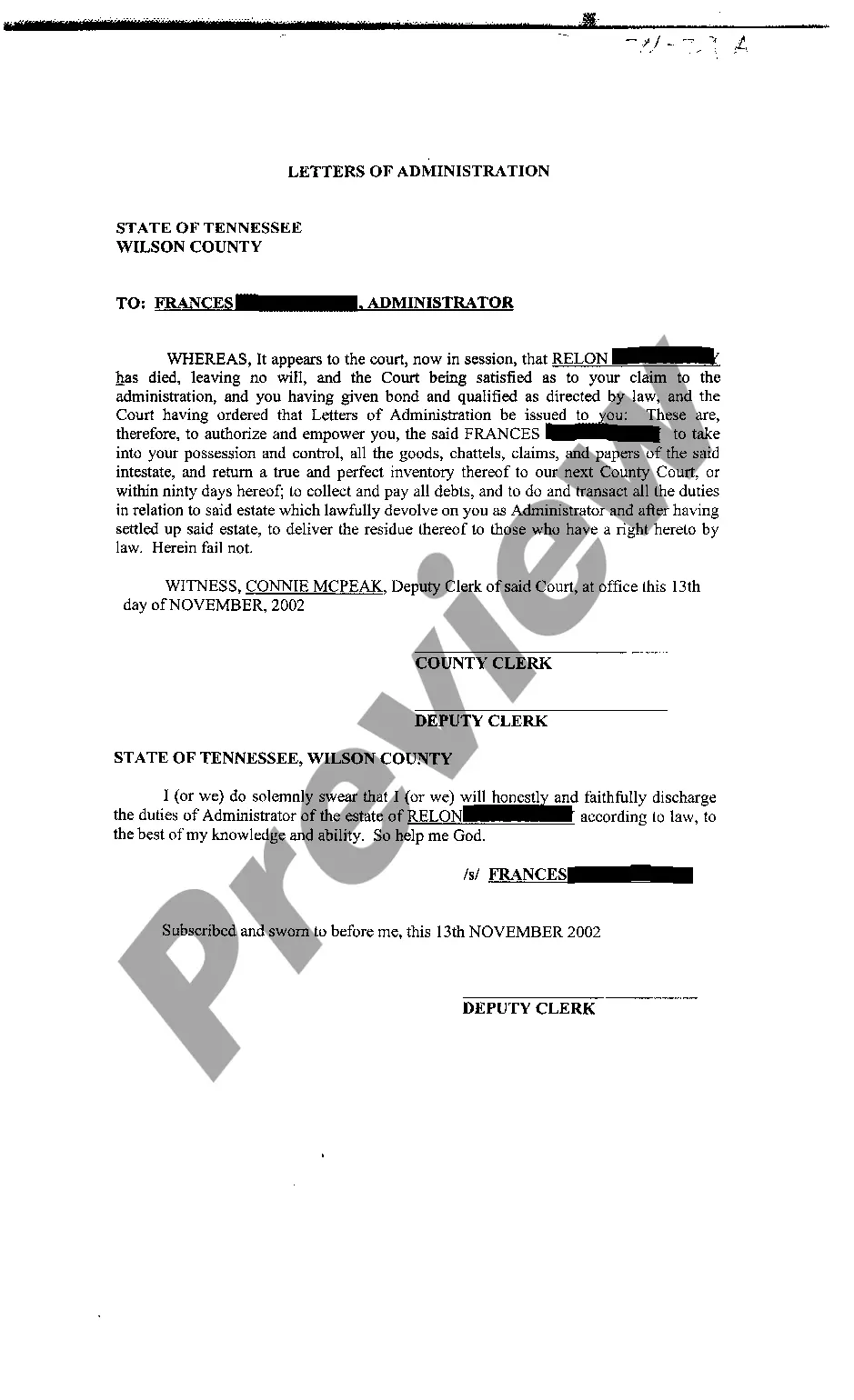

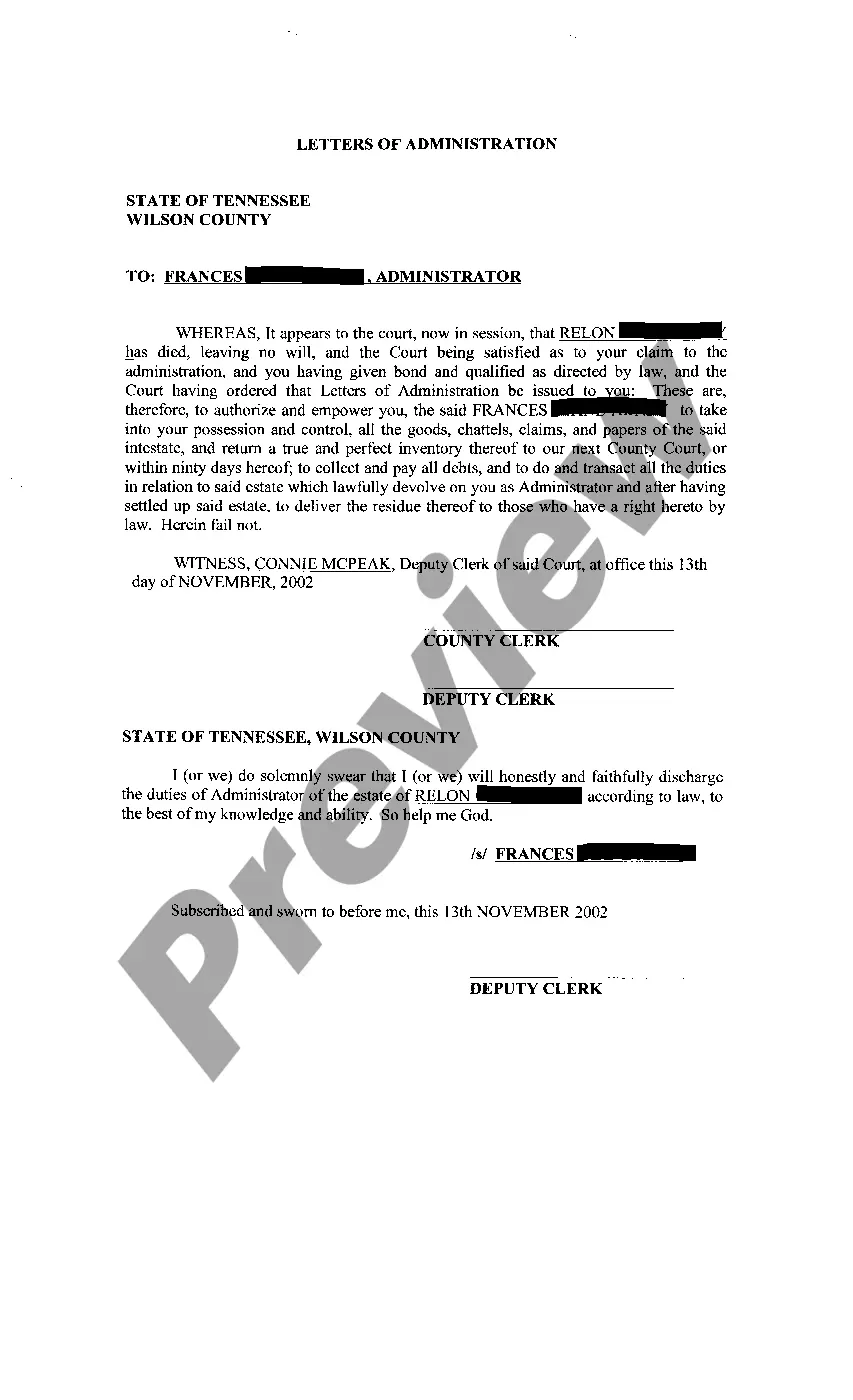

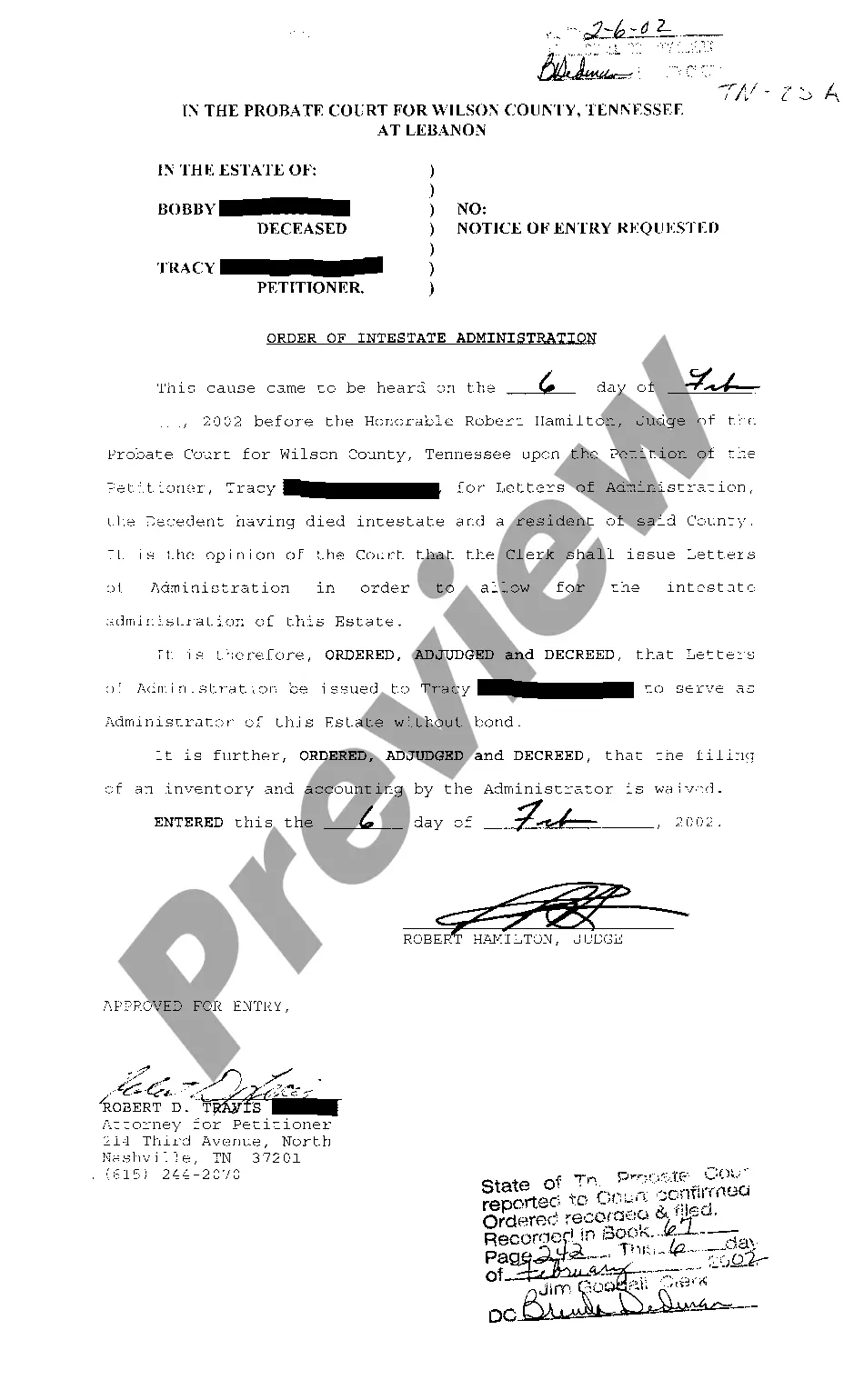

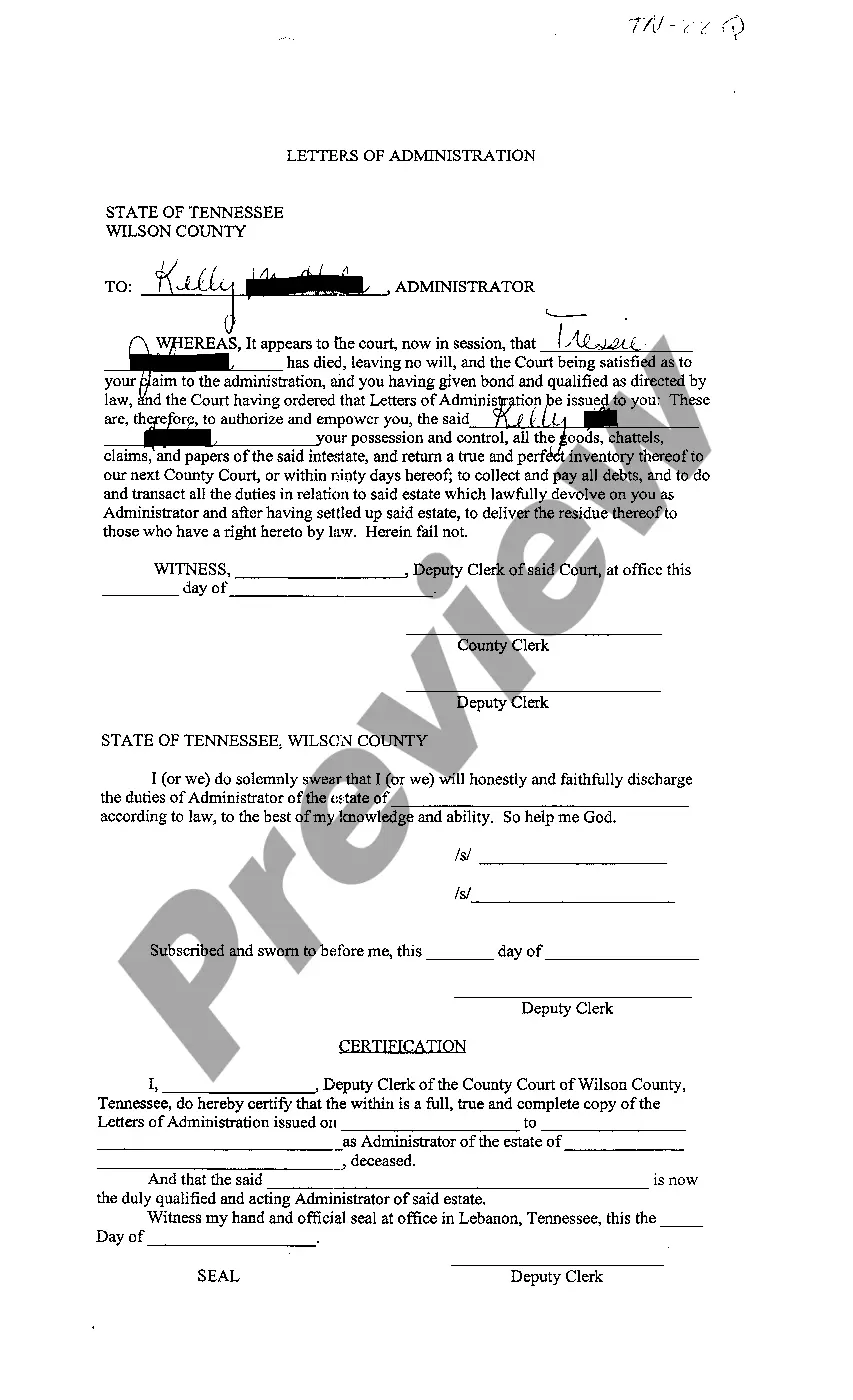

Letters of Administration refer to legal documents granted by a court that allow an individual to manage and distribute the estate of a deceased person who died without a will. This process is part of probate law in the United States and is crucial for legitimizing an individuals authority to handle the affairs of the deceased.

Step-by-Step Guide

- Initiating the Process: File a petition for letters of administration with the probate court in the county where the deceased lived.

- Document Preparation: Gather necessary documents like the death certificate and any potential will documents.

- Court Appearance: Attend a court hearing where the judge will evaluate your claim and appointment as the administrator.

- Obtaining the Letters: Receive the letters of administration from the court if approved.

- Executing Duties: Begin managing the estate, which includes settling debts and distributing assets according to state law.

Risk Analysis

- Legal Risks: Failure to accurately follow legal procedures can result in personal liability for the estates debts and legal challenges from heirs or creditors.

- Financial Risks: Administrators may face financial risks if the estates debts exceed its assets, potentially requiring out-of-pocket expenses.

Use Cases & Applications

- Real Estate Transactions: Administrators often need to work with real estate attorneys to manage or liquidate the deceased's property.

- Financial Management: Handling the deceased's obligations such as credit cards application closures, car insurance requirements, and small business loans.

- Legal Filings: May involve the name change process for beneficiaries or filing for bankruptcy if the estate is insolvent.

- Document Acquisition: Obtaining death certificates and navigating grief resources are also key roles of an administrator.

Best Practices

- Seek Professional Help: Consult with a probate attorney to navigate complex legal issues smoothly.

- Organize Documentation: Maintain thorough records and documentation for all estate transactions and decisions.

- Communicate Effectively: Keep open lines of communication with all parties involved including beneficiaries and creditors.

Common Mistakes & How to Avoid Them

- Underestimating Responsibilities: Understand the full scope of the administrators duties to manage expectations and workload efficiently.

- Ignoring Legal Counsel: Avoid making unilateral decisions without proper legal advice to prevent legal repercussions.

- Delaying Actions: Procrastinating on crucial decisions can complicate the administration process and potentially increase liabilities.

How to fill out Tennessee Letters Of Administration?

Get access to high quality Tennessee Letters of Administration templates online with US Legal Forms. Prevent days of lost time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get over 85,000 state-specific legal and tax forms you can save and submit in clicks in the Forms library.

To get the sample, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Find out if the Tennessee Letters of Administration you’re looking at is suitable for your state.

- See the sample making use of the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Pick a favored format to download the document (.pdf or .docx).

You can now open the Tennessee Letters of Administration sample and fill it out online or print it out and get it done yourself. Think about giving the document to your legal counsel to be certain things are filled out correctly. If you make a mistake, print and fill sample once again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and get much more templates.

Form popularity

FAQ

At PKWA Law, our legal fees for applying a Grant of Letters of Administration are $1,500 (without GST and disbursements). How much are the court fees and disbursements? The court fees range from about $300 to about $600.

Speak to a probate specialist over the phone to discuss the value and details of your loved one's estate. Your probate application and tax forms are then prepared and sent to you to be signed. The application is then submitted to the probate registry for approval.

Probate or letters of administration will be needed so the personal representative can pass it whoever will inherit the share of the property, according to the will or the rules of intestacy. The property might have a mortgage. Example: Ayodele and Olujimi are not married. They have one grown-up daughter called Ife.

Speak to a probate specialist over the phone to discuss the value and details of your loved one's estate. Your probate application and tax forms are then prepared and sent to you to be signed. The application is then submitted to the probate registry for approval.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Clear any funeral expenses. If there were any outstanding funeral fees, then this is the time to clear them. Pay up any taxes that are due. Pay off any creditors. Distribute the estate among the beneficiaries.