Oklahoma Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Are you presently in a role that requires documentation for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Oklahoma Wage Withholding Authorization, that are crafted to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oklahoma Wage Withholding Authorization template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and verify it is for the correct area/state.

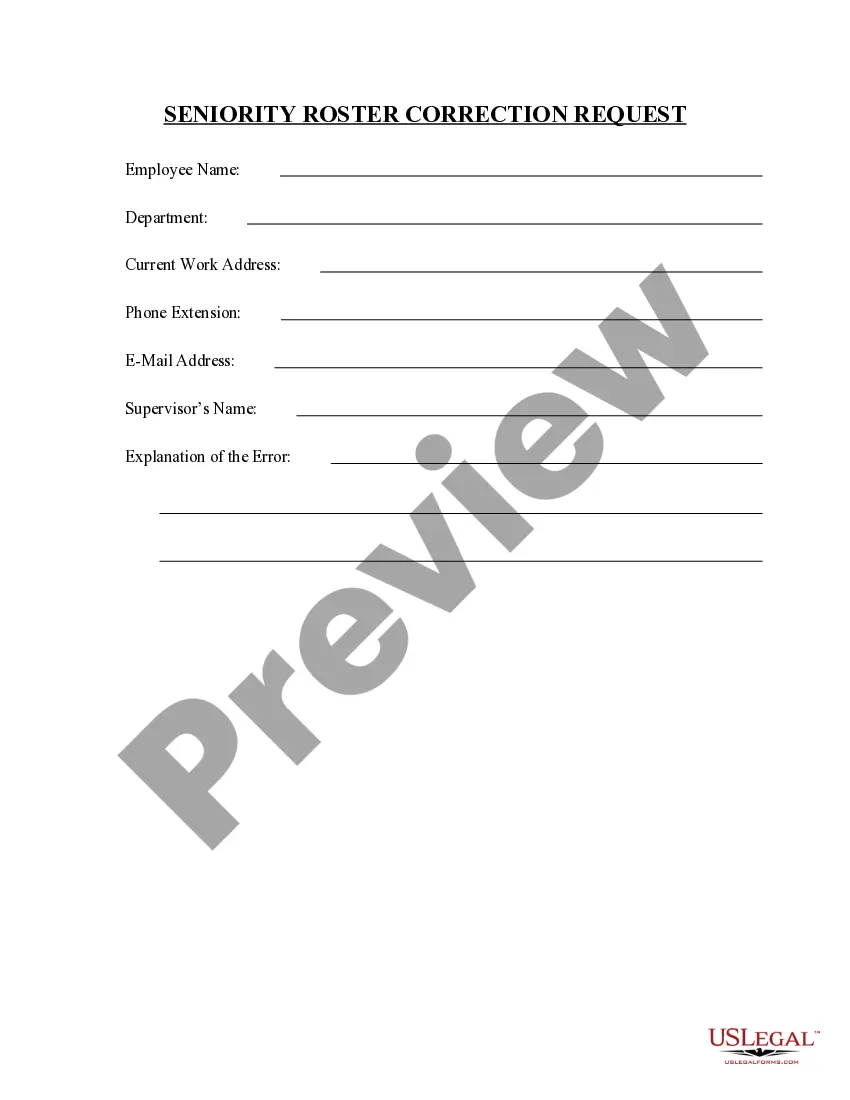

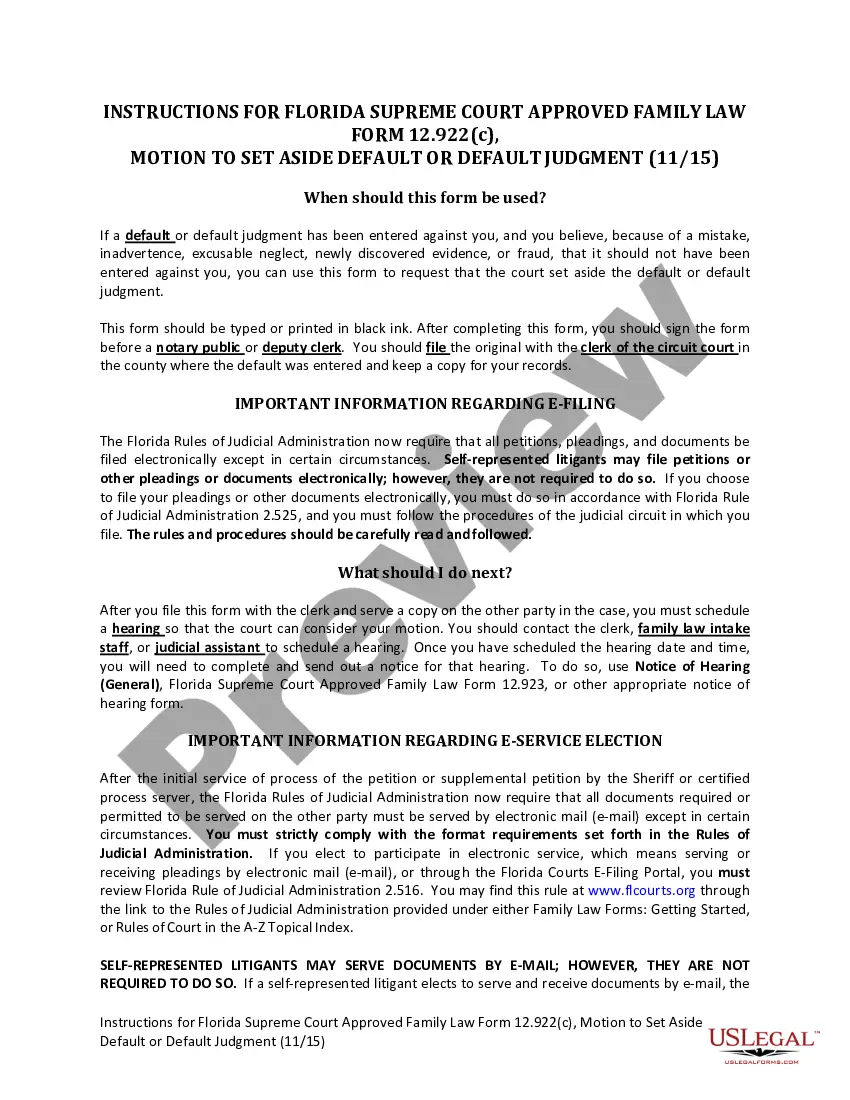

- Utilize the Review button to preview the document.

- Check the details to ensure you have selected the right form.

- If the form is not what you were looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

For non-residents working in Oklahoma, the withholding tax is generally based on the employee's income and the number of allowances claimed on the Oklahoma Wage Withholding Authorization. Non-residents must fill out this form to ensure the correct amount is withheld. It's essential to remain compliant with state regulations to avoid any potential penalties.

Filling out your W-4 correctly involves providing accurate personal and financial information. Start by entering your name, address, and Social Security number, followed by your filing status. Then, indicate the number of allowances you wish to claim and any additional amount you want withheld. Following the guidelines in the Oklahoma Wage Withholding Authorization will assist in ensuring complete and accurate information on your form.

On the W-4 form for Oklahoma, the allowance for yourself typically allows you to reduce the amount withheld from your paycheck. The more allowances you claim, the less tax is taken out. It's advisable to review your financial situation carefully to determine the right number of allowances that reflect your marital status and dependents. Using the Oklahoma Wage Withholding Authorization can help clarify your personal circumstances.

No, Oklahoma does not permit employers to withhold final paychecks from employees. Employers may only deduct part of an employee's wages for authorized reasons, such as back tax payments, or with written authorization from the employee for benefits like insurance.

Registering for Employer Account with Oklahoma Employment Security CommissionHead to the EZ Tax Express login page.Click the Create New User ID (Registration) link in the letfthand list.Click Create an Employer Account.Complete the application by providing the requested information.03-Jan-2018

Register your business in the state of Oklahoma, register for withholding tax, add a license or permit, or add a new retail site to your permit account using the Business Application link on the OkTAP home page. 1. Click the Business Application link under the For Businesses colum of the OKTAP home page.

To register online, go to the Online Business Registration section of the OTC website. (A link will take you to the Oklahoma Taxpayer Access Point (OkTAP).) Processing of an online application takes a minimum of 5 days. To apply on paper, use Form WTH10006, Oklahoma Wage Withholding Tax Application.

Taking money from wages without consent or contractual provision can result in a claim for unlawful deduction of wages, even if the individual has been employed for less than two years.

through entity shall withhold income tax at the rate of five percent (5%) from a nonresident member's share of the Oklahoma share of income of the entity distributed to each nonresident member and pay the withheld amount on or before the due date of the passthrough entity's income tax return, including

If your employer fails to pay you on time, you can file a Wage Claim with the Oklahoma Department of Labor, but you must ask your employer first for your final wages before filing a claim. Contact the Oklahoma Department of Labor at (888) 269-5353; (405) 528-1500, OKC area; (918) 581-2400,Tulsa area.