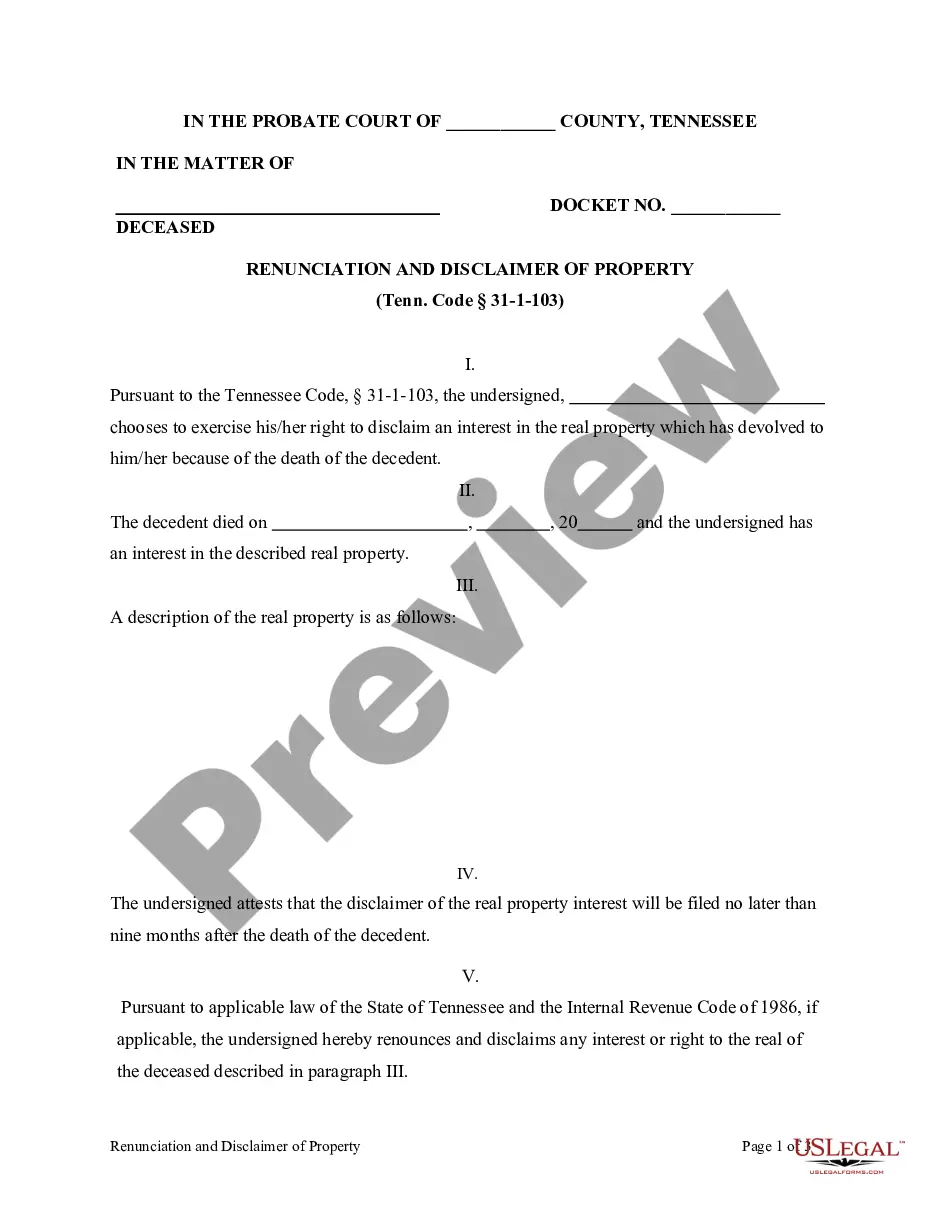

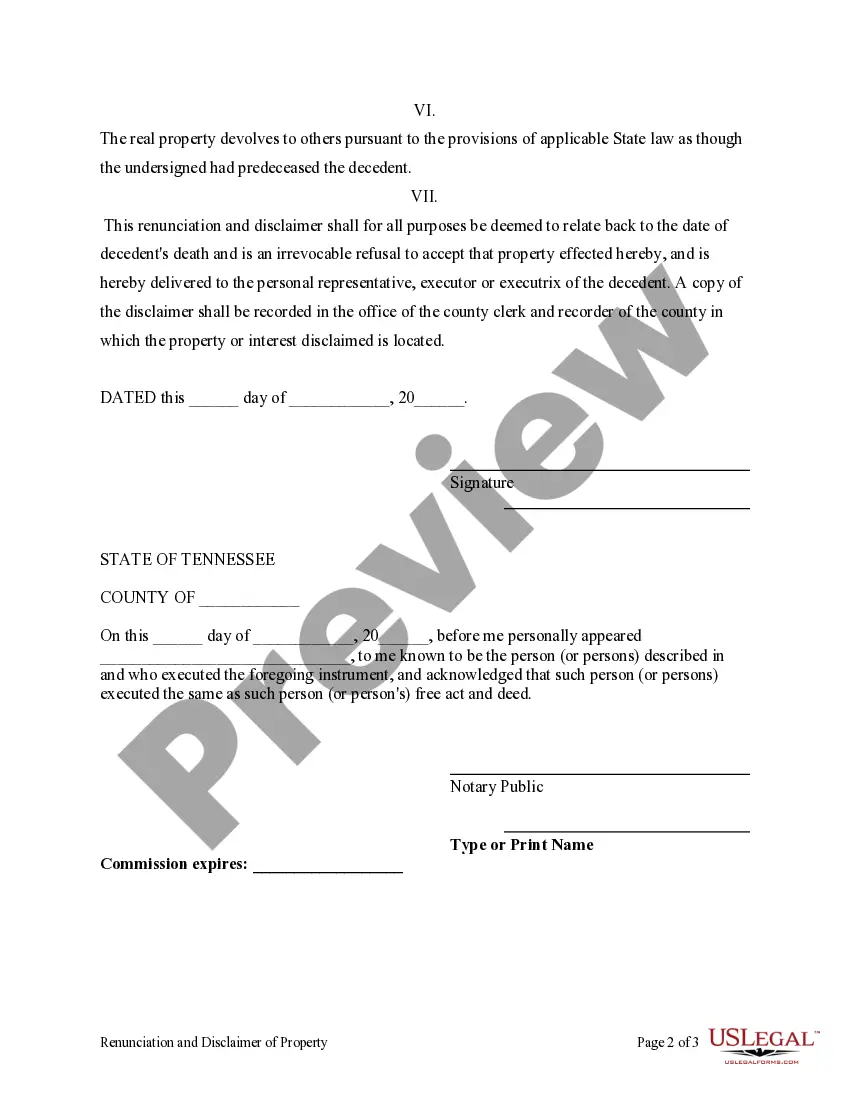

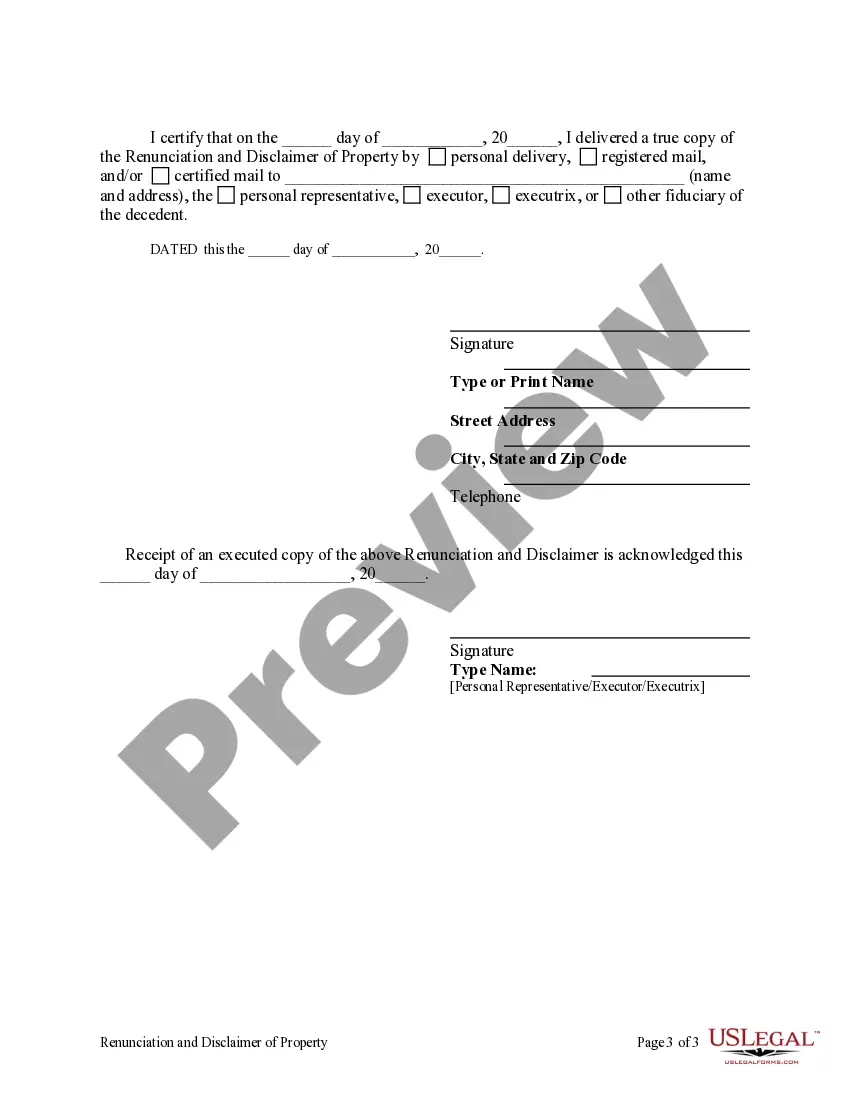

This form is a Renunciation and Disclaimer of a Real Property Interest, where the beneficiary gained an interest in the real property upon the death of the decedent, but, will terminate his/her interest in the real property pursuant to the Tennessee Code, Title 31, Chapter 1. The real property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Tennessee Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Tennessee Renunciation And Disclaimer Of Real Property Interest?

Get access to high quality Tennessee Renunciation And Disclaimer of Real Property Interest forms online with US Legal Forms. Steer clear of days of wasted time browsing the internet and lost money on files that aren’t updated. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific legal and tax templates that you could save and complete in clicks in the Forms library.

To get the example, log in to your account and click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- See if the Tennessee Renunciation And Disclaimer of Real Property Interest you’re looking at is suitable for your state.

- Look at the form utilizing the Preview function and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Select a preferred file format to download the file (.pdf or .docx).

Now you can open up the Tennessee Renunciation And Disclaimer of Real Property Interest example and fill it out online or print it and do it by hand. Consider giving the file to your legal counsel to make sure all things are filled in correctly. If you make a mistake, print and complete sample again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and get a lot more samples.

Form popularity

FAQ

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

A beneficiary is always free to refuse to accept benefits under a trust or a will.The beneficiary may be willing to sign a disclaimer as she does not wish to accept the bequest. The disclaimer would protect you as Trustee from a breach of a fiduciary duty by distributing the assets to a different beneficiary.