South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

Are you in the circumstance where you require documents for either commercial or personal uses almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

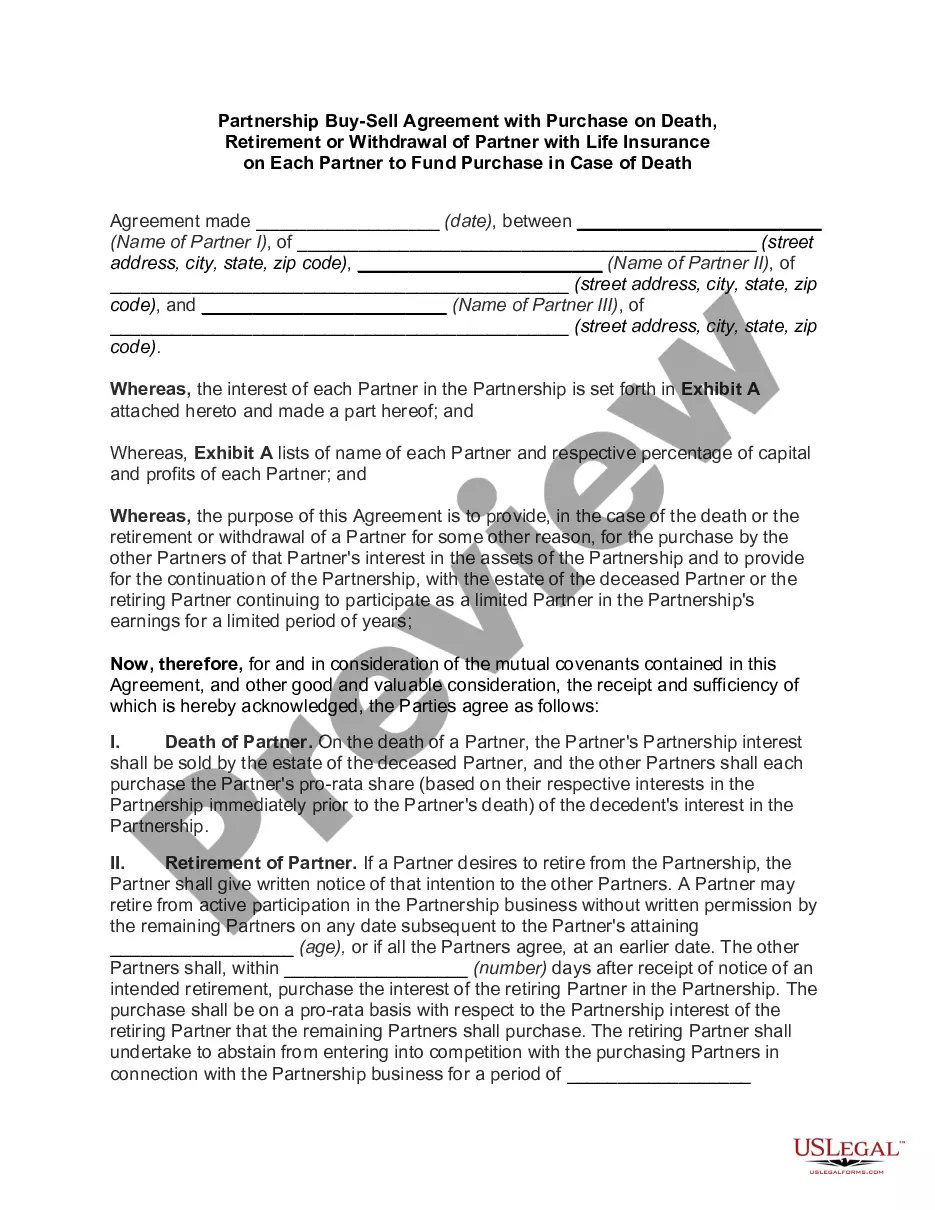

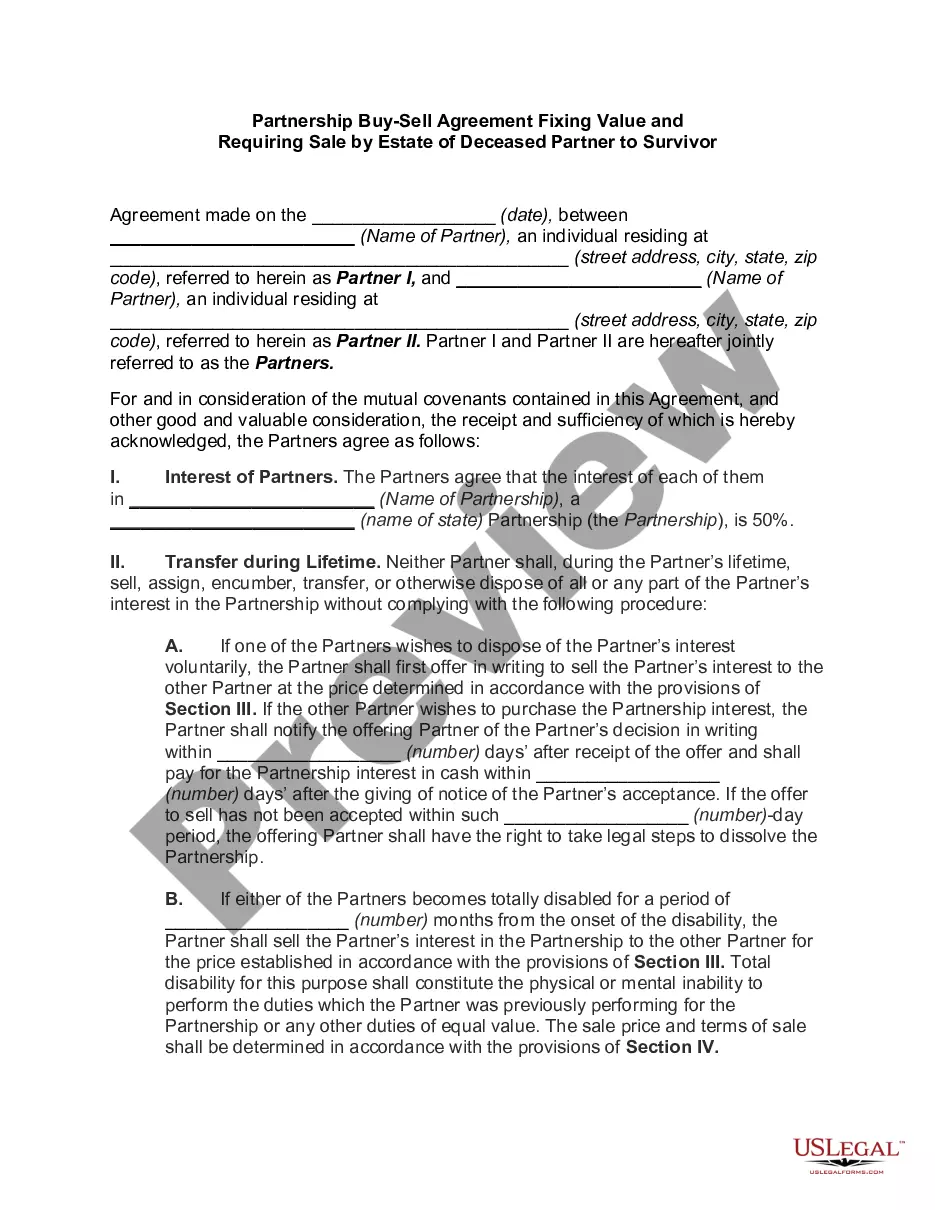

US Legal Forms offers thousands of form templates, such as the South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership, designed to comply with federal and state requirements.

Choose a convenient paper format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership anytime, if needed. Click on the desired document to download or print the file template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of the Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to examine the form.

- Review the details to ensure you have selected the correct document.

- If the form is not what you seek, use the Search field to find the form that meets your needs and specifications.

- When you find the right document, click Buy now.

- Select the pricing plan you desire, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

Generally speaking, any person can be a partner in a partnership. A partnership is formed simply when two or more persons decide to get together and agree to do business together for profit.

Can You Inherit A Partnership Interest? The partner can acquire his interest from his existing partner, for example. Gift or inheritance may be used to acquire a partnership interest. In addition, a partnership could get a special interest in property and cash from a partner.

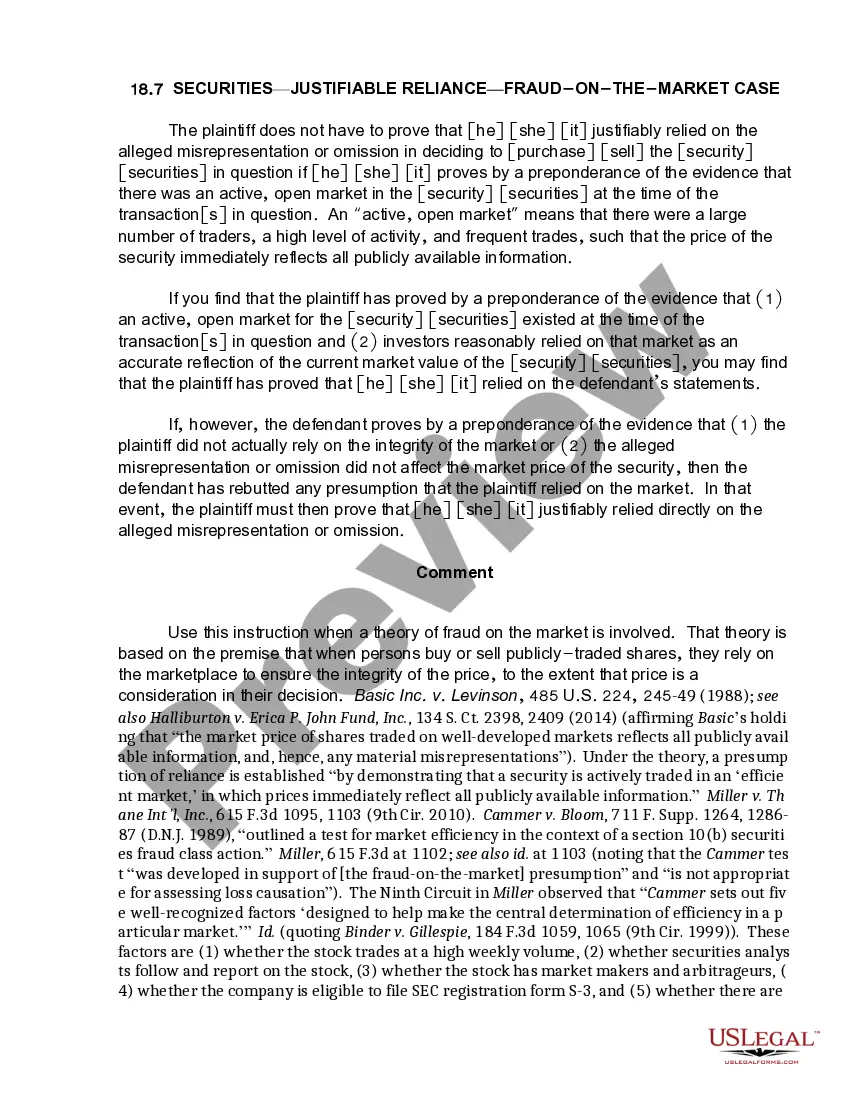

A buyout agreement can stand on its own or can be several provisions in your written partnership agreement that control the following business decisions: whether a departing partner must be bought out. what price will be paid for the departing partner's interest in the partnership.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

An experienced property manager, a corporation, or a successful real estate development company would serve as the general partner.

The parents may have a revocable living trust serve as general partner. A revocable living trust holds title to assets of the trust maker. It is frequently used to avoid probate and to provide for the trust maker in the event of incapacitation. The trust maker is usually the trustee of the trust.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.

One benefit of a buy-sell agreement is that it outlines terms to ensure the former spouse is compensated. The agreement avoids the risk of having to manage the business alongside a co-owner's ex-spouse or lose control of the company altogether. Tensions are often high in a divorce.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.