South Dakota Petty Cash Form

Description

How to fill out Petty Cash Form?

If you wish to finalize, obtain, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Leverage the site's straightforward and user-friendly search tool to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finish the payment.

- Use US Legal Forms to access the South Dakota Petty Cash Form in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the South Dakota Petty Cash Form.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

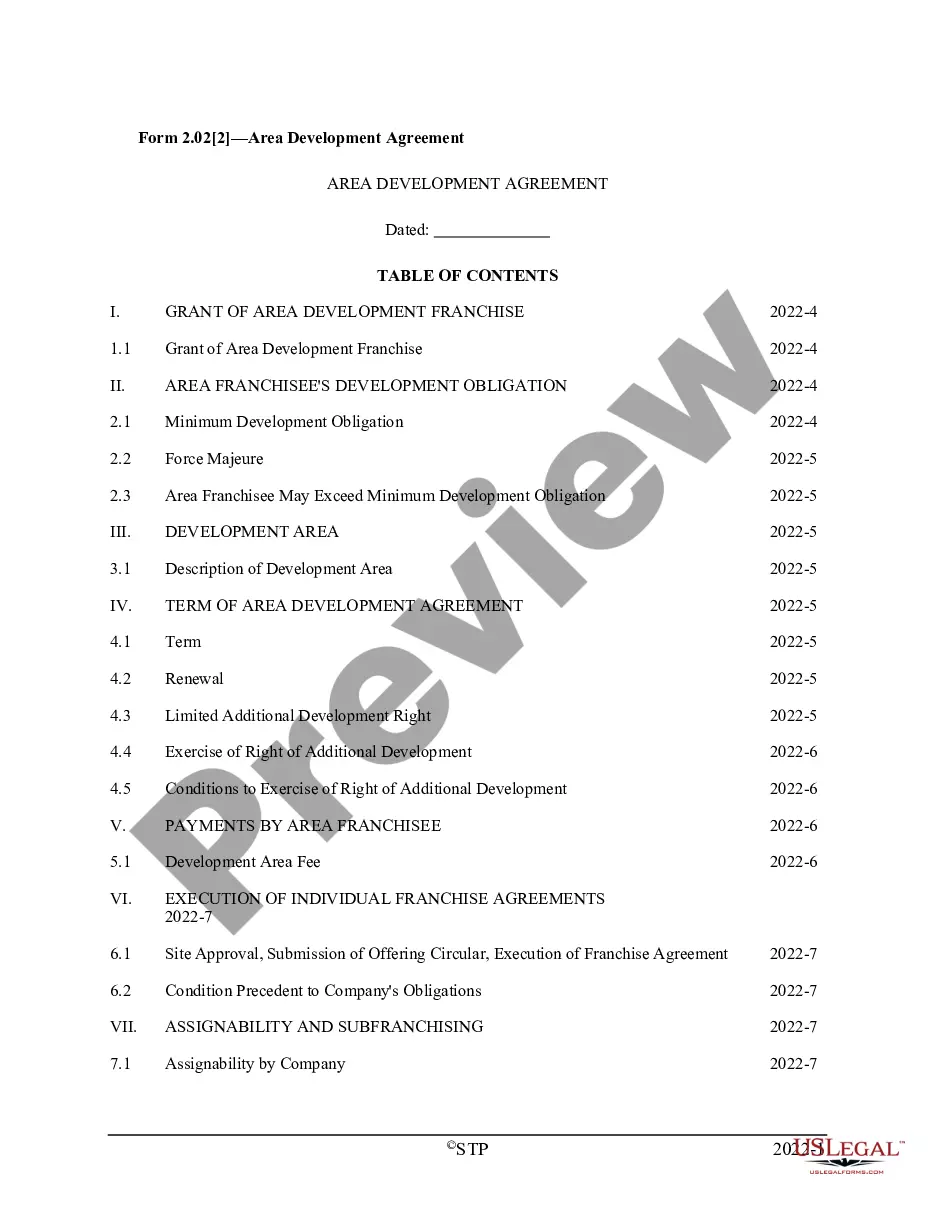

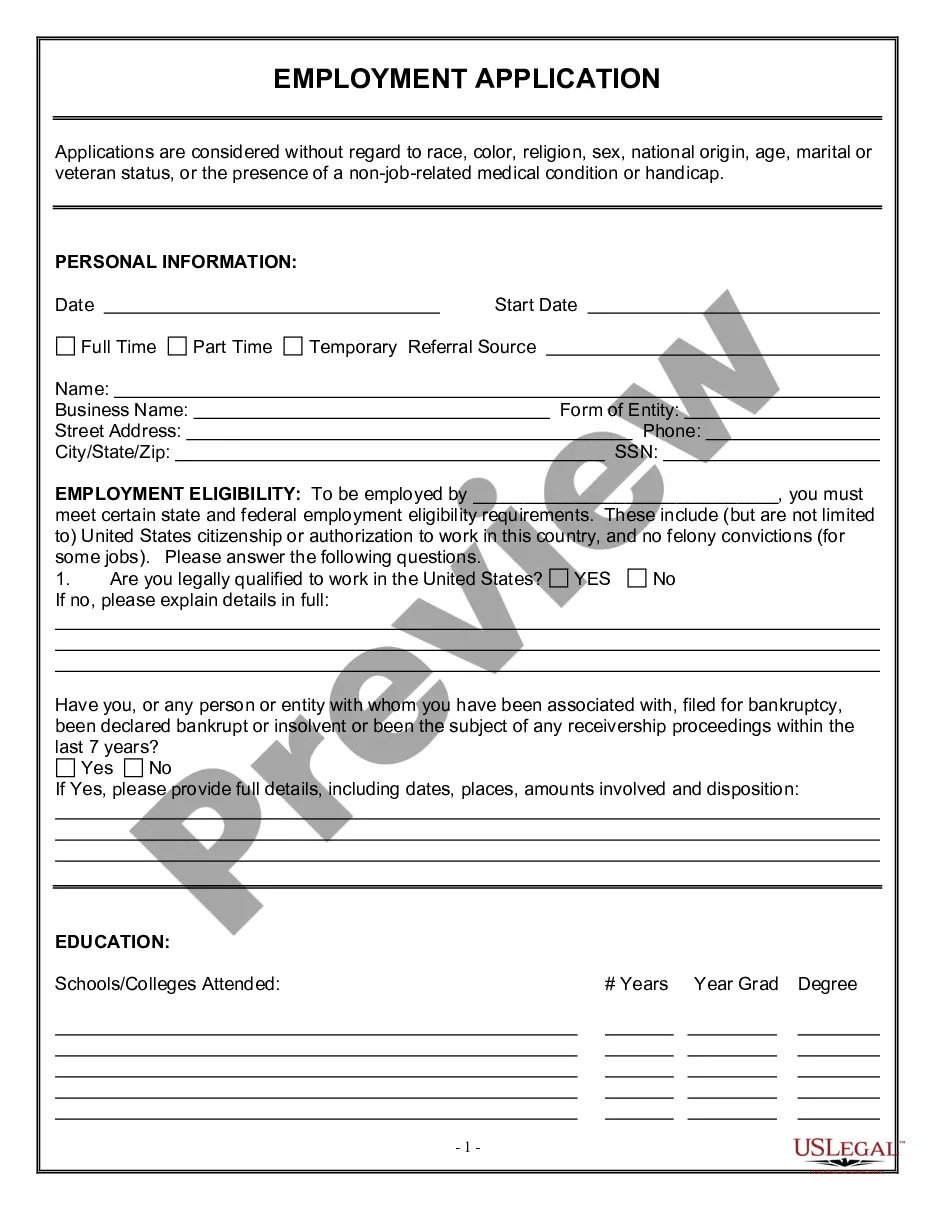

- Step 2. Use the Review function to examine the form's details. Always remember to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative types of your legal form template.

Form popularity

FAQ

The forms for the petty cash book typically include various receipts and vouchers that document the dispensed cash and its purpose. These forms provide a structured way to record expenditures and balance the cash on hand. By using the South Dakota Petty Cash Form, you can ensure that all transactions are documented properly, making it easier to reconcile funds and keep accurate financial records. This organized approach simplifies the overall accounting process for any business.

The law for petty theft in South Dakota outlines that stealing property valued under $400 is classified as a Class 1 misdemeanor. This classification can result in fines or up to one year in jail. It is essential to understand your rights and obligations under this law if you face such charges. A South Dakota Petty Cash Form can be a practical tool for managing any financial responsibilities stemming from these situations.

In South Dakota, the minimum amount for petty theft is generally considered to be anything below $400. This threshold distinguishes petty theft from grand theft, which involves larger sums. Being aware of this amount is crucial for anyone dealing with theft-related legal matters. For expenses or fines resulting from such issues, using a South Dakota Petty Cash Form can simplify the payment process.

A petty offense in South Dakota refers to a minor violation of the law that does not carry severe penalties. These offenses often result in fines rather than jail time. Common examples include certain traffic violations and minor drug offenses. Understanding this classification can help you navigate legal issues more effectively, especially when using a South Dakota Petty Cash Form for any related fines.

To fill a petty cash form, start by adding the appropriate date at the top. Then, provide information on what the cash was used for and attach any related receipts. Ensure you include your signature to authorize the expense. Utilizing the South Dakota Petty Cash Form provides a user-friendly design that helps streamline this process.

Filling out a petty cash form involves providing essential details about the transaction. Include the date, the amount spent, and the purpose of the cash usage. Make sure to sign and date the form to validate it. The South Dakota Petty Cash Form offers a structured format that helps ensure you capture all necessary information accurately.

To prepare a petty cash report, first, gather all receipts and documents related to your expenditures. Next, list each item clearly, noting the date, amount, and purpose. Finally, reconcile the total of your receipts with the remaining cash to ensure everything aligns. Using the South Dakota Petty Cash Form simplifies this process, allowing you to organize your report efficiently.

In South Dakota, the preparation of a voucher is typically the responsibility of the individual managing the petty cash fund. They should document each transaction accurately to maintain clear record-keeping. Furthermore, utilizing a South Dakota Petty Cash Form helps streamline this process by providing a structured format for recording expenses. This ensures that all funds are accounted for and makes it easier to reconcile the petty cash at the end of each period.