South Dakota Letter Requesting Transfer of Property to Trust

Description

How to fill out Letter Requesting Transfer Of Property To Trust?

If you are looking to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or by keywords. Use US Legal Forms to find the South Dakota Letter Requesting Transfer of Property to Trust within just a few clicks.

Every legal document template you obtain is yours forever. You will have access to every form you downloaded in your account. Navigate to the My documents section and choose a form to print or download again.

Compete and download, and print the South Dakota Letter Requesting Transfer of Property to Trust with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to download the South Dakota Letter Requesting Transfer of Property to Trust.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your pricing plan and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the South Dakota Letter Requesting Transfer of Property to Trust.

Form popularity

FAQ

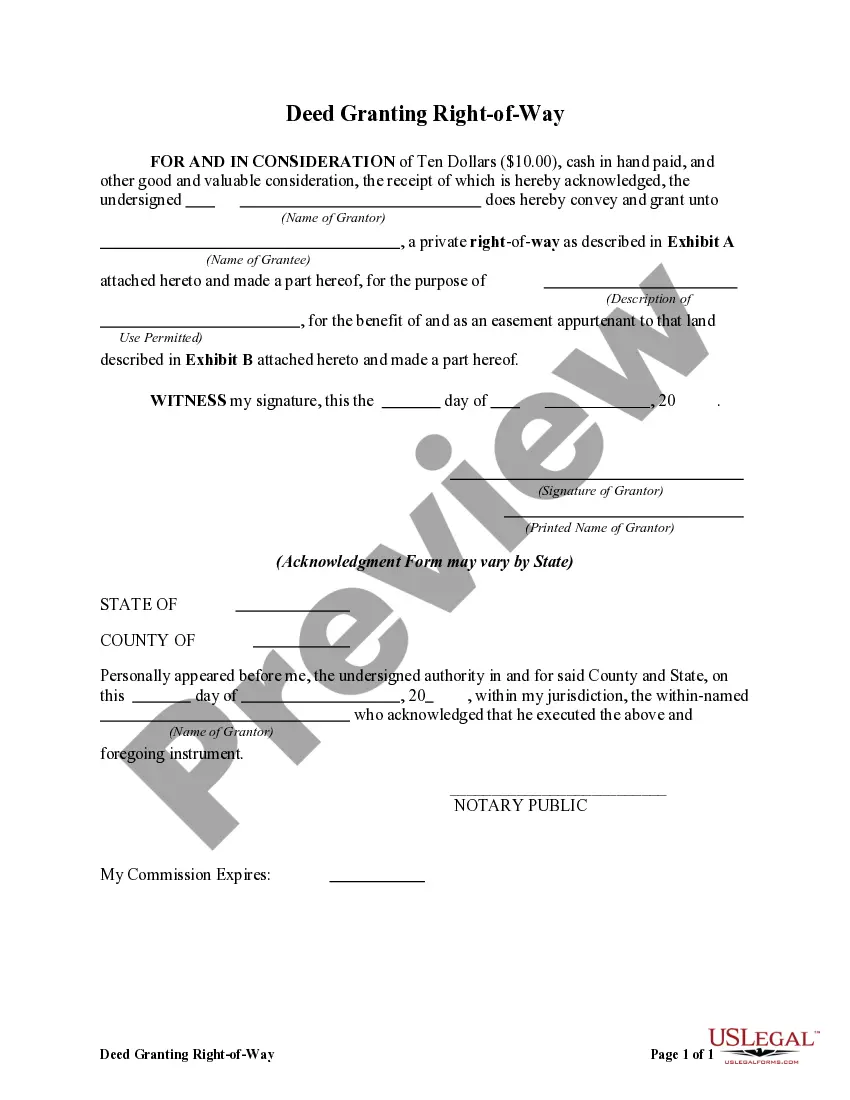

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

On July 1, 2014, South Dakota enacted the Real Property Transfer on Death Act, which provides for the transfer of real property in the event of death.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

A Trust Deed is a general term for a document which contains the terms of a Trust. A Declaration of Trust is a type of Trust Deed and is a document by which the person or people who own an asset declare that they hold it on Trust in specified shares for themselves and or other parties.

How to Avoid Probate in South Dakota?Establish a Revocable Living Trust.Title property in Joint Tenancy.Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or register of deeds, or sometimes it's part of the county clerk's office.

A swap power is also called a power to substitute. It is a special right reserved to you (or someone else) in a trust you create while you are alive. This right gives you the power to swap an asset of yours, say cash, for an asset held in the trust you created.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.