Rhode Island Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Have you ever found yourself in a situation where you require documents for either professional or specific activities nearly every workday.

There are numerous reliable document templates accessible online, but finding ones you can trust can be challenging.

US Legal Forms provides thousands of template designs, including the Rhode Island Wage Withholding Authorization, which are designed to meet federal and state requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Rhode Island Wage Withholding Authorization at any time if needed. Simply select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Wage Withholding Authorization template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

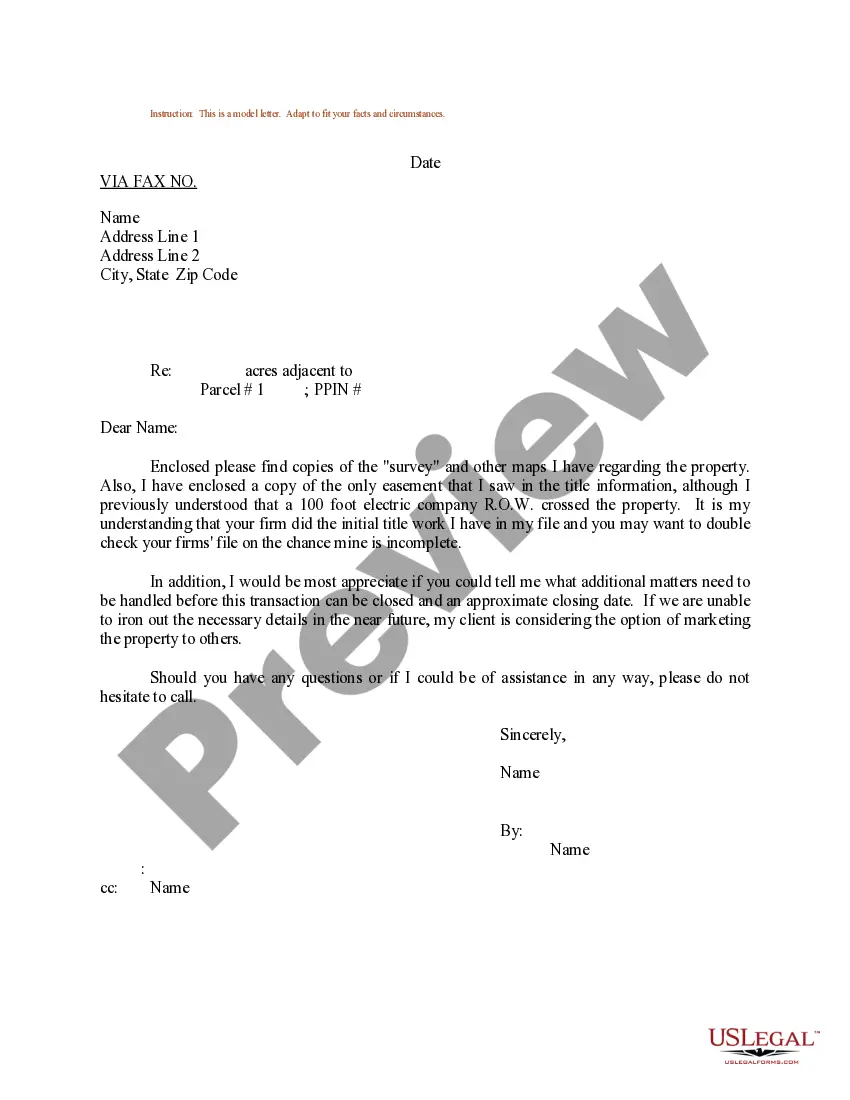

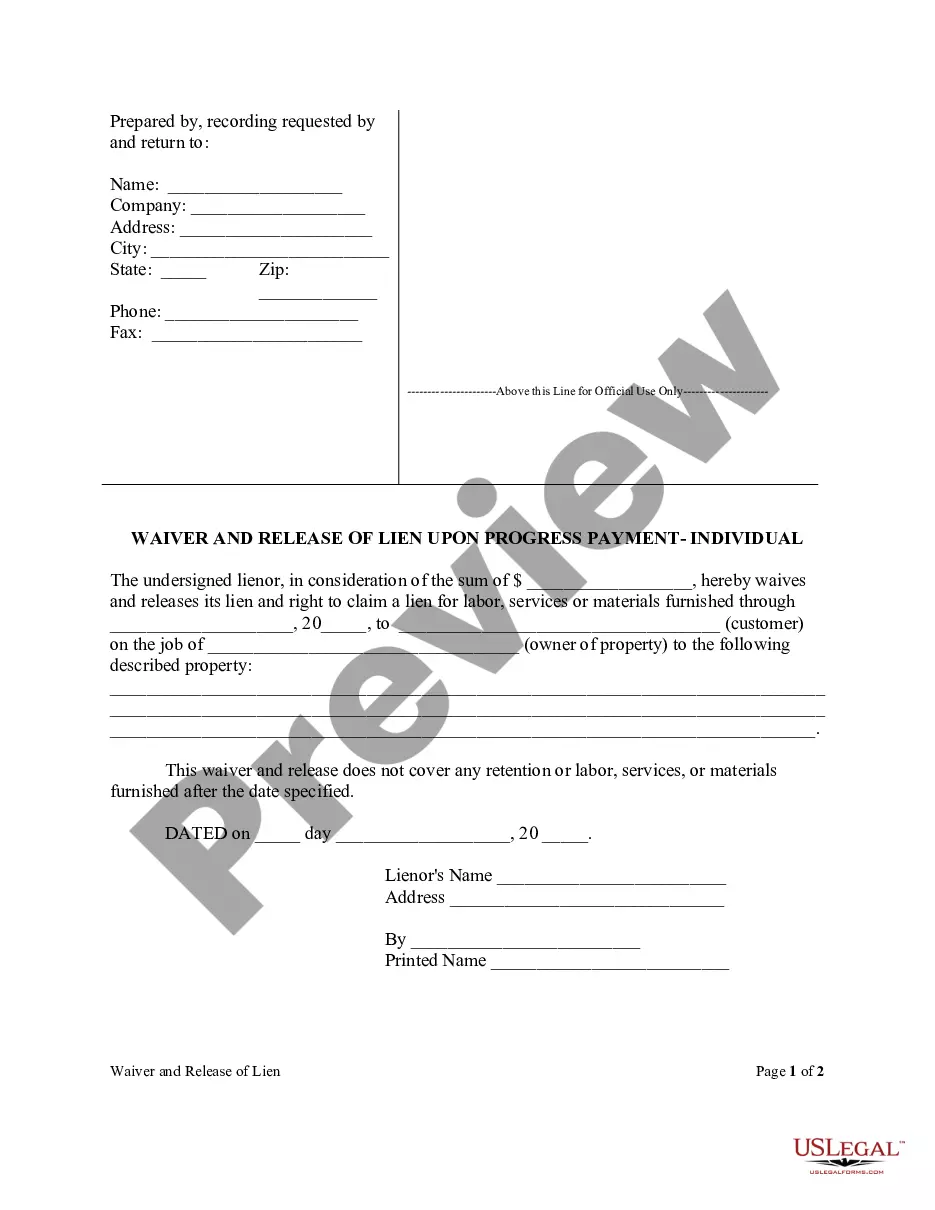

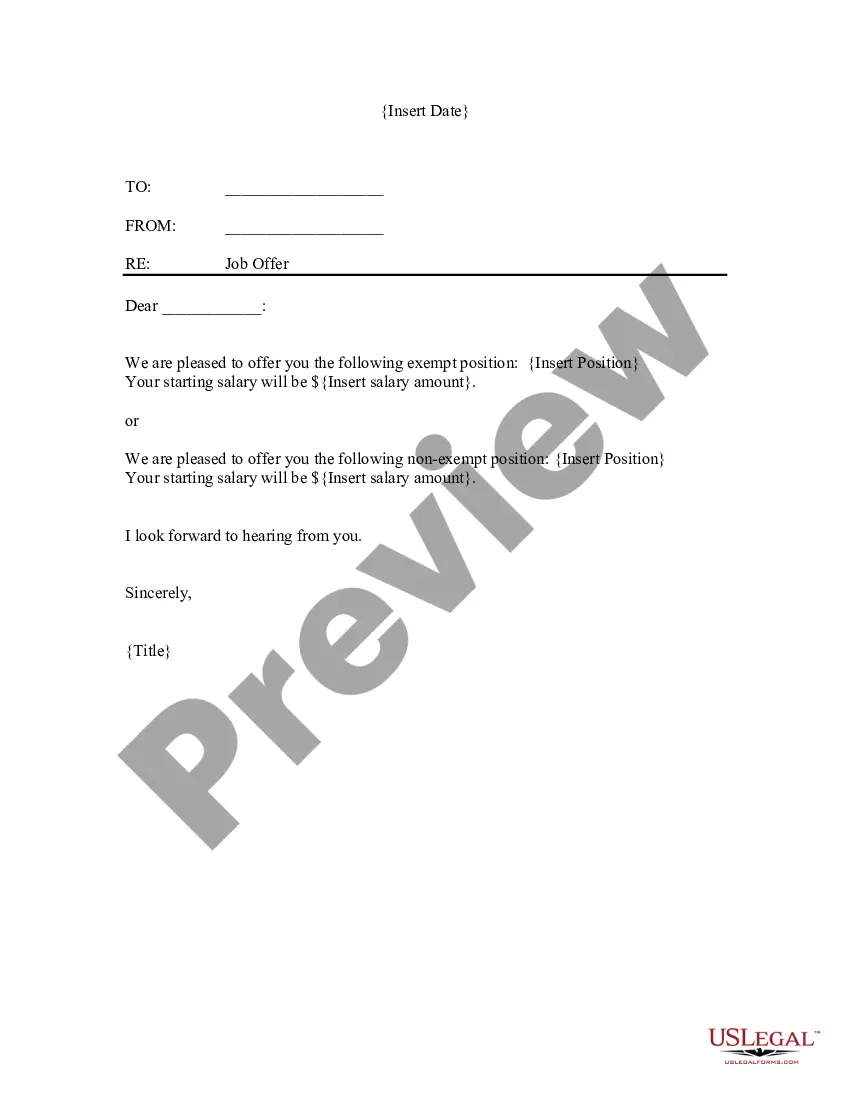

- Utilize the Preview option to review the form.

- Check the description to ensure you have chosen the right form.

- If the form isn’t what you need, use the Lookup section to find the form that fits your needs and requirements.

- Once you find the right form, click on Acquire now.

- Choose the pricing plan you prefer, fill in the required information to process your payment, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form.

In most cases, state withholding applies to state residents only. In Maine, Massachusetts, Montana, Nebraska, Oregon, and Wisconsin, state withholding also applies to individuals required to file a state tax return in that state.

Rhode Island Withholding: What you need to know The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

The Rhode Island (RI) state sales tax rate is currently 7%. Rhode Island is one of the few states with a single, statewide sales tax. Businesses that sell, rent or lease taxable tangible personal property at retail in Rhode Island must register with the state and collect sales tax.

If your small business has employees working in Rhode Island, you'll need to withhold and pay Rhode Island income tax on their salaries. This is in addition to having to withhold federal income tax for those same employees. Here are the basic rules on Rhode Island state income tax withholding for employees.

How to fill out a W-4: step by stepStep 1: Enter your personal information.Step 2: Account for all jobs you and your spouse have.Step 3: Claim your children and other dependents.Step 4: Make other adjustments.Step 5: Sign and date your form.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD: A Rhode Island employer must with- hold Rhode Island income tax from the wages of an employee if: (1) The employee's wages are subject to federal income tax withholding, and (2) Any part of the wages were for services performed in Rhode Island.