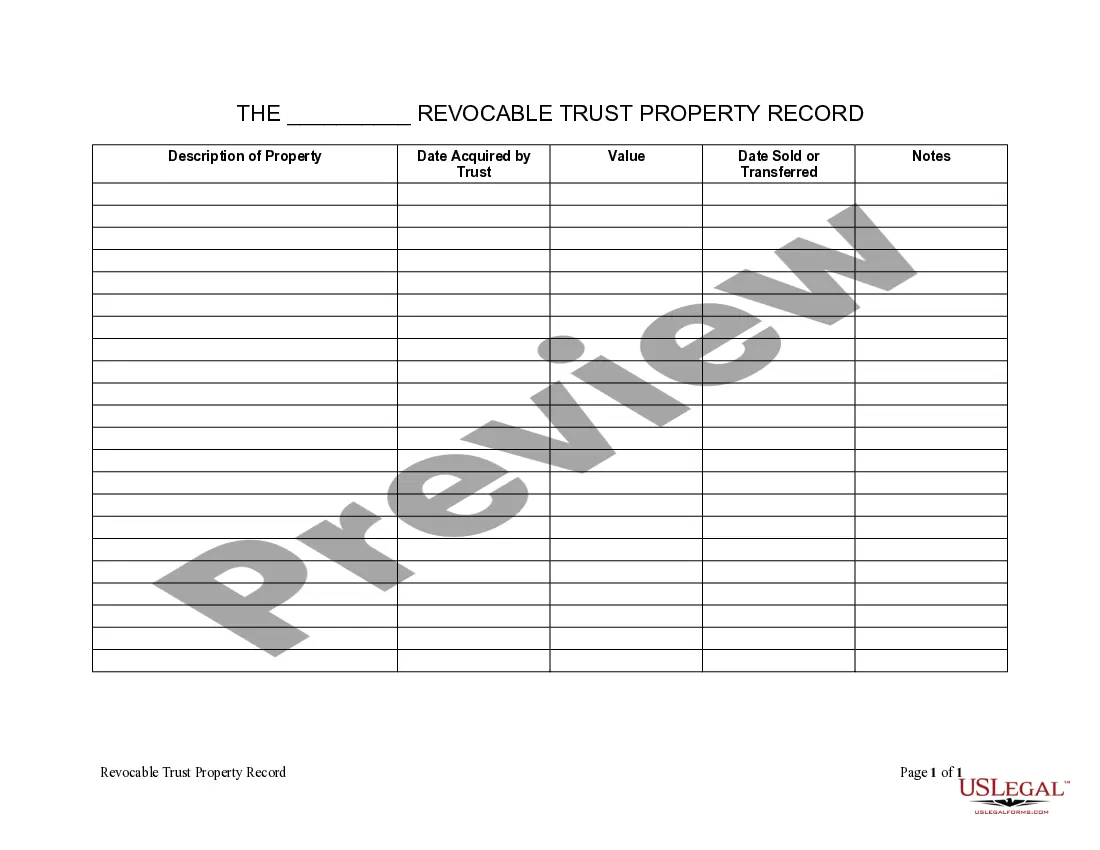

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Missouri Living Trust Property Record

Description

Key Concepts & Definitions

Living Trust: A legal document that places assets into a trust for the grantor's benefit during their lifetime and transfers to designated beneficiaries at their death. Property Record: Official documentation evidencing ownership of property. Estate Planning: The process of arranging the management and disposal of a persons estate during and after their life.

Step-by-Step Guide to Incorporating Property into a Living Trust

- Determine the Type of Living Trust: Decide between a revocable or irrevocable trust based on your financial planning and estate goals.

- Inventory Your Real Estate: List all properties including main residential real estate and other real estate investments.

- Seek Legal Counsel: Consult with a lawyer who specializes in estate planning and trusts to draft the trust document.

- Transfer Property Titles: Officially transfer the titles of your properties to the living trust, done through signing a deed.

- Record the Trust: Depending on state laws, file the necessary documents with the county recorder to establish the trust as the new owner of the property in public records.

- Regular Review: Continuously review and amend the trust as necessary, especially after major life events or significant changes in property or financial status.

Risk Analysis

- Probate Avoidance: While a living trust can avoid the probate process, mistakes in trust creation or property titling can still lead to probate, potentially leading to a legal dispute.

- Financial Risk: Improper handling of the trust could affect credit and financial processes.

- Legal Disputes: Discrepancies in trust documents or lack of clarity can cause disputes among beneficiaries.

Common Mistakes & How to Avoid Them

- Not Updating the Trust: Ensure that the trust is updated regularly to reflect changes in assets and personal circumstances.

- Failing to Properly Transfer Titles: Work with a professional to ensure all real estate titles are correctly transferred into the trust.

- Neglecting to Record the Trust: Always record the trust in applicable public record databases to officially reflect the ownership change.

FAQ

What happens if a living trust is not recorded? If a living trust that includes property is not recorded, the trust does not necessarily become invalid, but it can lead to complications and disputes regarding property ownership. Is a living trust public record? Generally, living trusts are private documents, but the deeds transferring property to a living trust might be public.

How to fill out Missouri Living Trust Property Record?

Access any version from 85,000 legitimate documents such as Missouri Living Trust Property Record online with US Legal Forms. Every template is crafted and refreshed by state-authorized lawyers.

If you possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the instructions below.

With US Legal Forms, you’ll always have instant access to the correct downloadable template. The service offers you access to forms and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Missouri Living Trust Property Record quickly and effortlessly.

- Review the state-specific criteria for the Missouri Living Trust Property Record you intend to utilize.

- Browse through the description and preview the template.

- Once you’re certain the template is what you require, simply click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Download the file to the My documents section.

- As soon as your reusable template is downloaded, print it out or store it on your device.

Form popularity

FAQ

Yes, trusts can be public record in Missouri, but the level of access varies. Typically, the details surrounding a trust's administration may be available through the probate court. For comprehensive insights into Missouri Living Trust Property Records, US Legal Forms offers a variety of tools and templates to assist you in accessing this information easily.

In Missouri, a trust may not be fully public, but some information can be accessed through legal documents filed with the probate court. The specifics often depend on the nature of the trust and its administration. To delve deeper into Missouri Living Trust Property Records, consider using resources like US Legal Forms that can provide you with the information you need.

Trusts can be part of the public record, but this depends on the type of trust and local laws. In Missouri, certain details about living trusts may be filed with the probate court, making them available for public access. If you need assistance, US Legal Forms can help you understand which aspects of Missouri Living Trust Property Records are public and how to access them.

Yes, you can look up information on a trust, though the process may vary by state. In Missouri, information about living trusts may be accessible through court records or relevant state agencies. Utilizing services like US Legal Forms can simplify your search by offering tools to help you navigate Missouri Living Trust Property Records effectively.

To find a trust in Missouri, you can start by checking with the local probate court where the trust may have been filed. You might also consider searching online databases that specialize in Missouri Living Trust Property Records. Additionally, platforms like US Legal Forms can guide you through the process, providing helpful resources and templates to aid your search.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.