South Dakota Terms for Private Placement of Series Seed Preferred Stock

Description

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

US Legal Forms - one of many largest libraries of authorized varieties in the United States - offers an array of authorized document themes you are able to down load or print. While using web site, you can get a huge number of varieties for business and personal functions, sorted by classes, states, or key phrases.You can get the most up-to-date variations of varieties much like the South Dakota Terms for Private Placement of Series Seed Preferred Stock in seconds.

If you currently have a registration, log in and down load South Dakota Terms for Private Placement of Series Seed Preferred Stock from your US Legal Forms collection. The Down load button will show up on every single form you look at. You gain access to all earlier saved varieties within the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed below are easy guidelines to help you began:

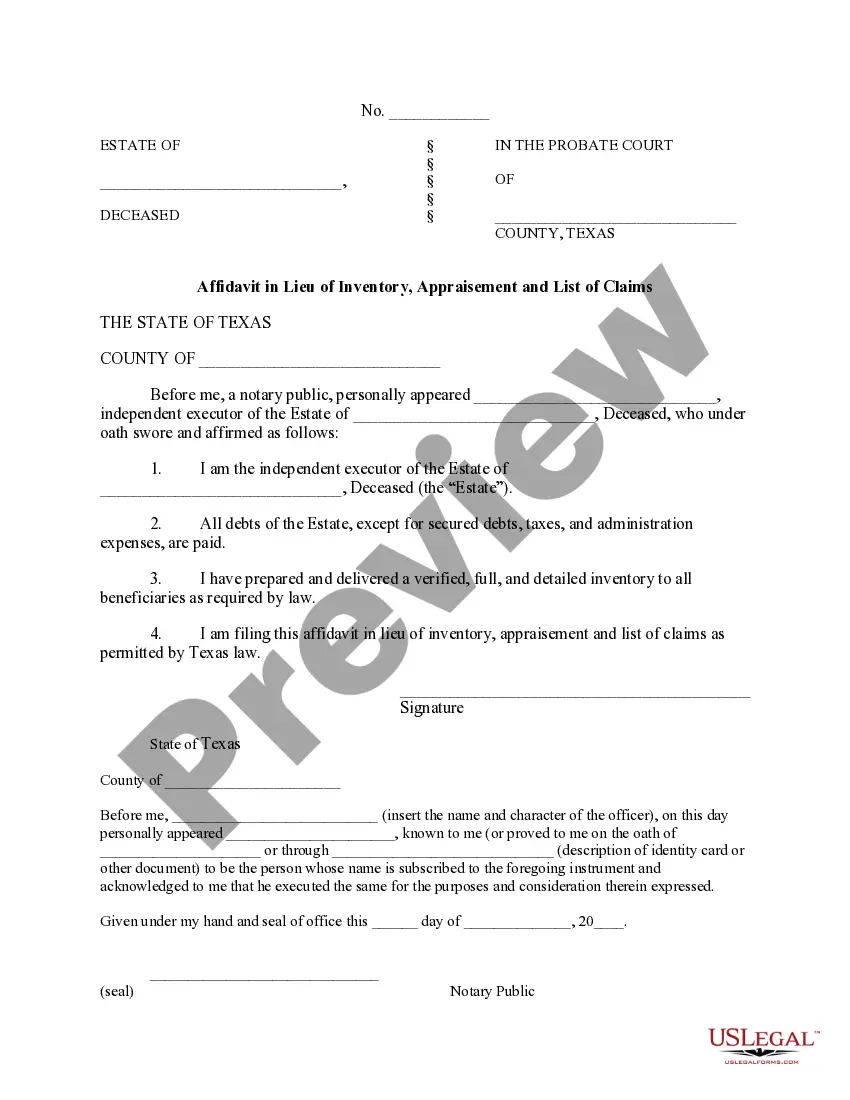

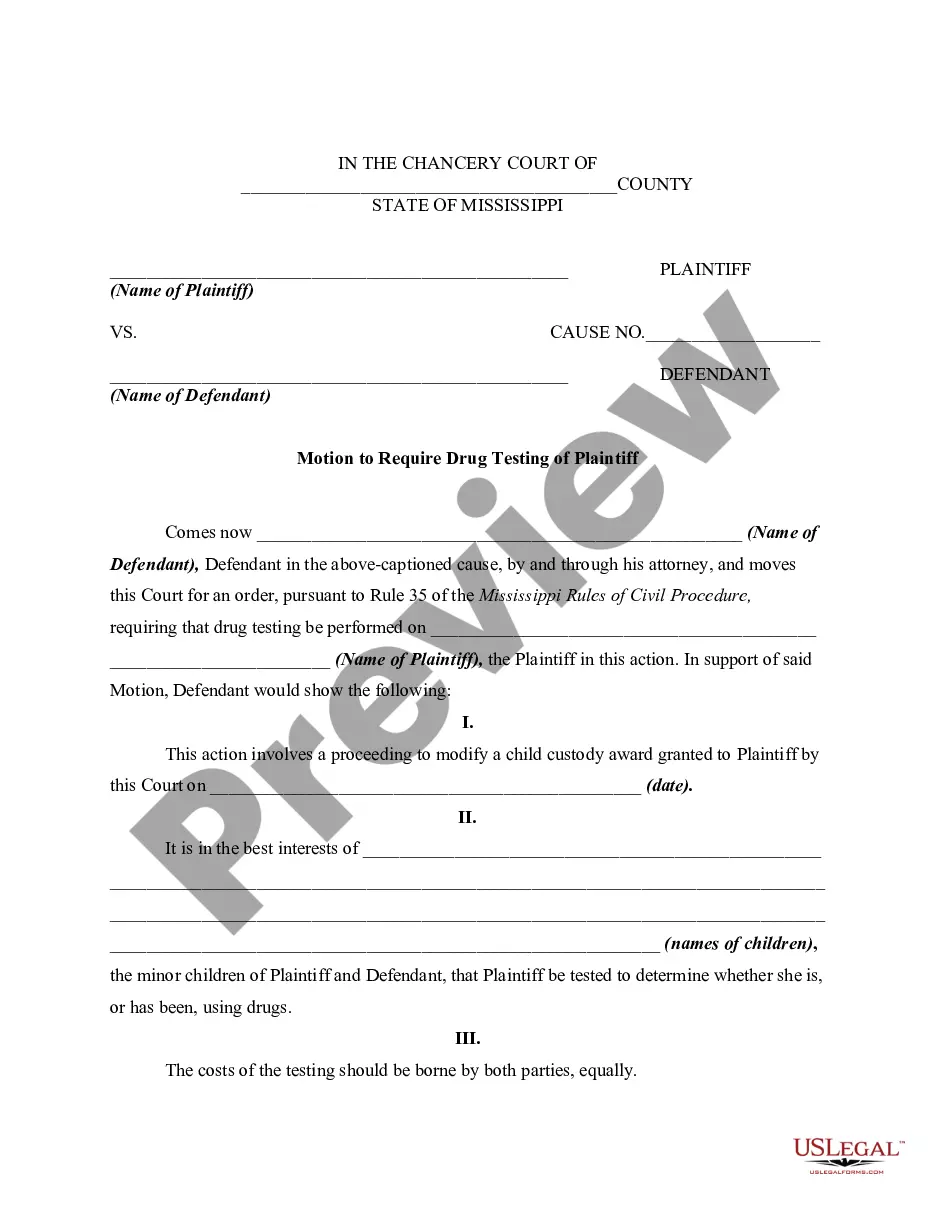

- Make sure you have selected the best form for your personal town/state. Click on the Preview button to review the form`s content material. Read the form outline to actually have chosen the appropriate form.

- In case the form doesn`t suit your needs, utilize the Look for area near the top of the display screen to obtain the the one that does.

- When you are satisfied with the shape, verify your selection by clicking the Purchase now button. Then, choose the costs strategy you want and supply your credentials to register on an bank account.

- Process the deal. Make use of your credit card or PayPal bank account to perform the deal.

- Find the structure and down load the shape on your own gadget.

- Make modifications. Fill out, change and print and indication the saved South Dakota Terms for Private Placement of Series Seed Preferred Stock.

Each and every design you put into your bank account lacks an expiry date which is your own forever. So, if you wish to down load or print yet another copy, just proceed to the My Forms portion and click on in the form you will need.

Gain access to the South Dakota Terms for Private Placement of Series Seed Preferred Stock with US Legal Forms, probably the most extensive collection of authorized document themes. Use a huge number of skilled and state-specific themes that fulfill your organization or personal requires and needs.

Form popularity

FAQ

Hear this out loud PauseSimilar to previous stages of financing, the series C round primarily relies on raising capital through the sale of preferred shares. The shares are likely to be convertible shares. They offer holders the right to exchange them for common stock in the company at some date in the future.

Hear this out loud PauseSeries Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Class A shares generally have more voting power and higher priority for dividends, while Class B shares are common shares with no preferential treatment. Class A vs Class B vs Class C Shares, Explained - SoFi sofi.com ? learn ? content ? classes-of-stock... sofi.com ? learn ? content ? classes-of-stock...

In Series B investors provide capital to a company in exchange for the latter's preferred shares. The majority of the deals include anti-dilution provisions like in the series A. This means that a company usually sells preferred shares that do not provide its holders with voting rights. Series B - What does Series B mean? Definition and Differences. entrepreneurscollective.biz ? glossary ? serie... entrepreneurscollective.biz ? glossary ? serie...

Hear this out loud PauseA Series AA Round is a round of startup financing using a class of preferred stock called the ?Series AA Preferred Shares.? Series AA is also known as ?Seed? because it comes before Series A. Series AA terms are usually not as onerous as Series A terms, and the valuation is typically lower.

Hear this out loud PauseKey Takeaways Series B investors usually pay a higher share price for investing in the company than Series A investors. Series B investors typically prefer convertible preferred stock vs. common stock due to the anti-dilution feature of preferred stock.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company. Series A Preferred Stock - ILPA ilpa.org ? glossary ? series-a-preferred-stock ilpa.org ? glossary ? series-a-preferred-stock

In series A, a startup is positioned to develop and refine its offer and processes. During series B, the cash is needed to be able to scale up and reach a much wider market. The fundamental business is already in place at series B, with the barrier to reaching a wider market being the need for investment. What's The Difference Between Series A & Series B Funding? Accountancy Cloud ? Blog Accountancy Cloud ? Blog