Oklahoma Payroll Deduction Authorization Form

Description

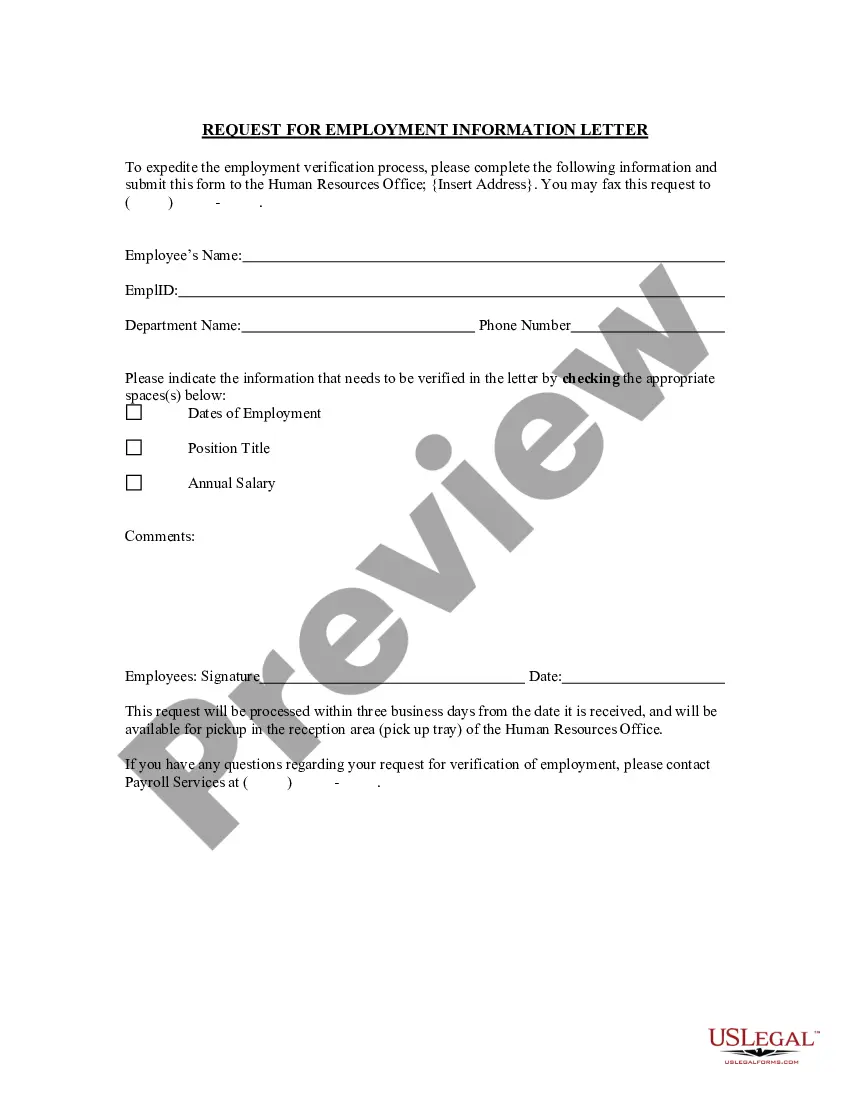

How to fill out Payroll Deduction Authorization Form?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast selection of legal document designs that you can download or create.

By utilizing the website, you can obtain countless templates for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms such as the Oklahoma Payroll Deduction Authorization Form in mere moments.

If you already have a monthly subscription, Log In and retrieve the Oklahoma Payroll Deduction Authorization Form from your US Legal Forms library. The Acquire button will appear on every document you view. You have access to all previously downloaded forms in the My documents tab of your account.

Select the format and download the form onto your system.

Make modifications. Fill, edit, and print and sign the downloaded Oklahoma Payroll Deduction Authorization Form. Every template you add to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Oklahoma Payroll Deduction Authorization Form with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that address your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some basic tips to get started.

- Ensure you have selected the correct document for your location/state.

- Click the Preview button to review the content of the form.

- Examine the form outline to ensure you have chosen the appropriate document.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Complete the payment. Utilize a credit card or PayPal account to finish your transaction.

Form popularity

FAQ

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

Mandatory payroll deductions are the wages that are withheld from your paycheck to meet income tax and other required obligations. Voluntary payroll deductions are the payments you make to retirement plan contributions, health and life insurance premiums, savings programs and before-tax health savings plans.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

Involuntary deductions include those made to satisfy debts for federal taxes, child support, creditor garnishments, bankruptcy orders, student loan garnishments and federal agency loan garnishments. Employers need to be well versed in all aspects of these types of orders to avoid serious penalties for noncompliance.

Employees wishing to cancel their deductions should contact their agency payroll office and request the allotment be cancelled.

Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations. Voluntary deductions: Life insurance, job-related expenses and retirement plans.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include: Federal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding.