South Dakota Qualified Investor Certification Application

Description

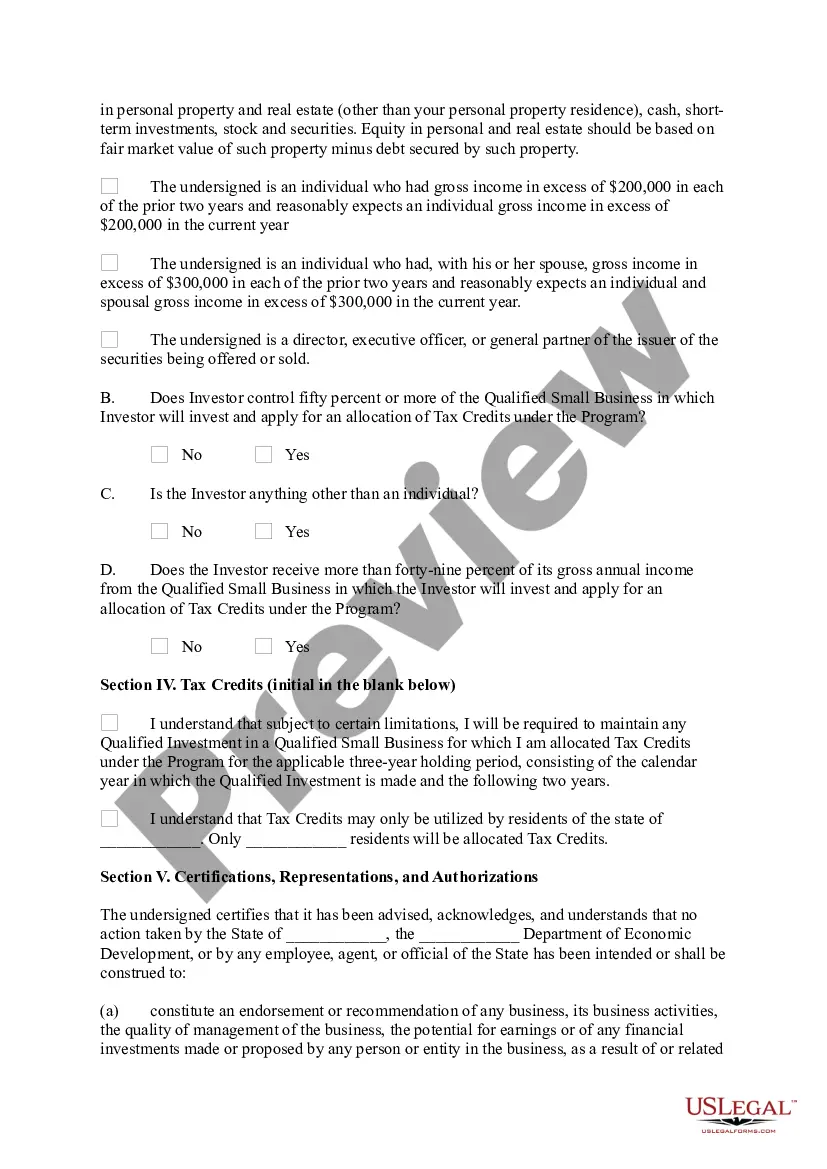

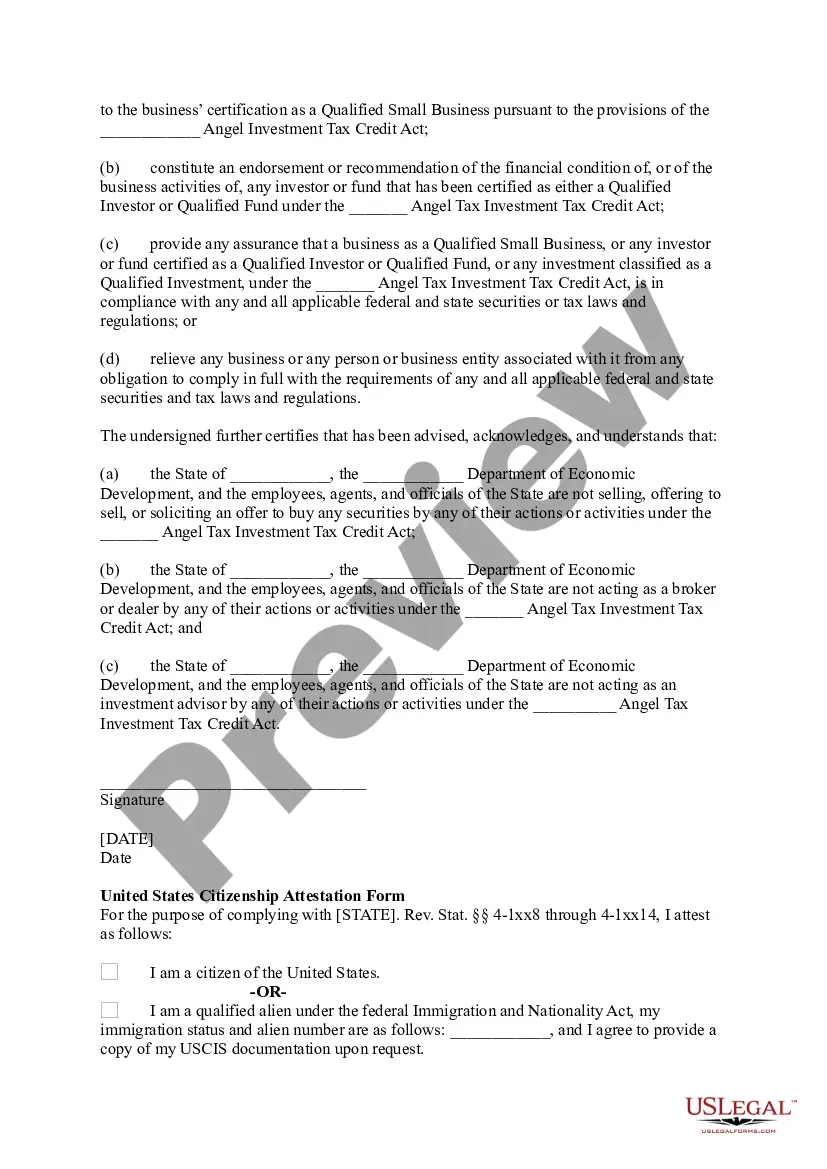

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

Are you inside a place where you need to have files for possibly company or specific uses nearly every time? There are plenty of lawful document web templates accessible on the Internet, but getting versions you can depend on isn`t simple. US Legal Forms offers a huge number of form web templates, like the South Dakota Qualified Investor Certification Application, which can be published to meet state and federal specifications.

When you are presently informed about US Legal Forms web site and get a free account, basically log in. Afterward, you are able to obtain the South Dakota Qualified Investor Certification Application web template.

If you do not offer an bank account and would like to begin using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for your correct metropolis/area.

- Utilize the Review button to examine the form.

- See the outline to actually have selected the appropriate form.

- When the form isn`t what you`re trying to find, make use of the Look for area to obtain the form that suits you and specifications.

- Whenever you find the correct form, simply click Purchase now.

- Choose the prices plan you desire, fill out the necessary information to make your account, and pay for the order using your PayPal or charge card.

- Choose a practical data file file format and obtain your duplicate.

Locate every one of the document web templates you might have bought in the My Forms food list. You can get a additional duplicate of South Dakota Qualified Investor Certification Application any time, if required. Just go through the needed form to obtain or print the document web template.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, to save time as well as steer clear of blunders. The assistance offers expertly produced lawful document web templates that you can use for a range of uses. Produce a free account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income. How do I verify my investor status? - Alta Knowledge Centre alta.exchange ? articles ? 4556508-how-do-i-... alta.exchange ? articles ? 4556508-how-do-i-...

Becoming a Financial Advisor in South Dakota Get Your Education. Pursue a relevant degree. ... Step 2: Register Your Firm in South Dakota. (This step is only required if you're establishing a new IA firm. ... Step 3: Take the Required Exam(s) ... Step 4: Ongoing Renewal and Update Requirements in South Dakota.

Hear this out loud PauseIn the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

The SEC in 2020 issued rules in Release No. 33-10824, Accredited Investor Definition, allowing investors holding certain professional licenses, such as a Series 7, to qualify as accredited, even if they fall short of meeting the income or asset tests. House Passes Bill to Set up SEC Accredited Investor Exam thomsonreuters.com ? news ? house-passes-bil... thomsonreuters.com ? news ? house-passes-bil...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments. How Does the Accredited Investor Verification Process Work? montague.law ? blog ? accredited-investor-verific... montague.law ? blog ? accredited-investor-verific...

Generally, if you are the trustee of your Solo 401k and your combined assets (Solo 401k plus personal assets) meet the $1 million threshold, both you and the Solo 401k should qualify as accredited investors. Significant Changes to SEC Accredited Investor Definition solo401k.com ? blog ? significant-changes-t... solo401k.com ? blog ? significant-changes-t...