South Dakota Computer Repairman Services Contract - Self-Employed

Description

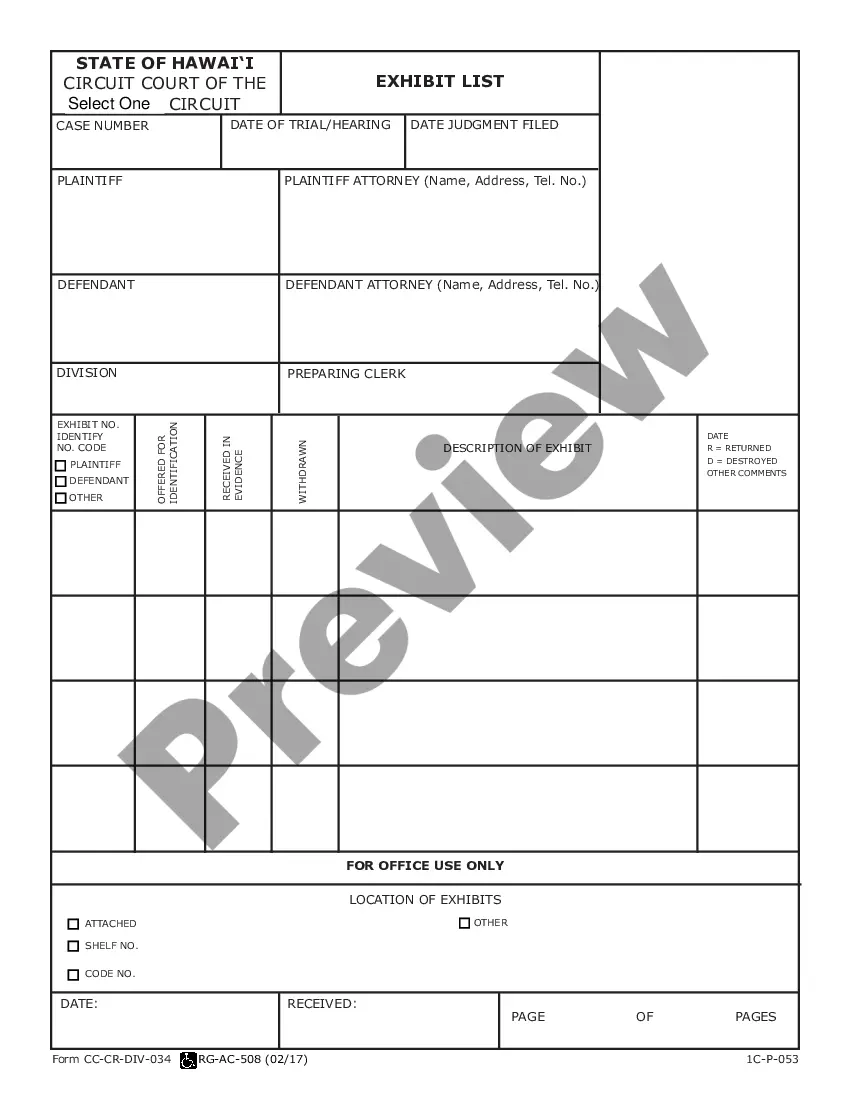

How to fill out Computer Repairman Services Contract - Self-Employed?

You might spend hours exploring online for the legitimate document format that fulfills the state and federal requirements you will need.

US Legal Forms offers thousands of legal templates that can be examined by experts.

You can actually download or print the South Dakota Computer Repairman Services Contract - Self-Employed from my service.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have chosen the correct document format for your desired state/city. Read the document description to confirm that you have selected the right form. If available, use the Review button to browse through the format as well. To find another version of the document, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Choose your desired pricing plan, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the file and download it to your device. Make adjustments to your file if possible. You can complete, modify, sign, and print the South Dakota Computer Repairman Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Computer Repairman Services Contract - Self-Employed.

- Each legal document you acquire is yours permanently.

- To obtain another copy of any purchased document, go to the My documents section and click on the corresponding button.

Form popularity

FAQ

Several states, including South Dakota, do not require a license for general contractors for most projects. However, each state has its own regulations, and it’s advisable to verify local laws before commencing work. Utilizing a South Dakota Computer Repairman Services Contract - Self-Employed can help ensure you follow the correct procedures while providing your services.

In South Dakota, you can undertake minor repairs or projects without a contractor's license, such as painting or basic maintenance. However, significant work, such as building a structure or making extensive renovations, often requires a license. If your focus is on computer repair, ensure your work aligns with the South Dakota Computer Repairman Services Contract - Self-Employed to clarify your offerings.

A contractor typically manages larger projects and may hire subcontractors, while a handyman often performs smaller, varied tasks or repairs. Contractors may require specific licenses and permits for construction work. By using the South Dakota Computer Repairman Services Contract - Self-Employed, you can delineate the scope of your services whether you're acting as a contractor or providing handyman assistance.

South Dakota does not require a general contractor license for most construction work. However, specialized trades may have different licensing requirements. If your services include computer repair as part of renovations or installations, using a South Dakota Computer Repairman Services Contract - Self-Employed can streamline your offering and help you meet any necessary requirements.

Creating an LLC is not mandatory to operate as a contractor in South Dakota, but it offers several benefits. Forming an LLC can protect your personal assets and provide a professional structure for your business. When you use a South Dakota Computer Repairman Services Contract - Self-Employed, this protection can be vital as it clarifies your business responsibilities and limits personal liability.

In South Dakota, you do not necessarily need a license to work as a handyman. However, certain tasks, especially those involving electrical or plumbing work, may require specific licensing. It is essential to understand the scope of your services under the South Dakota Computer Repairman Services Contract - Self-Employed. Always check local regulations to ensure compliance.

Service labor in South Dakota is typically exempt from sales tax, particularly when it is part of repairs or installations for tangible personal property. However, understanding the details of what constitutes labor versus a taxable service is essential when drafting contracts. Your South Dakota Computer Repairman Services Contract - Self-Employed should clearly define the services offered to avoid tax complications. Engaging with tax experts can clarify any uncertainties.

Service contracts in South Dakota are generally not subject to sales tax when they relate to professional services. However, if a contract includes tangible goods or taxable services, different tax rules could apply. It's vital to clearly outline the services covered under your South Dakota Computer Repairman Services Contract - Self-Employed to determine tax implications. Seeking advice from tax professionals ensures you're on the right track.

In South Dakota, most professionals providing services do not require a general contractor’s license, but specific trades do have distinct licensing requirements. For instance, electrical and plumbing contractors must be licensed. If your work falls under the South Dakota Computer Repairman Services Contract - Self-Employed, you may not need a license, but always check local regulations. Ensuring compliance with local laws protects your business and client relationships.

In South Dakota, the taxation of labor often depends on the type of service provided. Generally, labor related to manufacturing, installing, or repairing tangible personal property is not subject to sales tax. However, when creating a South Dakota Computer Repairman Services Contract - Self-Employed, it's wise to specify whether you are charging for labor or materials, as this can influence tax responsibilities. For clarity on your situation, consulting tax resources or professionals can be beneficial.