South Dakota Certificate of Amendment to Certificate of Trust of (Name of Trustor)

Description

How to fill out Certificate Of Amendment To Certificate Of Trust Of (Name Of Trustor)?

You are able to commit several hours on the Internet looking for the legitimate file web template which fits the federal and state requirements you require. US Legal Forms gives 1000s of legitimate types which can be analyzed by pros. It is simple to acquire or print the South Dakota Certificate of Amendment to Certificate of Trust of (Name of Trustor) from our services.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Down load button. Afterward, it is possible to total, edit, print, or indication the South Dakota Certificate of Amendment to Certificate of Trust of (Name of Trustor). Every legitimate file web template you acquire is yours for a long time. To have one more copy of any purchased form, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms website initially, keep to the basic recommendations listed below:

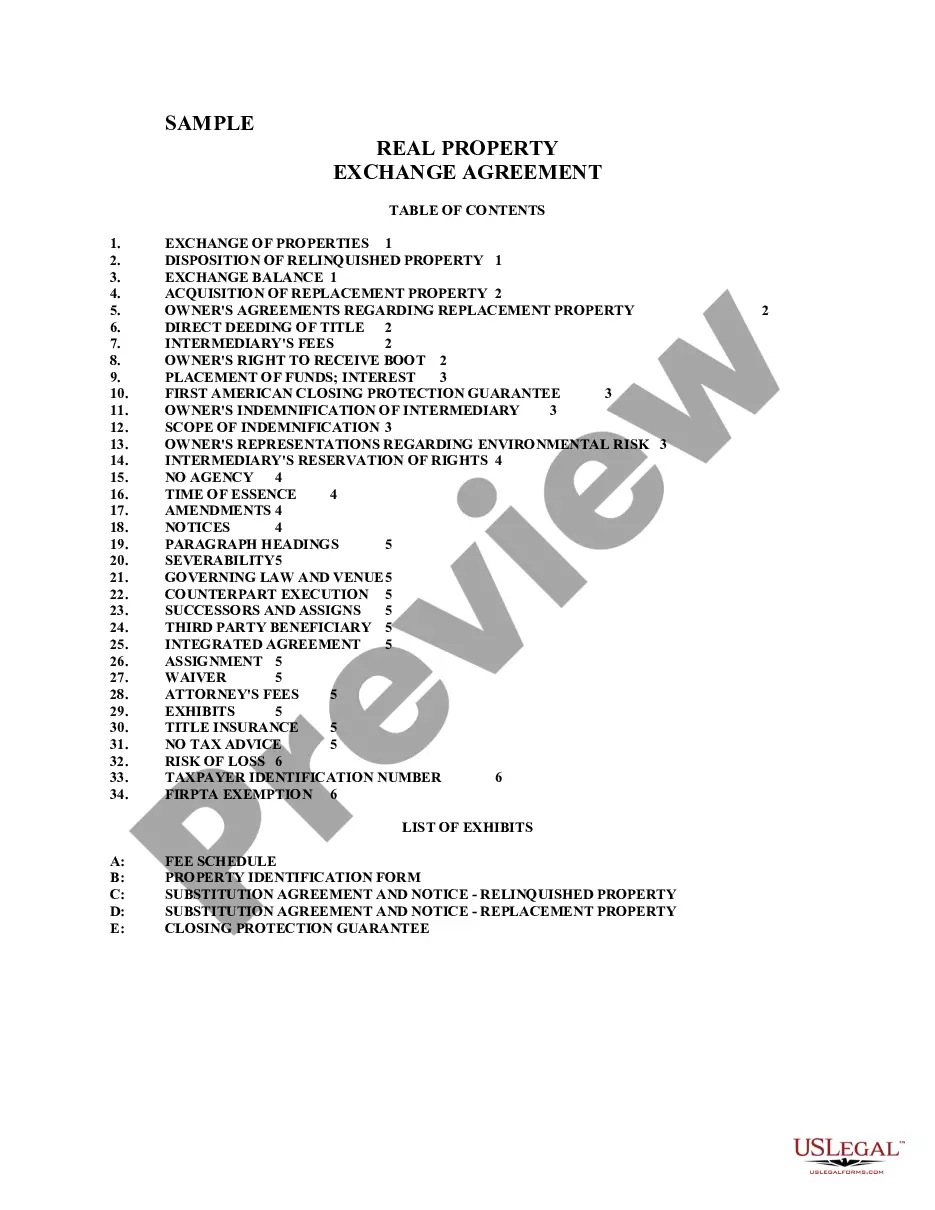

- Very first, make sure that you have selected the best file web template for that region/town that you pick. Look at the form explanation to make sure you have selected the right form. If available, take advantage of the Review button to look with the file web template at the same time.

- If you want to locate one more version of your form, take advantage of the Lookup field to find the web template that fits your needs and requirements.

- Upon having found the web template you desire, simply click Purchase now to continue.

- Pick the prices strategy you desire, type in your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal bank account to cover the legitimate form.

- Pick the structure of your file and acquire it to your device.

- Make alterations to your file if required. You are able to total, edit and indication and print South Dakota Certificate of Amendment to Certificate of Trust of (Name of Trustor).

Down load and print 1000s of file templates while using US Legal Forms Internet site, which offers the biggest variety of legitimate types. Use specialist and condition-specific templates to handle your small business or personal requires.

Form popularity

FAQ

The cost of setting up a trust in South Dakota varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more. South Dakota: Make A Revocable Trust Online in 12 Minutes | Snug getsnug.com ? south-dakota-trusts getsnug.com ? south-dakota-trusts

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

In addition to no state income tax, South Dakota doesn't charge capital gains tax for assets held in the trust. This means that the trust can grow in value while remaining tax-free?an important wealth-building benefit. South Dakota isn't a state that inflicts estate or inheritance tax. Why South Dakota Is The Best State To House Your Trust firstdakota.com ? news ? why-south-dakota-... firstdakota.com ? news ? why-south-dakota-...

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.

The most significant tax advantage offered by South Dakota is that it does not collect income tax. This fact, combined with all the other trust laws, is what makes South Dakota such an attractive jurisdiction to establish trusts originating from other states.

South Dakota allows for a trust to exist in perpetuity, i.e., for an unlimited duration.

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it. A revocable living trust is a popular estate planning option. It may be an option that will work for you. Create a living trust in South Dakota | .com ? articles ? create-a-living-tr... .com ? articles ? create-a-living-tr...

A South Dakota Dynasty Trust is a very powerful planning tool that preserves family wealth over generations, allowing a trust to live in perpetuity (forever), therefore never subjecting the assets to federal estate taxation through a forced distribution. What is a South Dakota Dynasty Trust and Why Does Jurisdiction Matter? bridgefordtrust.com ? south-dakota-dynasty... bridgefordtrust.com ? south-dakota-dynasty...