South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

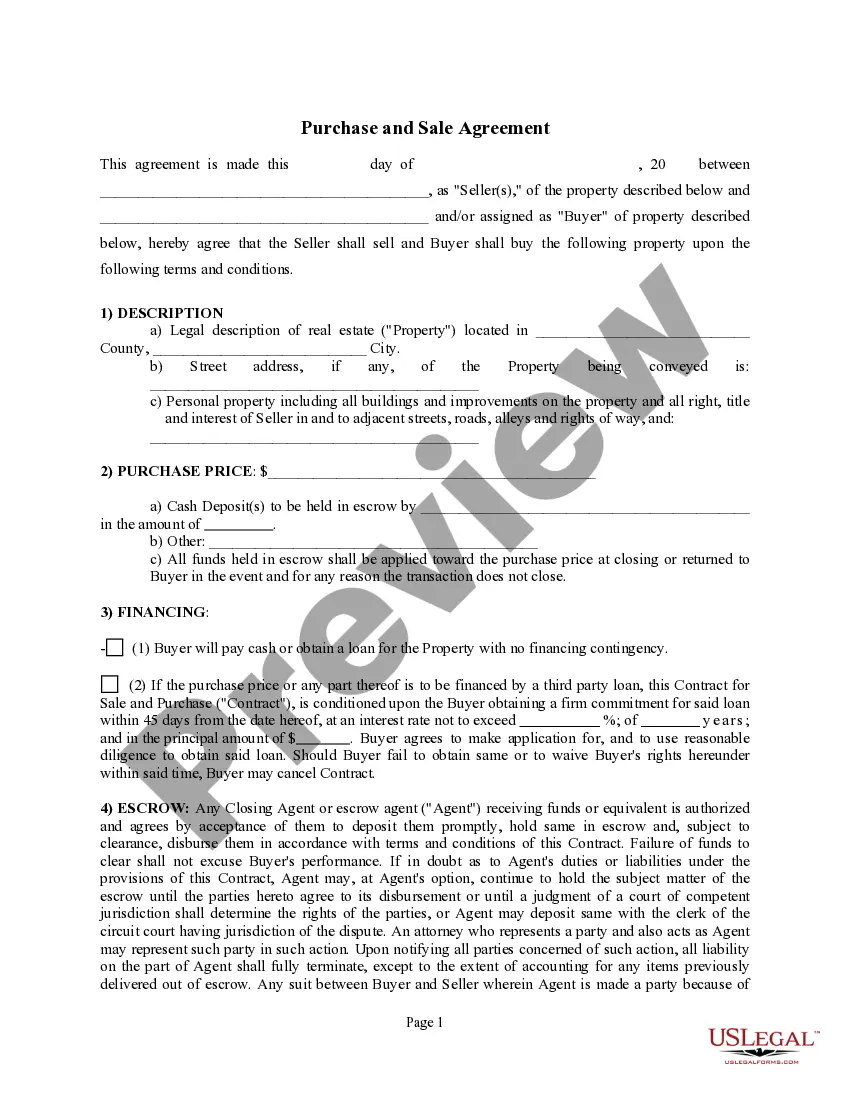

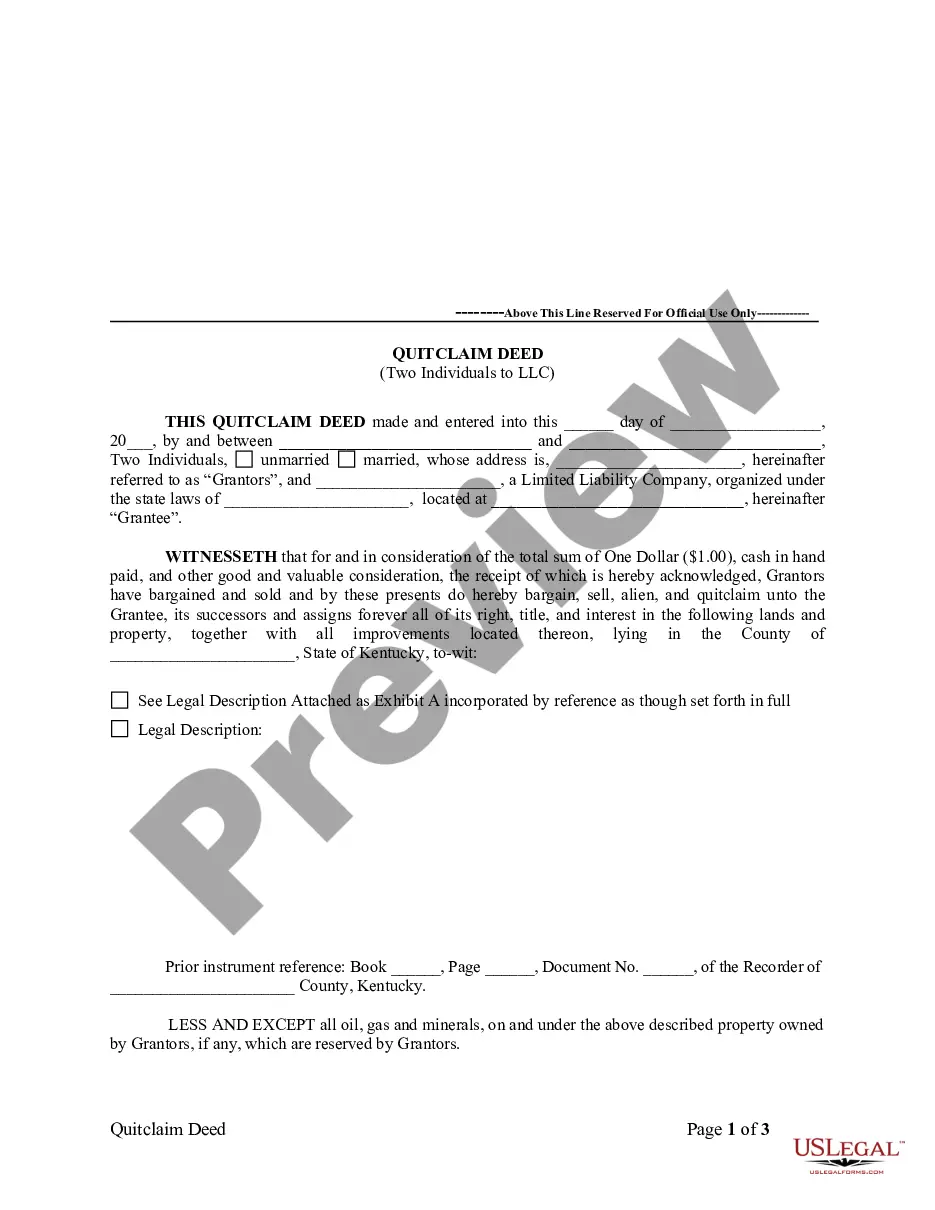

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or print.

While using the site, you can discover numerous forms for both business and personal purposes, sorted by categories, states, or keywords. You can access the latest versions of forms like the South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a matter of minutes.

If you already hold a membership, Log In and download the South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor from the US Legal Forms repository. The Download option will be visible on every form you access. You can view all previously saved forms under the My documents section of your account.

Make modifications. Fill out, edit, and print and sign the downloaded South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are straightforward guidelines to help you get started.

- Ensure you have chosen the correct form for your area/region. Click the Review option to examine the form's content. Check the form description to confirm that you have chosen the right template.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are content with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to create an account.

- Proceed with the payment. Use a credit card or PayPal account to complete the transaction.

- Choose the format and download the form onto your device.

Form popularity

FAQ

If it was death that had caused the end of the partnership, then the monies are paid out in equal shares to the surviving ex-partners and the deceased's estate. When all the partners are living there may be room to negotiate, but when one of them dies, the options disappear, especially if the beneficiaries are minors.

Although a partner's death terminates the partnership year for that partner, the partner's death does not automatically cause the closing of the partnership's tax year for the other partners. Under Sec.

An experienced property manager, a corporation, or a successful real estate development company would serve as the general partner.

The decedent's estate (or other successor, such as a living/revocable trust, depending upon how the deceased partner held their partnership interest; the Estate), will take such interest with an adjusted basis equal to the fair market value of such interest at the date of the partner's death, increased by the

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

The parents may have a revocable living trust serve as general partner. A revocable living trust holds title to assets of the trust maker. It is frequently used to avoid probate and to provide for the trust maker in the event of incapacitation. The trust maker is usually the trustee of the trust.

Generally speaking, any person can be a partner in a partnership. A partnership is formed simply when two or more persons decide to get together and agree to do business together for profit.

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

Can You Inherit A Partnership Interest? The partner can acquire his interest from his existing partner, for example. Gift or inheritance may be used to acquire a partnership interest. In addition, a partnership could get a special interest in property and cash from a partner.