South Dakota Sale of Deceased Partner's Interest

Description

How to fill out Sale Of Deceased Partner's Interest?

If you need to aggregate, download, or produce sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Make use of the site’s straightforward and user-friendly search function to find the documents you need.

Various templates for commercial and personal applications are categorized by types and jurisdictions, or keywords.

Every legal document template you obtain is yours forever. You have access to every form you downloaded within your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, and print the South Dakota Transfer of Deceased Partner's Interest with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the South Dakota Transfer of Deceased Partner's Interest with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to get the South Dakota Transfer of Deceased Partner's Interest.

- You can also find forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate region/country.

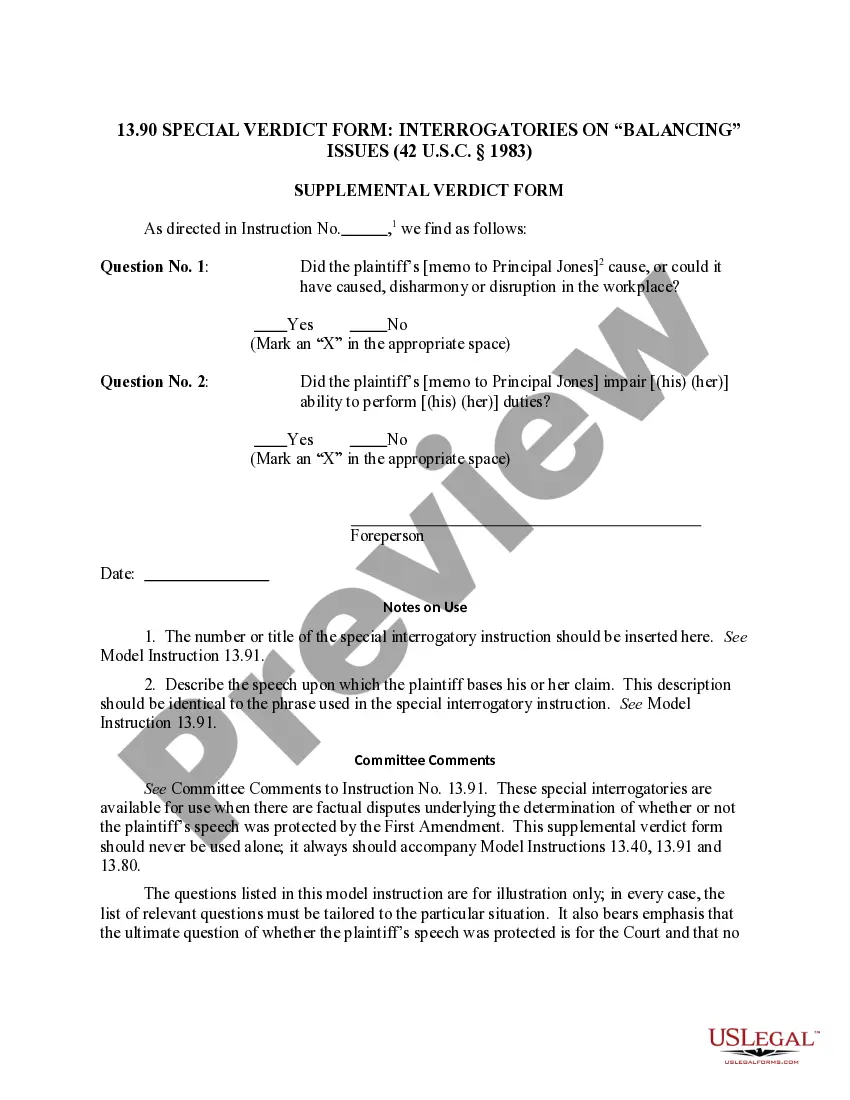

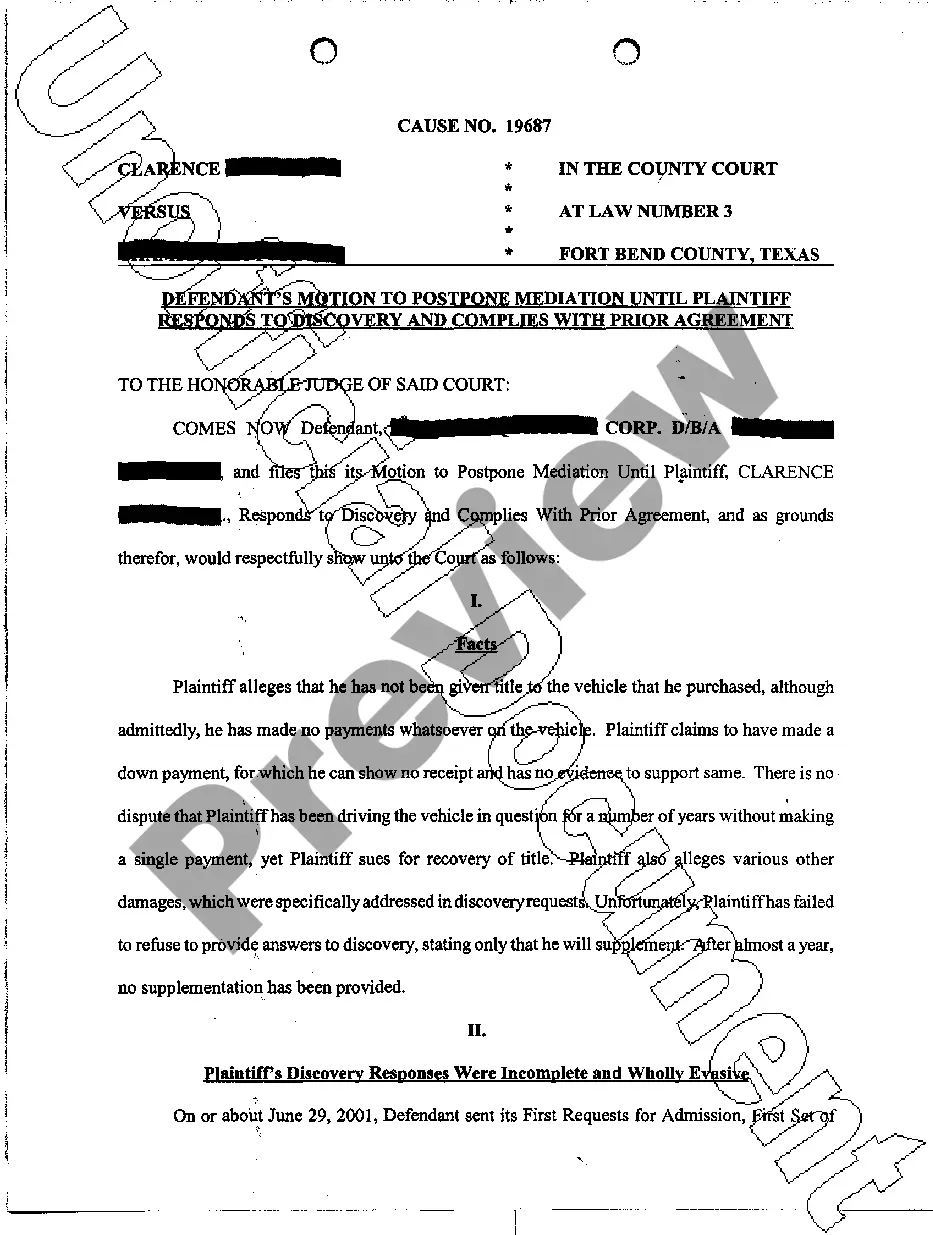

- Step 2. Use the Preview feature to review the content of the form. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to locate other templates in the legal form collection.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the purchase. You can pay using your credit card or PayPal account to finish the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the South Dakota Transfer of Deceased Partner's Interest.

Form popularity

FAQ

How to Avoid Probate in South Dakota?Establish a Revocable Living Trust.Title property in Joint Tenancy.Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together. In South Dakota, each owner, called a joint tenant, must own an equal share.

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

South Dakota's statute of limitations regarding probate litigation generally range between three to twenty years following the date of the testator's death, depending on the aspect of the will you're contesting; for instance, if your issue is with the conduct of an adjudicator which may have corrupted a will's intent,

South Dakota's statute of limitations regarding probate litigation generally range between three to twenty years following the date of the testator's death, depending on the aspect of the will you're contesting; for instance, if your issue is with the conduct of an adjudicator which may have corrupted a will's intent,

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate.

To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or register of deeds, or sometimes it's part of the county clerk's office.

On July 1, 2014, South Dakota enacted the Real Property Transfer on Death Act, which provides for the transfer of real property in the event of death.

According to 29A-3-108 of the South Dakota statutes, probate must be started within three years of the decedent's death. The statute does allow for several exceptions, such as whether there was sufficient doubt of the death of the decedent.

Finally, if an executor does not distribute the estate, he or she can face some serious penalties, such as being held in contempt of court, fined, or given a jail sentence. A civil lawsuit can also be filed against the executor in an attempt to reclaim what is rightfully yours.