Most debt counselors say that it is a good idea to talk to the people to whom you owe money. If you ignore the problem it will only get worse. You may find that you are paying extra interest and your debts are just getting bigger every day. Many creditors try to be understanding and if you tell them why you are unable to pay, then they will sometimes be willing to reach a compromise.

Connecticut Letter to Creditors Informing Them of Fixed Income and Financial Hardship

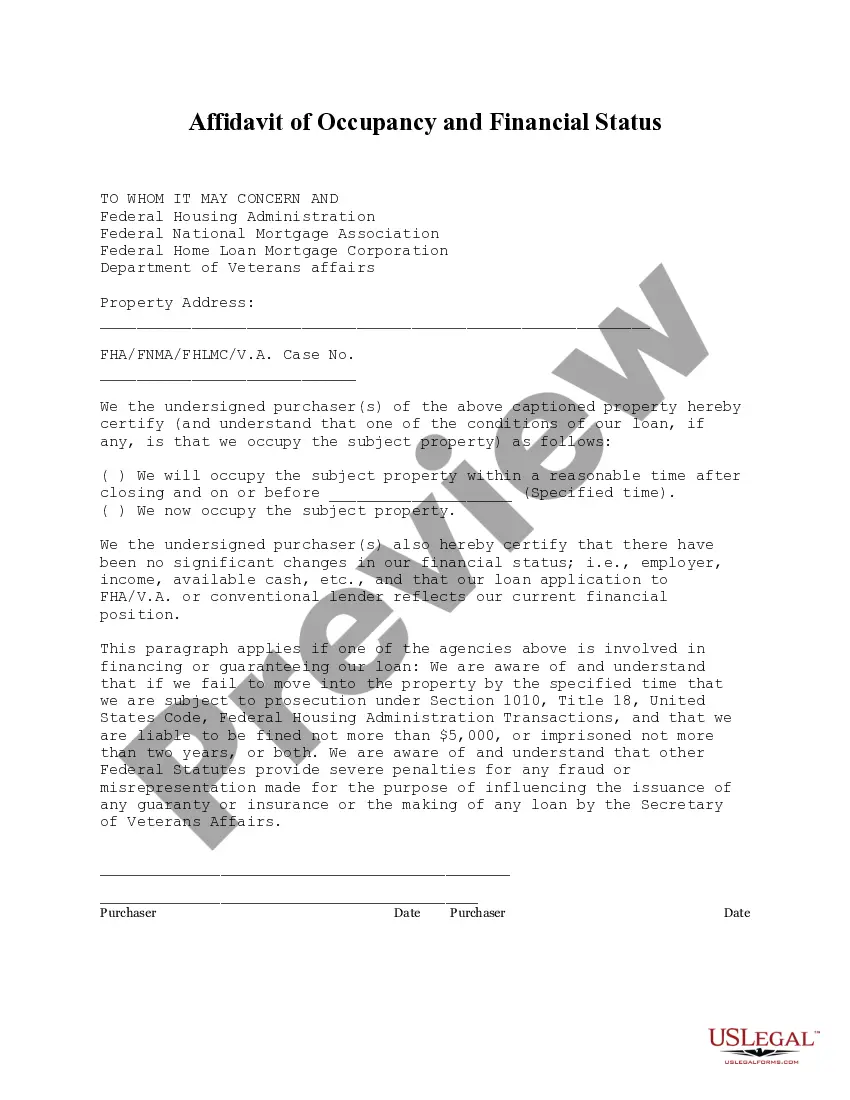

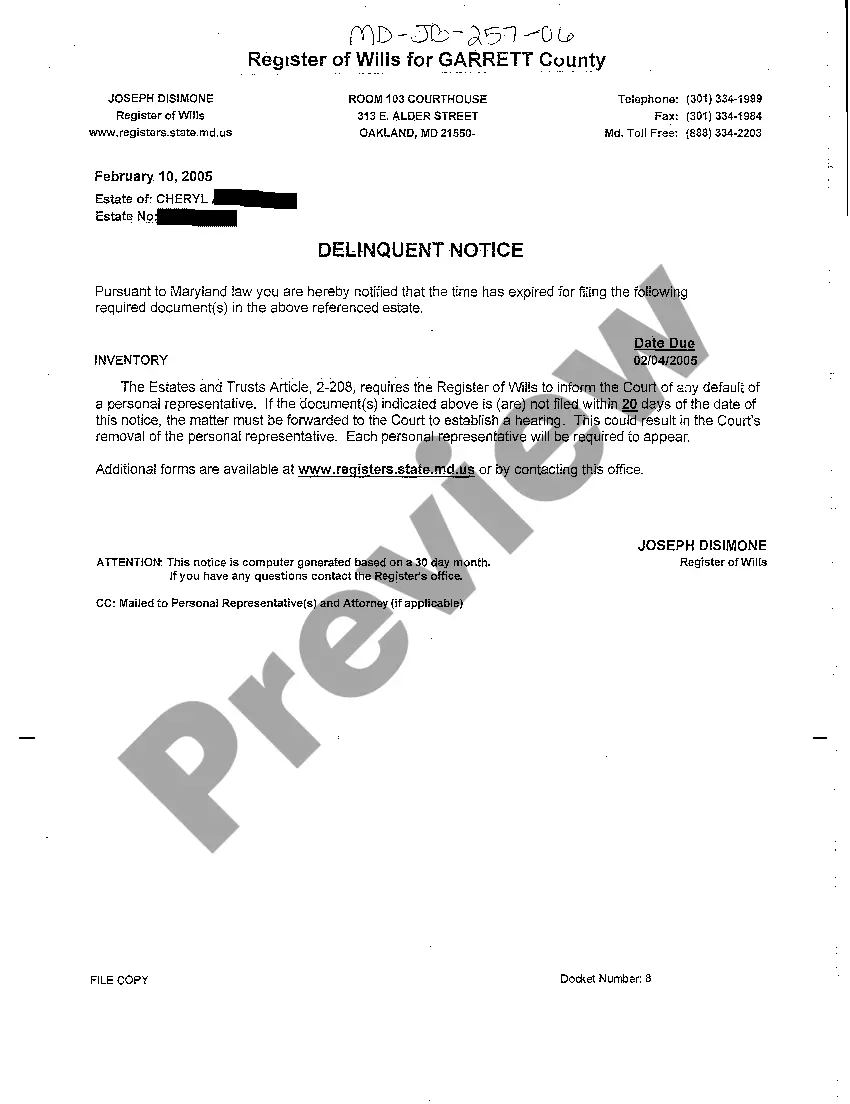

Description

How to fill out Letter To Creditors Informing Them Of Fixed Income And Financial Hardship?

Are you currently in the place where you need paperwork for sometimes organization or personal purposes virtually every day? There are a variety of lawful document templates available on the net, but finding versions you can rely on isn`t straightforward. US Legal Forms provides a large number of develop templates, such as the Connecticut Letter to Creditors Informing Them of Fixed Income and Financial Hardship, that are written to fulfill federal and state demands.

When you are currently knowledgeable about US Legal Forms web site and also have an account, merely log in. Next, you can down load the Connecticut Letter to Creditors Informing Them of Fixed Income and Financial Hardship format.

Should you not have an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for that appropriate area/state.

- Make use of the Preview key to examine the shape.

- Read the information to ensure that you have selected the appropriate develop.

- If the develop isn`t what you`re looking for, make use of the Research area to discover the develop that meets your needs and demands.

- When you get the appropriate develop, click on Buy now.

- Opt for the pricing plan you desire, submit the desired information and facts to generate your account, and buy an order making use of your PayPal or bank card.

- Pick a practical file formatting and down load your copy.

Get every one of the document templates you may have bought in the My Forms menus. You can get a additional copy of Connecticut Letter to Creditors Informing Them of Fixed Income and Financial Hardship at any time, if possible. Just click on the required develop to down load or print the document format.

Use US Legal Forms, probably the most substantial variety of lawful varieties, to conserve time and avoid mistakes. The support provides expertly manufactured lawful document templates that you can use for a selection of purposes. Create an account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

What Is a Hardship Letter? A hardship letter explains to a lender the circumstances that have made you unable to keep up with your debt payments. It provides specific details such as the date the hardship began, the cause and how long you expect it to continue.

Lenders may use them to determine whether or not to offer relief through reduced, deferred, or suspended payments. Hardship Examples. ... Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan.

Example letter I am sorry that I am unable to keep up my monthly payments to your company. I'm sick and unable to work. I've claimed benefits and I'm waiting to hear the outcome of my claim. My situation is unlikely to improve for at least 3 months.

In a straightforward manner, explain what caused your current financial struggles, whether it is a job loss, divorce, medical emergency or another unexpected hardship. Highlight how you're being proactive about your financial situation.

To Whom It May Concern: I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet but unfortunately we have fallen short and would like you to consider working with us to modify our loan.

You can call, write to or email the creditor letting it know you cannot afford your repayments and that you want to make a repayment arrangement. If possible, contact your creditor 's hardship department . This is called a hardship notice.

When you write the hardship letter, don't include anything that would hurt your situation. Here are some examples of things you shouldn't say in the letter: Don't say that your situation is your lender's fault or that their employees are jerks. Don't state that things will likely turn around for you.

Keep your hardship letter brief and to the point: four paragraphs is ideal, and no more than two pages.